Bitcoin and crypto assets in general fall into the risk-on asset category. This is why Bitcoin will be the first asset to respond to any change in liquidity or condition. Additionally, any significant decision, such as Quantitative Easing and Tightening from the US Federal Reserve, will heavily impact Bitcoin. So, what is Quantitative Easing (QE) and Quantitative Tightening (QT)? Why do these two decisions impact Bitcoin and how? We will dive deep into the interplay between the Fed’s decision and the crypto market.

Key Takeaways

- 🚗 The Liquidity “Gas and Brake”: Quantitative Easing (QE) acts as the “gas pedal” by injecting liquidity to stimulate growth, while Quantitative Tightening (QT) serves as the “brakes” to cool inflation. As an extreme “risk-on” asset, Bitcoin is highly sensitive to these shifts.

- ⚠️ The Risk Curve Mechanism: Capital flows sequentially based on risk. During QE, money spills over from safe government bonds into equities and finally into speculative assets like crypto. Conversely, during QT, liquidity retreats from crypto first, explaining the violent crash in 2022 when rates rose.

- 🐌 The “Pivot” is Gradual: The shift between policies is a slow process rather than a sudden U-turn. For example, the Fed held interest rates steady for a full year (2023-2024) to ensure stability before officially cutting rates and announcing a return to QE in December 2025.

- ❓ The 2026 Anomaly: Despite the official start of QE, Bitcoin is currently underperforming traditional assets like the S&P 500 and Gold. This creates a conflict between favorable macro conditions and Bitcoin’s historical four-year “bear market” cycle, leaving analysts divided.

What is Quantitative Easing and Quantitative Tightening?

Bitcoin vs Global money M2 supply chart. Source: Newhedge.

Quantitative Easing (QE) and Quantitative Tightening (QT) are two monetary policies of the Federal Reserve. In simple terms, Quantitative Tightening is the “break” of the Fed for combating inflation or cooling down an overheating economy. On the contrary, Quantitative Easing is the “pedal” for the Fed to inject liquidity into the economy by buying bonds or printing money. As the ultimate “risk asset,” cryptocurrencies are sensitive to changes in monetary policy.

QT and QE dictate how much money flows into the economy, and in extension, into investors. During QT, investors can’t borrow money because interest rates are rising, and it is more profitable to hold treasuries. After a period of Quantitative Tightening, the Fed will eventually shift back into QE to grow a stagnating economy.

Understanding these mechanics isn’t just for economists, it is a survival skill for traders and investors. The Federal Reserve’s money printer dictates the boom and bust cycles of crypto. The trend will always follow where the money goes.

In investment, there are the terms “risk-on” and “risk-off” assets. Risk-on assets refer to equities and crypto, while risk-off assets refer to treasuries, bonds, and store-of-value assets like gold.

How QT and QE Work

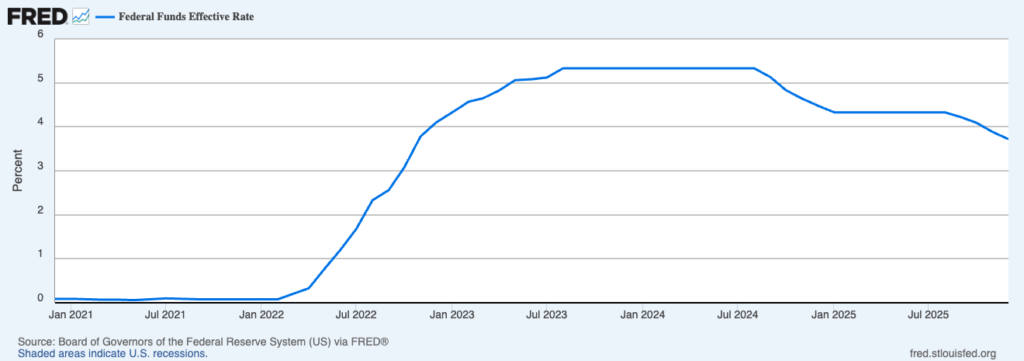

Source: FRED.

Quantitative Easing and Tightening are market-driving tools for the Fed. It drains and fills the market with liquidity. So, when changing course or ‘pivoting’, the Fed did not make a sudden U-turn. The pivot from one policy to the other happens slowly and gradually.

As you can see above, after hiking up rates (QT), the Fed doesn’t immediately lower interest rates to pivot into QE. According to FRED’s data, the Fed holds the interest rates for a year from August 2023 to 2024. This was done to ensure the pivot is smooth and gradual. After they stop hiking rates, the Fed monitors responses from the market and moves on to the next phase by reducing interest rates.

The last phase of Quantitative Easing is when the Fed reduces interest rates and increases its balance sheet. In December 2025, the Fed officially announced the start of its Quantitative Easing plan. This happened after several rate cuts. However, the announcement marks a shift in intent. For crypto and other risk-on assets, an official QE announcement is often the catalyst.

Quantitative Tightening vs. Quantitative Easing Policy

| Feature | Quantitative Easing (QE) | Quantitative Tightening (QT) |

|---|---|---|

| Central Bank Action | Buys bonds/assets to inject cash. | Sells bonds (or lets them expire) to remove cash. |

| Money Supply (M2) | Expands (More dollars in the system). | Contracts (Fewer dollars in the system). |

| Interest Rates | Usually lowered (Cheap to borrow). | Usually raised (Expensive to borrow). |

| Investor Behavior | “Risk-On”: Investors chase high yields. | “Risk-Off”: Investors flee to safety (Cash/Bonds). |

| Impact on Crypto | Bullish: High liquidity flows into speculative assets. | Bearish: Liquidity dries up; speculative assets are sold first. |

| Example | 2020–2021 (Post-COVID Stimulus). | 2022-2023 |

Why Does the Fed Need Quantitative Easing and Tightening?

Source: Babypips.

As previously explained, QT and QE can be likened to a gas and brake pedal in a car. Another analogy would be a faucet, but for money (QT is stopping the faucet, and QE is flowing it). The shift between the two policies is guided by many data points, but the most prominent are the inflation price (CPI), the job market (unemployment rate), and bond market volatility (the MOVE index).

The difference between QE and QT is simply the state of the economy. When the economy stagnantes and unemployment is rising for a long period of time, the Fed will consider Quantitative Easing to encourage growth. On the contrary, when inflation rises too quickly from the wealth effect (crypto and stock bull market), the Fed will pivot to Quantitative Tightening to control inflation and reduce demand.

Why Quantitative Easing and Tightening Impact Crypto

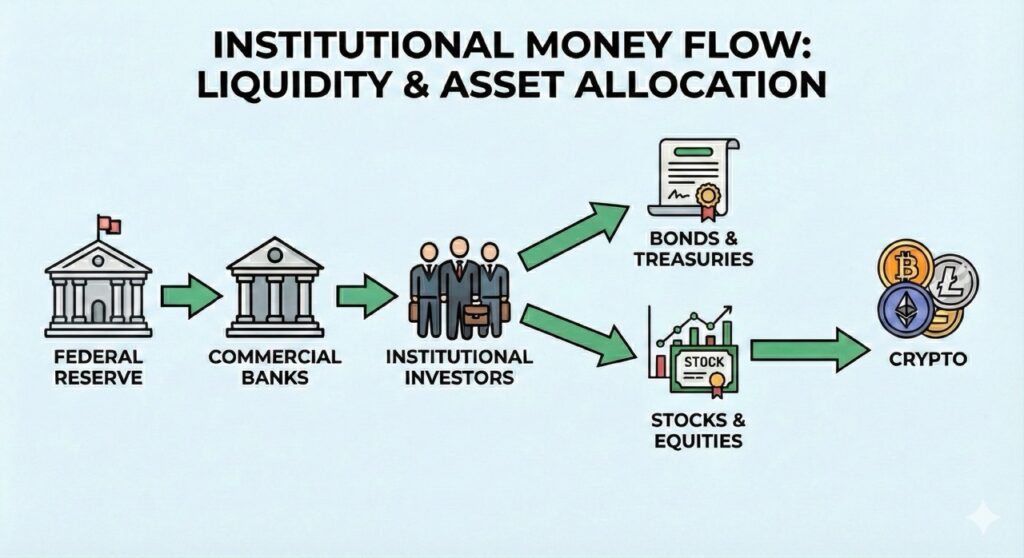

Institutional money flow during a Quantitative Easing period from the Fed.

As previously said, crypto is basically on the extreme end of the risk-on asset category. It is the first to go down with the ship when the situation worsens, and the fastest to rise once the condition becomes better. Institutional investors will buy crypto to chase profit when it becomes clear the market is bullish, and sell crypto first at the first sign of a bearish turn. This is what’s called the Risk Curve.

The risk curve basically explains how money flows from safe assets (treasuries and bonds) to risky assets (Tech Stocks) and finally to speculative assets (Crypto). This usually only happened during QE and retreats in the exact reverse order during the pivot to QT. So, from here, it is clear that crypto will always be impacted by the flow of money from the Fed’s monetary policy.

How QT and QE Impact Crypto: the 2022 Bear Market and the 2024 Bull Market

Bitcoin chart vs Federal Reserve interest rates.

2022 was actually the first time Bitcoin had to face a high-interest rates environment. Interest rates have been below 3% since 2008. For the first time in more than 10 years, interest rates reached 5% (the last time they reached this number was 2007). As you can see in the chart above, Bitcoin went from $66k to $15k in a year.

After more than two years of Quantitative Tightening period, the Fed then signals a pivot. Interest rates stabilize for a year from August 2023 to August 2024. In this period, Bitcoin actually goes parabolic because of renewed interest from institutional investors such as BlackRock. Then, the Fed started lowering interest rates in Q3 2024, and Bitcoin went up +140% in a year.

The Bitcoin ETFs are one of the biggest factors for the move in 2024 and 2025.

Deep dive on the impacts of Bitcoin ETF: 7 Spot Bitcoin ETF Impact and Potential – Pintu Academy.

The 2026 Situation

The 2026 situation is tricky. Despite the Fed declaring an official start of Quantitative Easing in December 2025, Bitcoin is now underperforming compared to the S&P500, Gold, Silver, and most tech stocks. This is unprecedented and defies the general rule explained above.

However, we also need to consider the four-year cycle theory in Bitcoin, which puts 2025 as the top and 2026 as the bear market. Also, the majority of the move for Bitcoin has already happened in 2024 and 2025. One can say that 2026 is the ‘cooldown’ phase for Bitcoin, and money moves to other assets.

Currently, Bitcoin has fallen around 35% since the top in October 2025. Analysts are divided over the Bitcoin price at the end of 2026. Some, such as Sidney Powell of Maple Finance and Geoff Kendrick of Standard Chartered, predict Bitcoin will be at $175k and $150k, respectively. Others, such as Matt Mena (21Shares) and Russell Thompson (Hilbert Group), said that Bitcoin will go as low as $70k if the current support doesn’t hold.

Ultimately, 2026 will be a test for Bitcoin as a risk-on asset during a period where liquidity is being injected into the market. If we go with the flow of money, as the Fed continues its Quantitative Easing, capital will eventually flow into Bitcoin and crypto. If it does not, that will say a lot about Bitcoin as a risk-on asset.

Conclusion

Ultimately, the Federal Reserve’s monetary policy remains the primary engine driving crypto market cycles, but 2026 is shaping up to be a critical stress test for this correlation. While the mechanics of Quantitative Easing usually mean that fresh liquidity should eventually flow into risk assets, Bitcoin is currently underperforming. Investors must now watch closely to see if capital from the Fed’s money printer eventually flows into crypto, or if the asset class is entering a unique cooldown phase despite the abundance of liquidity in the market.

References

- Arthur Hayes, “Frowny Cloud”, Crypto Trader Digest on Substack, accessed on January 25, 2026.

- Lyn Alden, “Bitcoin: A Global Liquidity Barometer”, accessed on January 26, 2026.

- Joseph Brombal, “Bitcoin Analysis: Beyond the Block”, Ainslie Wealth, accessed on January 27, 2026.