Signal Trading Summary:

- Tether Gold (XAUT)

- Entry [Sell/Short]: $4.819,7

- Stop Loss [SL] : $4.973,4

- Take Profit [TP] :

- TP1: $4.594,8

- TP2: $4.509,2

- Livepeer (LPT)

- Entry [Sell/Short] : $2,697

- Stop Loss [SL] : $2,863

- Take Profit [TP] :

- TP1: $2,501

- TP2: $2,363

- Syscoin (SYS)

- Entry [Sell/Short] : $0,01495

- Stop Loss [SL] : $0,01588

- Take Profit [TP] :

- TP1: $0,01403

- TP2: $0,01307

1. Tether Gold (XAUT)

XAUT’s price movement is still held back by strong horizontal resistance in the $5,088 area. This level has been tested twice and always leads to price rejection, signaling a fairly dominant selling pressure in the zone.

Currently, the price is trying to rebound after retesting the uptrend line. However, if this trend line is successfully broken (breakdown), then the scenario of continued decline becomes increasingly valid and can be utilized as a short opportunity.

In the breakdown scenario, XAUT has the potential to continue weakening with the target of falling towards the next support area in the range of $4,594.

Notes: As long as the price remains below the $5,088 resistance, the bias is bearish to neutral.

XAUT Potential Sell/Short Setup:

Entry [Sell/Short]: $4.819,7

Stop Loss [SL]: $4.973,4

Take Profit [TP]:

- TP1: $4,594.8

- TP2: $4,509.2

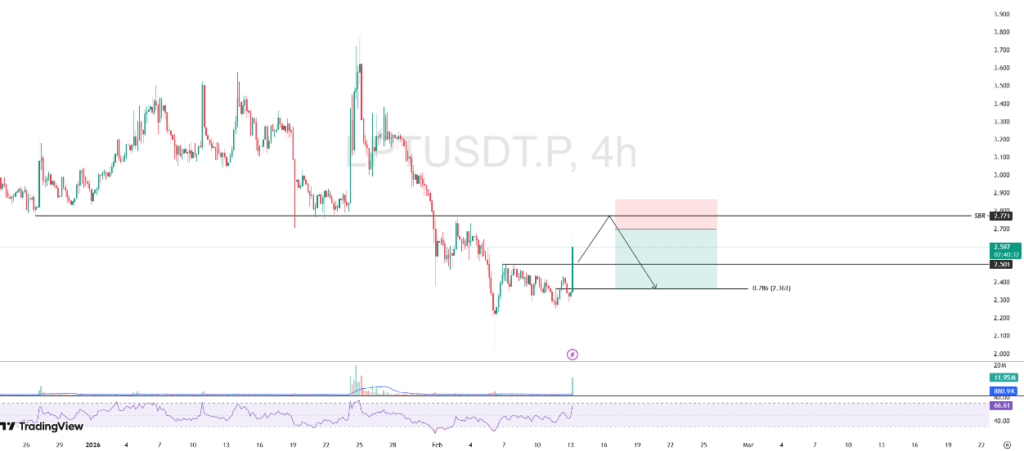

2. Livepeer (LPT)

LPT prices registered an increase after the close of the daily candle this morning, where the upward movement managed to break the resistance in the $2,501 area. This breakout indicates a continued buying impulse in the short term.

However, the $2,771 area which is a SBR (support become resistance) is a crucial level to watch out for. If the price touches this zone and a rejection appears, then a short opportunity opens up.

If the rejection scenario occurs, LPT could potentially experience a correction with a downward target towards the $2,363 – $2,501 area as the closest support zone.

Notes: As long as the price fails to stay above the $2,771 SBR area, the potential for correction is still quite open.

LPT Potential Sell/Short Setup:

Entry [Sell/Short]: $2,697

Stop Loss [SL]: $2,863

Take Profit [TP]:

- TP1: $2,501

- TP2: $2,363

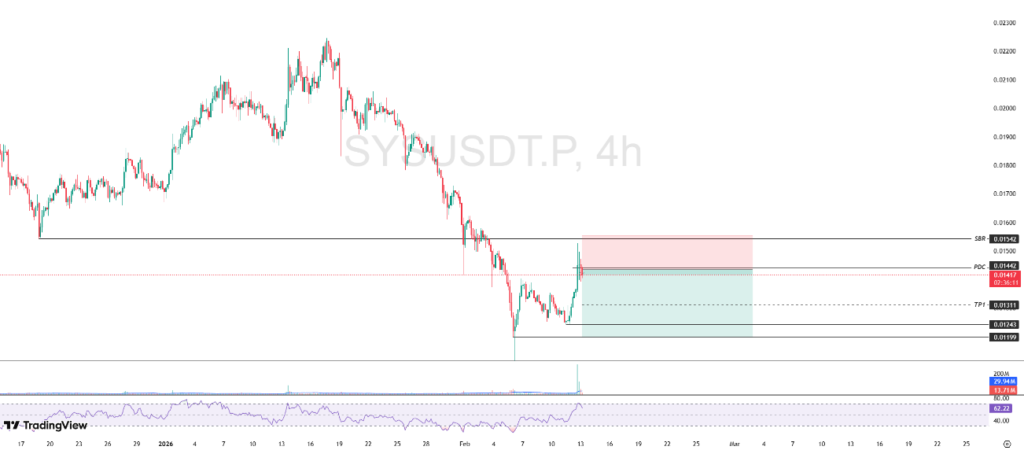

3. Syscoin (SYS)

SYS’s upward movement began to show weakness when the price approached the resistance area which is the SBR (resistance becomes support) at $0.01542. This zone is a crucial area because it has the potential to trigger selling pressure.

Meanwhile, the current price decline is still stuck at $0.01403 support, opening up the opportunity for a short-term rebound to retest the resistance area.

If at the retest resistance phase the SYS price experiences rejection, then this condition can be utilized as a short selling opportunity. In this scenario, SYS has the potential to continue its correction with the main target towards the $0.01307 area.

Notes: As long as the price fails to break and hold above $0.01542, the movement bias is likely to be corrective.

Setup Potential Sell/Short SYS:

Entry [Sell/Short]: $0,01495

Stop Loss [SL]: $0,01588

Take Profit [TP]:

- TP1: $0.01403

- TP2: $0.01307

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, it is best to use a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.