The Russia-Ukraine conflict since late February has brought back public attention to the crypto industry. The onset of the Russia-Ukraine conflict led to cryptocurrencies being used for a variety of humanitarian purposes, with people around the world sending donations in crypto to the Ukrainian government and non-governmental organizations. Not only in Ukraine, the use of cryptocurrency in Russia also experienced a spike when the war began, following the imposition of economic sanctions on Russia.

So, what are the impacts of this conflict on crypto? What makes people turn to cryptocurrency in times of crisis? And what are the advantages of crypto as a medium of exchange? Read more in this article.

Article Summary

- 💥 As a result of the Russia-Ukraine conflict, bitcoin, which had previously been utilized primarily as an investment instrument, began to be used as a medium of exchange.

- 🙌 Various crypto assets are used for various humanitarian missions, including donations in the form of bitcoin to NFT.

- ⚡ Ukrainian government purchase military equipment using crypto donations and later legalized the use of crypto.

What has happened in the crypto world since the Russia-Ukraine conflict began?

1. Ukraine raises donations in the form of crypto

The Ukrainian government, NGOs, and volunteer groups have raised donations by advertising their Bitcoin wallet addresses online. More than 4,000 donations have been made so far, with one unidentified donor giving $3 million worth of Bitcoin to an NGO. The average donation is $95.

On February 26, the Ukrainian government’s official Twitter account posted the message: “Stand with the people of Ukraine. Now accepting cryptocurrency donations. Bitcoin, Ethereum and USDT.”

2. Pressure on crypto exchanges to block Russian user accounts

Kraken CEO and co-founder Jesse Powell said the San Francisco-based company is under legal sanctions requirements and is working with law enforcement to ensure blocked accounts don’t escape loopholes. But the total ban is unfair to the average Russian, who may not support the country’s invasion of Ukraine, Powell said.

The CEO of Binance, Changpeng Zhao, said that blocking all Russian citizen accounts was unethical.

“Crypto is meant to provide greater financial freedom for people across the globe,” the company told BBC News.

3. Development of Decentralized Autonomous Organization (DAO)

One of the impacts of the Russia-Ukraine conflict is the use of the Decentralized Autonomous Organization (DAO) for humanitarian purposes. Russian punk activist band Pussy Riot even helped found a DAO that sells NFTs (non-fungible tokens) bearing the image of the Ukrainian flag. The NFT later sold for 6.75 million US dollars to help Ukraine.

4. Ukraine announces airdrop plans which were later canceled

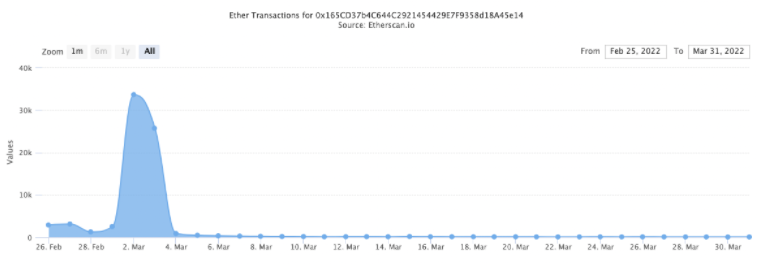

On March 2, the Ukrainian government announced that it would airdrop or deliver crypto assets indicated to be aimed at rewarding donors who have donated crypto to support Ukraine. The plan was later canceled the day after the announcement of the airdrop.

The data from Etherscan above shows an increase in Ethereum transactions to Ukrainian government wallets on the day of the airdrop announcement. Transactions then dropped dramatically after the airdrop plan was canceled.

6. Bitcoin tends to move sideways, and there are no significant fluctuations in on-chain activity

On the first day of the invasion on February 24, 2022, there was panic in the market and investors were more dominant in avoiding risk by selling risky assets such as stocks and cryptocurrencies. At the same time, global stocks, while the dollar, gold, and oil prices skyrocketed higher as investors scrambled for safe-haven assets. On February 28, following the economic sanctions on BTC price increased significantly, creating the largest bullish candlestick (15%) in the past year, as seen in the chart below.

After reaching resistance at US$44,000 on March 3, 2022, we can see a reversal of the next two candles until BTC is below the 21-day EMA, and the price is back between US$34,000- 40,000.

Until mid-March, Bitcoin was moving in a sideways or stagnation mode. This represents a situation where most market participants are not ready to sustain longer and more sustainable accumulations in the short term.

Meanwhile, Russia’s invasion of Ukraine created a massive wave of migration from both countries. For many migrants and refugees, crypto has become the only real way to carry their savings. However, research by blockchain analytics firm, Crystal Blockchain, found no significant fluctuations related to war and migration, according to CoinDesk.

The volume of crypto trading in rubles has more than halved on March 18, from a peak volume of around $70 million on March 7, according to data from Chainalysis.

6. Ukraine buys military equipment from crypto donations

More than US$50 million in crypto donations have been raised for Ukraine since the Russian invasion on February 24, 2022. According to Bloomberg, US$15 million has been used by the Ukrainian government to purchase military equipment as of March 5, 2022.

7. Ukraine legalizes the use of crypto

Last February, the Ukrainian parliament passed a bill to legalize cryptocurrencies, setting up a framework for the regulation and management of cryptocurrencies such as Bitcoin and Ethereum. On March 17, Ukrainian President Volodymyr Zelenskyy, signed the law, “On Virtual Assets,” which establishes the legal framework for countries to operate crypto markets.

What are the advantages of transactions using cryptocurrency?

1. No intermediaries

You can transact crypto assets directly from the sender to the recipient, without the need for an intermediary to manage the transaction. Each transaction is only carried out by the sender to the recipient only.

2. Censorship-resistant

Nobody can turn off crypto assets because the software is free and anyone in the world can participate to make the crypto asset network more secure.

3. Relatively fast payment method

When you send money to another person anywhere in the world using a crypto asset, the destination address can receive it immediately in an almost instantaneous process.

Reference

- Ben Caselin, Ukraine war is crypto’s biggest test yet, Nikkei Asia, diakses pada 11 Maret 2022

- Jason Nelson, Ukraine DAO’s Flag NFT Sells for $6.75 Million, Decrypt, diakses pada 11 Maret 2022

- David Ingram & Ben Goggin, How the Ukraine conflict became a turning point for cryptocurrency, NBC News, diakses pada 11 Maret 2022

- Ukraine crisis: Crypto exchange boss rejects Russian user ban, BBC News, diakses pada 11 Maret 2022

- Emily Nicolle, Binance CEO Says Blocking All Russians From Crypto Exchange Is ‘Unethical’, Bloomberg, diakses pada 12 Maret 2022

- Connie Loizos, Ukraine’s president signs law to legalize crypto as digital donations roll, Techcrunch, diakses pada 24 Maret 2022

- What is a decentralized autonomous organization, and how does a DAO work?, Cointelegraph, diakses pada 8 April 2022

- Matt Bindar, Most crypto donors to Ukraine were looking to profit with an airdrop, Mashable, diakses pada 8 April 2022