The global economy and the crypto industry faced numerous macroeconomic issues in 2022, with high inflation and aggressive policies from the US central bank likely causing uncertainty in the crypto industry in 2023.

However, 2022 also brought innovations and advancements within the industry, such as Ethereum’s successful implementation of The Merge, which significantly reduced the industry’s energy consumption. In this article, we will look at what happened in 2022 and what to expect from the crypto industry in 2023.

Article Summary

- ⚠️ Throughout 2022, the global economy was hit by an energy crisis, which resulted in high inflation. Responding to this, global central banks implemented aggressive monetary policies.

- ❗Entering 2023, the global economy is faced with the threat of a recession due to high inflation and aggressive monetary policy.

- 🚨 These macroeconomic problems have negatively affected the crypto industry throughout 2022. Various issues in the crypto industry also exacerbate the poor performance of crypto.

- 📉 Throughout 2022, Bitcoin is in a downtrend where currently, Bitcoin has the strongest support level at 14,000 US dollars. However, it cannot be ensured that this point is the bottom area of Bitcoin.

- 💡However, various innovations in this industry continue to be developed. One of them is the successful implementation of The Merge by Ethereum, which cuts the energy consumption of this blockchain by 99%, and is believed to increase the adoption of crypto.

- ⚖️ In 2023, the crypto industry will still face challenges from macroeconomic problems and potential tightening of regulations.

- 🚀 Given the various challenges facing the industry in 2022, it is expected that interest in assets such as Bitcoin and Ether will grow, based on factors such as tokenomic sustainability, ecosystem maturity, and market liquidity

2022 Overview

2022 should be a year of recovery for the economy after the Covid-19 pandemic. Unfortunately, the recovery process was disrupted by several events that caused the world economy to slow down.

Macroeconomic Uncertainty

Worrying Inflation

The war between Russia and Ukraine caused a variety of macroeconomic problems including an energy crisis. The war led to a rise in natural gas prices, which reached their highest level of $9.72 per MMBtu in June due to Russia cutting off supply lines to the European Union. Similarly, oil prices also increased after the Russian invasion to Ukraine, reaching a high of $120 per barrel in mid-March before gradually decreasing towards the end of the year.

| Commodity | End of 2021 | Highest | % | 26 Dec 22 | % |

| Natural Gas | US$ 3.61 per mmbtu | US$ 9.72 per mmbtu | 169.25% | US$ 5.08 per mmbtu | 40.72% |

| WTI Crude Oil | US$ 75.74 per barrel | US$ 119,95 per barrel | 58.37% | US$ 79,56 per barrel | 5.04% |

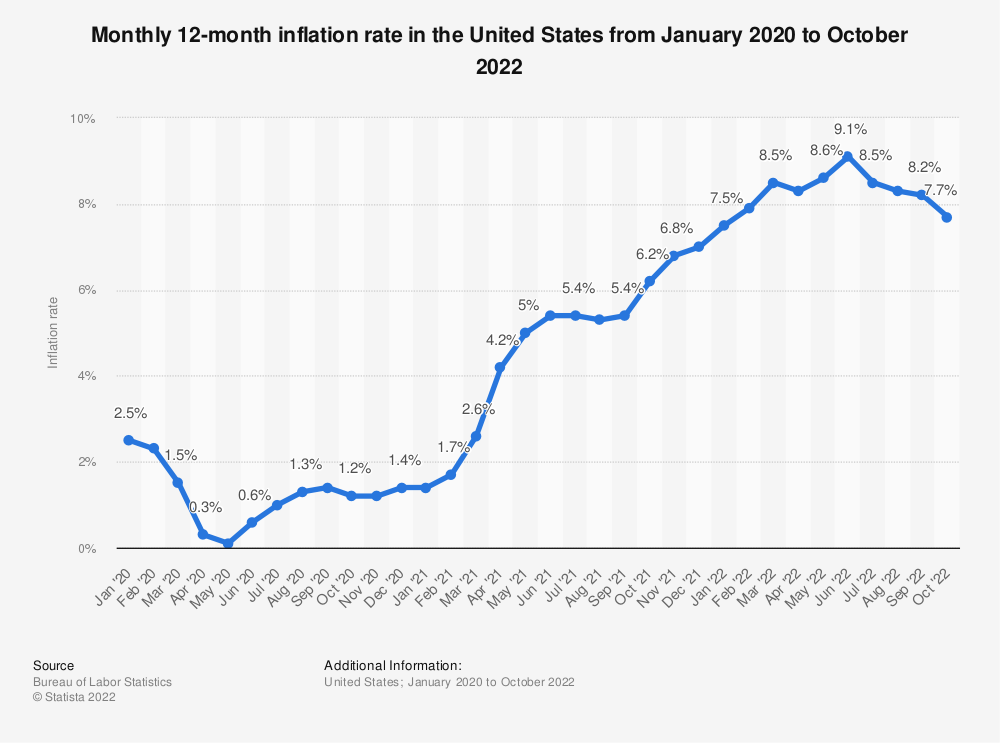

The impact of these rising energy commodity prices also contributed to higher rates of inflation in several countries. For example, in the United States, the increase in energy commodity prices combined with the Fed’s quantitative easing policy led to inflation reaching 9.1%, the highest level in 41 years. The additional liquidity injected into the market through this policy also caused the Fed’s balance sheet to increase from $5 trillion to $9 trillion.

The rise in inflation eventually prompted several central banks to take aggressive steps. This is also a contributor to macroeconomic problems throughout 2022.

Read the following article to find out how central bank policies affect the crypto market.

The Aggressiveness of The Fed.

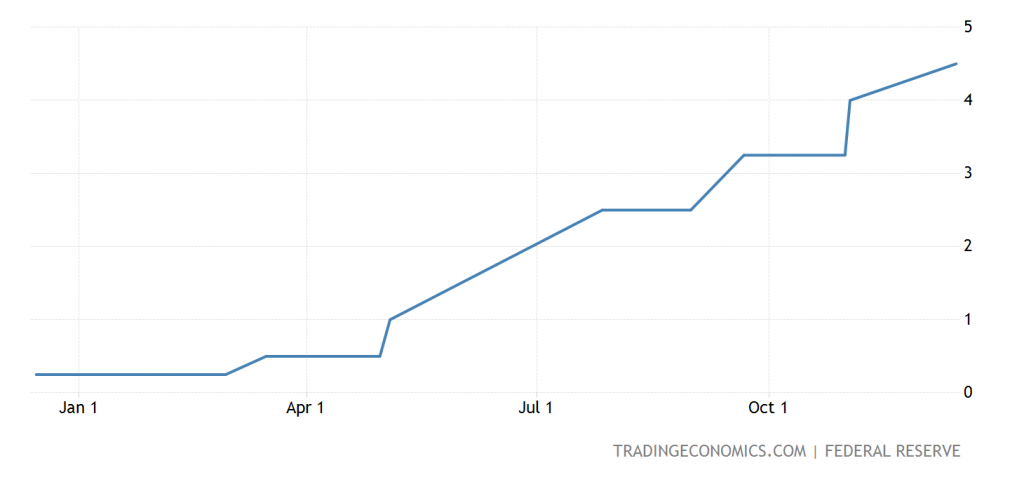

As the inflation rate continued to rise, central banks around the world began to take steps to tighten the monetary policy. The Fed, for example, the benchmark interest rate, which was initially at 0 – 0.25%, is now at the level of 4.25 – 4.5%.

This increase in interest rates caused investors to avoid risky assets such as stocks and cryptocurrencies, and instead shift their funds towards safer havens like the US Treasury. This can be seen in the 10-year US Treasury yield, which reached 4.23%.

The End of Several Crypto Projects

The prices of crypto assets significantly dropped throughout 2022. Investors avoided risky assets as a result of uncertain macroeconomic situations. To make matters worse, the industry was hit by a series of major controversies, contributing to a negative sentiment that only exacerbated the downturn.

The Downfall of LUNA

In May, TerraUSD (UST) stablecoin suddenly depegged or lost its benchmark 1:1 against the US dollar. As a result, UST plummeted to its lowest level at 0.06 US dollars. Meanwhile, LUNA plunged 100% to the level of 0.0002 US dollars. With both coins holding significant market capitalization, the incident sent shockwaves through the industry.

Find out more about the difference between stablecoins in the following article

The Bankruptcy 3AC and Celcius

After the LUNA downfall, the crypto industry was again rocked by negative sentiment. Crypto lending platform Celsius froze their withdrawals and was declared bankrupt. In a similar fate, crypto-asset investment firm Three Arrows Capital (3AC) also went bankrupt. 3AC has several debts to pay as a result of the crypto market being bearish, as well as the incident that happened to LUNA.

The Collapse of FTX

The crypto market was hit with another crisis when FTX, a top global crypto exchange, crumbled. The trouble began when FTX sent its customer funds, including the FTT native token, to Alameda Research – a company that was struggling with losses from various transactions. FTT’s asset prices tumbled in the aftermath, and FTX froze withdrawals.

You can learn more about self-custody and how to store your crypto safely in the following article.

Completion of “The Merge” Ethereum

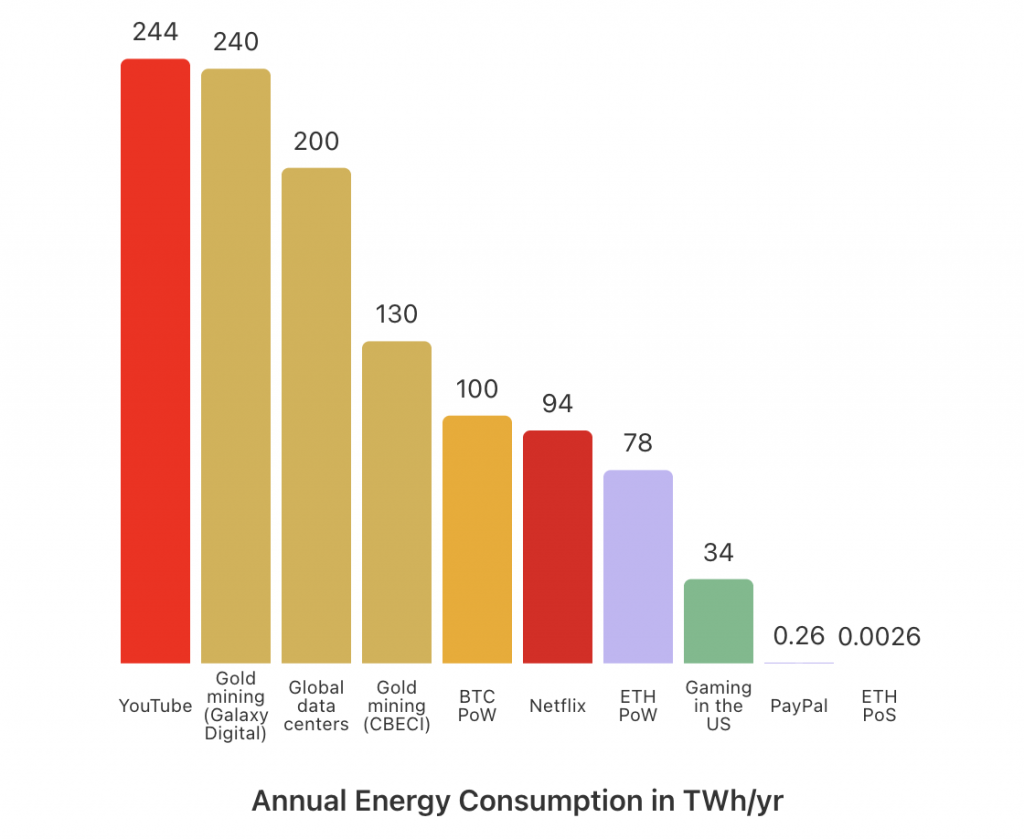

2022 was not entirely a year filled with negative sentiment for the crypto industry. In 2022, the industry has seen several milestones. One of them is Ethereum successfully completed the transition to a consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS) on September 15, 2022.

Do not miss it! You can learn more about Proof-of-Stake in the following article.

Based on the graph above, we can see that the annual energy consumption of ETH PoS, or after The Merge, has decreased dramatically and is far below other industries. From a user perspective, The Merge has no significant impact on their experience using the Ethereum network. Gas fees, for example, have mostly stayed the same after The Merge. The Merge, however, allows for increased scalability of the Ethereum blockchain in the future.

In the following article, we have explained what happened after the completion of the merge

Predicting 2023

2022 has been a challenging year for the global economy. Meanwhile, for the crypto industry, 2022 has been even more difficult. It started from the pressure caused by the macroeconomic issues to various problems in the crypto industry itself. Then, can 2023 be a better year for the global economy and the crypto industry? To find out the answer, here are the following factors that could affect the outlook for 2023:

Observing Macroeconomic Condition

Recession Threat in 2023

The big theme of macroeconomic conditions in 2023 is a recession. So far, the global economy already experiencing a technical recession as growth has declined for two straight quarters. But the worst may be yet to come, as market predictions point to a full-blown recession next year, with an economic slowdown leading to even more dire economic data. According to forecasts from world banks and the IMF, the US, China, and the global economy are all expected to take a hit in 2023

| Global | U.S | China | |

| Morgan Stanley | 2.20% | 0.50% | 5.0% |

| Goldman Sachs | 1.80% | 1.0% | 4.50% |

| J.P Morgan | 1.6% | 1.0% | 4.0% |

| Barclays | 1.7% | -0.1% | 3.80% |

| Credit Suisse | 1.6% | 0.8% | 4.5% |

| IMF | 2.7% | 1.0% | 4.4% |

Regarding recession, the World Bank, in its study, noted the decision of the world’s central banks to raise their interest rates in response to rising inflation could trigger a recession.

💡 So far, the main factor causing the rise in inflation is the Russia-Ukraine conflict which has disrupted commodity supply chains, especially energy commodities. Meanwhile, the factors that can dampen the inflation rate are the easing of labor market pressure and the normalization of commodity supplies.

World Bank Group President David Malpass said the looming threat of a 2023 recession could seriously impact world economic growth. Recessions can lead to layoffs, rising prices for necessities and energy, and increased poverty rates, all of which can slow down world economic growth even further as more and more countries slip into recession.

Thus, the fate of world economic growth next year will depend on the inflation rate. If the inflation rate remains high, then the effects of the recession will be more severe. This could spell trouble for the crypto industry, as investors become more wary and less likely to invest in risky assets like crypto during an economic slowdown.

Besides inflation, here are some factors that can causes crypto prices to fall.

Waiting for The Fed’s Decision in 2023

In 2023, the policies of the world’s central banks will be the essential factor in efforts to control and mitigate the effects of a recession. One of the steps that can be taken is to raise interest rates. It’s just that the increase in interest rates can not be done carelessly. Based on a study from the World Bank, an increase in interest rates can push the core inflation rate, excluding energy, to increase to 5% in 2023. This figure is almost double the average inflation five years before the pandemic.

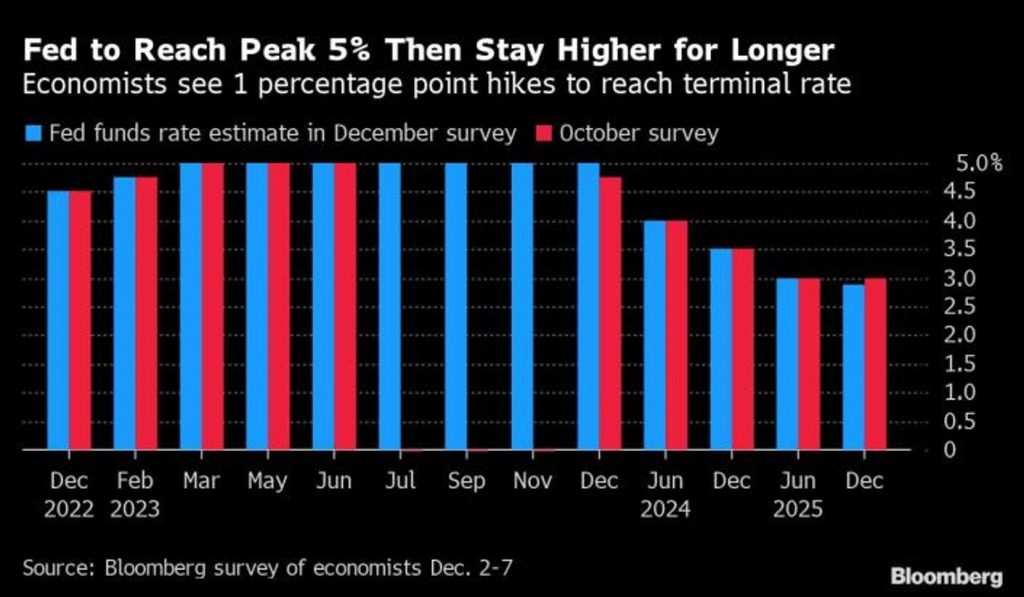

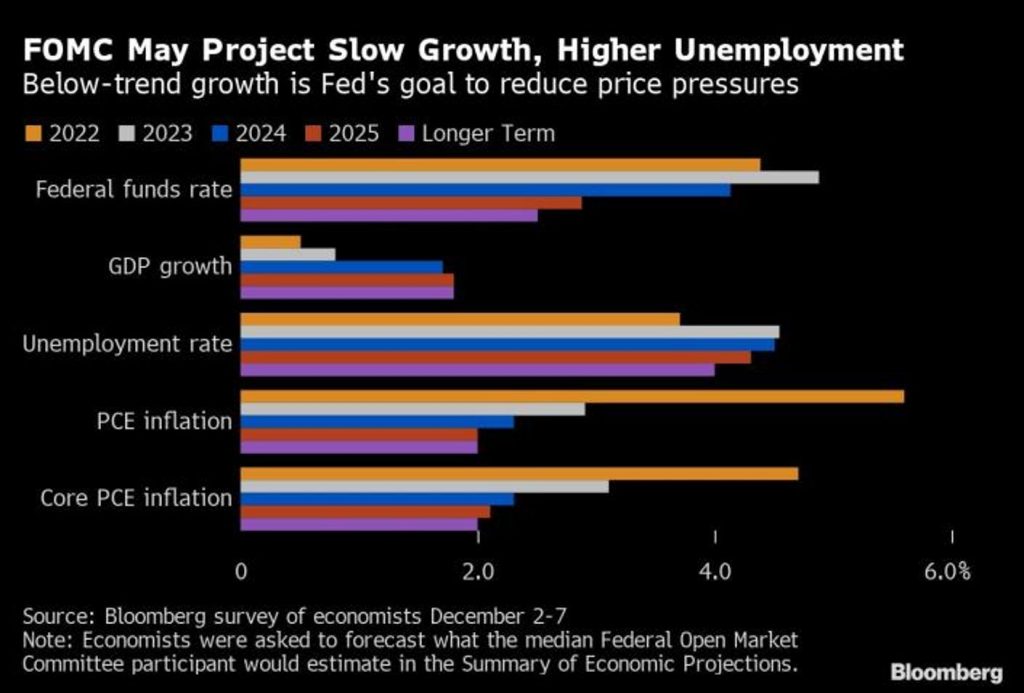

The Fed’s policies are the most influential among several global central banks. Thus, the Fed’s stance in 2023 will be decisive in moving the global economy. After seeing the Fed aggressively raising interest rates throughout 2022, market participants predict that the Fed will be moderate in 2023. However, the latest signals show that the Fed will maintain interest rates at their highest level, 5%, throughout 2023. This contrasts the expectations of market participants who believe the Fed will start cutting interest rates in the second half of 2023.

According to Bloomberg economists Anna Wong and Elize Winger, the interest rate is expected to hit 5% in early 2023, after the Fed raises rates by 50 bps at the December meeting and another 25 bps twice in early 2023

Fed Governor Jerome Powell has previously stated that high-interest rates are necessary to curb price pressures, with the aim of reducing demand and lowering prices. The chart below shows that interest rates are expected to peak in 2023, before new interest rate cuts are implemented in 2024 and 2025.

With these signals and possibilities, what remains next year is to wait for whether the world economy will experience a soft or hard landing.

💡 So far, all of The Fed's decisions and actions have been based on efforts to create a cushion so that the economy can experience a soft landing next year.

The Fate of Crypto in The Next Year

After having a challenging year throughout 2022, the fate of crypto in 2023 is still shrouded in question marks. Here are some things that could affect the fate of crypto in the next year.

Macroeconomic Uncertainty

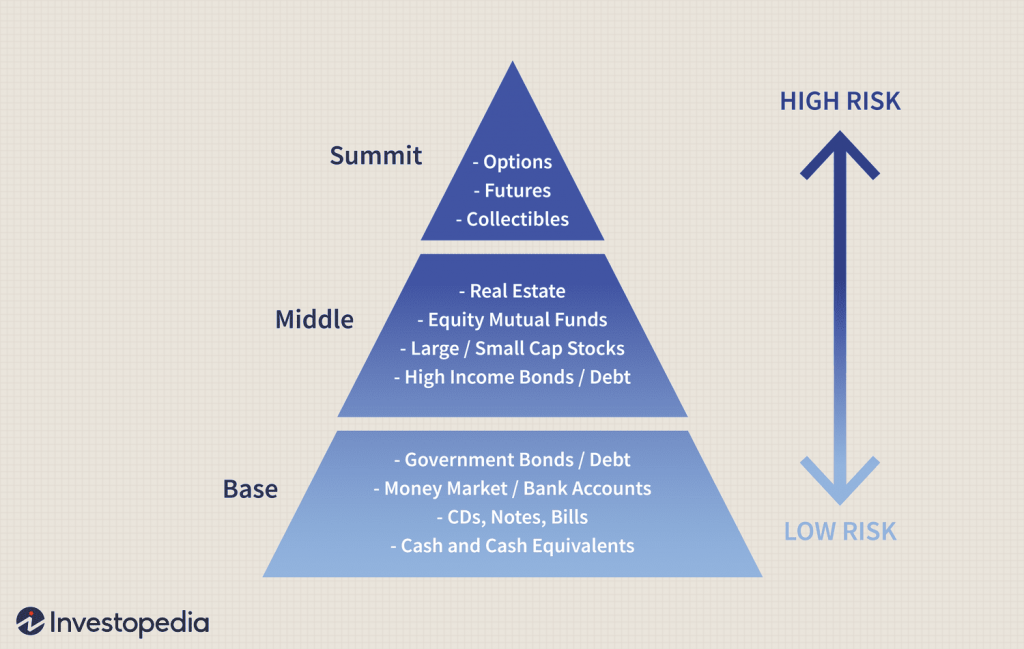

Next year’s macroeconomic concerns, such as recession and inflation, may negatively impact the crypto industry. Investors often prioritize safety and liquidity during uncertain times, leading them to avoid risky assets like crypto. The uncertain macroeconomic climate may also lead to a continued preference for liquid assets like the US dollar and US Treasury.

Even if the economy improves and investor risk appetite increases, it is not guaranteed that funds will return to the crypto market. Instead, investors may first move from US Treasury to commodities like gold before potentially redirecting funds to bonds in emerging countries. Furthermore, when gold returns are no longer competitive, funds will be diverted to bonds in developing countries.

As investor appetite for risk increases and conservative assets lose their appeal, risky assets like crypto may become more attractive. However, before funds flow into the crypto market, investors will likely turn to the stock market first, particularly tech stocks. If tech stocks regain favor with investors, that’s when crypto assets may see an influx of investment.

You can read the following article on how to choose crypto assets for investment.

Has the Bottom Been Touched?

Based on historical data, Bitcoin and crypto assets have a cycle: the bull market-bear market (bottom)-consolidation (sideways). If you reflect on this cycle, the 2021 period was a bull run as Bitcoin reached an all-time high level of US$69,045 on November 10, 2021. After reaching that level, Bitcoin then continued to decline. On November 22, 2022, Bitcoin reached 15,195 US dollars, its lowest level in the last two years. This downtrend shows that Bitcoin is currently in a bear market phase.

Amid this situation, then a question arises. Is the level of 15,195 US dollars the bottom point of Bitcoin? Technical analysis indicates that the strongest support point for Bitcoin is currently at $14,000. At the same time, Bitcoin is testing the $18,000 resistance point. If it can overcome this barrier, the next resistance points are $20,000 and $25,000.

Even though it is the strongest support point, in reality, no one can guarantee that Bitcoin will not fall deeper than that level. As we know, the bottom of a bearish cycle is difficult to predict. What’s more, the uncertain macroeconomic conditions next year will also be a challenge. On the other hand, recent problems in the crypto industry still leave big question marks.

If the $14,000 level proves to be Bitcoin’s bottom, the next phase in its cycle will be consolidation or sideways movement. In the past, Bitcoin went through a three-year consolidation phase, falling from a high of $17,760 on December 16, 2017 to $3,000 before consolidating in the $5,000-$10,000 range. After breaking through this phase in November 2020, Bitcoin soared past $17,760 and continued to rise until it reached its all-time high.

So, how long will the sideways phase of Bitcoin last? It’s the same as looking for a bottom point. No one can predict it. From now on, the price movement of Bitcoin and other crypto assets will depend heavily on the economic recovery process itself. Meanwhile, for the bull run phase, a very strong positive catalyst will be needed.

Learn more about support and resistance in crypto through the following article.

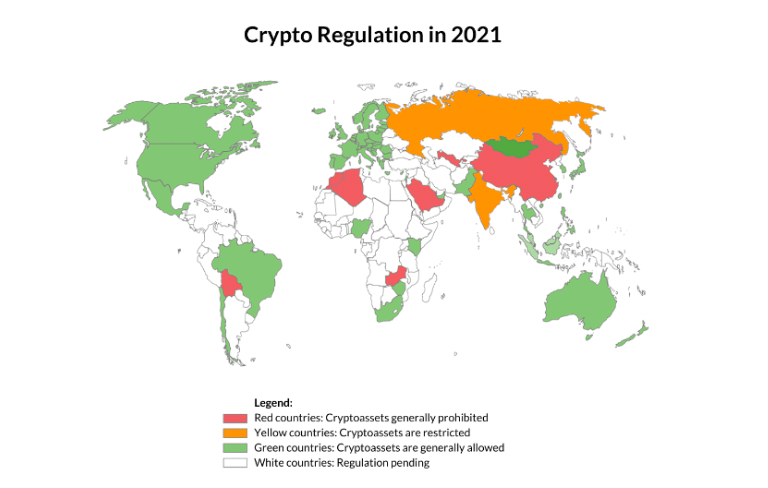

Regulatory Tightening

The FTX turmoil not only had an impact on the crypto market but also raised concerns about the future of the crypto industry itself. So far, the lack of regulations in the crypto ecosystem has often been in the spotlight from non-crypto market players and the government. As a result of the FTX problem, regulatory tightening is being more widely considered to prevent similar incidents from happening again. In fact, several countries have started setting up regulations for the crypto industry.

- 🇺🇸 United States. In the US, for example. The Security and Exchange Commission (SEC) has pushed a rule that crypto platforms must be registered like securities companies. If registered, crypto exchanges would be forced to adopt technology systems to make their order books audit-compliant. They would also face strict rules on order execution to prevent market manipulation. In September 2022, the White House also launched the Crypto Regulatory Framework.

- 🇪🇺 European Union. Meanwhile, the European Union has also issued a legal framework through Markets in Crypto Assets (MiCA). The proposal contains monitoring mechanisms, consumer and crypto asset ecosystems protection from market manipulation and financial crime.

- 🇬🇧 United Kingdom. Likewise, the UK through The Treasury also plans to launch new rules regarding the crypto industry. One of the things that will be regulated is how to deal with a company’s bankruptcy, limiting foreign companies offering transactions in the UK and restricting the advertising of crypto products.

It is considered that the urgency of tightening regulations will get stronger after the FTX situation. In the short term, the discourse on tightening regulations can create negative sentiment for the crypto industry. This is because the crypto ecosystem comes with a concept free from any regulation and interference from third parties. Going forward, those situations could spread Fear, Uncertainty, and Doubt (FUD). Crypto investors and traders can feel uncomfortable due to stricter regulations or government interference.

Even so, it cannot be denied that stricter regulations could positively impact the long term. So far, many investors and the public have doubted crypto assets due to unclear regulations. With investors protected by tighter laws, it is possible that investors who were hesitant before will be interested in entering the crypto market. However, it is undeniable that this process will not happen overnight. The whole process will take a long and challenging process.

In the end, two possibilities will arise after the fall of FTX. Is the crypto industry still standing in an area free from regulation? Or will there be a tightening of regulations that can have a positive impact? It will be interesting to see how the fate of the crypto industry will develop in the future.

Regarding regulation, don’t forget to read the future of crypto in Indonesia through the following article.

The Growth of Investor Interest in High-Quality Assets.

With various uncertainties from the macroeconomic situation, most investors are anticipating a mild recession in the US which is expected to occur between early 2Q23 to 1Q24. As previously explained, this causes investors to reduce their portfolio in risky assets. The same is happening within the crypto market itself.

According to the Coinbase report, it is estimated that there will be a growing interest in quality and tested assets in the context of digital assets. These assets are Bitcoin and Ether because they consider factors such as tokenomic sustainability, ecosystem maturity, and market liquidity. This growing interest in quality assets is also due to the failure of several crypto projects that occurred in 2022.

Start Investing at Pintu

Regardless of the conditions in 2023, you can invest in various crypto assets such as BTC, BNB, ETH, and others through Pintu safely and easily. Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as a financial advice.

Reference

Rakesh Sharma, Is There a Cryptocurrency Price Correlation to the Stock Market? Investopedia, accessed on 15 December 2022.

Hannah Ward-Glenton, IMF cuts global growth forecast for next year, warns ‘the worst is yet to come’ CNBC, accessed on 15 December 2022.

Reuters, Big banks see global economy slowing more in 2023, with likely U.S. recession, Reuters, accessed on 15 December 2022.

Kyle White, Bitcoin on-chain data shows 5 reasons why the BTC bottom could be in, Coin Telegraph, accessed on 15 December 2022.

Taylor Tepper, 2023 Federal Reserve Outlook, Forbes, accessed on 15 December 2022.

Steve Matthews, Fed Expected to Keep Peak Rates for Longer, Dashing Hopes for 2023 Cuts, Bloomberg, accessed on 15 December 2022.

Coin Desk, Crypto Outlook 2023: Regulation, Web3, DAOs, Stablecoins and Jobs, accessed on 15 December 2022.

Wen Sheng, US money-printing policy is source of global financial distress, Global Times, accessed on 15 December 2022.

Rakesh Sharma, How SEC Regs Will Change Cryptocurrency Markets, Investopedia, accessed on 15 December 2022.