The CLARITY Act emerged as one of the latest crypto regulations in the United States aimed at providing legal certainty for the cryptocurrency industry, from Bitcoin to DeFi projects and stablecoins, amid increasing global regulatory pressure.

Article Summary

📜 CLARITY Act still stuck in US Congress

The CLARITY Act was not passed until early 2026 due to differences in views between regulators, legislators, the banking industry, and large crypto players like Coinbase, especially regarding stablecoin and yield rules.

📉 Direct Impact to Crypto Prices

This regulatory standoff fueled price volatility in major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), as investors delayed investment decisions while waiting for legal clarity.

🏦 Institutional Investors Are More Cautious

Regulatory uncertainty makes institutional investors likely to hold back expansion into the crypto market, while retail investors face the risk of higher price fluctuations due to policy sentiment.

🔮 Delays Can Be a Positive Negotiation Space

Some analysts see the delay in the CLARITY Act as giving time to craft more balanced regulations, potentially protecting investors without stifling blockchain and DeFi innovation in the long run.

Introduction to the CLARITY Act and its Origins

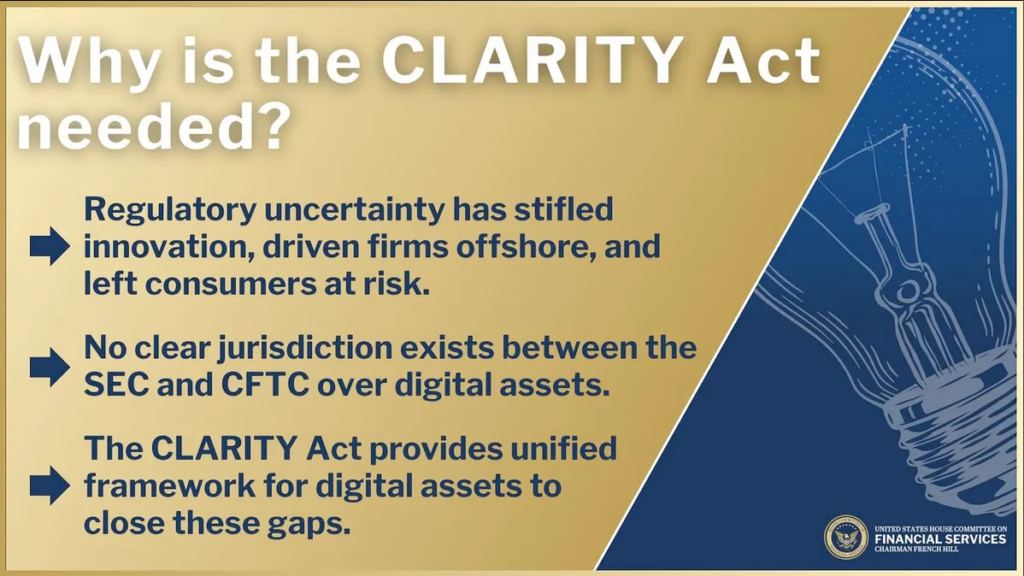

The CLARITY Act is a draft United States crypto regulation designed to clarify the legal status of digital assets and blockchain activities. It was born out of the market’s need for crypto legal clarity after years of the industry running in regulatory uncertainty. Many crypto projects previously faced legal risks due to overlapping authority between regulators.

Historically, US crypto regulation has been fragmentary, with roles divided between the SEC, CFTC, and other financial authorities. The CLARITY Act attempts to address this issue by defining the classification of crypto assets more strictly. The goal is to create a more consistent and predictable legal framework.

The CLARITY Act is a draft US crypto regulation that aims to provide legal certainty for digital assets and blockchain by clarifying the classification and authority of regulators that previously overlapped.

Why the CLARITY Act Matters for the Crypto Industry

The importance of the CLARITY Act lies in its efforts to reduce the legal uncertainty that has overshadowed the cryptocurrency industry. Without clear regulations, innovation is often stifled due to the risk of later enforcement. This is especially felt by blockchain startups and DeFi projects.

With America’s latest crypto rules, industry players are expected to have more definitive guidance regarding compliance. This clarity is considered to encourage institutional investment, which has been cautious about entering the crypto market.

Key Points in the CLARITY Act to Know

One of the main points of CLARITY Act crypto regulation is the classification of digital assets based on function and level of decentralization. This regulation distinguishes which assets are considered securities and which are digital commodities. This approach is expected to reduce conflicts of legal interpretation.

In addition, the CLARITY Act also regulates the authority of regulators more specifically. With a clearer division of roles, the supervisory process is expected to become more transparent and efficient. For the market, this means more stable rules of the game.

Impact of the CLARITY Act on DeFi and Stablecoins

In the context of the CLARITY Act DeFi, this regulation has the potential to bring significant changes to decentralized finance protocols. Some DeFi activities may be required to meet certain transparency standards without losing the principle of decentralization. This has led to debate among blockchain developers.

For stablecoins, the stablecoin CLARITY Act highlights the importance of asset reserves and governance. These rules aim to protect users from the risk of default or misuse of funds. On the other hand, the increased compliance burden can be challenging for small stablecoin issuers.

Impact of CLARITY Act on Investors and Crypto Market

From an investor’s perspective, the impact of the CLARITY Act for crypto investors is significant. It promises to protect crypto investors through clearer disclosure standards. Retail investors are expected to have more transparent information before making a decision.

However, some market participants are concerned that overly stringent regulation could reduce market flexibility. However, many analysts believe that legal certainty can reduce systemic risk in the long run.

Comparison of CLARITY Act with Other Countries’ Crypto Regulations

When compared to the EU through MiCA, the CLARITY Act vs crypto laws in other countries show a different approach. Here are some of them:

- United States (CLARITY Act)

Placeholder polylang do not modify

- European Union (MiCA)

- Promote harmonization of crypto regulations across member states.

- Create a single compliance standard that applies uniformly across the region.

- More emphasis on consumer protection and regional market stability.

- Asian countriesPolylang

placeholders do not modify

- Global ContextPolylang

placeholders do not modify

Pros and Cons of CLARITY Act in the Blockchain Community

There are two sides that respond to the CLARITY Act policy with different perspectives. Here are the points:

- Parties supporting CLARITY ActPolylang

placeholder do not modify

- Parties opposing CLARITY ActPolylang

placeholder do not modify

CLARITY Act’s Long-term Potential for Global Crypto

In the long run, the CLARITY Act has the potential to shape the future of crypto regulation globally. If successfully implemented, this regulation could become a reference standard for other countries. The impact could extend to affecting Bitcoin (BTC) and Ethereum (ETH) as the main crypto assets.

However, the effectiveness of the CLARITY Act remains dependent on implementation and market response. Adaptive and proportionate regulation will be key to balance innovation and investor protection.

Latest Update 2026: CLARITY Act Stalled and its Impact on Crypto & Investors

Entering 2026, the CLARITY Act crypto regulation is reportedly at an impasse in the United States Congress, especially after differences in views between regulators, the banking industry, and crypto players such as Coinbase. This delay was triggered by the debate over stablecoin rules, especiallyyield restrictions, which are considered to have the potential to hinder innovation in the decentralized finance [DeFi] sector.

For crypto and cryptocurrency markets, this creates short-term uncertainty. The prices of major assets such as Bitcoin (BTC) and Ethereum (ETH) have been volatile as investors delay investment decisions while waiting for clarity on regulatory direction. Institutional investors tend to be more cautious, while retail investors face the risk of higher price fluctuations due to regulatory sentiment.

On the other hand, some analysts believe that the delay of the CLARITY Act gives room for negotiations for a more balanced regulation. If the revised regulations are able to protect investors without killing blockchain innovation, this legal clarity has the potential to strengthen long-term investor confidence and encourage wider crypto adoption in the global market.

Conclusion: Clarity or New Obstacles?

The CLARITY Act offers the promise of crypto legal clarity that the industry has been waiting for. With a clearer legal framework, regulatory risk is expected to be reduced. However, challenges remain in maintaining a balance between oversight and innovation.

Whether the CLARITY Act becomes a solution or a new obstacle will largely be determined by how these rules are implemented on the ground. For investors and market participants, understanding its contents and implications is an important step in the 2026 crypto regulatory era.

Reference

- a16z Crypto.Genius Act & Clarity Act: Crypto Legislation Explained. Accessed January 21, 2026

- Arnold & Porter. Clarifying the Clarity Act. Accessed January 21, 2026

- Investopedia. The Clarity Act Has Stalled, Hitting Crypto Prices-What You Need to Know. Accessed January 21, 2026.