Ever thought about starting futures trading even though you’re new to it or consider yourself a beginner, but don’t know where to start?

If so, you’re reading the right article. Here, you will learn 7 concepts and features that every futures trader, including beginners, must understand. By understanding these concepts and features, you can make wiser trading decisions and tailor them to your style and risk profile.

Article Summary

- ⚖️ Flexibility of Perpetual Futures: Spot trading involves buying and owning an asset outright without the risk of liquidation. Futures, on the other hand, use leverage and trade contracts, allowing traders to profit on both rising and falling prices.

- 🧠 Importance of Understanding Concepts and Features in Perpetual Futures: Understanding the basic concepts and features in perpetual futures helps beginner traders adapt to various market conditions. Leverage can be an effective tool to increase potential profits, as long as it is used with good risk management.

Key Differences Between Spot and Futures Trading

Before going further, it is important to understand that trading in perpetual futures and spot markets have different mechanisms. It’s not just a matter of which one is more profitable, but also the goals, strategies and risks that traders want to manage. Even professional traders adjust their approach when using these two markets, as each has characteristics that can be utilized accordingly.

- Perpetual Futures Trading: A type of market that allows you to utilize leverage to increase the size of your trading position. Here, you’re not trading an asset directly, but rather a derivative contract that represents the price of that asset. Therefore, if the price moves against the position opened, there is the potential for a margin call to liquidation or the loss of all your margin.

- Spot Trading: A type of market where crypto assets are bought and owned directly by traders or investors. If the price drops, the impact is only on the value of your portfolio. There is no liquidation risk.

With spot trading, you can only earn potential profits by waiting for the price of the crypto asset to up. Whereas perpetual futures trading allows you to profit whether the market is bullish or bearish, as long as you open a position that matches the direction of the market movement.

7 Concepts and Features That Beginner Traders Must Understand

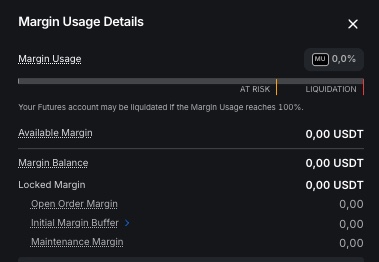

1. Margin and Margin Call

Margin is a collateral that is used as the main requirement to open a perpetual futures trading position. The funds you deposit are in the form of stablecoins such as USDT. You must also manage this margin properly to avoid margin calls and liquidation.

- Margin Balance: The total of all funds in a Futures account, including available margin, locked margin, and the value of unrealized PnL (ongoing profit or loss ).

- Available Margin: Funds that you are free to use to open positions, place new orders, and pay funding fees.

- Cross Margin: A system that uses the entire funds/margin in a perpetual futures account to hold all open positions. In this mode, the available margin may increase or decrease according to the position conditions.

Example: If the position is floating profit, the available margin will increase with the current profit. Conversely, when a position experiences a floating loss, the available margin will decrease.

- Initial Margin / Margin Cost: Funds used to open a position. The amount of the margin fee depends on the size of the position you want to open. Leverage determines what percentage of the position value you have to pay as margin cost.

Example: If you want to open a position worth 1,000 USDT with 25x leverage, you only allocate 4% of the position value i.e. 40 USDT as margin cost.

- Maintenance Margin: The minimum margin amount that must be maintained for a perpetual futures position to remain active. At Pintu Futures, the maintenance margin is set at 1% of the position value. This margin will remain locked as long as the position is active.

- Locked Margin: The amount of margin that is locked while having an active position or open order that has not been executed.

- Open Order Margin: The amount of margin that is temporarily locked when you place an unexecuted limit order . This margin will remain held until the order is filled, partially executed or canceled.

- Margin Usage: The percentage of margin balance usage calculated from total open positions, open order margin, and maintenance margin.

- Margin Call: Margin call is a warning to traders when the available margin is no longer sufficient to support an open position. This happens when the floating loss approaches the liquidation level. If you do not increase the margin or close the position, the position may be liquidated.

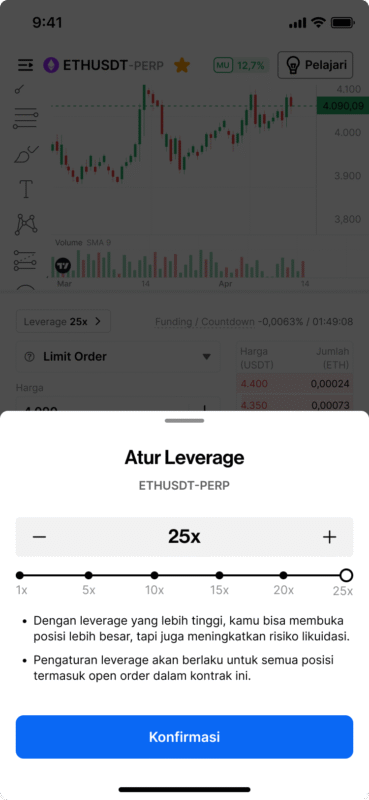

2. Leverage and Volatility

Leverage is a feature that allows you to open positions that are much larger than your capital. In Indonesia, perpetual futures trading such as on the Pintu platform provides 1-25x leverage. Each time you open a position, you can choose how much leverage you want to use.

Example: If you have a margin balance of 100 USDT, you can theoretically open a position with a maximum size of up to 2,500 USDT using 25x leverage. However, this limit may be reduced if there are other fees.

In general, the greater the leverage used, the smaller the margin cost required to open a position. However, the high risk in futures trading is not solely due to the size of the leverage, but because the margin capacity is not proportional to the size of the position opened.

Using too much leverage and thus oversizing positions can increase the volatility of a Futures account portfolio, as even small price movements can have a significant impact. This risk is even greater given that crypto markets generally have much higher price volatility than other investment instruments.

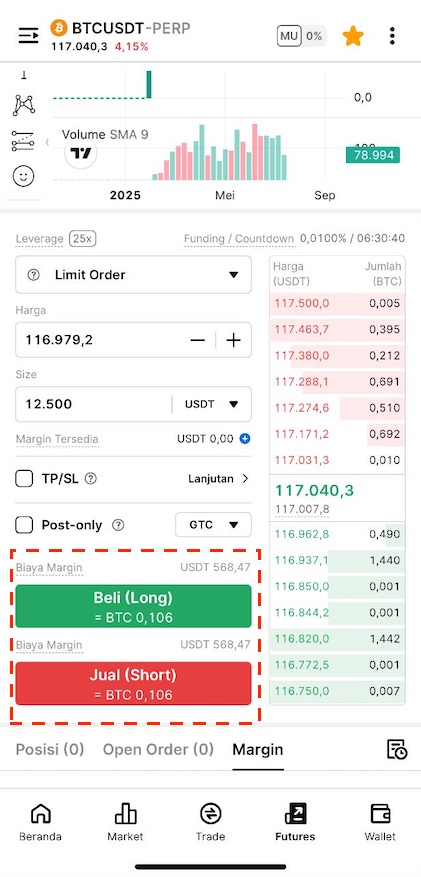

3. Position Types: Long and Short

Perpetual futures trading allows you to open positions in two directions, namely long and short. For beginner traders, this can be used as an opportunity to profit from market volatility, both when prices are rising and falling.

- Buy (Long): A trading position of buying a contract because you believe the price of a crypto will rise. When the price rises, you make a profit.

- Sell (Short): A trading position of selling a contract because you believe the price of a crypto will fall, When the price falls, you make a profit.

Be aware that if the price moves against the position you open, you could incur losses that could potentially lead to margin call and liquidation. Therefore, it is important to understand the direction of the market before opening a position.

In addition, these two types of positions allow you to customize your strategy according to market conditions. Not only can you respond to bullish or bearish conditions, but you can also open both types of positions simultaneously on different contracts. That way, you have greater flexibility in managing your trading strategy.

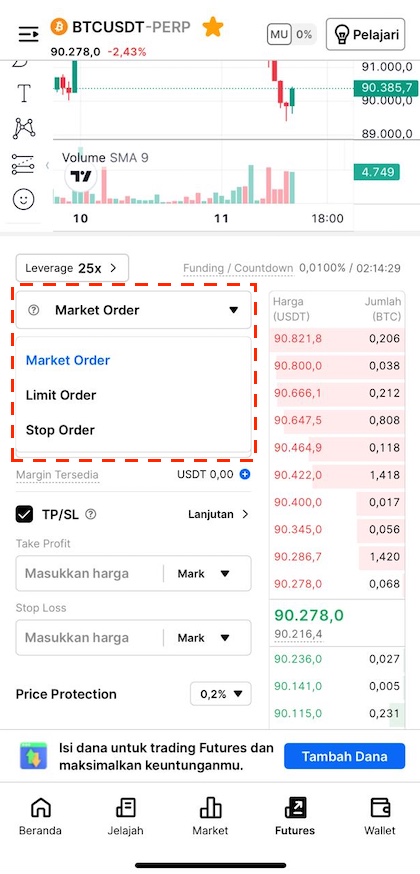

4. Order Types: Limit Order, Market Order, and Stop Order

Once you’ve determined the type of position you want to open, you then need to understand the three types of orders: Limit Order, Market Order, and Stop Order. By understanding these three types of orders, you can execute trading positions more precisely according to your needs and market conditions.

- Limit Order is a contract buy/sell order feature that is executed only when the asset price reaches a certain price you specify.

- Market Order is a contract buy/sell order feature that is executed directly at the current market price.

- Stop Order is an order feature that will execute a buy/sell contract when the price reaches a certain level (based on the last price or mark price). This order can be used as a trigger for limit orders or market orders.

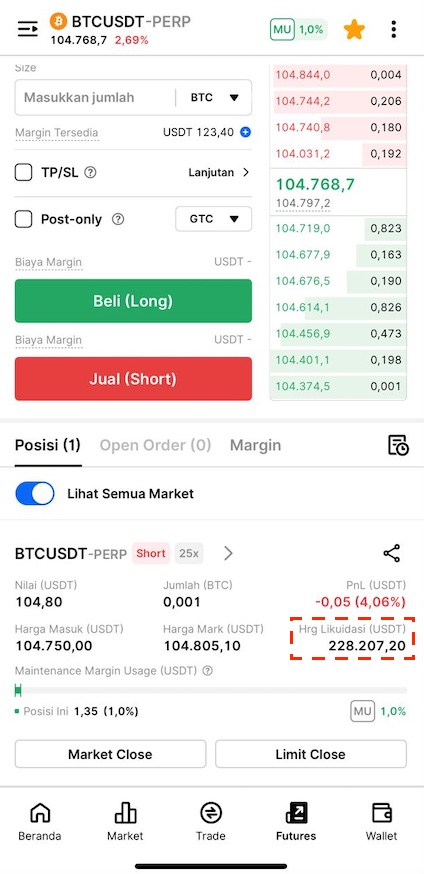

5. Liquidation

Liquidation is the process of automatically closing a position when the margin balance falls below the maintenance margin. When liquidation occurs, all funds in the futures account will be depleted because the margin is no longer sufficient to withstand losses.

On Pintu Futures, you can see the percentage of margin usage ranging from 0-100%. If your margin usage reaches 100%, your position will be subject to liquidation. In addition, each position you open also displays the liquidation price so you can estimate the limit of price movement before the position is liquidated.

Liquidation avoidance tips for beginners:

You can focus on the size of the position you want to open and the margin balance you have. If your margin balance is small, consider not opening a position that is too large. Take a look at the following table:

| Margin Balance | 500 USDT | 500 USDT |

|---|---|---|

| Position | BTC (Long) | BTC (Long) |

| Leverage | 25x | 2x |

| Total Position Value | 12,500 USDT | 1,000 USDT |

| Total Initial Margin (IM) | 500 USDT(4% of position value) | 500 USDT(50% of position value) |

| Maintenance Margin (MM) | 125 USDT(1% of position value) | 10 USDT(1% of position value |

| Available Margin Margin Balance – IM & MM | 375 USDT | 490 USDT |

| Margin Usage Ratio Maintenance Margin / (Maintenance Margin + Available Margin) x 100% | 25% | 2% |

| Remarks | The price moves down by 3% from the entry price, the position will be liquidated. | A price move down about 49% from the entry price will cause the position to be liquidated. |

It’s clear that if you don’t set the position size appropriately, the potential for liquidation will be much closer than when you open a position with a smaller size. The use of stop loss is highly recommended to minimize large losses.

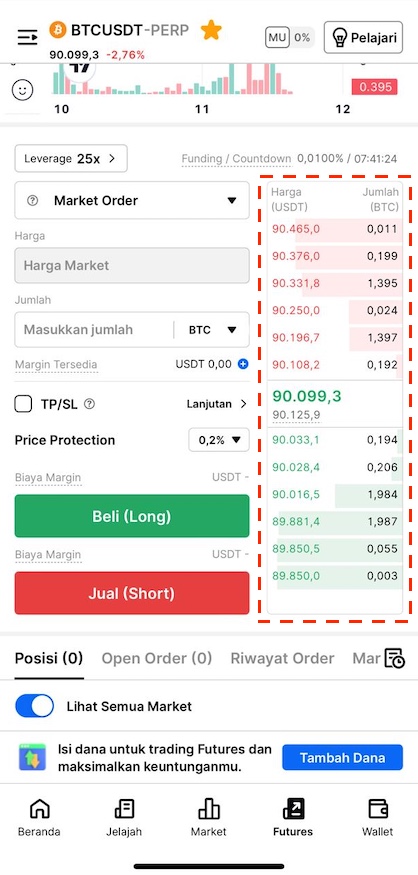

6. Order Book

Order Book is a collection of queues to buy and sell assets or contracts from all traders on an exchange.

Here are the details of the Order Book at Pintu Futures:

- Bid Column (Green): The queue list of traders who place the price and number of contracts they wish to buy (long).

- Ask Column (Red): The queue list of traders who place the price and number of contracts they wish to sell (short).

- Price (USDT): The price at which a trader decides to open or close a position.

- Amount (BTC): The number of buy or sell contracts a trader has placed at a given price.

If you or another trader has an order that hasn’t been executed due to a limit order or stop order, it will be included in the Order Book. This allows you to see at which price levels traders place the most bids and asks, allowing you to read the strength of liquidity in the market.

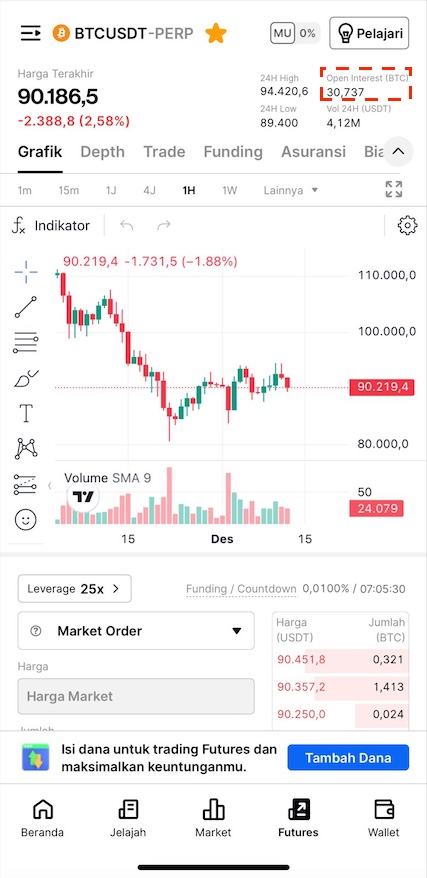

7. Open Interest

Open Interest is the number of active futures contracts both long and short that are currently open in the market. It shows how much interest or engagement traders have in a contract on a crypto market or exchange. For beginners, Open Interest can help understand how heavily a contract is traded.

- Open Interest rises + price rises → bullish trend reinforced by long positions.

- Open Interest rises + price falls → bearish trend reinforced by short positions.

Trading Futures on Pintu Pro Web

Apart from accessing Pintu Futures through the app, you can also open long or short positions such as BTC, SOL, and more directly through Pintu Pro Web. On Pintu Pro Web, you can trade Futures and spot right away!

How to trade Crypto Futures on Pintu Pro Web:

- Go to https://pintu.co.id/

- Click the Open Pro on Desktop button at the top center.

- Register or log in to Pintu Pro Web.

- Go to the Futures section.

- Trade BTC and other cryptocurrencies.

In addition to trading, Pintu also lets you learn more about crypto through various articles on Pintu Academy, updated weekly!

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

The concepts and features of trading in the perpetual futures market can help you understand its mechanics and choose a market type that suits your risk profile. The perpetual futures market offers flexibility as it can be utilized in high volatility conditions, whether the market is rising or falling. However, high volatility also increases the risk of margin calls and liquidation, so good risk management is key for all traders who want to survive and achieve consistent results in the perpetual futures market.