Futures trading provides an opportunity to manage positions larger than the capital you have, but it also comes with significant risks if not handled properly. Without a clear strategy, traders may face substantial losses, even to the point of losing their entire capital due to liquidation. On the other hand, with disciplined risk management, the potential of futures trading can be approached in a more controlled manner. That’s why understanding how to manage risk is essential. In this article, we’ll explore the different types of risks in futures trading and the strategies that can help you make more informed decisions.

Article Summary

- 📉 Risks in Futures Trading: Liquidation occurs when the margin in a trading account is no longer sufficient to maintain a losing position, especially once it drops below the maintenance margin threshold.

- 📊 The Importance of Risk Management: Risk management isn’t just about limiting losses, it’s also about maintaining consistency and discipline in trading. With strategies such as stop-loss orders, proper position sizing, and routine evaluations, traders can handle market volatility with more confidence.

- 📌 Use Margin Wisely: Avoid using your entire margin on a single or multiple positions, and always align usage with your risk profile.

Risks in Futures Trading

One of the defining characteristics of futures trading is the use of leverage and margin. Leverage can be a powerful tool for boosting potential returns, but it also comes with heightened risk, like a double-edged sword. When used with discipline and caution, it increases profit opportunities. But without proper management, the losses can be equally significant. That’s why understanding these risks is critical for avoiding costly mistakes.

1. Risk of Using Leverage

Leverage allows traders to open positions far larger than their initial capital. For example, on Pintu, traders can use leverage of up to 25x. This means with a capital of 100 USDT, a position worth up to 2,500 USDT can be opened if the entire margin is used.

However, using all available margin on a single position is highly discouraged. If the market moves against the trade, losses can quickly escalate, potentially wiping out all the capital. Unlike spot trading, which doesn’t involve leverage, futures trading demands a clear risk management plan to avoid liquidation.

2. Risk of Liquidation

Liquidation occurs when the margin balance is insufficient to sustain a losing position, especially when it falls below the maintenance margin. At that point, the system will automatically close the position to prevent further losses. This often affects traders who lack discipline in managing margin and fail to implement protective strategies like stop-loss orders. Without proper risk management, a sudden market move could result in a total loss of funds.

3. Market Volatility

Volatility is inherent in the crypto market. For traders who don’t fully understand how futures work or who lack proper risk controls this volatility can be overwhelming, especially if trades are driven by speculation alone.

Example: A trader opens a long BTC position using 100 USDT in margin with 25x leverage at a price of $100,000. This gives them a total position of $2,500. If the price drops to $96,040, just a 3.96% decrease, their position is automatically liquidated because their margin can no longer support the loss.

This example illustrates how dangerous high volatility can be, especially when all available margin is used without proper calculation. In crypto markets like BTC, a 3-5% price move is not unusual. That’s why it’s essential to avoid overexposure and align your strategy with your personal risk tolerance.

Risk Management Strategies in Futures Trading

In the context of crypto futures trading, risk can’t be eliminated but it can be managed effectively. Here are several futures risk management strategies that can help you protect your capital:

1. Choose Assets That Match Your Risk Profile

Each crypto asset comes with different levels of volatility and market capitalization. Generally, the smaller the market cap, the more volatile the asset. This means higher reward potential but also greater risk.

If you’re an aggressive trader, small-cap assets may be suitable, provided you have a solid risk management plan. On the other hand, if you’re more conservative or just starting out, it’s wiser to focus on high-cap assets like BTC or ETH. These tend to move more predictably and are easier to monitor.

2. Use Stop-Loss Orders

A stop-loss order automatically closes your position when the price reaches a certain level. Its main purpose is to limit losses before they get out of hand and to avoid liquidation. By setting a stop-loss, you define your acceptable loss in advance, making trading more objective.

3. Manage Position Size and Margin Wisely

The larger the margin you use, the larger your open position and naturally, the greater the associated risk. One common mistake among beginner traders is using their entire margin to open one or more positions at once. In reality, this significantly increases the potential for losses.

To minimize risk, it’s essential to have a well-thought-out trading plan, including how you size your positions. Ideally, you should use only about 1-5% of your total margin for each futures trade. While that may seem small, keep in mind that with leverage, the actual position size can be much larger. This is why careful calculation is crucial to keeping risk under control and ensuring your trading positions can survive in the long run.

4. Consider the Risk to Reward Concept

The risk-to-reward concept is a fundamental principle in any sound trading strategy. Risk refers to the potential loss if the price moves against your position, while reward represents the potential gain if the price moves in your favor.

To calculate this, you can use technical analysis as a guide to determine appropriate stop loss and take profit levels. This way, risk can be managed from the outset, and profit potential can be realistically assessed.

Many traders typically use a risk-to-reward ratio of 1:2, meaning for every Rp100,000 risked, the target profit is Rp200,000. However, this ratio is not fixed. It may vary depending on your strategy, market conditions, and confidence level in your analysis.

5. Avoid Emotional Decision-Making

One of the biggest pitfalls in trading is making decisions based on emotion whether it’s panicking during a price drop or holding onto a position that’s moving against you out of hope or fear. Emotional reactions often lead to significant losses and, in some cases, liquidation.

In futures trading, risk cannot be completely eliminated, but it can be managed through sound analysis and clear risk planning. Trading isn’t just about technical or fundamental strategies, it’s also a test of mental discipline. Sticking to your plan and managing your emotions are key to staying objective when the market doesn’t move in your favor. By removing emotions from your decision-making process, you can stay focused on your goals and execute your strategies with greater consistency.

6. Evaluate Your Performance Regularly

Trading isn’t just about opening positions, it’s also about reviewing the strategy behind them. Always monitor market movements and assess your trading results consistently. If you find yourself experiencing repeated losses over time, it could be a signal that your current approach needs to be re-evaluated.

Take a step back and determine whether your strategy is still relevant to current market conditions or if adjustments are needed. Regular evaluation is crucial to avoid falling into the same patterns and to help you grow into a more disciplined and adaptive trader.

Case Study: Poor Risk Management Can Be Costly

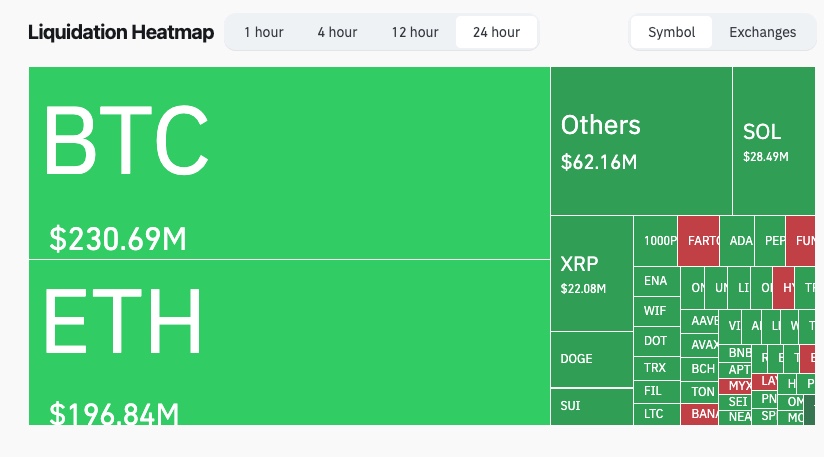

As a real-world example, let’s take a look at the latest 24-hour liquidation data in the futures market. According to the liquidation heatmap from Coinglass, total liquidations exceeded $509 million. The largest amounts came from BTC positions ($230.69 million) and ETH ($196.84 million), followed by other assets like SOL, XRP, and SUI.

Many traders opened long positions when prices were still high, without using protective strategies such as stop-loss orders or proper position sizing. As the market dropped by around 10%, their margins failed to absorb the losses, leading to automatic liquidation of their positions.

This incident serves as a crucial reminder that futures trading is not about predicting market direction, it’s about how prepared you are for worst-case scenarios. Without solid risk management, a single correction could be enough to wipe out your entire capital.

Tips to Avoid Liquidation in Futures

After understanding the importance of risk management, the next step is to learn how liquidation works in futures trading, so you can avoid it.

Each platform sets its own maintenance margin threshold. On Pintu Futures, the required maintenance margin is 1%.

Example: Ari has a balance of 100 USDT in his Pintu Futures account. Confident that Bitcoin’s price will rise, he opens a long position on BTC at $100,000 using 25x leverage. With that leverage, Ari opens a $2,500 position using just $100 of initial margin. The remaining value is essentially borrowed from the exchange. Since Pintu Futures requires a maintenance margin of 1%, Ari must ensure his margin balance never falls below $25 (1% of $2,500). If his balance drops below that due to unrealized losses, his position will be automatically liquidated.

How to Avoid Liquidation

Based on the example above, we can conclude that the risk of liquidation can be minimized through the following steps:

- Use margin wisely: Avoid using your entire margin to open one or multiple positions. Always leave some buffer to withstand price fluctuations.

- Set a stop-loss: A stop-loss allows you to close a position early before your margin hits the liquidation threshold.

- Evaluate floating losses: If your position is experiencing a floating loss (unrealized loss), ensure your remaining margin is still far from the liquidation point. If it’s getting too close, consider adding more margin, reducing your position size, or partially closing the trade manually.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Conclusion

Futures trading offers more flexibility compared to spot trading, but it also carries significantly higher risk. That’s why understanding key elements such as leverage, liquidation, and market volatility is a crucial first step before getting involved. Without a clear risk management strategy, trading can quickly shift from something promising to something harmful, especially when decisions are made without proper calculation and rely solely on speculation.

By taking a disciplined approach managing position sizes, setting stop-losses, choosing assets that match your risk profile, and regularly reviewing your strategy, you can manage risk more effectively. Remember, in futures trading, the main goal isn’t just to make profits, but to protect your capital so you can survive and grow over time.

References

- Peter Gratton, “Risk Management in Futures Trading”, Investopedia, accessed on June 19, 2025.

- Robinhood Learn, “Futures risk management”, Robinhood, accessed on June 20, 2025.