TerraUSD, an algorithmic stablecoin from Terra, the second-largest DeFi ecosystem after Ethereum, depegged and collapsed last week. UST, whose value is supposedly pegged at 1:1 with the US dollar, fell to only 0.06 US dollars as of May 13, 2022.

The fall in the price of UST resulted in the same decline of LUNA, Terra’s protocol token which functions to keep the value of UST stable to the US dollar. As of May 13, 2022, several crypto exchange platforms were no longer trading LUNA as its price continued to fall to only US$0.0002 from US$80 a week earlier. What happened to Terra (LUNA) and UST? And how will this impact crypto as a whole? We will discuss it in this article.

Article Summary

- 🌖 Terra Protocol is an open-source decentralized blockchain that produces algorithmic stablecoins, with TerraUSD (UST) as its main stablecoin. An algorithmic stablecoin is backed by an algorithm to keep the value the same as the asset it pegged to.

- 🔗 UST in this case is backed by LUNA, Terra’s protocol token, to keep the value 1:1 with US dollars. Basically, Luna will be printed (mint) or reduced (burn) depending on the number of UST in the market. In other words, the price of UST is designed to be the same as the US dollar value but it is not backed with fiat currency.

- 🚨 Starting from May 7, 2022, UST experienced a depeg where its value is no longer worth the same as US dollars and dropped to 0.06 US dollars on May 13, 2022. As a result, LUNA underwent massive hyperinflation in an effort to stabilize the value of UST, and the price of LUNA fell 100% to the level of US$0.0002.

- 📉 Luna was among the top 10 cryptocurrencies by market capitalization according to Coin Market Cap data. The fall of Luna’s price evaporates 41 billion US dollars, making Luna’s market cap falls to only 500 million US dollars within 24 hours.

- 🔥 This event caused panic and shook the crypto industry which impacted the Bitcoin price, making it touch US$27,000, before settling at US$30,000, or 17% lower than the previous week.

About Terra Protocol and Algorithmic Stablecoins

Terra Protocol is an open-source decentralized blockchain that produces algorithmic stablecoins. Developed by Terraform Labs based in South Korea, Terra Protocol produces various algorithmic stablecoins including TerraKRW And also TerraUSD (UST) whose value is made equivalent to the US dollar.

Unlike other stablecoins such as USDT or USDC that are backed with real currencies in this case the US dollar, Terra uses its native token, LUNA, to keep the UST value 1: 1 with US dollars. Basically, Luna will be printed (mint) or reduced (burn) depending on the number of UST in the market. This technology makes UST an algorithmic stablecoin.

In addition, Luna is also used as a governance token and mining. Users can stake LUNA to a validator who records and verify transactions in the blockchain. As UST adoption increases, the value of Luna will follow. How exactly do UST and LUNA work? We will discuss it further below.

Read also: What Is Stablecoin?

How do UST and LUNA work?

Stablecoin basically combines the advantages of cryptocurrency and fiat currencies; fast transaction processing and security/privacy owned by crypto, as well as the stable values of fiat.

Therefore, many crypto users use stablecoin to secure the profits obtained from trading crypto or utilize the high yield of decentralized finance or DeFi products. So, stablecoin is only useful and gives added value if the price remains the same as the assets it pegs.

Terra keeps the price of UST the same as the US dollar through Terra (Luna) which can be exchanged into UST by Terra users. In theory, the system of exchange and burning of LUNA should benefit both UST and LUNA, because LUNA’s supply will continue to decrease as UST adoption increases (making LUNA even rare).

Terra’s algorithm makes the supply of the two tokens experience contraction and expansion depending on demands for UST.

- 📈 Expansion: Expansion happens when the price of UST is higher than the US dollar, the supply is limited while demand is too high. The protocol will provide incentives for users to burn LUNA so that it increases the supply of UST. This is done to balance the supply and demand. The number of LUNA is reduced, thereby increasing the price.

- 📉 Contraction: Contraction happens when the price of UST is lower compared to the US dollar, the supply is too much while demand is less. The protocol will encourage users to burn UST and print new LUNA. This will decrease the supply of UST, increasing its price to maintain the peg. However, LUNA’s price will decrease.

Also read: What is Terra (Luna)?

The algorithm used by Terra basically provides incentives for traders to carry out arbitrage trading. Arbitrage is a trading strategy that seeks to profit from price differences between two markets.

The following is an example of arbitrage trading that can be done with UST and LUNA as quoted from Terra Protocol:

💡 Example: If 1 UST is worth US$1.01 and 1 LUNA is worth $80 then traders can exchange 1 LUNA and get 80 UST. Traders then can sell 80 UST and get a profit of US$0.08. Arbitrage can continue until UST is equivalent to the US dollar. Every UST trade will burn some LUNA, reducing LUNA’s supply and raising the price. Ideally, this method can continue to guarantee the stability of UST prices.

Traders can also take advantage if the price of UST is lower than the US dollar. Below is the example.

💡 Example: If 1 UST is US$0.99, traders can buy 1 UST for US$0.99. He can then exchange 1 UST with $1 dollar worth of LUNA. This exchange burned 1 UST and mint $1 dollars worth of LUNA (0.0125 LUNA is minted if 1 LUNA is worth US$80). The trader will get a profit of US$0.01.

Also read: What is Arbitrage in Crypto Trading?

It should be noted that there is a major risk in the mechanism of using LUNA to maintain the stability of UST. When the crypto market is experiencing a bear market and traders’ enthusiasm began to decline, there will be great pressure to sell both LUNA and UST. Massive selling of both of these tokens will result in a Death Spiral where the algorithm will push the price of the two tokens down.

A Death Spiral On UST will force Terra to continuously mint new LUNA in an effort to maintain the value of UST at US$1. This then pressed the price of LUNA so that it will also decline dramatically. This cycle continues to repeat until it destroys the value of both LUNA and UST. At this stage, a large financial intervention is needed from the terra protocol to save the price of the two tokens.

Chronology of the UST Depeg

The beginning of the Depeg

On May 7 and 8, 2022, the value of Ust depeg to US$0.98 or was no longer equivalent to the US dollar value. The terra algorithm prints LUNA to stabilize the price of UST and made the price of Terra Coin (Luna) decrease 20% to reach a price of US$61.

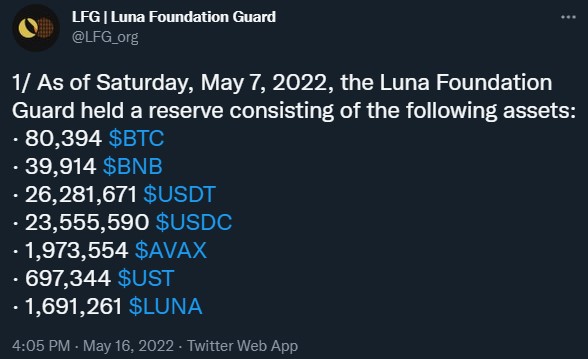

Responding to this, the Luna Foundation Guard (LFG) then announced that they would mobilize US$1.5 billion from their reserves to stabilize UST. LFG plans to lend BTC worth US$750 million to market makers to be traded and also lend UST worth US$750 million which will be used to buy back BTC after volatility subsides.

Panic in the Market

Although LFG had taken steps to stabilize UST prices, panic had already spread in the market. Between May 7-8, the borrowing protocol at the Terra Ecosystem, Anchor, recorded a decrease in total UST deposits from 14.02 billion UST to 11.7 billion UST.

On May 9, the price of UST fell steadily throughout the day, reaching US$0.60 at one point. The panic continued in Anchor, with UST deposits falling to 10.8 billion.

💡 Anchor, a decentralized savings protocol that promises an APY of up to 19.5%, was one of the most widely used DeFi applications in Terra. Anchor is widely used by Terra users as a place to store assets due to the high interest offered.

As of May 4, the UST token deposit in Anchor reached 16 billion. Deposits in Anchor began to drop drastically since May 7, until finally there was only 1.1 billion UST as of May 16 with 1 UST worth only US$0.1.

LUNA Hyperinflation

Please note that, when LUNA’s price is down, every time the user exchanges 1 UST with US$1 worth of LUNA, the system continues to require more LUNA to reach a value of US$1 (which means printing more Luna).

By May 12, the supply of Luna had become so huge and the price plummeted so low that there was no incentive for it to be exchanged for UST. The price of Luna and UST reached the stage where the Terra network could not increase its value through the arbitrage mechanism. Terra needed a large financial intervention through assets outside LUNA and UST.

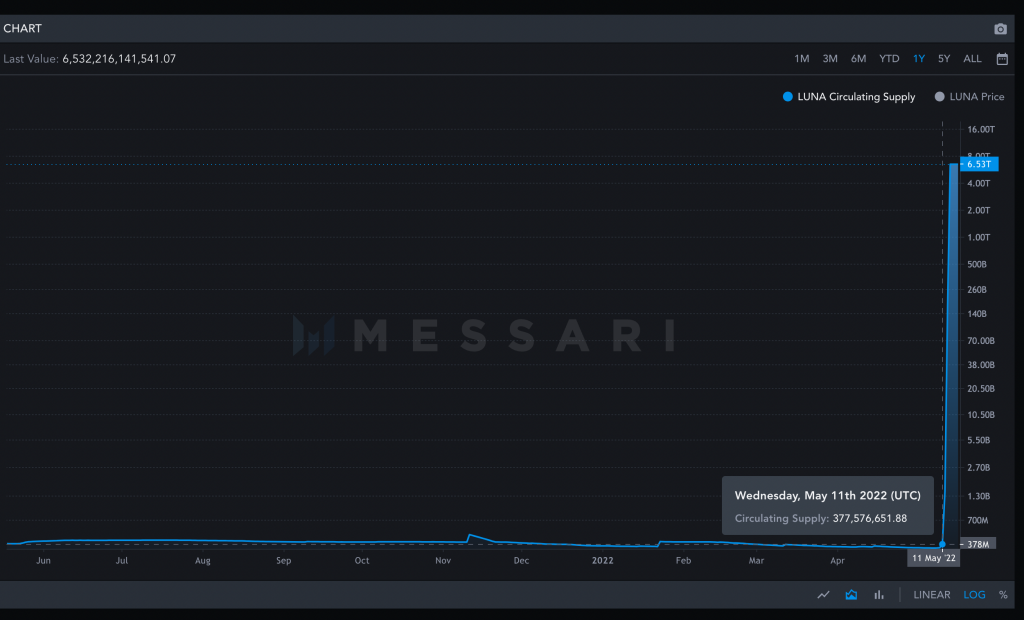

💡 As of May 8, 2022, the number of LUNA circulating in the market was around 346 million. Only four days later (May 12, 2022), the number jumped to 7.1 trillion following the UST selling action which continued to increase the number of LUNA. LUNA’s price fell 100% to the level of US$0,0002 on May 13, 2022.

Terra’s response to UST Depeg

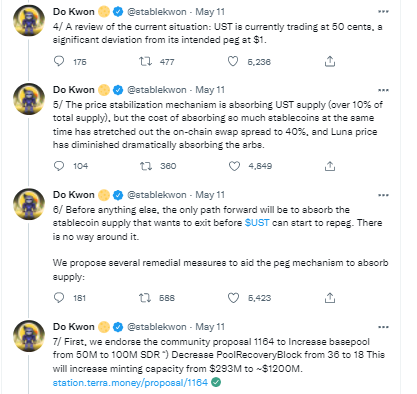

- On May 10, 2022, UST’s price reached US$0.75. Do Kwon recounted what happened in a series of tweets on May 11. The following day, Terra’s official Twitter made a statement regarding the proposal to burn UST supplies and plans to stake LUNA to avoid an attack on the Terra network.

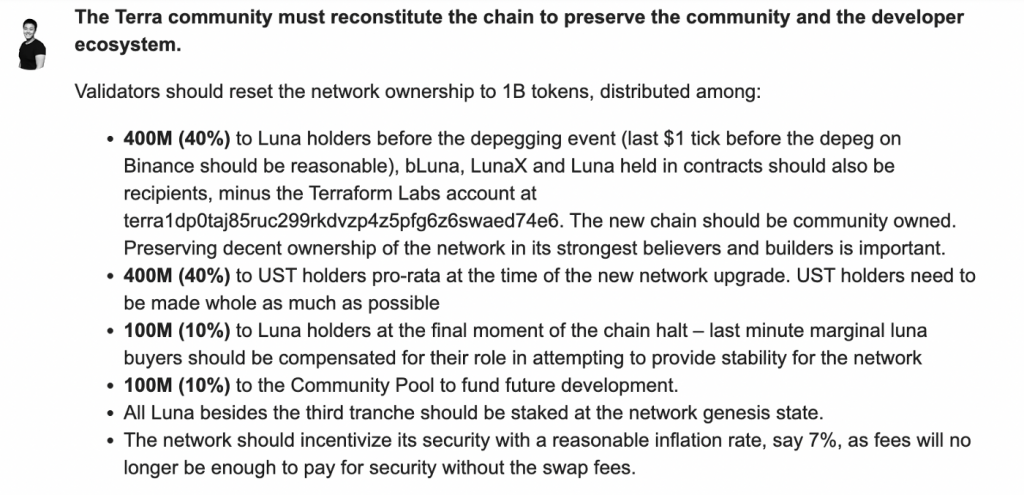

- On May 13, Do Kwon officially tweeted about a plan to revive the terra and UST ecosystem. Do Kwon then released his first proposal related to the revival of the Terra Network titled “Terra Ecosystem Revival Plan.” In the plan, Do Kwon mentioned several important points.

- At this point, many members of the Terra communities on Twitter expressed disapproval of DO Kwon’s plan and questioned what Terra was doing with the Bitcoin in the LFG Foundation reserves.

- On May 16, 2022, LUNA Foundation Guard (LFG) Twitter explained a complete report on its assets, including the Bitcoin which was used to stabilize UST prices. In short, LFG has sold 80,081 BTC, 26,281,671 USDT, and 23,555,590 USDC as an effort to stabilize UST prices. On May 16, LFG only had 313 BTC and several other assets which would be used as compensation to users who suffer losses.

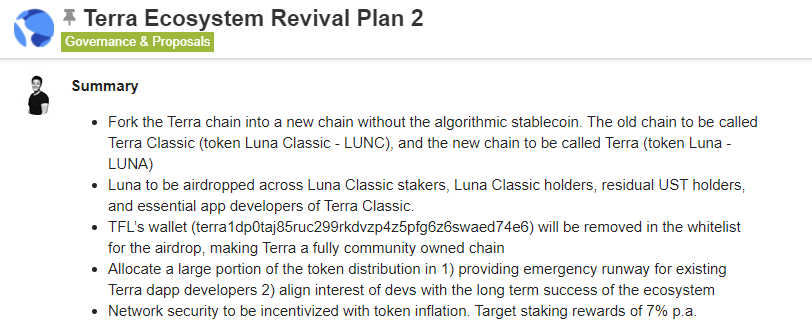

- Do Kwon then released Revival Plan 2 to improve the Terra ecosystem via a hard fork. In his plan, he explained that the priority of the terra network was to save LUNA, those who suffer loss from the depeg, and the ecosystem of developers of its application. Do Kwon also pinned the hashtag #TerraIsMoreThanUST to indicate that Terra would be born again without the existence of the UST as its pillar.

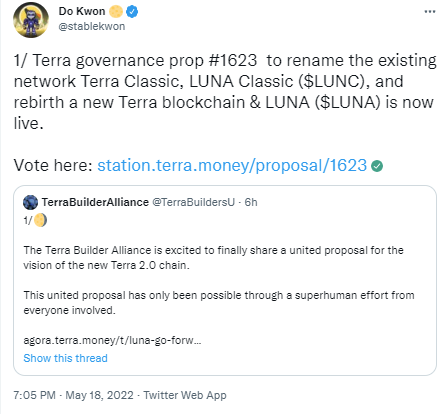

- On May 18, 2022, the Terra Builders Alliance officially launched a proposal to create a new blockchain without an algorithmic stablecoin via a hard fork. Terra users who stake LUNA tokens can vote and choose to agree or disagree with the plan on Terra Station.

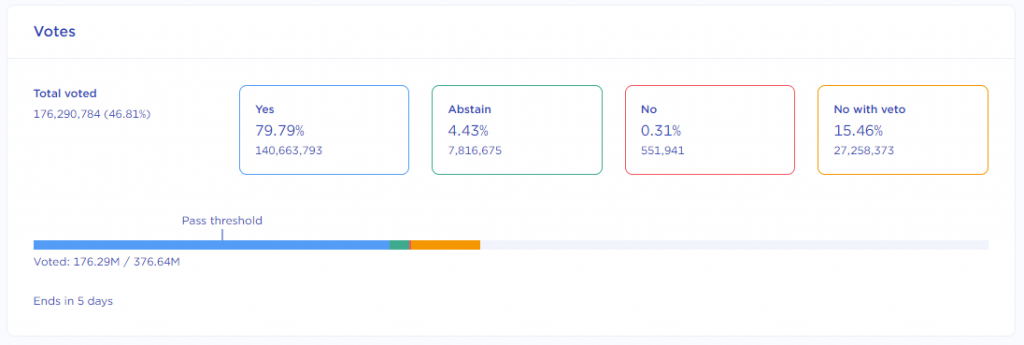

- As of 20 May 2022, more than 79% of the votes were in favor of the revival plan. The proposal needs around 188 million votes in favor to pass before the voting ends on May 25.

What is the impact on the overall Crypto industry?

- Pressure on the price of Bitcoin: At the peak of the occurrence of the depeg, LFG sold around 80 thousand BTC. This massive sale dropped Bitcoin prices and brought the entire crypto market with it.

- Creating panic: The combination of Bitcoin prices that fall and the UST events have succeeded in creating panic in the crypto market. Many altcoins such as FTM even dropped 80% in a day. This panic was also caused by the uncertainty as the community was waiting for a response from Do Kwon and Terraform Labs who only issued statements a few days after the incident.

- The impact of the failure of the Big 10 Crypto Assets: The depeg of UST and the fall of LUNA’s price is a historical event in the crypto world. LUNA is a top 10 cryptocurrency with a market capitalization of $20 billion US dollars (May 9, 2022). Meanwhile, UST is the largest algorithmic stablecoin with a market capitalization of $18 billion US dollars (May 9, 2022). With such a large market value, the event resulted in Terra users losing billions of dollars.

- Weaknesses of Algorithmic Stablecoins: Finally, The UST depeg also becomes a reminder as well as a warning for other blockchain networks who want to create algorithmic stablecoin. Although we can argue that Terra’s management of the depeg is less than optimal, we cannot argue that this event shines a light on the weaknesses of algorithmic stablecoin.

Reference

- About the Terra Protocol, Terra Money, accessed on 13 May 2022

- Messari, UST Roundtable, Messari, accessed on 13 May 2022

- Ryan Selkis, Salvation Lies Within, Messari, accessed on 13 May 2022

- Ben Giove, UST Luna Meltdown: What Happened?, Bankless, accessed on 13 May 2022

- Shaurya Malwa, Terra Becomes Second-Largest DeFi Protocol, Surpassing Binance Smart Chain, CoinDesk, accessed on 13 May 2022

- Terra Ecosystem Revival Plan – Governance & Proposals – Terra Research Forum

- Terra Ecosystem Revival Plan 2 – Governance & Proposals – Terra Research Forum

- Tim Kelas Bitcoin, Bagaimana kekacauan UST Terra Luna berdampak terhadap Bitcoin, Kelas Bitcoin, accessed on 16 May 2022

- Shaurya Malwa, Do Kwon Pushes On-Chain Proposal Live Even as 92% Vote ‘No’ in Online Poll, CoinDesk, accessed on 16 May 202