Bull markets are the most coveted market situation for traders and investors. However, this period often lures traders and investors into a trap where the market suddenly crashes. These sudden price drops are very common in a bull market. Investors who do not implement risk management will get their risk managed by the market. However, opportunities in a bull market are not limited to trading. This article will give you several crypto bull market strategies to stay profitable despite the market crashing.

Key Takeaways

- Bull runs deliver both huge upside and violent corrections. BTC has climbed 300% and SOL over 1,000 %, while some memecoins have posted 10,000% gains, yet each rally has been interrupted by sharp drawdowns, making active risk management essential.

- On-chain yield can keep profits compounding. Staking quality altcoins (especially with liquid-staking options) and parking funds in high-TVL stablecoin protocols provide steady returns when trading setups dry up and the market is moving sideways.

- DeFi lending turns idle tokens into earning assets. Supplying coins to reputable lending markets such as Aave, Morpho, or Kamino lets long-term holders collect interest and even pursue advanced looping strategies for extra profit (and extra risks).

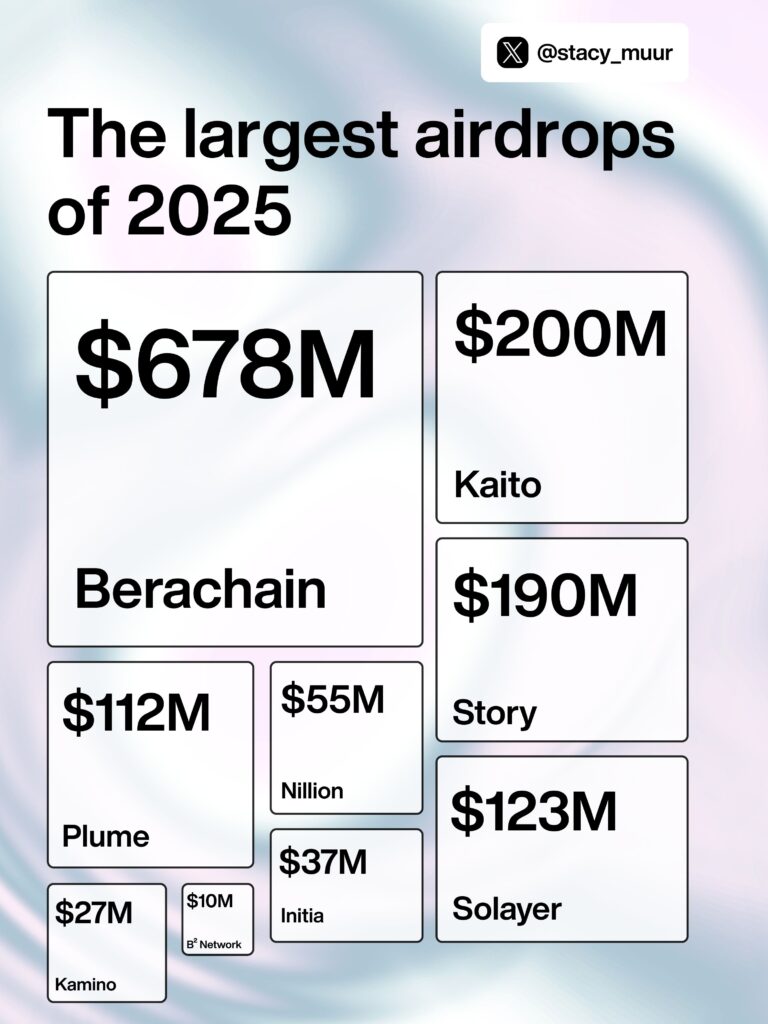

- Airdrop farming and early DEX access offer asymmetric upside. Testing new protocols and holding a non-custodial Web3 wallet positions you for potential token airdrops and early entries before CEX listings.

Crypto Market Bull Run

The crypto bull market is one of the most lucrative times for crypto investors and traders. Since the start of the 2024 bull run, BTC has given investors around 300%. Big-cap altcoins such as Solana have risen more than 1,000%.

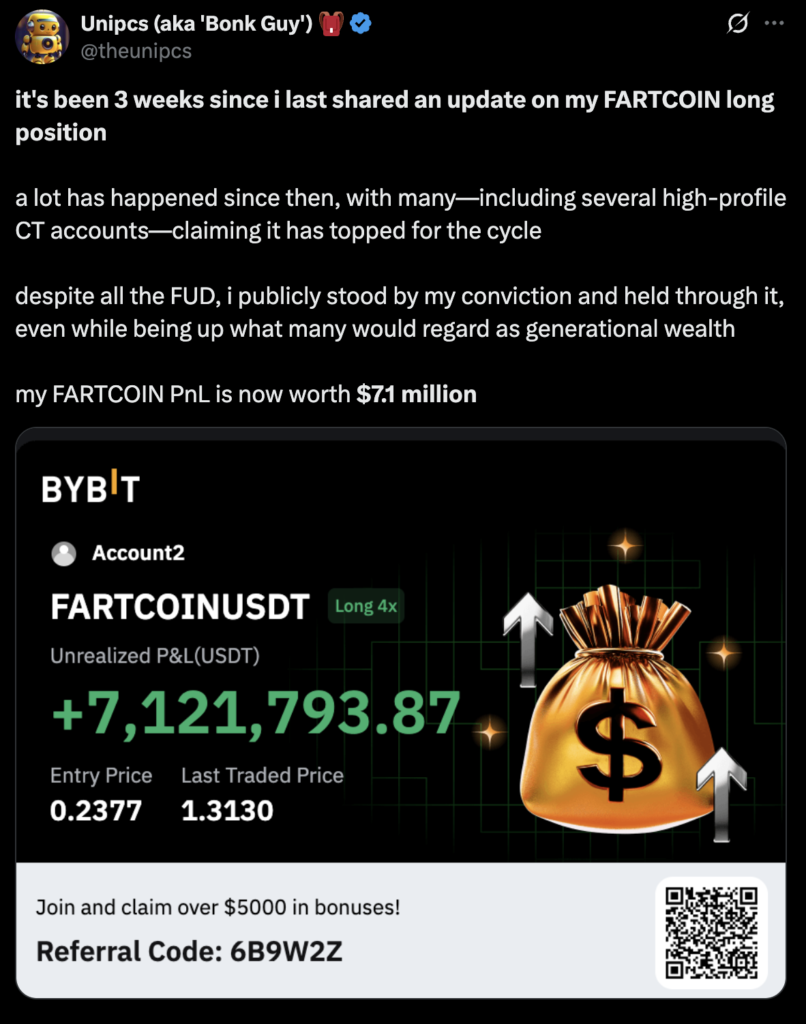

If we go down the rabbit hole, many memecoins like POPCAT, FARTCOIN, MOG, and PEPE have given early investors more than 10,000% of profits. This is profit from pure spot holding, not futures. One of the most famous memecoin influencers, @theunipcs, currently has $7 million unrealized profit from his FARTCOIN futures trade.

However, it is not all sunshine and rainbows in a crypto bull market. Throughout the 2024 and 2025 bull market, there are periods of sideways movement and significant corrections for most crypto assets. The market went into sideways mode for eight months in 2024. At the start of 2025, Bitcoin slowly fell from $106k to $75k in four months.

In a sideways period of the bull market, most participants usually step away from the market. This is because the market is no longer profitable for trading. On the contrary, these periods of ‘rest’ in the market usually bring many non-trading opportunities.

DeFi or Decentralized Finance is an entire economy made up of onchain activities on blockchain networks. Since 2021, the DeFi world has been maturing and growing significantly. The total value locked within the DeFi ecosystem is $121 billion. In the onchain world, you can find airdrop opportunities, stablecoin savings products, and earn more yield from your altcoins.

Here are five things you can do during a crypto crash or sideways market!

4 Things To Do In A Bull Market Besides Trading

1. Altcoin Staking

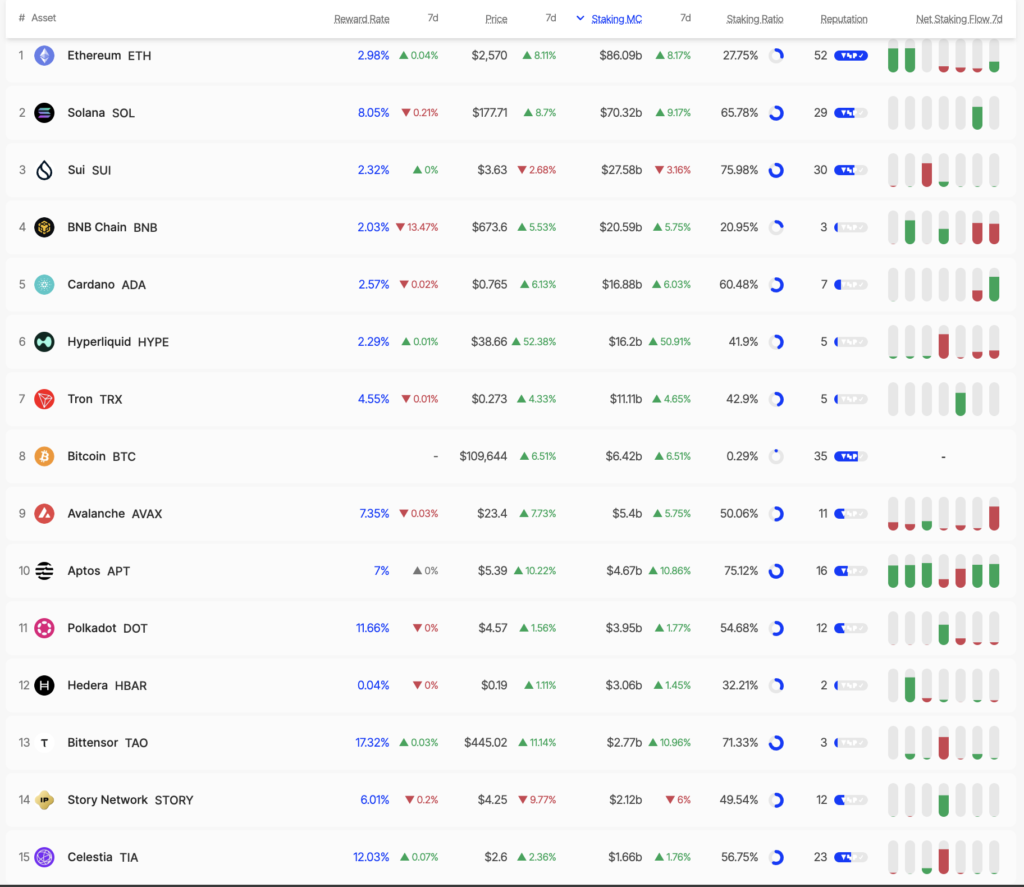

Since the advent of Solana and newer-generation blockchains, staking has become an important part of the blockchain ecosystem. Many altcoin investors who wish to hold their coins for the medium and long term tend to stake their assets. While staking also plays an important part in securing a blockchain, from the investor’s perspective, staking compounds their profit.

Staking is one of the easiest ways to compound your altcoin gains, especially if it’s a high-quality altcoin such as ETH or SOL. Some altcoins, such as SUI, ETH, and SOL also feature liquid staking. Liquid staking is where you loop your staked tokens to DeFi protocols for extra yield (and extra risk).

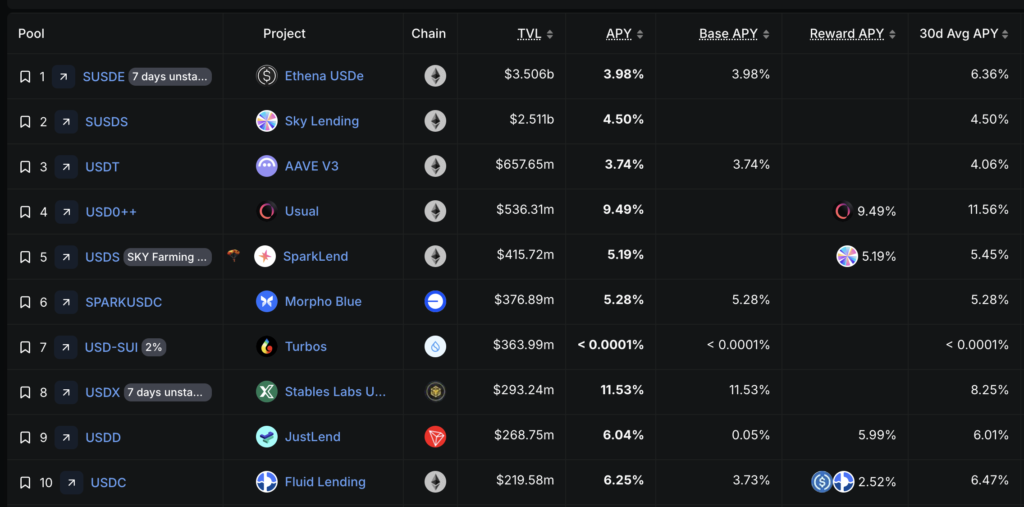

2. Finding Stablecoin Yield

Stablecoin yield is a crypto version of savings, and it is one of the most widely used DeFi products. Some of the biggest DeFi protocols offer very competitive yields for stablecoins like USDC and USDT. Currently, Ethena, Sky, Aave, and Usual are dominating the stablecoin yield sector with the biggest TVL.

In sideways or choppy market conditions where you don’t want to trade, parking your assets in stablecoin protocols can be really helpful. So, this is one of the best ways on how to profit when the market crashes. This can also help avoid overtrading in a bad market.

Additionally, it is best to use proven DeFi protocols, as there is still risk from smart contract hacks. Don’t get tempted by high APY stablecoin protocols with little liquidity. Always choose protocols with the highest TVL. For instance, in Solana, this would be Kamino Lend, and in Ethereum, it is Sky Lend or Ethena.

You can access stablecoin lending apps through web3 wallets such as MetaMask, Wallet Connect, Trust Wallet, etc.

3. DeFi Lending

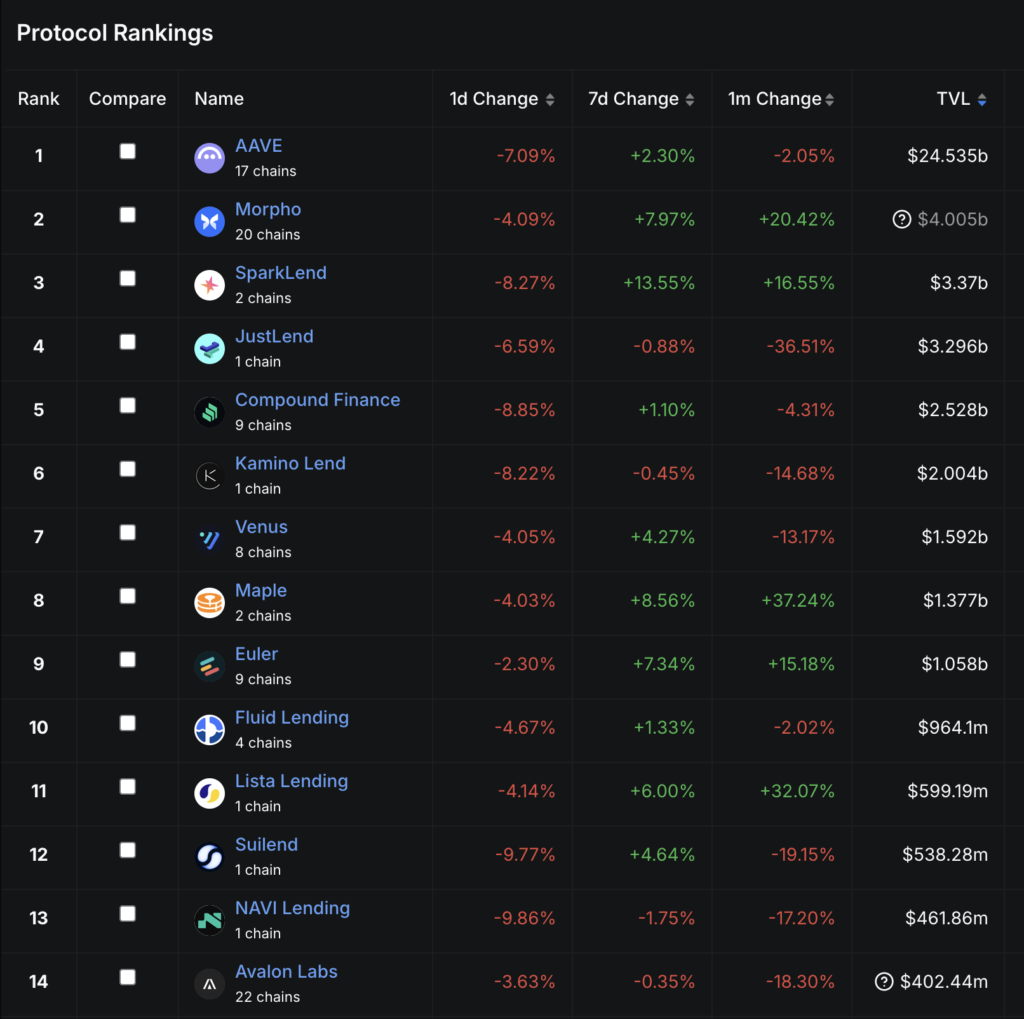

DeFi lending is supplying tokens (usually altcoins) to a lending protocol. Lending apps are one of the most popular use cases in DeFi, accounting for almost 50% of the TVL in DeFi. Additionally, more than 60% of DeFi activities exist on Ethereum and its L2 networks, with apps such as Aave, Morpho, and Compound leading.

The TVL for DeFi lending apps have reached a new all-time high in 2025, surpassing even the mania of the 2021 bull market.

In DeFi lending, users can loan out their assets for yield. Many investors often do this to compound their long-term altcoin holdings, especially if the token has liquid staking. Additionally, advanced DeFi lending often involves yield looping or yield farming by lending tokens repeatedly through several liquidity pools.

DeFi lending apps are easily accessible through web3 wallets such as MetaMask, Wallet Connect, Trust Wallet, etc.

4. Airdrop Farming

Airdrop farming is the act of trying out new protocols and crypto apps in the hope of getting an airdrop allocation when the project launches its token. It is a popular activity for crypto investors and Web3 enthusiasts. The popularity of airdrop farming has shot up in the last few years after several successful airdrop projects such as Hyperliquid, Jito, Jupiter, etc.

Airdrop farming is essentially committing time, energy, and capital to a new and emerging crypto project. Users will stress-test the app or network, help discover bugs, and become early adopters for projects. Usually, projects reward users based on their contribution and capital commitment.

However, the caveat here is that projects usually hide airdrop qualifications until the launch to prevent bots and sybils. This is why airdrop farming is often hit-and-miss, as users can only speculate on their allocation.

Airdrop farming on major blockchains such as Solana, Sui, Base, and Ethereum is relatively easy, as you can access the projects using an existing wallet. However, trying out new projects like Monad will not be as easy and will require some technical know-how.

Why Having A Web3 Wallet Is a Must in This Bull Market

All four strategies above will give you ideas on how to stay profitable in a bull market, even when the market crashes. Many new investors and traders are confused about what to do in a bull market besides buying or selling assets.

However, as shown in this bull market, investors who are curious can be rewarded by the market. In this bull market, we see the resurgence of DeFi protocols, big airdrops such as Hyperliquid, and the general Web3 ecosystem flourishing.

In addition, owning a non-custodial wallet is important to be early in the market. We see that so many winning altcoins (FARTCOIN, POPCAT, HYPE, etc) can be bought early through DEX before being listed on CEXes. Owning a Web3 wallet such as Pintu Web3 opens up so many profit opportunities, whether you’re an investor or trader.

There are already several guides on how to use Pintu Web3 for DeFi apps:

- A Practical Guide: 4 Optimal Strategies for Using Jupiter in DeFi

- What is Kamino Finance? Key Features and Optimal Strategies

- MakerDAO Rebrands to Sky: How It Works and Features of the New Tokens USDS & SKY

Conclusion

A bull market isn’t just about buying low and selling high; it’s about leveraging every phase of the cycle. As shown in the last two years, there are long periods of market slumps, marked by choppy sideways activity with low liquidity. Smart investors will utilize staking, stablecoin yields, DeFi lending, and airdrop hunting to maximize profit in various types of markets. You can continue compounding gains even when prices chop or correct.

References

- @DeFiMinty, “What to do in a bull market“, X, accessed on 10 June 2025.

- Chris Seabury, “Profiting in Bear and Bull Markets“, Investopedia, accessed on 12 June 2025.

- DeFi Education, “DeFi Renaissance,” Substack, accessed on 13 June 2025.