In the DeFi lending ecosystem, users can borrow and lend crypto assets directly without intermediaries by using Web3 DeFi protocols powered by smart contracts. Understanding how platforms like AAVE, Morpho, Kamino, and Sky DeFi operate is key to gaining lending profits while managing DeFi lending risks.

🔎 Article Summary

🏦 DeFi lending is a system for borrowing and lending crypto assets without intermediaries, powered entirely by smart contracts. Users can lend or borrow digital assets through Web3 protocols such as AAVE, Kamino, Morpho, and Sky to earn interest or access liquidity in a fast and transparent manner.

⚡ AAVE is the most established lending protocol in Web3, supporting major assets like ETH and USDC. It offers flexible lending with both fixed and variable interest rates, but liquidation risks remain high if the collateral value drops. Its UI is complex but highly comprehensive, making it ideal for advanced users.

⚡ Kamino Finance operates on the Solana network, offering low-fee crypto loans with competitive interest rates, especially for stablecoins like USDC. It’s a strong choice for medium-term borrowers, thanks to its fast and user-friendly interface. However, risks arise from volatile collateral such as SOL.

⚡ Morpho optimizes peer-to-peer lending through algorithmic user matching, delivering better interest rate efficiency on assets like ETH and USDC. Its interface is minimalist and focused, though demand-based rate fluctuations can affect borrowing conditions.

⚡ Sky DeFi, a rebrand of MakerDAO, offers stablecoin-based loans (USDS) with a conservative, low-risk approach, making it suitable for beginners. The interface is simple, but asset options are limited and technical transparency (such as audits) should be reviewed carefully.

📉 Core risks in DeFi lending include smart contract vulnerabilities, liquidation risk, and interest volatility. Managing loan-to-value ratios, using audited protocols, and diversifying across platforms are essential strategies to minimize losses and secure returns.

What Is DeFi Lending?

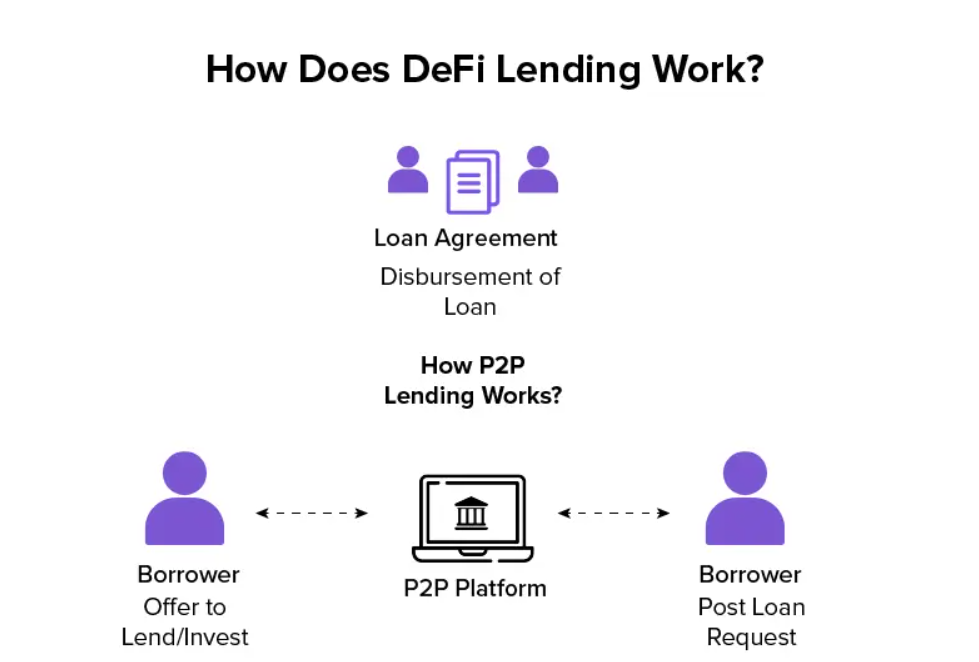

DeFi lending is a decentralized system where users, either as lenders or borrowers, interact via DeFi smart contracts. Lenders deposit assets into liquidity pools, while borrowers must provide over-collateralized crypto assets to ensure the platform’s solvency and user safety.

This process is more transparent and faster than traditional banking, with interest rates dynamically set by algorithms based on supply and demand. All transactions are recorded publicly on the blockchain.

Why Choosing the Right DeFi Protocol Matters

Each DeFi lending protocol offers different interest rate structures, collateral models, and governance systems. Choosing the right one maximizes yield while minimizing risks such as liquidation, impermanent loss, or smart contract bugs. Code transparency, security audits, and the team’s track record are essential factors in protocol selection.

Popular DeFi Lending Protocols

Several DeFi lending protocols stand out in the Web3 landscape—Kamino, AAVE, Sky DeFi, and Morpho. Each offers unique benefits, strategies, and risk profiles that every crypto user should understand.

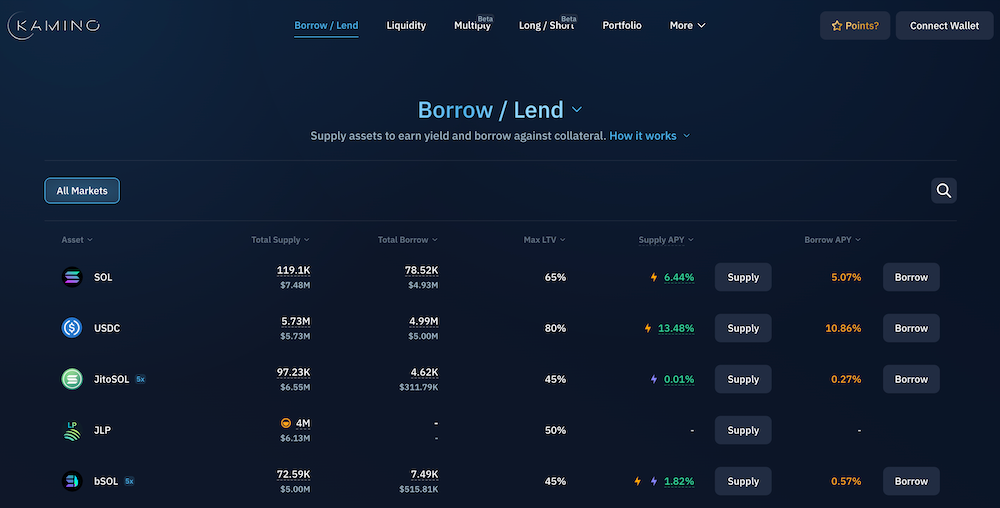

1. Kamino

Kamino is a Solana-based lending protocol offering borrowing and lending for assets like SOL and USDC. Known for its low fees and fast transactions, Kamino is well integrated into the Solana ecosystem. The platform provides competitive interest rates—especially on stablecoins—and is ideal for users seeking a mid-term lending option with a modern, easy-to-use interface.

However, users must watch for liquidation risks, especially when using volatile collateral like SOL. Not all assets on Kamino are highly liquid, so users should prioritize stable, high-volume assets. Users can access Kamino’s lending services directly through Pintu Web3 here.

2. AAVE

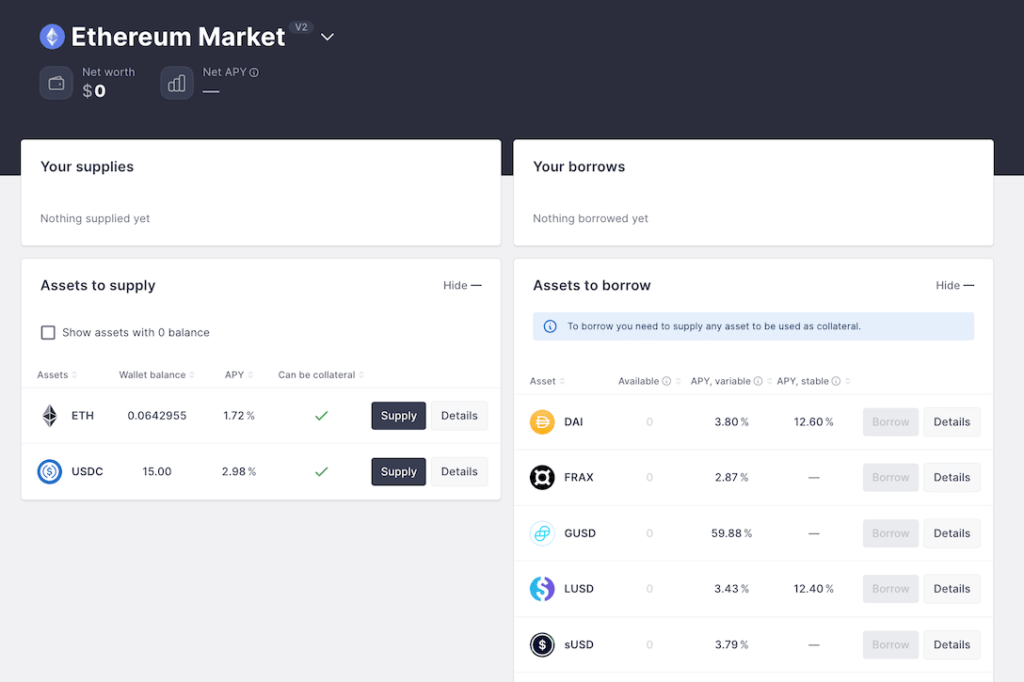

AAVE is one of the most established and trusted, with a Total Value Locked (TVL) in DeFi of $115.334 billion, available across chains like Ethereum and Polygon. It supports major crypto assets like ETH, DAI, USDC, and WBTC. AAVE offers flexible lending with both variable and fixed interest rate options.

The most common strategy involves using dynamic rates on high-demand assets. While powerful, AAVE’s complex UI may challenge beginners, but it remains a top choice for advanced users thanks to its robust features. Users can access AAVE’s lending services directly through Pintu Web3 here.

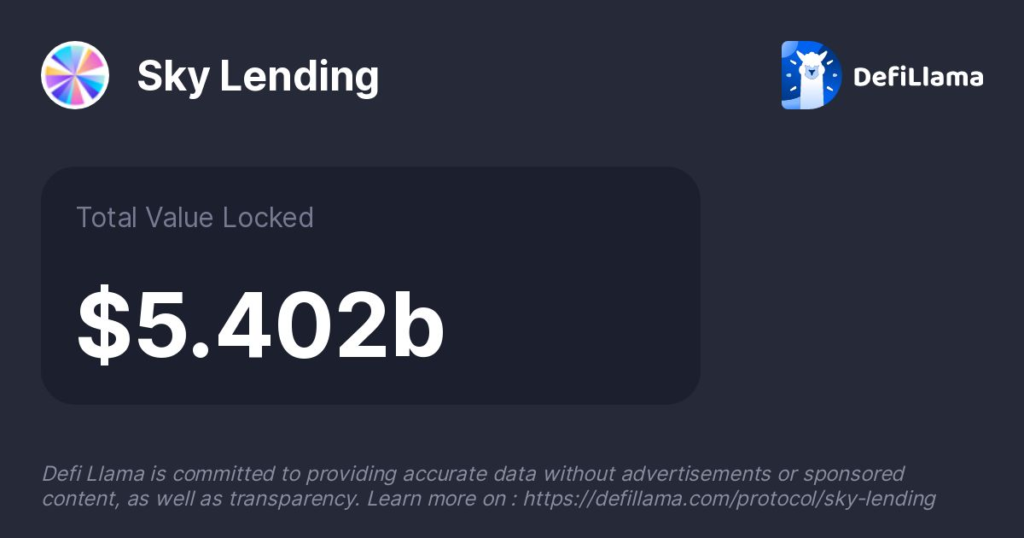

3. Sky DeFi

Sky DeFi, formerly MakerDAO, offers a simple and stable approach to lending by allowing users to borrow the stablecoin USDS against ETH collateral. It’s tailored for conservative users looking for minimal risk and fixed outcomes.

The protocol’s over-collateralized model lowers risks, but it supports fewer asset types and could improve in transparency. The user interface is beginner-friendly, making it suitable for users new to DeFi lending. Users can access Sky’s lending services directly through Pintu Web3 here.

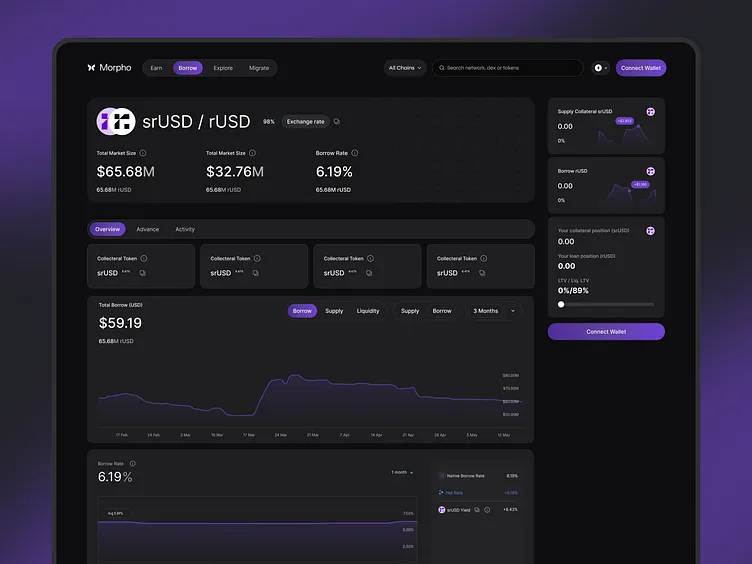

4. Morpho

Morpho delivers a peer-to-peer lending model that enhances open-market efficiency, such as seen with AAVE and Compound, while offering optimized interest rates. Lenders and borrowers can earn better returns thanks to a smart matching system.

Morpho is most effective with ETH and USDC, the most liquid assets on the platform. Its primary challenges lie in interest rate fluctuations when borrowing demand is low and dependency on liquidity volume. The minimalist yet efficient UI is ideal for data-driven users. Users can access Morpho’s lending services directly through Pintu Web3 here.

Risks in DeFi Lending & How to Mitigate Them

Despite the opportunities, DeFi lending carries notable risks. Smart contract bugs can expose vulnerabilities that hackers exploit. This can be mitigated by selecting audited and open-source protocols.

Another concern is liquidation risk, where collateral value falls below a set threshold, causing forced asset sales. This is manageable by maintaining a safe loan-to-value (LTV) ratio. Lastly, impermanent loss may affect users when collateral values shift significantly—making it essential to monitor positions closely and exit at optimal times.

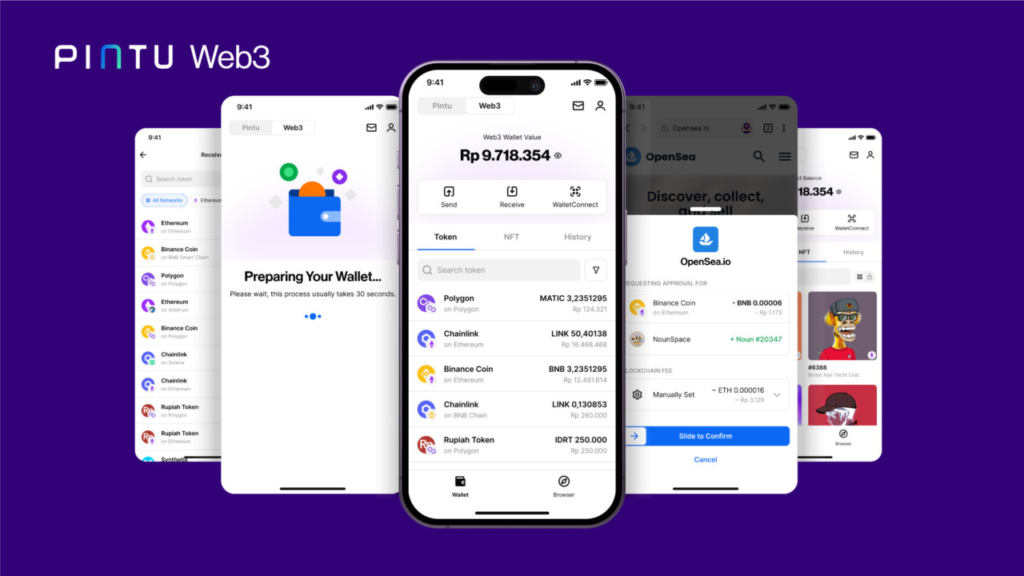

Accessing DeFi Lending via Pintu Web3

Users can now explore lending protocols like Kamino, AAVE, Sky, and Morpho more easily via Pintu Web3. Just follow these steps:

- Open the Pintu app and access the Web3 menu.

- Search for your preferred DeFi lending platform from the list.

- Connect your wallet through Pintu Web3.

- Start borrowing or lending assets directly from the app.

Pintu Web3 offers a streamlined and secure experience without needing browser wallet extensions—making it easy to explore DeFi lending within one integrated interface.

Conclusion

Lending through DeFi protocols like Kamino, AAVE, Sky, and Morpho unlocks higher-yield crypto loan opportunities compared to traditional finance. But those rewards come with risks such as liquidation, smart contract vulnerabilities, and market volatility.

A well-thought-out strategy—spanning protocol diversification, audit verification, and exit planning—is critical to maximize gains and minimize losses. Choosing the right DeFi lending protocol lays the foundation for safer, smarter investing in Web3.

Thanks to platforms like Pintu Web3, accessing DeFi lending has never been easier. Users can now tap into crypto yield opportunities with greater confidence—while staying informed about the risks.

Download the Pintu cryptocurrency app from the Play Store or App Store! Pintu is registered and supervised by the Financial Services Authority and the Commodity Futures Trading Regulatory Agency (CFX). Explore crypto trading, or continue learning with Pintu Academy—your go-to source for weekly crypto education.

All Pintu Academy content is for educational purposes only and does not constitute financial advice.

References:

- Tangem Blog. How DeFi Lending Works. Accessed July 7, 2025

- Webisoft. A Detailed Guide to Decentralized Finance DeFi. Accessed July 7, 2025

- Exponential Fi Blog. How DeFi Lending Works. Accessed July 7, 2025