Key Takeaways

- Positive Start Amidst Geopolitical Tension: The crypto market began 2026 on a recovery trend, though it remains overshadowed by geopolitical tensions following the U.S. operation in Venezuela.

- The Rise of Solana and Memecoin Season: Memecoins have seen significant gains (over 50% in the last 24 hours). The Solana ecosystem is showing a strong recovery, with DEX volume increasing by 19.95% over the past week alongside.

- Technical Analysis of Major Assets (BTC, ETH, SOL): Bitcoin successfully broke the $90,000 psychological level with a next target of $94,000, while Ethereum is attempting to break a trendline to reach $3,500. Solana is also showing strong bullish signals, with resistance targets set between $145 and $168.

- Focus on U.S. Economic Data: Investors should brace for high volatility at the end of this week, specifically regarding the release of Initial Jobless Claims (Jan 8) and Non-farm Payrolls (Jan 9), which are expected to be the primary market drivers.

The year is off to a good start for the crypto market. However, an unexpected event happened over the weekend: the US invasion of Venezuela, followed by the arrest of Venezuelan President Maduro and his wife. This action led to a lot of speculation on the direction of movement of commodities and risk assets such as crypto or US stocks.

Many cryptocurrencies are on the rise. On-chain volumes on some networks have increased significantly. These signs point to further recovery potential for the crypto market this week.

A few points about the market situation:

- The “wild ball” caused by the United States military operation in Venezuela. Many opposing opinions consider what the United States military is doing is military aggression that violates the sovereignty of other nations and ignores international rules. Some speculate that it is only a matter of time until other superpowers such as China or Russia will do the same extreme thing. For example, against Taiwan and Ukraine. This will put investors in fear and reduce liquidity flow into risky asset markets.

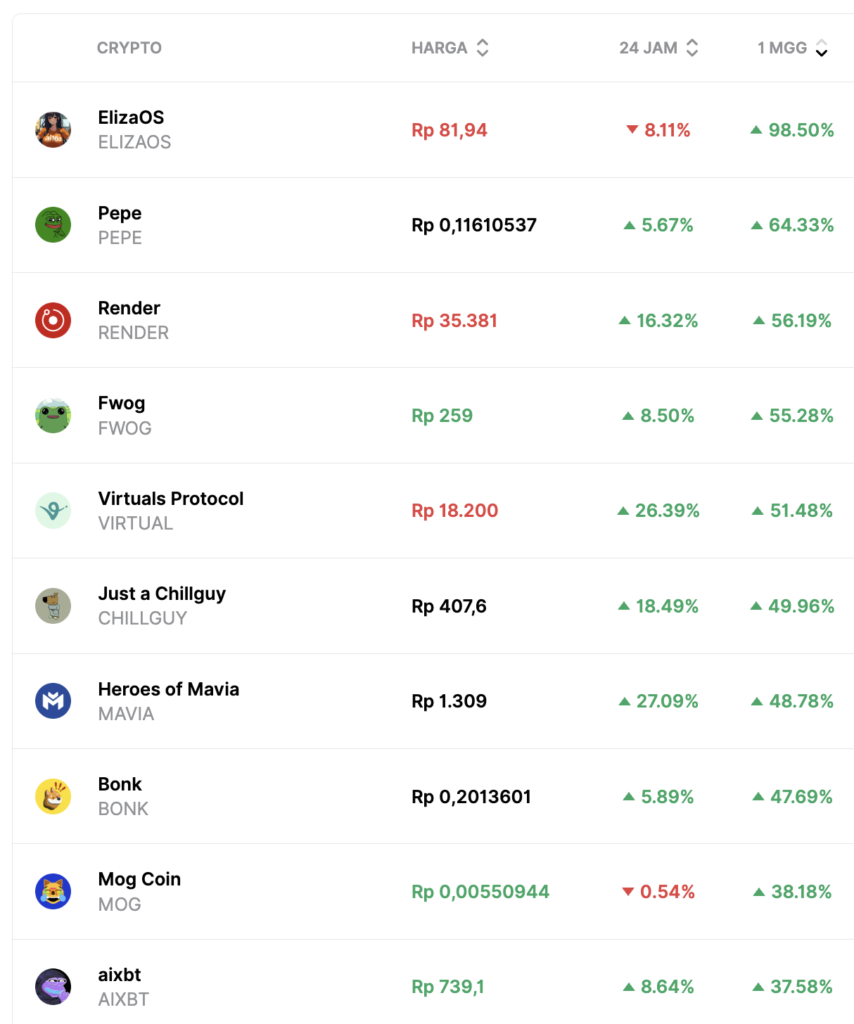

- “Memecoin Season“. Many cryptocurrencies in the memecoin category have been on the rise. Some of them have even increased by more than 50% in the last 24 hours. This indicates that the flow of funds from retail has started to enter the crypto market again.

Overall, market sentiment indicates that the market is trying to make a recovery. Currently, the focus will be on technical analysis where prices of assets with large market capitalization are facing their resistance points.

Bitcoin (BTC) Analysis

Breakout from Resitance

Bitcoin is seen showing its strength by breaking the $90,000 resistance level and holding above the 21 EMA indicator on the 1-day timeframe. The next resistance is the area around $93,000-$94,000.

Some crucial aspects to consider:

- The price formed a higher low indicating an uptrend.

- BTC needs to hold above the 21-day EMA.

- The $93,000-$94,000 area acts as resistance which, if broken, could provide momentum for Bitcoin to return to the $100,000 area.

Ethereum (ETH) Analysis

Determination of Bullish Momentum

Similar to Bitcoin, Ethereum is seen forming some bullish signals on its daily timeframe. It can be seen by the formation of a “higher low” in the area around $2,780 which acts as support.

However, the main difference with Ethereum technically is that at the moment Ethereum needs to break the trend line formed on the 1-day time frame. If Ethereum can break this trend line, then there is a possibility that Ethereum could continue its upward momentum to $3,400-$3,500.

Solana Analysis (SOL)

Technically, Solana also shows a fairly strong bullish signal. Marked by the price being above the 21 EMA and bullish divergence on its RSI.

Solana’s next target is at resistance at $145 and $168 provided that the price can stay above the 21-day EMA. In addition, the bullish condition of Solana can bring its ecosystem to increase, such as RAY tokens, JUP, and others.

On-Chain Analysis: Solana’s Resurgent Ecosystem

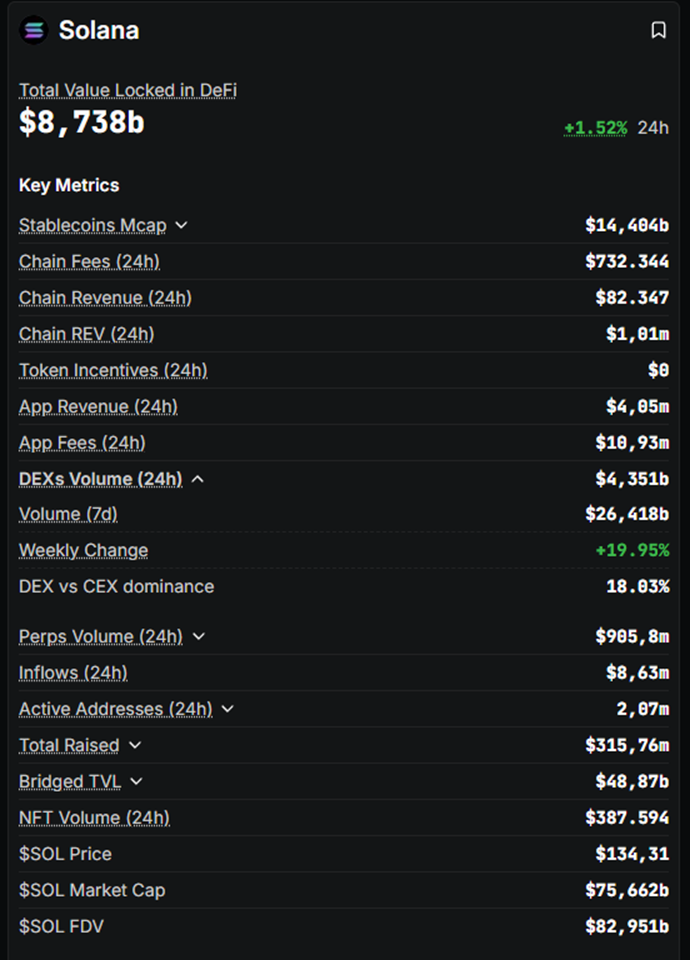

Solana network metrics. Source: Defillama.

Solana looks to be one of the stronger assets and networks in this recovery. In the last 24 hours, the locked value (TVL) on the Solana network increased by 1.52% and earned $82,347 in revenue.

The volume of decentralized exchanges (DEX) on the Solana network also increased by 19.95% over the past week. This indicates that the Solana ecosystem is experiencing significant activity and recovery.

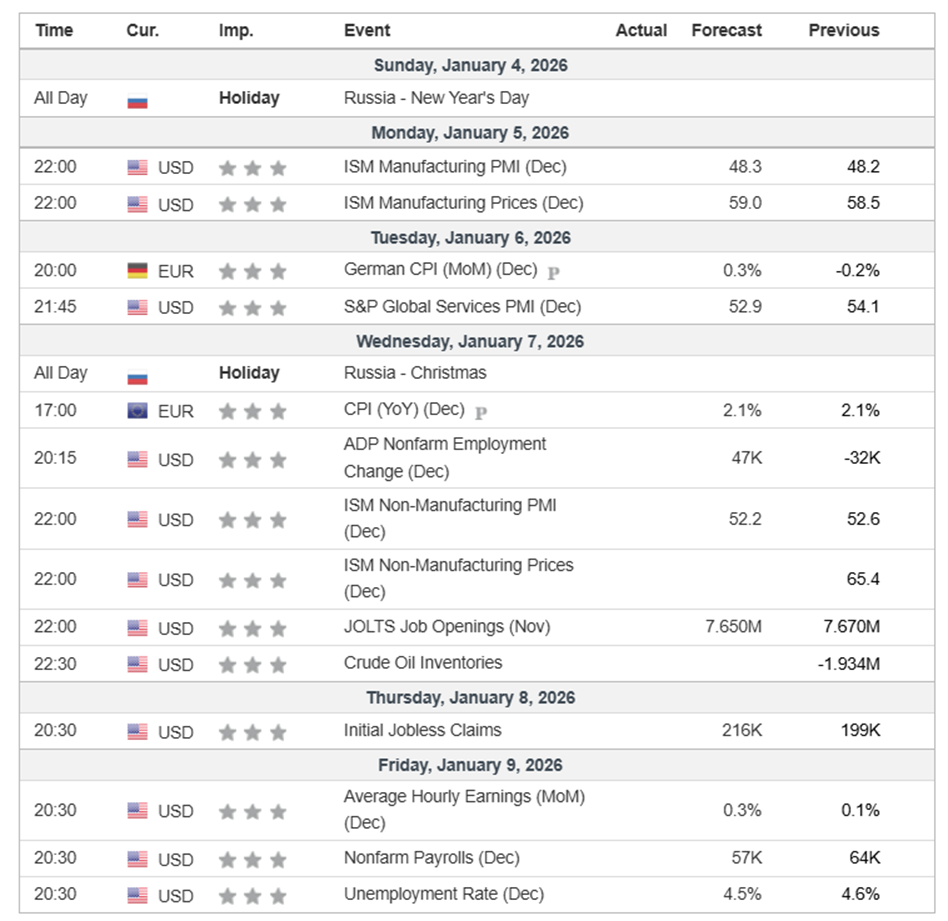

Macro Analysis

This week there will be some important economic events, such as Crude Oil Inventories which could be affected after the US military operation in Venezuela and some other manufacturing news. However, what could affect the crypto market significantly is the Initial Jobless Claim that will occur on Thursday, January 8, 2026 and the Non-farm payroll that will occur on Friday, January 9, 2026. We can anticipate market volatility on these days.

Crypto Asset Performance in the Last Week

Top Performing Crypto Assets

- ElizaOS ($ELIZAOS) +98.5%

- Pepe ($PEPE) +64.3%

- Render ($RENDER) +56.1%

- Fwog ($FWOG) +55.2%

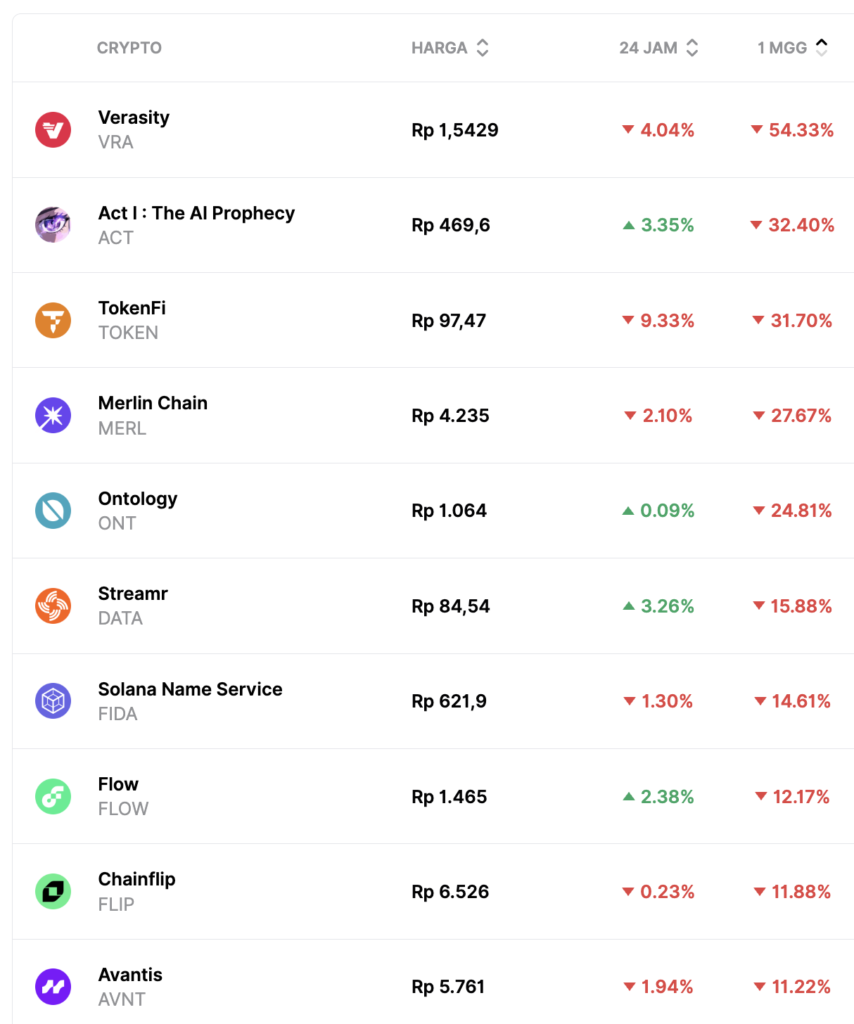

Worst Performing Crypto Assets

- Verasity ($VRA) -54.3%

- Act I: The AI Prophecy ($ACT) -32.4%

- TokenFi ($TOKEN) -31.7%

- Merlin Chain ($MERL) -27.6%