2025 is primed to be a significant year for crypto with many significant catalysts. Donald Trump’s appointment as US President sparks optimism about the changing regulatory environment in the US. With a more positive attitude towards crypto, Bitcoin adoption among financial institutions is already increasing. Additionally, the potential of altcoin ETFs in the US excites the altcoin market.

Key Takeaways:

- 2025 is a pivotal year for crypto, driven by regulatory optimism under Donald Trump’s presidency, increasing Bitcoin adoption by financial institutions, and the potential for altcoin ETFs in the U.S.

- Decentralized exchanges (DEX) are gaining traction, with Solana emerging as a key player, surpassing Ethereum in DEX volumes, active addresses, and revenue, while memecoins and AI-driven projects fuel growth.

- Bitcoin remains dominant, bolstered by the success of spot ETFs, which have amassed $129 billion in assets under management, though altcoins are expected to surge later in the bull market cycle.

- Emerging narratives for 2025 include the intersection of crypto and AI, the growth of real-world asset (RWA) tokenization, and the intensifying competition in the stablecoin market, with decentralized stablecoins challenging established players like USDT and USDC.

Into 2025: The Current Crypto Landscape

Bitcoin tumbled from $100k to around $92k towards the end of 2024, with talk of a weak economy into 2025. Rumors about the US DOJ selling BTC from the Silk Road case triggered a bigger drop, adding pressure to altcoins. However, the current landscape points to many key narratives that have yet to fully play out and potential catalysts for the market.

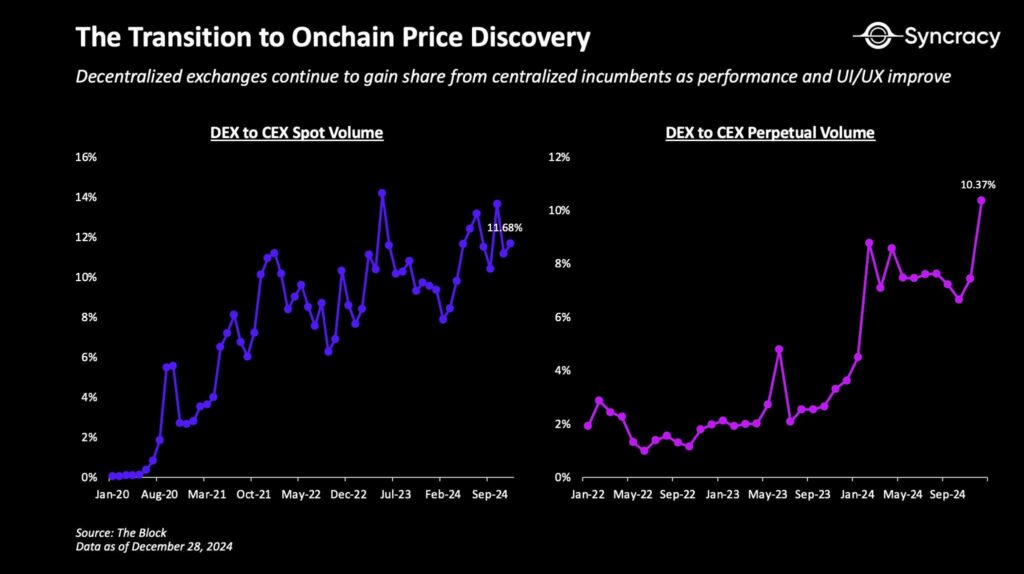

One of the most interesting data from the past year is the increasing volume of DEX compared to CEX. The emergence of performant decentralized perps such as Hyperliquid doubled the volume of DEX in 2024. Furthermore, DEX to CEX spot volume has been going up since 2020 and almost doubled in 2024.

Even though the total DEX-to-CEX volume is still around 10%, many of the winning altcoins of 2024 originated from DEX. PEPE, POPCAT, Bittensor’s TAO, VIRTUAL, and many others originally gained popularity from the community. This is a big shift from where the winning altcoins come from CEX such as TIA, DYM, etc.

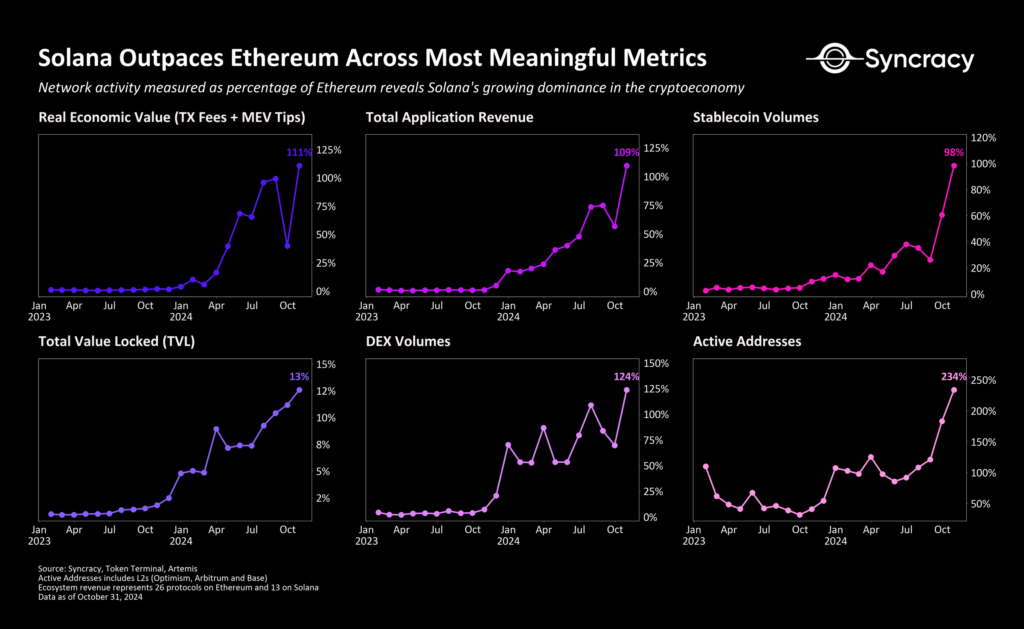

One factor of why DEX volume is soaring is the emergence of Solana as a haven for memecoins and new sectors emerging (such as AI agents). The data above shows a clear trend: Solana is truly catching up to Ethereum. In fact, Solana is already ahead of Ethereum in DEX volumes, total Dapps revenue, and active addresses.

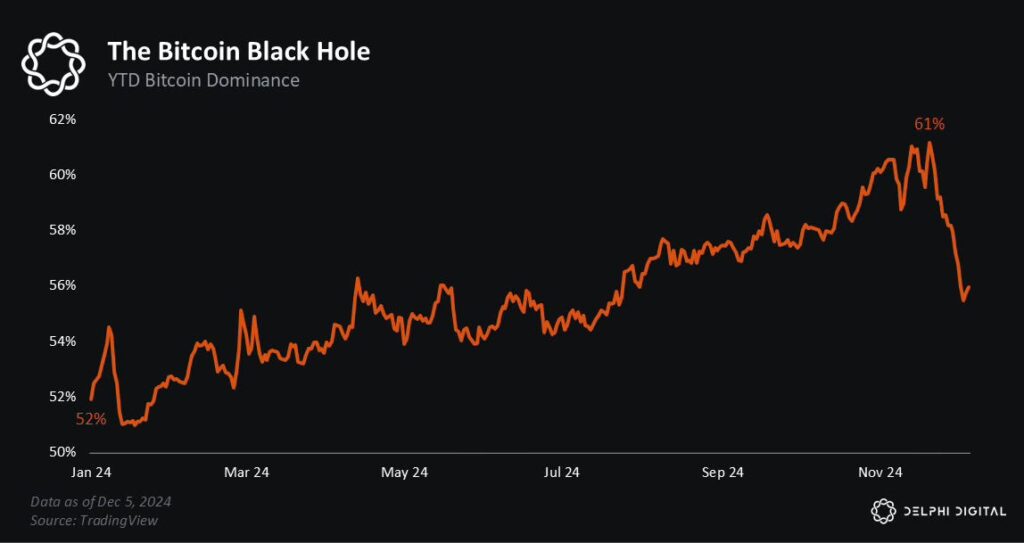

In addition to Solana, other altcoins such as XRP, SUI, and HYPE also had their moments in 2024. Although several up-and-coming altcoin trends are evident throughout 2025, data still shows that 2024 was still the year for BTC. The Bitcoin dominance chart below shows a consistent increase since the start of 2024.

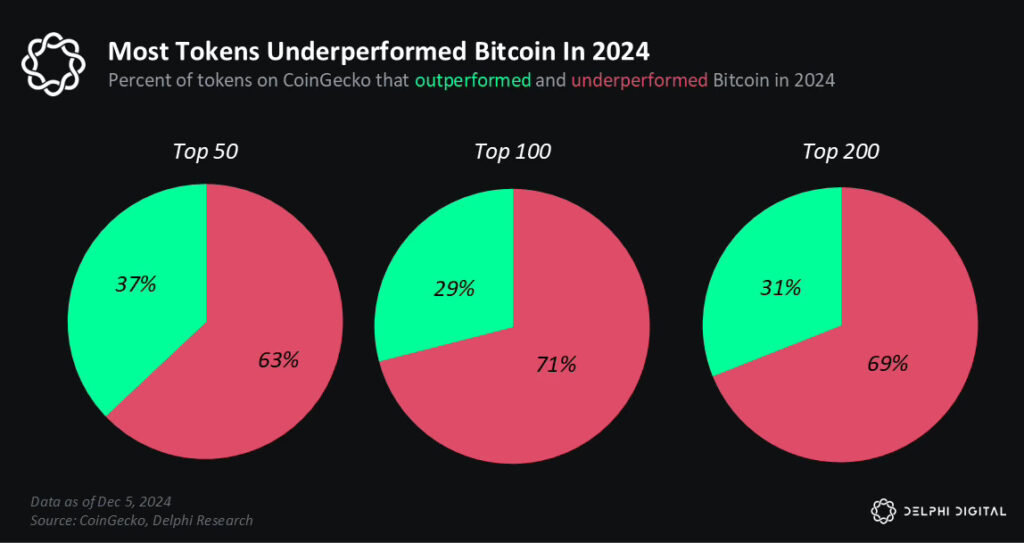

One of the biggest reasons for Bitcoin’s mammoth strength in 2024 was the spot ETF. As of December 17, 2024, the total US BTC ETF assets under management (AUM) is $129 billion, surpassing US Gold ETF despite just 11 months since launch. This is why only 37% of altcoins in the top 100 outperform BTC—which means 64 out of 100 altcoins can’t even surpass BTC in performance.

However, this doesn’t mean that altcoins won’t perform in 2025. As with previous cycles, altcoins tend to go parabolic towards the end of the bull market. Various key catalysts and narratives will breathe life into the altcoin market.

Two Key Catalysts for Crypto in 2025

1. Donald Trump Presidency and Regulatory Clarity in the US

Donald Trump is poised to be the first pro-crypto president in the US. Not only that, Trump brings along with him many pro-crypto staffers who have been placed in key positions. Immediately, Trump chooses known pro-crypto chairman Paul Atkins as the chair of the SEC. The previous chair, Gary Gensler, is famous for being anti-crypto and carried out several punitive actions against crypto entities such as Ripple.

Additionally, many analysts hope that Trump will be the first president to draft a proper regulation for cryptocurrencies. Trump’s pro-crypto approach will potentially open the floodgates for Bitcoin adoption in the US. More investors and institutions can confidently participate in the crypto economy.

Trump was also the first president to create a DeFi project and use memecoin. The official TRUMP memecoin reached $17 billion in market cap (as of January 19).

2. Altcoins ETF

The successful application of BTC and ETH spot ETFs opens the potential for altcoin listings. Analysts are especially hopeful after the anti-crypto Gary Gensler is no longer in charge of the SEC, the organization responsible for accepting ETF listings. VanEck’s head of digital asset research, Matthew Sigel, believes that there will be a SOL spot ETF before the end of 2025.

In addition to Solana, there are rumors of DOGE and XRP ETF products. XRP is the likelier of the two since Ripple has established itself in the US with more plans to integrate into the TradFi environment. However, a DOGE ETF in the US will likely send a bigger shockwave within the crypto industry—Memecoins ETF will likely accelerate the memecoin supercycle thesis.

Another high-impact event regarding ETFs is integrating staking and staking rewards for ETF investors. As of now, the previous SEC leadership prohibited ETF funds from staking ETH. Enabling staking for all crypto-related ETF products will likely forever impact the demand and supply side of crypto as an asset.

Three Potential Narratives for Crypto in 2025

1. Crypto x AI

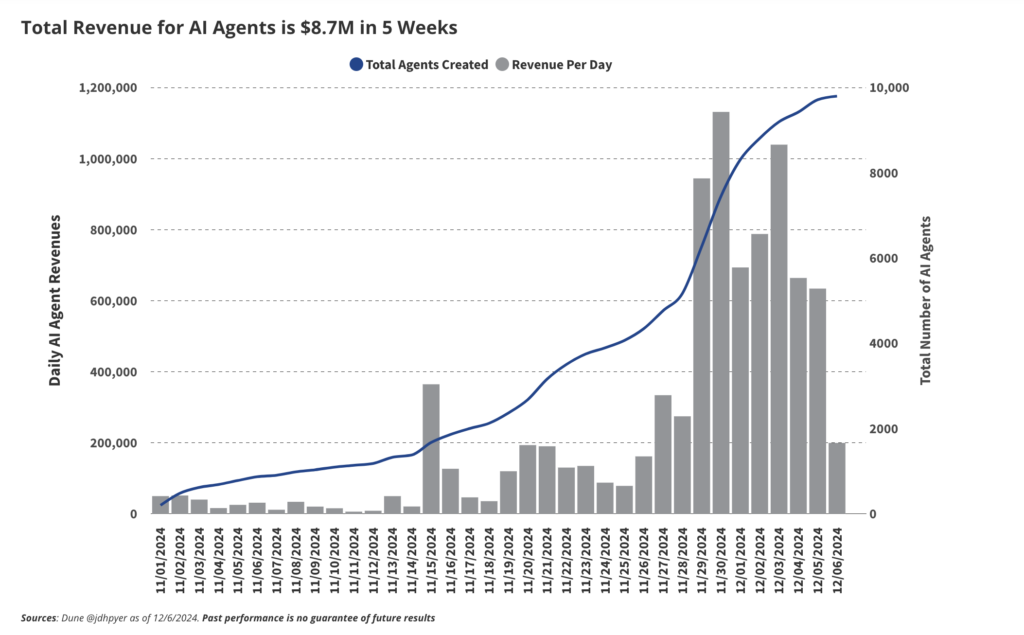

AI has been dominating mindshare in the crypto community throughout 2024. This is likely to extend further into 2025 as there are always “new shiny things” in the AI Crypto space. It is even more true now with the AI agents sector where new projects keep popping up every week. With that, it is obvious that the AI x crypto sector is here to stay.

The rising popularity of AI agents particularly rejuvenated the AI sector in crypto. Previously, investors could only invest in a few big projects such as Bittensor’s TAO, Fetch AI, and AIxDePin projects like Render.

The AI agents sector brings back the excitement of AI innovation within crypto. In a few months, projects like VIRTUAl, AIXBT, Alchemist, and Zerebro are enough to get the crypto community to speculate again on the next big thing.

Teng Yan (former Delphi) predicts that AI agents will keep increasing and become users sending onchain transactions. Multicoin Capital sees intelligent AI agents such as AIXBT to become alpha hunters and provide powerful analyses for investors.

Notable projects in this sector: TAO, VIRTUAL, AIXBT, AI16Z.

2. RWA and Tokenization

Tokenization has been one of the most talked-about crypto utilities in the last two years. The idea of turning valuable physical assets into tradable tokenized assets enticed many investors. Throughout 2024, the RWA sector grew more than 100%. Furthermore, RWA tokens based on the US treasury assets jumped 500%.

If we delve deeper into the sector, the Ethereum ecosystem has the most RWA protocols and the largest RWA TVL. Ethereum boasts 66 RWA tokens with a $3.8 billion in TVL with ZKSync Era surprisingly trailing in the second place ($1.9 billion TVL). The impressive number on ZKSync Era is because of Tradable, a platform tokenizing $1.7 billion of assets.

Various institutional investors are bullish on the prospect of RWA. VanEck predicts that securities tokenization will reach a $50 billion market cap by the end of 2025 (around 500% of current numbers). Research by Tren Finance reported that most institutional firms sets a potential target of the RWA sector of around $2 to $10 trillion by 2030. The long-term targets of these institutions also reflect the fact that this is RWA’s first cycle and we have yet to know its resilience in the midst of a bear market.

Notable projects in this sector: Ondo Finance, Syrup Finance, Mantra Chain, and MakerDAO.

3. Stablecoin War

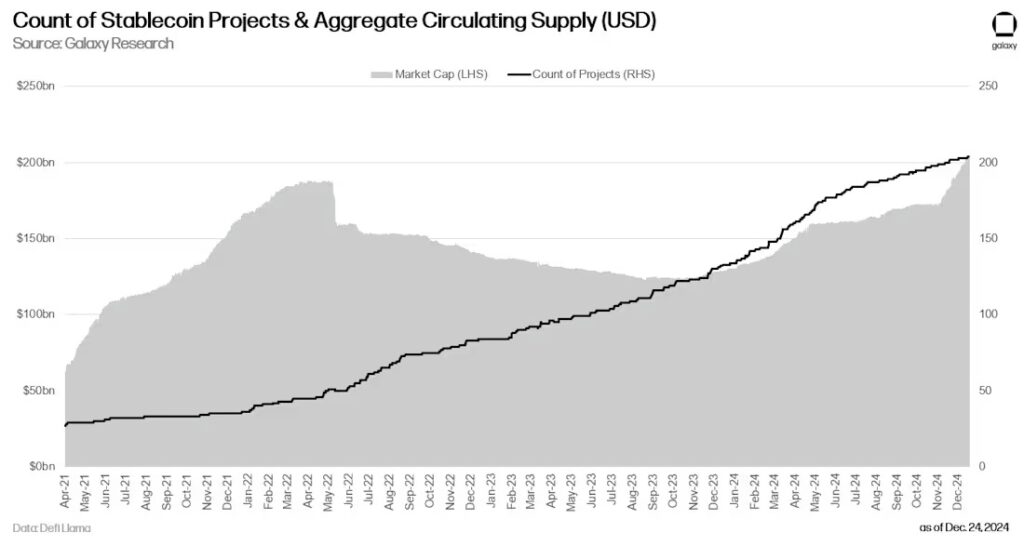

One of the key highlights from the past 2 years is the rise of stablecoins issued by DeFi protocols. Even though the dominance of USDT and USDC are far from being challenged. Their decentralized competitors aren’t lacking any momentum. Ethena’s USDe, MakerDAO’s USDS, and the newly-released Usual USDS are good candidates for finally competing with the giants.

Currently, the total market cap of stablecoin is around $200 billion. VanEck predicts that the stablecoin sector will grow past $300 billion by the end of 2025 while Galaxy Research puts the number higher at $400 billion. It isn’t impossible for big stablecoin protocols such as Sky (formerly MakerDAO) and Ethena to eat into the market share of USDT and USDC to fulfill the $300 and $400 billion target.

In addition, traditional financial institutions and countries are becoming interested in stablecoins. PayPal and BlackRock have already entered the stablecoin market to capture attention. However, DeFi protocols such as Ethena are also preparing to create a stablecoin product tailored for institutions. BlackRock’s Securitize, Ethena, and Usual Protocol even formed a strategic partnership.

Notable projects in this sector: Sky, Ethena, and Usual Money.

Conclusion

The crypto landscape in 2025 is poised for significant transformation, shaped by regulatory clarity, technological innovation, and evolving market dynamics. While Bitcoin continues to dominate, the rise of decentralized exchanges, the emergence of AI-driven projects, and the expansion of tokenized assets and stablecoins highlight the sector’s diversification. With key catalysts like pro-crypto policies and altcoin ETFs on the horizon, 2025 could mark a new era of institutional and retail adoption, further solidifying crypto’s role in the global financial ecosystem.

References

- @Darrenlautf, “2025 Reports to read”, X, accessed on 20 January 2025.

- Coinbase, “Crypto Market Outlook: 5 Things to Watch in 2025”, accessed on 21 January 2025.

- TheDeFiInvestor, “The State of Crypto in 7 charts”, Substack, accessed on 23 January 2025.

- Multicoin Capital, “12 things that excite us in Web3 in 2025”, Medium, accessed on 27 January 2025.

- Teng Yan, “What I’m Watching in 2025”, Chain of Thoughts, accessed on 27 January 2025.

- Galaxy Research, “Cryptocurrency & Bitcoin Predictions for 2025”, accessed on 28 January 2025.

- Matthew Sigel, Patrick Bush, “VanEck’s 10 Crypto Predictions for 2025,” accessed on 30 January 2025.

- CoinBase, “Crypto Market Outlook: 5 Things to Watch in 2025”, accessed on 30 January 2025.

- Stacy Muur, “Delphi’s “The Year Ahead for Markets 2025”: Key Insights”, Substack, accessed on 31 January 2025.

- Messari, “The Crypto Theses 2025”, 31 January 2025.