The crypto market entered the second week of January 2026 with a cautious sentiment. Despite positive news from major financial institutions, price movements of major assets such as BTC, ETH, and SOL are still stuck below key resistance levels, while markets await the release of crucial US macroeconomic data this week. Here is a complete summary of market conditions, institutional fund flows, and technical analysis for this week.

Article Summary

- Institutional Adoption: Morgan Stanley is set to launch the Spot Bitcoin ETF and Solana Trust, a strategic move that could potentially strengthen crypto’s legitimacy among institutional investors.

- BTC & ETH Technical Analysis: BTC & ETH still have further upside potential if prices hold above the 20-Day EMA although both failed to break the previous resistance.

- SOL Technical Analysis: Upside potential towards $173 is open if the price manages to reclaim and breakout above $144.8.

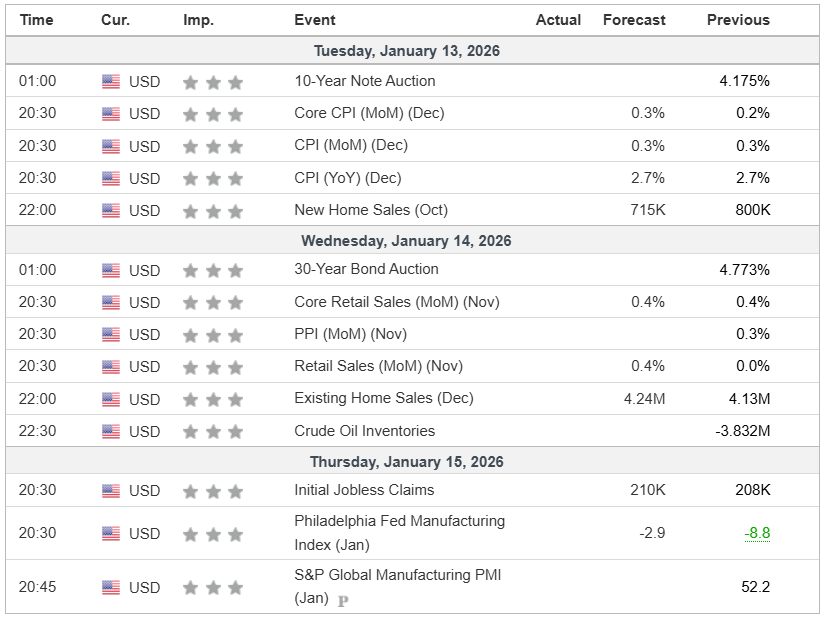

- Key Economic Calendar: A number of US economic data will be released on January 13-15, 2026, including CPI(Consumer Price Index), PPI(Producer Price Index), Retail Sales, Initial Jobless Claims, as well as the Philly Fed Manufacturing index.

1. Market Sentiment & Institutional Fund Flows

This week is a crucial period for the market, although the Fear & Greed index is still at neutral levels after the selling pressure from institutional investors in the previous week. In this context, the market’s attention will be focused on important news that could be an indicator of inflation and potentially affect monetary policy expectations and the direction of future asset movements.

Fear & Greed Index: Neutral

Market sentiment is currently in the Neutral zone with a score of 41. This figure is slightly lower than last week’s 42 and far from the annual high of 76(Greed). This shows that market participants are still waiting and seeing for confirmation of the next trend direction.

Bitcoin Spot ETF Netflow

Institutional activity through the Bitcoin Spot ETF shows mixed dynamics. Although the total net inflow since the beginning of the year has exceeded $1.1 billion, the latest trading data (January 5-9, 2026) shows selling pressure at the end of the week:

- Beginning of the Week (Jan 5): Positive inflow of +7.62K BTC.

- Weekend (Jan 6-9): There were consecutive outflows, with January 9 recording an outflow of -2.75K BTC.

- The total net assets of Bitcoin ETFs now stand at $123 billion, equivalent to 6.57% of the total Bitcoin market capitalization.

2. Headline Highlights: Morgan Stanley’s Big Move

Positive news comes from investment banking giant Morgan Stanley, which is getting serious about digital assets.

- New ETF Filings: Morgan Stanley has filed an S-1 form with the SEC to launch the Spot Bitcoin ETF and Solana Trust.

- Product Structure: Their Bitcoin product is designed as a passive fund that holds Bitcoin directly (not derivatives) to track the price of the asset.

- Impact: The move follows the rapid expansion of the Bitcoin ETF market in the US over the past two years and signals maturing institutional adoption. The Solana Trust product is also proposed to track the Solana price, where similar funds have grown to over $1 billion in total net assets.

3. Important Economic Calendar: January 13-15, 2026

Market volatility is expected to increase mid-week with a series of US economic data releases:

- Tuesday, January 13: Release of monthly and annual CPI (Consumer Price Index) data. This is a key inflation indicator that will influence the Fed’s interest rate policy.

- Wednesday, January 14: PPI (Producer Price Index) and Retail Sales data. This data will provide insight into consumer purchasing power and inflation at the producer level.

- Thursday, January 15: Initial Jobless Claims data and Philly Fed Manufacturing index.

4. Technical Analysis of Major Assets (BTC, ETH, and SOL)

Amid the recent market dynamics, BTC, ETH, and SOL have seen uneven price movements in the past few days. Here is an analysis of the price movements of each asset as of January 12, 2026.

Bitcoin

- Current Conditions: Bitcoin is facing high selling pressure as it hits the $93,837 level. This level is a strong resistance that is holding back the upside.

- Key Support: The price decline has so far been held back by dynamic support (20-Day EMA) at $90.378.

- Projection:

- Bullish: If the price holds above the 20-Day EMA, the upside potential is again open.

- Bearish: If the price drops (breakdown) below $90,378, the downside potential could reach the strong support area at $83.821 – $86.284.

Ethereum

- Current Conditions: ETH experiencedrejection as it approached the $3,318 – $3,448 resistance area. The bearish engulfing pattern that formed on January 7 signaled a further decline that occurred on January 8-9.

- Key Support: The 20-Day EMA at $3,088 is currently a solid stronghold.

- Projection: As long as the price stays above the 20-Day EMA, ETH still has the potential to chase resistance again. But if it fails, the next strong support is at $2,719 – $2,798.

Solana

- Current Conditions: The November 20 high at $144.8 is still a strong barrier. Several upside attempts ended with rejection at this level.

- Key Support: The 20-Day EMA at $133.88 serves as the immediate support. The November 21 low of $121.66 is a solid defense below it.

- Projection: A breakout above $144.8 is an absolute requirement to attract positive sentiment. If successful, the SOL consolidation target is expected to reach $173.

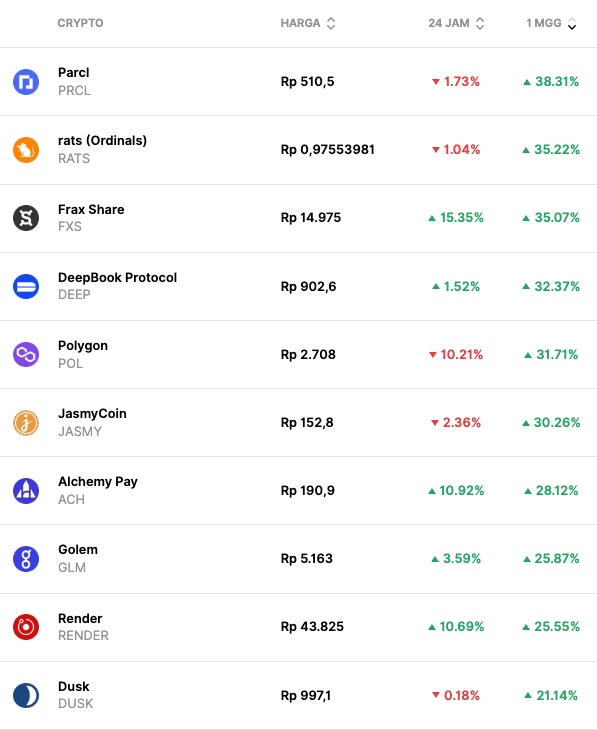

Crypto Asset Performance in the Last Week

Top Performing Crypto Assets

- Parcl ($PRCL) +38.31%

- Rats ($RATS) +35.22%

- Frax Share ($FXS) +35.07%

- DeepBook Protocol ($DEEP) +32.37%

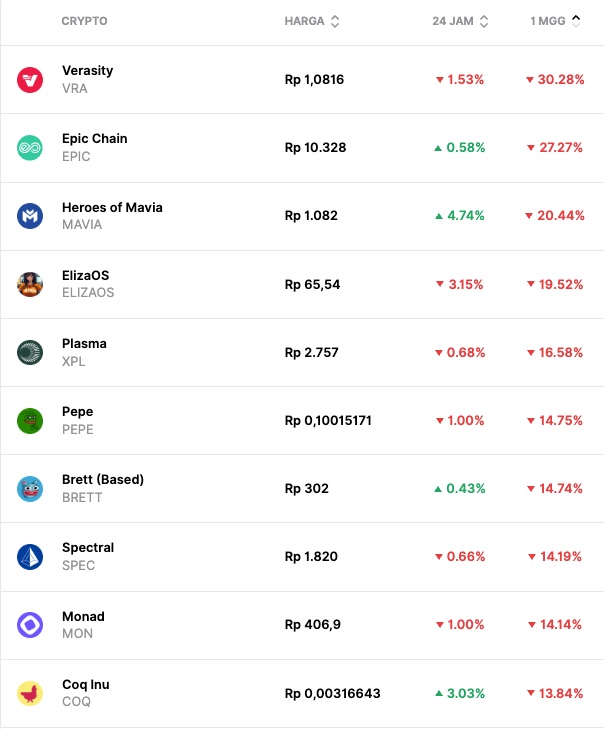

Worst Performing Crypto Assets

- Verasity ($VRA) -30.28%

- Epic Chain ($EPIK) -27.27%

- Heroes of Mavia ($MAVIA) -20.44%

- ElizaOS ($ELIZAOS) -19.52%

Conclusion

This week traders are advised to monitor the market reaction to the US inflation (CPI) data as well as the ability of Bitcoin and Ethereum to hold above their 20-Day EMA lines. News of Morgan Stanley’s ETF filing is a breath of fresh air for long-term fundamentals, but short-term technicals demand vigilance against critical support levels.

Disclaimer: All articles published on Pintu Academy are for educational purposes and do not constitute financial advice.

Reference Source:

- James Van Straten, Francisco Rodrigues, “Morgan Stanley files for bitcoin and solana ETFs, deepening crypto push“, CoinDesk, accessed on January 12, 2026.