Perpetual trading is a derivative contract with no expiration date, and it has become increasingly popular on DEXs. With DEX, perpetual trading can be done in a non-custodial way without involving a central party. Are you interested in learning more about decentralized perpetual trading? Read the full article below.

Article Summary

- 🌐 Decentralized perpetual trading is trading futures contracts with no expiry date on the DEX platform.

- 📈 Users can use leverage to open long or short positions in decentralized perpetual trading. It is non-custodial and can be done directly through the user’s wallet.

- 🏦 GMX, dYdX, and Gains Network (GNS) are the most popular decentralized perpetual trading protocols.

- 🔮 The DEX perpetual sector has the potential for significant growth due to the increasing demand for perpetual trading that do not rely on a centralized party.

What is Decentralized Perpetual Trading?

Before discussing perpetual trading, we will first understand derivatives, which are the basis of perpetual trading. Basically, derivatives are financial products whose value is based on other assets such as stocks, crypto assets, commodities, or currencies as underlying. In other words, traders can be exposed to a specific asset without owning it directly.

However, with traditional derivative products such as futures, each contract has an expiration date. Meanwhile, perpetual trading is a special type of futures contract because it has no expiration date. This means that traders can keep their buy or sell positions open for as long as they want.

Currently, perpetual trading of crypto assets can be done through centralized exchanges (CEX) and decentralized exchanges (DEX). Thus, as the name suggests, decentralized perpetual trading is perpetual trading executed on DEX platforms such as dYdX, GMX, GNS, Perpetual Protocol, etc.

You can learn more about DEX and how it works in the following article.

How Perpetual Trading Works

Just like any other derivative, perpetual trading allows users to go long if they believe the price of their asset will rise or short if they believe the price of their asset will fall. In addition, perpetual trading has a leverage feature that allows users to place positions larger than their capital.

For example, the DEX A platform offers leverage for perpetual trading of up to 20x. Then, a trader has US$1,000 in capital and uses leverage of up to 10x. Thus, he opens a position worth US$ 10,000. As it turns out, the asset’s price increases and the trader’s position becomes US$ 13,000. As a result, the trader made a profit of US$ 3,000 with a capital of only US$ 1,000.

However, leverage is a double-edged sword. The trader loses all his capital when the asset price drops 10% from US$10,000 to US$9,000. Therefore, leverage can be a very valuable or deadly tool for a trader. Active risk management is required when using leverage on perpetual trading.

In perpetual trading, there is also a funding rates mechanism. It can be defined as a mechanism that keeps the price of the futures contract close to the price of the underlying asset. The funding rate will be positive in bullish market conditions where long positions dominate. This means ‘long’ traders will pay funding rates to ‘short’ traders. And vice versa. Generally, traders have to pay the funding rate once every 8 hours. The amount of funding rate depends on each DEX perpetual platform.

Development of Decentralized Perpetual Trading

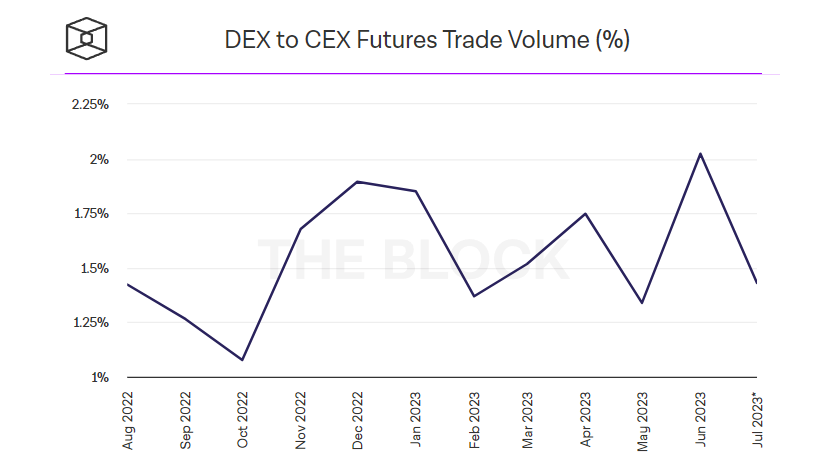

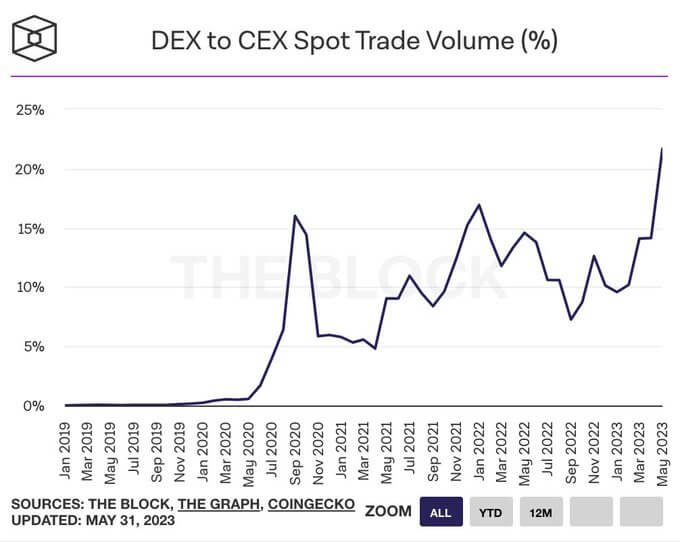

So far, the CEX platform still dominates the perpetual trading sector in the crypto industry. The large user base and ease of access is one of the reasons. However, traders are now starting to look at the DEX perpetual platform. The following data from The Block shows the start of volume growth in perpetual trading on DEX.

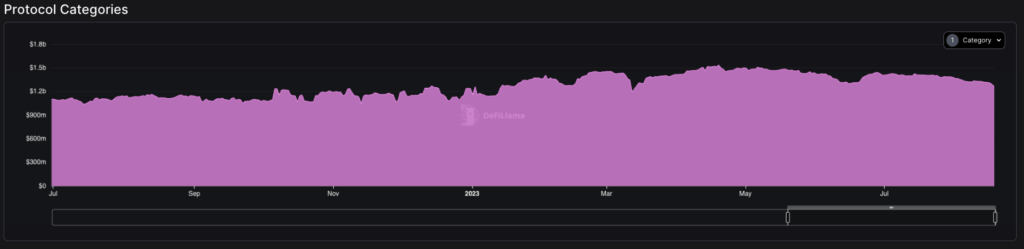

It can be seen that the perpetual trading volume on DEX has now reached around 2% of the CEX trading volume. Actually, this figure is still very small. But keep in mind that the decentralized perpetual trading sector was created two years ago. Meanwhile, data from DeFi Llama shows that the total amount of Total Value Locked (TVL) in the derivatives sector reached US$ 1.25 billion. Making it the eighth-largest industry in the entire DeFi sector.

As the name implies, perpetual trading on DEX is fully decentralized and executed directly from each user’s crypto wallet. This makes perpetual trading on DEX is non-custodial, as users hold their keys and tokens. Post FTX bankruptcy, more and more traders are looking to the DEX platform to avoid the risk of losing their assets.

To ensure liquidity availability, trading operations, and security, every DEX perpetual protocol uses smart contracts. This makes all transactions automated, non-interoperable, and recorded on the public blockchain. The following section will dive deeper into how each DEX perpetual protocol works.

Decentralized Perpetual Trading Protocol

The following are some of the most popular DEX perpetual protocols:

1. GMX

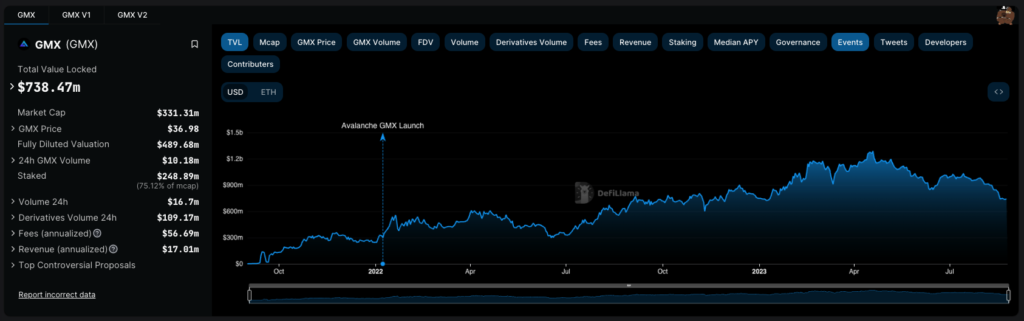

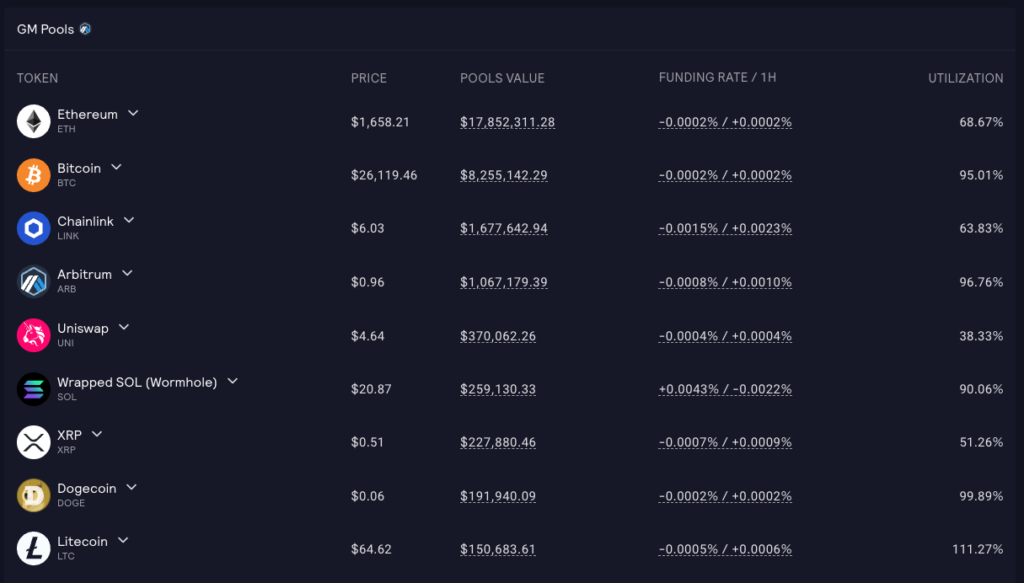

GMX is a DEX perpetual protocol built on the Arbitum and Avalanche networks. It is one of the favorite protocols for perpetual traders, reflected in its highest TVL, US$ 738 million. In addition to perpetual trading, users can do perpetual swaps and staking on GMX. Through GMX, users can do perpetual trading with leverage of up to 50x.

GMX uses a shared liquidity mechanism called GLP, which is GMX’s liquidity provider token. Unlike other perpetual DEXs that use multiple single-asset pools, GMX utilizes GLP as a single multi-asset pool. This aims to optimize the amount of liquidity locked in GMX. It also uses Chainklink Oracles to mitigate liquidation risk and ensure futures prices remain the same as spot prices.

In addition to GLP, there is also the GMX token, which serves as a governance token. GMX will charge a fee for every swap, leveraged trading, liquidations, and the creation and burning of GLP. Later, the fee will be shared between GLP (70%) and GMX (30%) stakers. The GLP portion is much larger due to the risk of trading on the GMX platform. Besides getting those rewards, liquidity providers on GMX also get an APR of up to 18.46%.

Pintu Academy has prepared an article that dives deeper into GMX and how it works here

2. dYdX

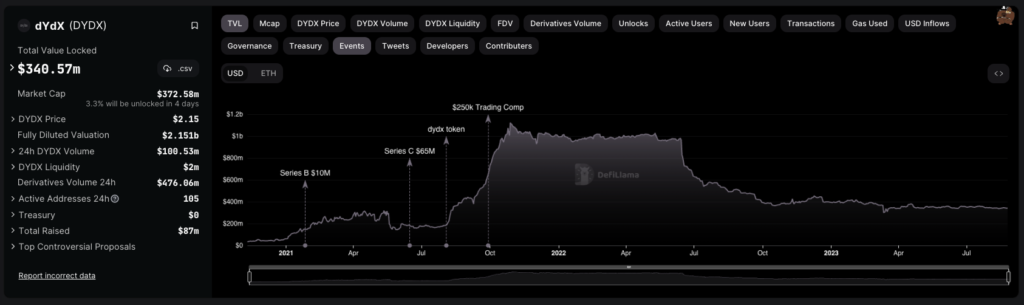

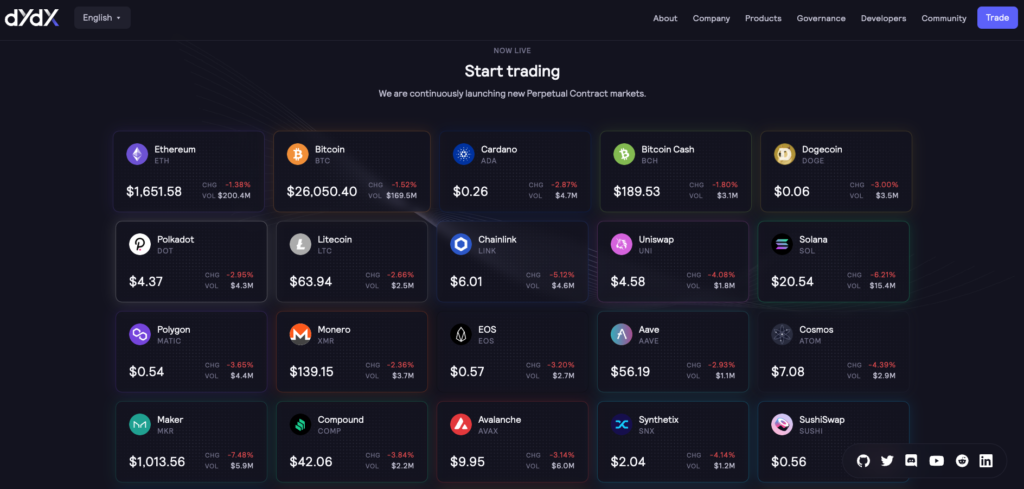

dYdX is a DEX that allows users to do perpetual trading, margin trading, and crypto asset lending. Based on DeFi Llama data, dYdX currently has a TVL of US$ 340 million.

Users can do perpetual trading on dYdX with leverage of up to 20x. Currently, there are more than 35 crypto assets in the dYdX perpetual futures market. In addition to perpetual, users can stake dYdX tokens to get rewards as well as discounts on trading fees.

dYdX is built on the blockchain and uses smart contracts to facilitate all transactions. Now, dYdX also utilizes StarkWare’s StarkEx, allowing layer-2 transactions for lower fees and faster processing.

Perpetual contracts on dYdX are fully collateralized. This means that traders must first deposit and pledge a crypto asset to trade. The amount of collateral is adjusted according to the size of the position opened and the volatility of the underlying asset. Some of the crypto assets that can be used as collateral include BTC, ETH, and USDC.

3. Gains Network (GNS)

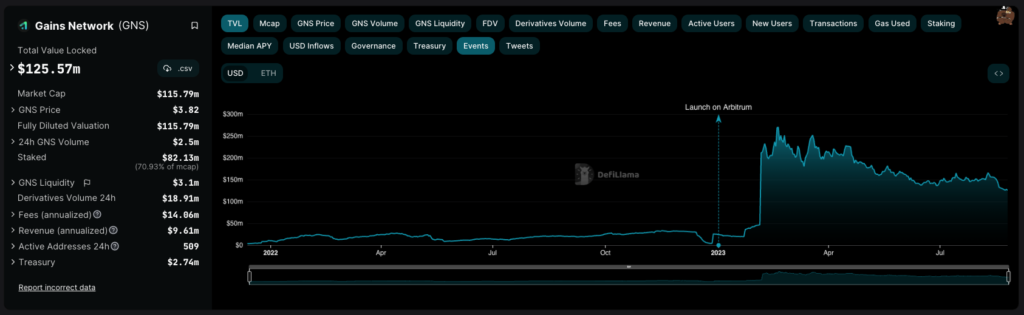

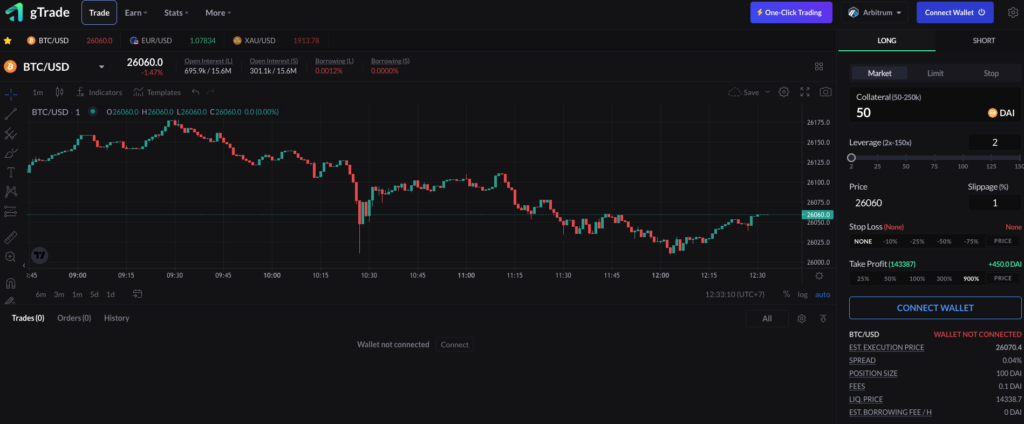

Gains Network (GNS) is a perpetual DEX for leveraged trading built on the Arbitrum network. It is a dark horse in the perpetual DEX industry, as it only started launching on the Arbitrum network earlier this year. Currently, GNS already has a TVL of US$125.57 million based on data from DeFi Llama.

One of the main features of GNS is that users can trade without having to have an account or deposit their funds into GNS. Users can already do perpetual trading on GNS by connecting a wallet. Thus, funds will remain in the user’s wallet and only move when the user authorizes it.

In addition to crypto assets, users can also perform perpetual trading that has an underlying of various forex or commodities (gold and silver). GNS offers leverage of up to 150x for perpetual crypto assets, 1,000x for currencies, and 250x for commodities.

Trades are opened with DAI collateral, regardless of the trading pair. The leverage is synthetic and backed by the DAI vault and the GNS token. DAI is taken from the vault to pay the traders PNL (if positive) or receives DAI from trades their PnL was negative. Furthermore, GNS also uses the Chainlick Oracle to ensure that futures prices remain the same as spot prices.

The Future of Decentralized Perpetual Trading

The DEX perpetual sector is getting more competitive by the day. Plus, the arrival of new protocols with their various innovations. This shows that the DEX perpetual sector has promising potential. Moreover, this sector is still relatively new, so it still has a long way to go to develop its services.

On the one hand, perpetual trading has a very large audience, given its potential to generate profits even in a bearish market. Moreover, the leverage feature also attracts retail or institutional traders who want higher returns. Unfortunately, perpetual trading transactions remain dominant on CEX rather than DEX.

However, the chart above shows that the trend of spot trading volume on DEX continues to increase against CEX. This indicates a trend of traders switching from CEX to DEX. Thus, it can be expected that the same thing will happen in perpetual trading. As more and more traders change from CEX to DEX for perpetual trading, the greater the potential of the DEX perpetual sector will be.

Conclusion

Decentralized perpetual trading is a new development in the derivatives market. It enables trading futures contracts on the DEX platform without any expiry date. As with other derivatives, traders can take long or short positions and leverage their trades. To maintain equal futures and spot prices, decentralized perpetual trading utilizes a ‘funding rates’ mechanism.

Although it is relatively new and has a smaller market share than CEX, the DEX perpetual sector displays signs of growth. This is evident in the emergence of innovative DEX perpetual platforms such as GMX, dYdX, and GNS. DEX’s decentralized and non-custodial nature makes it an attractive option for traders. Especially given the security risks associated with centralized platforms. With its dynamic nature, the perpetual DEX sector has significant potential to grow and become more competitive.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- Ananda Banerjee, What are Perpetual Futures Contracts in Cryptocurrency? BeinCrypto, accessed on 24 August 2023.

- Prableen Bajpai, Cryptocurrency Futures Defined and How They Work on Exchanges, Investopedia, accessed on 24 August 2023.

- Kunal Goel, GMX: Spotting the Future, Messari, accessed on 24 August 2023.

- Coin Telegraph, What is dYdX? A beginner’s guide to trading on a decentralized exchange, accessed on 24 August 2023.

- Gains Network Docs, Overview gTrade, accessed on 25 August 2023.

- DeFi Made Here, On-chain Derivatives sector is the most competitive in DeFi, Twitter, accessed on 25 August 2023.