When the crypto market had its initial bull run in 2021, everyone suddenly became an expert trader. Every trading decision they made paid off. However, once the bull run began to run out of steam and the bear market period began, many trading decisions became bitter lessons. So, what are some of the lessons that can be learned from losing trades to avoid repeating them? How can you ensure you avoid making the same mistakes again? Check out the full article below.

Article Summary

- 💸 First lesson: Don’t get caught up in the euphoria and take profits immediately based on predetermined targets or your specific criteria.

- 🔎 Second lesson: Always read and understand a project’s tokenomics before investing.

- 🚨 Third lesson: Do not be easily tempted by high yields, especially from new protocols that do not explain their mechanism or source of revenue.

- 🔆 Fourth lesson: Always diversify and don’t keep your assets in just one place.

5 Bitter Lessons Learned from Bull Run

Investment decisions never seem to go wrong when the crypto market is in a bull run phase. Just by relying on hype, investors can still get significant profits. This will continue until the bull run reaches its peak. Once the peak is reached, the bullish trend turns bearish.

In this phase, traders and investors who are careless and complacent will get stuck. Those who get stuck are only faced with two choices: lose money and cut their loss immediately or hope that prices will rise only to find out the prices keep falling, thus, the losses are getting bigger. Given this phenomenon, here are five bitter lessons from the last bull run.

1. Didn’t Take Profit

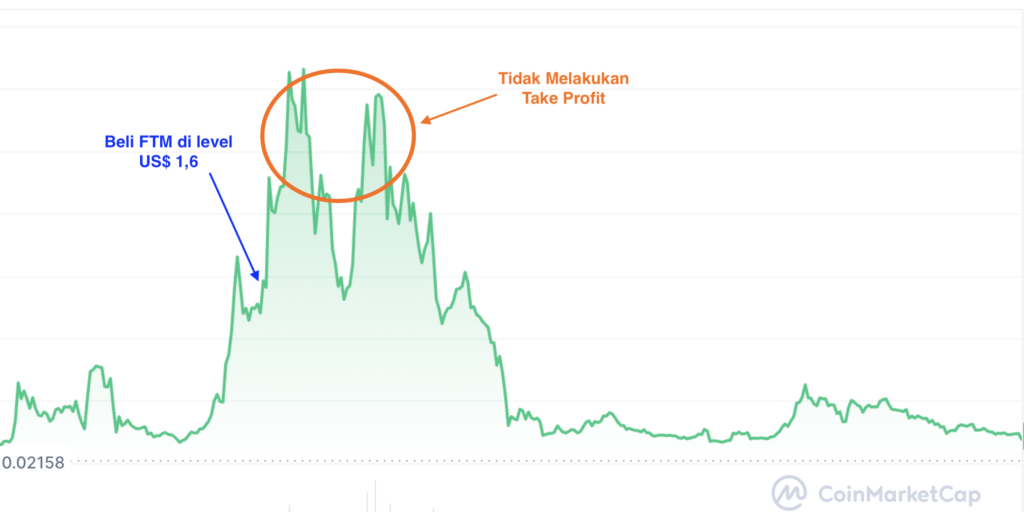

Taking a profit sounds very easy, but it isn’t easy to do. Especially when the price of an asset is rising significantly. Market conditions filled with FOMO can make traders hesitate to take profits. Traders often ignore their target price because they feel it can continue rising.

For example, Siti was tempted to buy Fantom due to the hype and strong fundamentals. Believing that FTM would be bullish, she decided to buy it when it was at US$1.6. It turned out that the price of FTM continued to rise until it reached US$ 3.0. However, Siti was reluctant to make a profit because she believed the price was still rising. She wanted to sell it in the US$ 3.2 area. Armed with blind faith, Siti missed its perfect price to profit taking.

Having a price target is important, but what’s equally important is ensuring that the price target is achieved. One way to do this is to apply the rules for taking profits. For example, selling all profits when the percentage reaches 35%. You can also sell all the initial capital when the profit percentage has reached 50%.

So if the positive trend ends, at least the trader has realized some of their profits or ensured that their capital is not lost. After that, take profit again by selling all the remaining assets held.

One way to be disciplined about taking profits is to set a price target and implement limit orders. Find out how to do it here.

2. Unable to Understand Its Tokenomics

Tokenomics can be the key to evaluating a token’s long-term potential and risk. When traders come across tokens with poor tokenomics, inevitably, they will only last for a while. During bull runs and alt seasons, the crypto market will be flooded with tokens with poor tokenomics. From minimal utility, massive supply, to poor vesting systems. However, some of these tokens can record fantastic price growth.

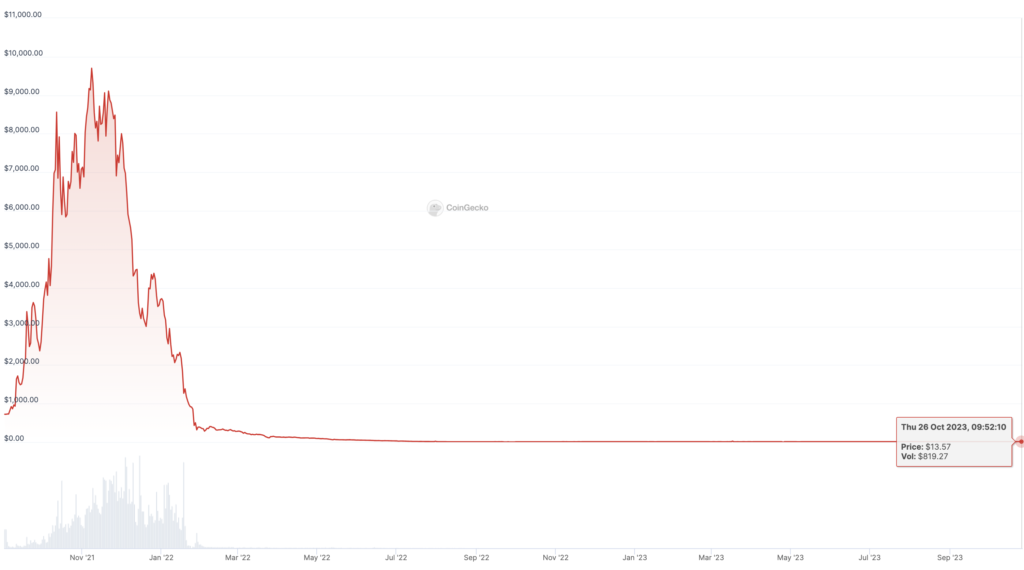

For example, during the DeFi Summer phenomenon, the DeFi ecosystem recorded an explosion of new DeFi protocols and attracted many investors. One of them is Wonderland, a DeFi protocol offering a very high yield. It has a native token, TIME, whose value is pegged to MIM (stablecoin).

In its tokenomics, it is mentioned that TIME is an inflationary token with an unlimited supply. When the supply continues to grow but is not matched by demand, it is only a matter of time before it falls. That’s exactly what happened to TIME. It only took three months for TIME to fall from its peak price of US$ 9,702 in November 2021 to US$ 300 at the end of January 2022.

In addition, many investors are tempted by high-yield offers, even though they do not realize they are the yield. In other words, new investors only become exit liquidity. We will discuss this in the next section.

To avoid bogus tokens during alt season, the lesson learned is to be willing to study the tokenomics of a token. The following article will help you understand how to use tokenomics to evaluate the value of an asset.

In addition, you should also do your own research regarding the token. Suppose you don’t have time to search one by one; take advantage of crypto influencers who have research content on a project or token. Check out the list of must-follow crypto influencers in the following article.

3. Don’t be Tempted by High Yield

During the bull run, many new DeFi protocols will offer large yields to attract users into their ecosystem. Be careful, though. These offers could be deliberately made for a pump-and-dump scheme. The mode is to wrap a large yield with the lure of “passive income”.

In addition to the large yield, the concept or how the yield is generated must be clearly explained. If you don’t understand where the source of the yield comes from, then you are the yield. In other words, the protocol is nothing more than a DeFi Ponzi scheme.

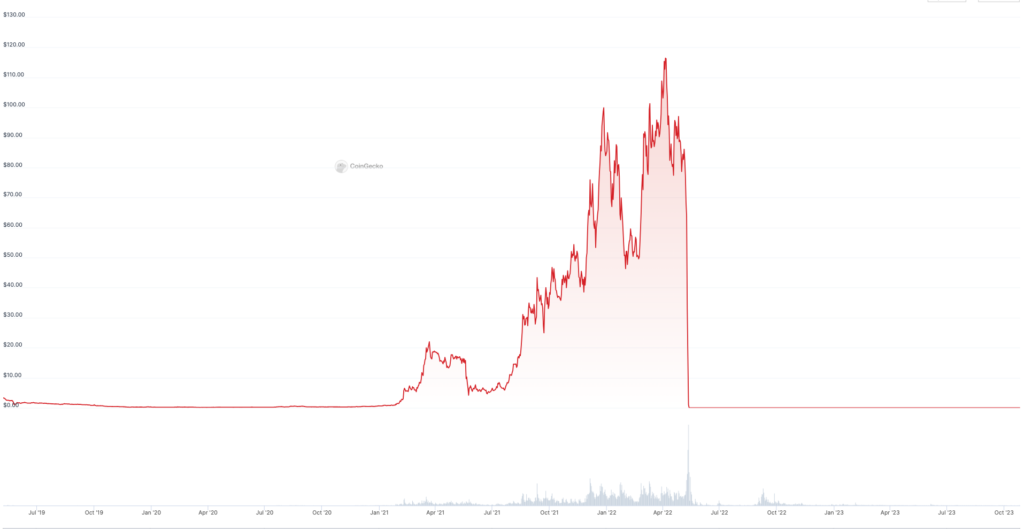

One example is Strongblock, which allows users to join and become Nodes-as-a-Service (NaaS). They can become a node without understanding the blockchain’s technicalities and will be rewarded with STRONG tokens. To become a node, apart from buying STRONG tokens, you need to stake your STRONG. After that, you will get “passive income” in return.

However, how the yield is generated is not clearly explained. Whether the yield comes from commissions on transactions or token inflation is not clearly explained. As a result, the fate is the same as TIME. Investors tempted by high yields and passive income had to find STRONG tokens losing their value. They eventually just became exit liquidity.

To prevent something similar from happening in the next bull run, the lesson learned is to ensure and understand how the yield is generated. You can also find out how the protocol generates revenue using platforms like DeFiLlama or Token Terminal. If you don’t find satisfactory results, it can be a red flag, and you should avoid the protocol.

The following six crypto analysis websites can help you research and analyze the fundamentals of a token.

4. Stablecoins aren’t Always Stable

The presence of UST with the concept of algorithmic stablecoins at that time shocked the crypto space. Using the LUNC mint and burn mechanism to maintain the value of UST made decentralized stablecoins the future. But, we all know how the story of UST and LUNC depeg ended.

When it depreciated to US$0.30, many traders and investors immediately cut their losses. However, not a few still believed that UST would return to US$ 1 because the price had reached US$ 0.80. This never happened, and countless investors or traders were stuck or had to cut losses.

From this failure, the lesson learned is that stablecoins are not always stable. They can depeg at any time. Therefore, always be ready to sell stablecoin assets immediately when experiencing a depeg. This can be done by setting a stop loss or tolerance limit for the depeg value of the stablecoin.

However, large stablecoins such as USDT or USDC have so far proven to be able to return to a 1:1 ratio every time they depeg. So, make sure that the cut loss limit is adjusted according to the quality and reputation of each stablecoin. Remember to diversify your stablecoin holdings to prevent losing many assets at once.

Learn more about stablecoins through Pintu Academy’s article here.

5. Keep Your Assets in One Place

Some entities can stand out and be considered the best during bull runs. We may remember the bankruptcies of FTX or Celsius. At the time, both looked very promising and too big to fail, as they said, giving them credibility and trust.

Finally, when the bull run ended, and the market switched to a bear market, both fell into bankruptcy and immediately lost their credibility. Unfortunately, because they were already trusted, many users kept all their assets in both. As a result, the downfall of FTX and Celsius brought many retail investors with them.

The lesson is that investors should not fully trust in one particular entity when the bull run happens again. This applies not only to exchanges but also to DEX protocols, wallets, and so on. Therefore, make sure always to spread your assets across different places. If something goes wrong, this can prevent you from losing all your assets and funds.

Conclusion

All the mistakes during the last bull run can be a valuable lesson for all investors. In the next bull run, there will likely be other mistakes that occur. But clearly, we should avoid repeating the same mistakes as investors.

As the old saying goes, Even a donkey doesn’t fall into the same hole twice. Therefore, by recognizing and learning from these mistakes, we will avoid making the same mistakes in the future. Make sure to be disciplined in taking profits, evaluating tokenomics, not being easily tempted by the lure of high yields, and diversifying.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Jake Pahor, I got completely rekt as a newbie in 2021, Twitter, accessed on 25 October 2023.

- Robert Stevens, Inflationary and Deflationary Cryptocurrencies: What’s the Difference? CoinDesk, accessed on 25 October 2023.

- Darren Kleine, DeFi Summer Is Over. Will It Ever Return? Blockworks, accessed on 25 October 2023.