The following is a summary of today’s information for February 7, 2026 compiled to give investors and traders an overview, covering crypto markets such as Bitcoin and altcoins, as well as traditional asset markets such as gold and silver.

Crypto Highlight of The Month

Data sources: Tokenomist, DefiLlama, CoinMarketCap, DropsTab, Yahoo Finance, AInvest, X.

| Ticker | Category | Total Unlock (new tokens entering circulation) | Latest Developments | Outlook |

|---|---|---|---|---|

| $HYPE | Perpetual DEX | 140,000 HYPE ($4.8 million). Note: unlock tokens were reduced by -90% based on the announcement via Discord channel. Allocation: Core Contributors | ✅ HIP-4 trials via testnet, focusing on prediction markets. ✅ Ripple Prime integration and institutional access. ✅ Coinbase listing. | 🟢 Bullish |

| $SUI | Layer-1 | 8,317,320 SUI or $7.3 million (378,060 SUI/day) Daily unlock period: February 6-February 28, 2026. Allocation: Stake Subsidies | ✅ Releasing Tidehunder storage engine. | 🔴 Bearish |

| $ENA | DeFi | 171.88 million ENA ($19 million) Period: February 5, 2026 | ✅ Introducing Ethena Exchange Point . | 🔴 Bearish |

| $ARB | Layer-2 | 92.6 million ARB ($10 million) Period: February 14, 2026 | ✅ Robinhood tokenized stock trading on the Arbitrum network. | 🔴 Bearish |

| $PUMP | Launchpad | 10 billion PUMP ($18.96 million) Period: February 10, 2026 | ✅ Pumpfun acquires Vyper, a multichain terminal trading platform. | 🔴 Bearish |

| $LAYERZERO | Cross Chain | 24.68 million ZRO ($35.76 million) Period: February 20, 2026 | ✅ Robinhood listing ✅ Integration with Irys | 🔴 Bearish |

| $EIGEN | Restaking | 36.82 million EIGEN ($7.44 million) Period: February 1, 2026 | ✅ Issuing AI verifiable services | 🟡 Neutral |

| $JUP | DEX | 52.85 million JUP ($8.35 million) Period: February 28, 2026 | ✅ Polymarket Integration in Jupiter | 🟢 Bullish |

| $ROSE | Layer-1, Privacy Blockchain | 36.75 million ROSE ($501,000) Period: February 18, 2026 | – | 🟢 Bullish |

The outlook rating given by the Pintu Academy team is determined based on the amount of token unlock and the impact of the project’s latest developments.

Today’s Market Summary

Bitcoin

Bitcoin (BTC) plummeted to $60,000 on February 6, 2026, registering a correction of about 23% in five days. BTC is currently trading in the $70,000-$71,000 range after rebounding from $69,275, the level that was the peak of the 2021 bull run and is now being tested again as support.

Technically, the 200-week moving average is at $58,097 and is the next area of support. Thus, the $58,097-$69,275 range is a crucial zone to watch. Meanwhile, BTC’s weekly Relative Strength Index (RSI) is at 29.07, close to the November 2022 level (31.39) when BTC price was at $15,805.

BTC Liquidation Heatmap

After rebounding from the support area, the price range around $65,135-$69,166 shows an area of high long leverage , with an estimated liquidation value exceeding $200 million. This could create the potential for a long squeeze, as it is a zone of significant liquidity that could potentially trigger aliquidation cascade.

Silver

Silver experienced extreme volatility on January 30, 2026 with an intraday correction of -35% and this sharp drop was accompanied by a volume spike that more than tripled the daily average.

On the daily timeframe, Silver’s RSI structure shows a drastic drop from the overbought zone (~78) to 42.83 levels, while the RSI smoothing line is still stuck at 63.65. This ~21-point gap indicates a sell-off momentum that is moving much faster than its average trend.

Gold

Gold experienced heavy selling pressure after printing a new high, dropping from $5,610/oz to $4,426/oz, or a correction of around -21.3% in less than a week. In terms of technical indicators, the RSI which was previously at 94.81 (overbought zone) has now dropped to 50.29, which is the same area as the RSI movement on January 1 before gold printed a new high.

In addition, JPMorgan Global Research projects gold demand from investors and central banks to reach around 585 tons per quarter, which has the potential to be a price support in this gold bull run.

Institution Movement

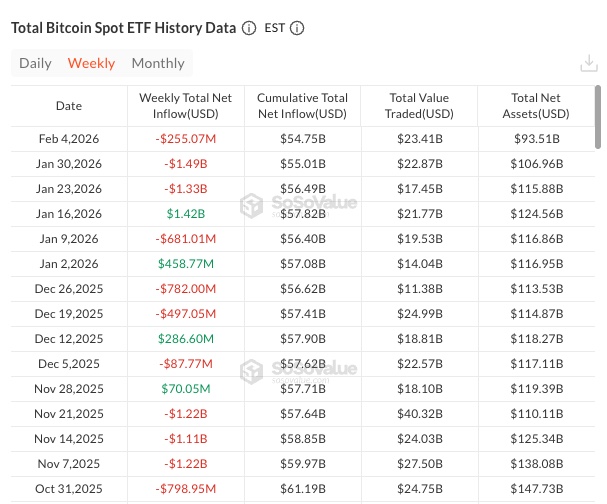

Capital movements from several institutions are one of the indicators often used to read broader market sentiment. In recent weeks, the data shows a consistent pattern of selling.

In terms of weekly institutional capital movements, BTC spot ETFs recorded outflows for three consecutive weeks (January 23-February 4), with the largest sale occurring on January 30 at $1.49 billion. More broadly, four of the last six weeks recorded net outflows, while total assets under management shrank from $124.56 billion to $93.51 billion on February 4, 2026.

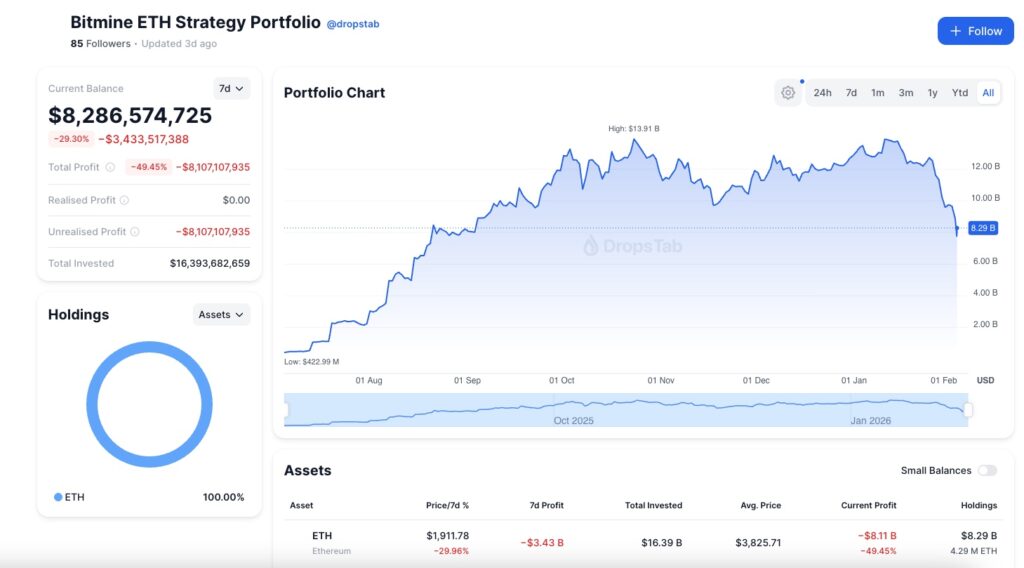

Meanwhile, firms with large BTC and ETH holdings are also feeling the pressure. MicroStrategy recorded a floating loss of around $6.5 billion on its BTC position as of February 5(CoinDesk), while Bitmine bore an unrealized loss of $8.1 billion on its ETH position, almost 50% of its total investment.

Alpha Radar

Interesting data and information we found this week, ranging from onchain signals to noteworthy project developments.

1. Layer-2 Sentiment Pressure

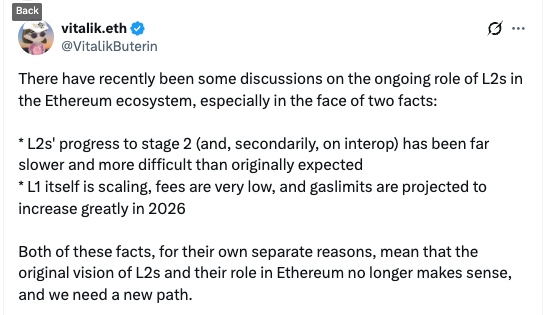

In addition, sentiment towards the Layer-2 sector is likely to weaken after a tweet from Vitalik Buterin questioning the future direction of Layer-2’s role.

He highlighted two things:

- Layer-2’s progress towards Stage 2 is slower than expected.

- Ethereum’s own scalability increases, both in terms of cheaper transaction fees and gas limit capacity which is projected to increase significantly in 2026.

Vitalik emphasized that the original vision of Layer-2 needs to be re-evaluated, and the ecosystem needs a new approach. This statement also depressed sentiment towards Layer-2 assets.

2. MegaETH Buyback Mechanism

MegaETH, the much-discussed blockchain project on X, announced a buyback program ahead of its Token Generation Event (TGE). The team will use protocol revenue in the form of USDM stablecoin to buy back tokens from the market.

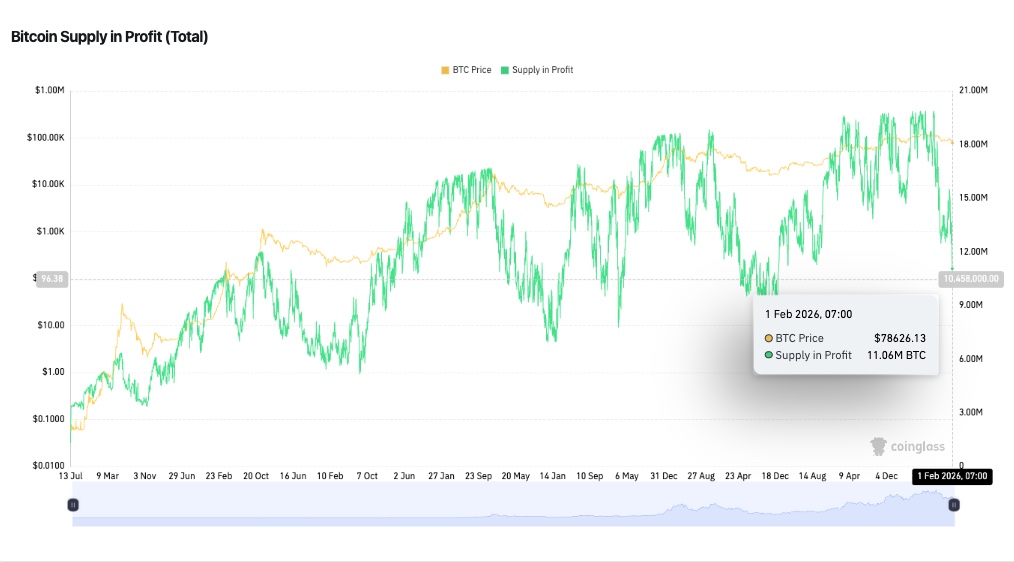

3. Almost Half of BTC Supply is in a Loss Position

According to Coinglass data as of February 1, 2026, only around 11.06 million BTC is still in a profitable position, this number has dropped sharply from the range of 18-19 million BTC when Bitcoin was trading above $100,000. This means that almost half of the total Bitcoin supply is currently in a losing position. Historically, a drop in Supply in Profit to this level often marks an accumulation zone, where selling pressure tends to subside as most holders looking to exit have already realized their positions.

Disclaimer: All information presented in this article has been prepared for general educational and informational purposes. This content is not intended as investment advice, recommendations, solicitation to buy or sell certain crypto assets, nor the basis for financial decision making. Any investment decision is entirely the responsibility of the reader, taking into account their financial condition, investment objectives, and risk tolerance.

Trading Futures on Pintu Pro Web

After learning about the common mistakes in perpetual futures trading, you can open long and short positions such as BTC, SOL, and more directly through Pintu Pro Web. On Pintu Pro Web, you can trade Futures and spot right away!

How to trade Crypto Futures on Pintu Pro Web:

- Go to https://pintu.co.id/

- Click the Open Pro on Desktop button at the top center.

- Register or log in to Pintu Pro Web.

- Go to the Futures section.

- Trade BTC and other cryptocurrencies.

In addition to trading, Pintu also lets you learn more about crypto through various articles on Pintu Academy, updated weekly!