2023 has been a year of volatility and fluctuation for the cryptocurrency industry. Crypto investors were taken on a roller coaster ride with dramatic ups and downs throughout 2023. So, what happened in the crypto market throughout 2023? This crypto market report will examine the state of the crypto market in the past year including trends, narratives, and important news.

Article Summary

- Crypto markets Condition at the end of 2023: Bitcoin hit the $40k mark, with altcoins like INJ and SOL experiencing significant gains. Solana is in the spotlight with a 500% increase in Total Value Locked (TVL).

- AI in Crypto: AI became a major trend in early 2023, with projects like Fetch.ai and SingularityNET experiencing 1000% value appreciation. The AI trend continues to grow, especially in the context of decentralized AI with projects like TAO and OLAS.

- Memecoin and Inscriptions: PEPE and BONK led the rise of memecoin. Meanwhile, Ordinals technology enables NFTs in Bitcoin, resulting in the BRC-20 ecosystem and Inscriptions across multiple blockchains.

- Airdrops and Bitcoin ETFs: Large airdrops such as BLUR and ARB catalyzed the market, while the potential of Bitcoin ETFs caught the attention of institutional investors, promising wider adoption and clearer regulation.

The State of the Crypto Market at the End of 2023

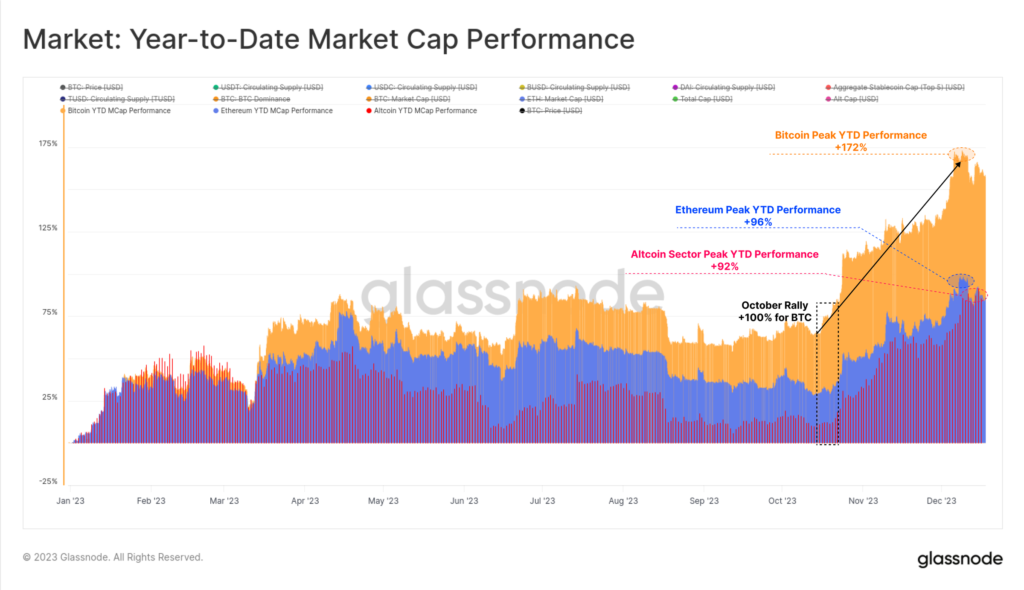

The fourth quarter of 2023 was the best quarter for Bitcoin and the crypto market as a whole. After failing to surpass the $30k resistance point several times and being stuck in the same price range, BTC finally managed to break through. Furthermore, BTC even climbed to the $40k mark in early December.

Bitcoin’s price movement triggered a positive response from the market and this extended to various altcoins. Altcoins such as INJ and SOL rose by around 500% and 400% during the fourth quarter of 2023.

Furthermore, Solana became the center of attention of many crypto users in the fourth quarter. Total value locked (TVL) in the Solana ecosystem rises 500%. The total DEX volume on Solana exceeded Ethereum’s DEX volume for the first time.

In addition, various potential trends and narratives for 2024 began to emerge throughout 2023. The dramatic rise of several memecoins such as PEPE and BONK created speculation that the memecoin season could return in 2024. The increasingly popular trend of modular blockchains also creates speculation on the potential narrative in 2024.

Next, we will discuss the crypto market trends throughout 2023 and their potential for 2024.

Recap of Crypto Market Trends and Narratives During 2023

1. AI or Artificial Intelligence

Artificial Intelligence or AI is one of the biggest jargons in 2023. This trend is fueled by OpenAI’s launch of ChatGPT at the end of 2022. Goldman Sachs estimates that investment in the AI industry will reach $200 billion by 2025.

The cryptocurrency industry certainly jumps on the AI trend. In early January 2023, several projects that mentioned AI integration experienced a drastic increase. As in the image above, FET of Fetch.ai increased by more than 1000%. SingularityNET, Numeraire, and Ocean Protocol are some of the projects that have successfully enjoyed the AI hype.

Many argue that the AI trend in the crypto industry is just hype. Andre Cronje, one of Fantom’s top brass, even said that AI and crypto are not compatible and AI projects in crypto are just pump-and-dump schemes.

However, the second wave of AI trend in crypto returned to popularity around the end of October 2023. However, this AIxCrypto wave was led by a different category, decentralized AI. Bittensor (TAO) and Autonolas (OLAS) are leading the adoption efforts of decentralized AI.

With the AI industry continuing to grow, it is not impossible that the idea of AIxCrypto could flourish in 2024.

2. Memecoin Season 2

Since DOGE and SHIB reached the mainstream, many crypto investors have been aggressively looking for memecoins. If you go to X, you can see many people tweeting “(name of memecoin) is the next DOGE!”. We can’t ignore the impact of memecoins like DOGE.

In 2023, two major memecoins emerged, PEPE and BONK. Both broke the $1 billion market cap. Furthermore, they also spark a new memecoin season.

Read more: Meme Coin Season: How to Avoid Scam and Rug Pull in Meme Coin.

PEPE’s rise in April 2023 was a catalyst for many other memecoins (most of which are now down 80%++) on Ethereum. BONK was the catalyst for the first memecoin season on Solana in early January and December 2023. There are now several memecoins on Solana that have broken the $100 million market capitalization such as WIF, MYRO, and SILLY.

The memecoin season has reinvigorated crypto investors’ faith in the potential of memecoins for a bull market. However, always remember that most memecoins always go down 99% and only 1 out of thousands of memecoins can become a BONK or DOGE.

3. Ordinals, Bitcoin Inscription, and Inscription on the EVM Blockchain

In early January 2023, a developer created a way to create NFTs in Bitcoin. Casey Rodarmor created the Ordinals protocol to create NFTs by sculpting or inscribing directly into Bitcoin network blocks.

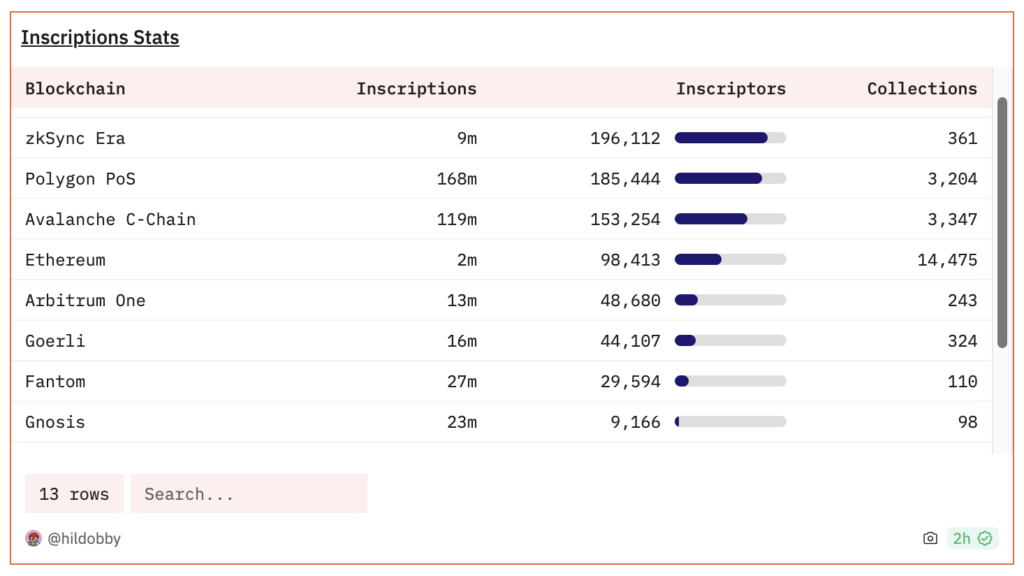

Casey’s Inscriptions method is very different from typical NFTs because each Inscriptions is recorded on-chain without using a Web2 server. As of January 4, 2024, the number of Inscriptions in Bitcoin has reached 53.2 million.

Still confused about Ordinals? Read this: What Are Ordinals? Bitcoin Booming NFT Innovation.

Then, two months after Ordinals, @domodata experimented with the BRC-20 token in Bitcoin. BRC-20 is a type of Inscriptions with fungible token instructions. Unexpectedly, BRC-20 exploded and created its ecosystem.

ORDI and SATS, the two earliest created BRC-20 tokens, now have a market capitalization of over $1 billion. Both have risen over 1000% since the beginning of November 2023. Yet, they have no meaningful functionality and are more akin to memecoins than projects with clear fundamentals.

Apart from Bitcoin, the Inscriptions fever has now spread to other blockchains. The crypto community has realized that the Inscriptions method creates “true” NFTs that are stored on-chain. As shown in the image above, millions of Inscriptions have been created on various EVM networks. The Arbitrum network was down for more than 1 hour due to Inscriptions.

With such staggering statistics, the potential for Inscriptions and the BRC-20 looks positive. However, a major obstacle to BRC-20 and Ordinals is the outcry from the Bitcoin community. Some members of the Bitcoin community consider the Ordinals protocol to be inconsistent with Satoshi’s goals for Bitcoin it has to be excluded from the BTC block.

4. Airdrop Season

The airdrop narrative also became very intense in 2023. Many projects took advantage of the improved market situation to start airdropping. Some of the major projects that airdropped in 2023 were Arbitrum, Blur, Celestia, Sei, and Jito.

Market conditions often come into consideration when launching an airdrop. In a bad market situation, users who receive an airdrop are likely to sell the assets immediately. Therefore, teams usually wait for conditions to improve before airdropping tokens.

The BLUR and ARB token airdrops kicked off the 2023 airdrop season. 1.16 billion ARB tokens were distributed to users on March 23, 2023. With the token value reaching $1, this means that the ARB airdrop totaled $1.16 billion. Meanwhile, BLUR distributed 360 million BLUR tokens to NFT traders on its platform.

Both airdrops in the first half of 2023 were significant catalysts. BLUR revived the NFT market and positioned Blur as a major competitor to OpenSea. In fact, as of January 5, 2024, the volume and number of NFT trades on Blur far exceeded that of OpenSea. The ARB airdrop was a catalyst to establish Arbitrum as one of the leaders of Ethereum’s L2 sector.

In the second half of 2023, the TIA, SEI, and JTO airdrops took the crypto community by surprise as they were quite sudden. So, most investors were focused on the potential airdrops of projects like LayerZero, zkSync, and Scroll.

While the much-anticipated LayerZero has yet to announce anything, Celestia and Sei are now projects above the $1 billion market cap. Celestia and Sei are even triggering a potential new trend for 2024: parallel EVM from Sei and the Celestia DA ecosystem.

Lastly, Jito’s JTO token airdrop was the catalyst for the drastic rise of Solana’s on-chain ecosystem. Many users earned $10,000 worth of JTO airdrops just by owning a few JitoSOLs. With such a massive capital injection, Solana’s DEX volume reached $28 billion in December 2023.

2023 was a happy year for many users who enjoy chasing airdrops. In addition, many protocols will airdrop in 2024 such as LayerZero, Jupiter, zkSync, and others.

5. Bitcoin ETF

The news of Bitcoin ETF (Exchange-Traded Fund) is the biggest catalyst and narrative in the crypto industry throughout 2023. ETF is a type of trading that is most often used by institutional investors. The acceptance of ETFs will open the floodgates of access to BTC and clarify its regulation as an asset.

Read more: What is Bitcoin ETF? – Pintu Academy.

Moreover, with BlackRock at the forefront of Bitcoin ETF demand, analysts predict the chance of the ETF being accepted is very high. Besides BlackRock, 14 other investment firms also file for Bitcoin ETF. The SEC must approve all ETF filings because these companies’ filing documents follow BlackRock’s template.

So, what is the impact of the potential acceptance of ETFs on Bitcoin? Galaxy Research estimates that the flow of funds toward BTC in 2024 will be around $14.4 billion. Furthermore, this figure will continue to rise to $38.6 billion by year 3.

Recommended reading: 7 Spot Bitcoin ETF Impact and Potential – Pintu Academy.

Recap of Important News from the Crypto World Throughout 2023

- February 14 – BLUR token airdrop.

- March 11 – USDC depeg as Silicon Valley Bank declared bankruptcy.

- March 16 – ARB token airdrop.

- April 12 – Shanghai Upgrade officially enters Ethereum mainnet.

- May 5 – PEPE memecoin reaches $1 billion market capitalization.

- June 5 and 6 – US SEC sues Coinbase and Binance.

- June 16 – BlackRock officially files a spot Bitcoin ETF.

- July 14 – Ripple wins against the SEC and XRP is declared not a security.

- July 24 – Sam Altman’s Worldcoin (WLD) is officially launched.

- August 7 – PayPal launches PYUSD stablecoin.

- August 11 – FriendTech goes viral among the crypto community.

- August 15 – SEI token airdrop.

- September 5 – Visa officially cooperates with Solana.

- September 26 – TIA token airdrop.

- November 3 – Sam Bankman-Fried is found guilty of FTX fraud.

- November 9 – BlackRock files a spot ETF for ETH.

- November 21 – Binance pays a $4 billion fine to the US DOJ.

- December 7 – JTO token airdrop.

- December 15 – BONK reaches a $1 billion market cap.

Conclusion

The year 2023 was a significant and turbulent year for the cryptocurrency industry. A significant rise in the value of Bitcoin and altcoins such as INJ and SOL, marked the fourth quarter as a period of strong growth. Emerging trends include the rise of memecoins, the integration of AI in crypto, and the popularity of Ordinals and Inscriptions technology in Bitcoin. Additionally, high-impact airdrops and the potential for Bitcoin ETFs came into focus, indicating the development of the crypto industry and the possibility of wider adoption in 2024.

References

- @CryptoKoryo, “2023 produced few new crypto millionaires. 23 Golden opportunities you missed in 2023. And 10 tips to not miss the next ones in 2024”, Twitter, accessed on 3 January 2024.

- Checkmate, Glassnode, “2023 Yearly On-chain Review”, Glass Node, accessed on 4 January 2024.

- DeFi Education, “2023 Year-in-Review”, Substack, accessed on 4 January 2024.

- Web3 Academy, “Top 29 Web3 News in 2023”, Bankless Substack, diakses pada 5 January 2024.

- Philcoin, “2023 Crypto Recap: Key Headline Events That Shaped the Year,” Substack, accessed on 5 January 2024.