The DeFi sector has been dominant in the crypto industry for the last few years. UniSwap, Compound, and Curve are some of the most widely used DeFi protocols. Apart from these three protocols, there is one DeFi project that is often referred to as a “decentralized bank”. This protocol is MakerDAO. In recent years, MakerDAO has proven itself as one of the largest DeFi protocols. So, what is MakerDAO? Why is it called a decentralized bank? This article will explain it in detail.

Article Summary

- ⚙️ MakerDAO is a large DeFi protocol that allows users to borrow the decentralized stablecoin DAI. Users can mint DAI with various assets as collateral. Maker is often called a “decentralized bank” in the DeFi sector.

- 🏦 The MakerDAO protocol has a high “real yield” from various earning mechanisms such as income from the difference between lending and borrowing interest and stablecoin exchange transaction fees. MakerDAO is emerging as one of the protocols with the largest revenue in the DeFi sector.

- 💵 Implementation of Smart Burn Engine (SBE) and the use of surplus buffers created a strategy to minimize the impact of financial losses and strengthen MKR’s position in the market.

- 🧠 Endgame is a massive update plan that includes introducing SubDAO, revising MKR’s tokenomics, and more. The endgame is designed to bring increased efficiency and better governance into the MakerDAO ecosystem.

What is MakerDAO?

MakerDAO is a lending application (CDP) that allows users to borrow the decentralized stablecoin DAI (overcollateralized). Users can mint DAI using various collateral such as crypto assets, other stablecoins, and even RWA (real-world assets). DAI is the largest decentralized US dollar stablecoin in the crypto world and the 3rd largest stablecoin after USDT and USDC.

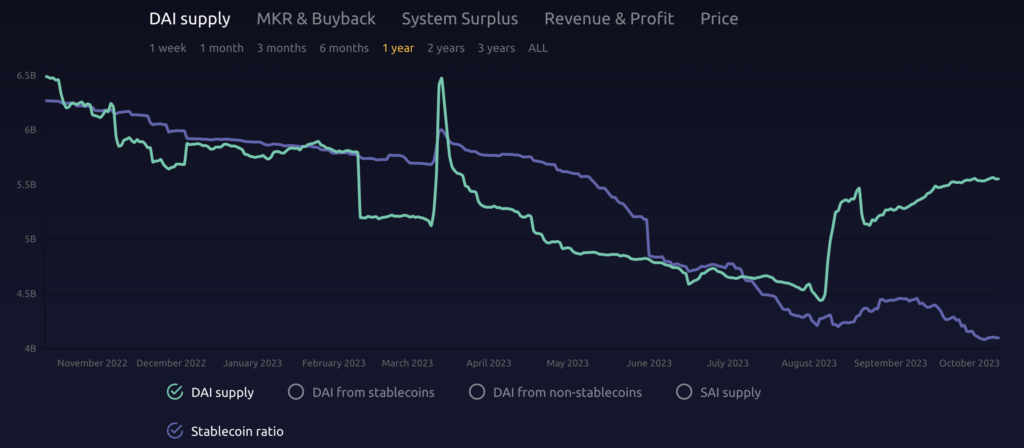

MakerDAO is the 4th largest app in the DeFi sector with a TVL of $4.2 billion dollars. As shown in the image above, the current DAI stablecoin supply is 5.5 billion DAI.

MakerDAO also has the MKR token, which functions primarily as a governance token and a last resort if MakerDAO goes bankrupt. In this situation, the protocol will mint new MKR and auction them off to cover losses. During MakerDAO’s existence, this only happened once in March 2020 due to many DAI borrowers being liquidated when BTC suddenly crashed.

Read more at Pintu Academy: What is MakerDAO and how does it work?

Why MakerDAO Has a Significant Role in the DeFi Sector?

DeFi Protocol With Real Yield

MakerDAO is one of the DeFi protocols with the largest real yield. Basically, Maker earns protocol profits in four ways:

- The difference between the interest that borrowers pay on loans (stability fee) and the DAI deposit rate. For example, currently, the DAI lending rate is 5% and the DAI borrower’s rate is 5.33%, the difference is MakerDAO’s profit.

- Income from liquidating the borrower’s position. The profit figure from here is usually small.

- Stablecoin swap transaction fees from the Price Stability Module (PSM) which allows stablecoin swaps without slippage but has a 0.1% platform fee.

- Since MIP-65 in 2022, real-world assets (RWAs) such as US government bonds can be used as collateral to borrow and mint DAI. RWA collateral provides MakerDAO with stable income, especially since the US government is raising interest rates.

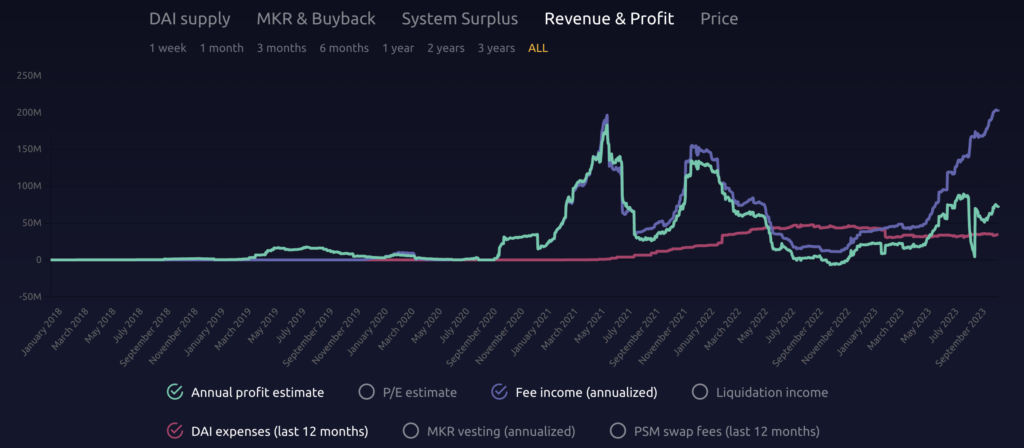

Total MakerDAO revenue from these four mechanisms reached $203 million dollars when annualized with a net revenue of $73 million dollars. According to DeFiLlama, MakerDAO has the 2nd largest revenue figure in the crypto industry with $12.5 million dollars in the last 30 days.

Largest Decentralized Stablecoin

As mentioned, DAI is the largest decentralized stablecoin in the crypto industry. It can even be considered the only decentralized stablecoin because it has very healthy liquidity, supply, and collateralization (DAI is very stable). In case of emergency, MakerDAO also has enough liquidity and reserves to stabilize DAI.

All Maker decisions are made through DAO executive voting, which is a process of proposal, discussion, and then election.

However, the DAI supply graph shows a significant downward trend until August 2023. MakerDAO then made a proposal to increase the DSR (DAI Savings Rate) which is basically like a traditional bank interest rate.

Users can deposit their DAI into a DSR contract to earn interest similar to a deposit. Saving DAI in DSR will earn you sDAI tokens (the concept is the same as liquid staking).

In June 2023, the DSR was increased to 3.45%. Then, MakerDAO made another proposal to increase the DSR rate in August 2023 to 5%. As a result, the supply of DAI skyrocketed from $1 billion DAI from August to October.

The increase in DAI interest rates was made possible because MakerDAO has had steadily increasing profits since last year. The interest given to those who store DAI in the DSR comes from MakerDAO’s revenue. The combination of DSR and DAI systems used by dozens of protocols makes MakerDAO often referred to as the decentralized bank of the crypto industry.

MakerDAO's DSR is similar to traditional bank interest rates. If the DSR is high, it means that MakerDAO has a lot of extra revenue that can be given out as an incentive for people to mint DAI.

Several Promising Catalysts for MakerDAO

1. SBE (Smart Burn Engine) Implementation and Surplus Buffer

The Smart Burn Engine is an aspect of the MakerDAO protocol that has only been implemented in the past few months. The SBE will use MakerDAO’s surplus DAI to buy MKR and provide liquidity in the MKR/DAI token pair. This is done in case the market experiences a flash crash like in March 2020.

The SBE will kick in when MakerDAO’s DAI profit (surplus buffer) exceeds $50 million dollars. You can track this MKR buyback program on Makerburn. Currently, MakerDAO has bought back 11,845 MKR, or about $16 million dollars. The SBE program is very bullish for the MKR token and this can be seen on the MKR chart which has seen a significant rise in the last few months.

2. Increase in RWA Percentage as DAI Collateral

As shown in the image above, MakerDAO has accepted RWA assets as collateral to print DAI. The above RWA companies mostly use short-term US Treasury assets as collateral for DAI. This helps to keep the assets liquid while the RWA assets earn high interest from the US government.

MakerDAO earns $128 million dollars from RWA in the DAI portfolio. The interest that MakerDAO earns on the RWA collateral category will directly contribute to the surplus buffer associated with the SBE.

As MakerDAO gets bigger, more and more traditional financial companies will see a huge opportunity in Maker. The potential of the RWA asset category on MakerDAO is still huge.

The Future of MakerDAO and its Potential

Rune, one of the founders of MakerDAO, released a plan for Maker V3 in August 2022 that he called Endgame. Endgame is a massive MakerDAO renewal plan that will cover important aspects such as changing MKR tokenomics, governance processes, and creating a new ecosystem for MakerDAO and DAI.

The Endgame update plan has five main pillars:

- The Maker Atlas: The Maker Atlas is the main guidebook for MakerDAO governance covering all aspects including the scope of SubDAO governance, SubDAO communication, and resolving disagreements.

- SubDAO: Through Endgame, MakerDAO plans to compartmentalize the governance process into multiple smaller-scale DAOs according to their topic scope (RWA, Lending platform, etc). These smaller-scale DAOs are called SubDAOs and have their own tokens and governance processes. Each SubDAO runs its own operations, develops its own system, and is expected to be sustainable.

- Scope and Scope Artifacts: Scope is the specific scope that MakerDAO aims to contribute to. This is created to separate different operations so that they do not overlap. Scope Artifacts are the rules and standards of each Scope. This system was created to ensure that each SubDAO understands its own scope and can run independently.

- Aligned Voter Committees: Aligned Voter Committees are small groups of MakerDAO voters who have aligned perspectives and values. Each AVC should promote the interests of MKR token holders and be active in the governance system. MakerDAO established AVCs and other voter communities to increase participation in MakerDAO governance, which is currently very low.

- Tokenomics: Endgame completely overhauls MKR tokenomics to have an important function in the MakerDAO ecosystem. Eventually, MKR tokens will be replaced with new governance tokens that play an important role in SubDAOs and the MakerDAO ecosystem as a whole.

The Endgame implementation will also be divided into five phases due to its large scope. The final phase of the MakerDAO Endgame is to create a dedicated MakerDAO blockchain. The Endgame implementation is already underway with the first SBE and SubDAO, the Spark Protocol. In fact, Spark Protocol is now the main application for printing DAI and interacting with MakerDAO.

With so many updates to the MakerDAO ecosystem, investor confidence in MakerDAO can be seen in the MKR chart. Since the beginning of June 2023, MKR has risen by more than 100%.

MakerDAO also has bullish catalysts such as increased RWA assets from financial institutions, high DAI interest, and MakerDAO’s huge revenue data compared to other crypto asset protocols. All this makes MakerDAO one of the most important protocols in DeFi with a promising future.

Conclusion

MakerDAO is well-known as a “decentralized bank” in the DeFi sector that offers the use of the decentralized stablecoin DAI. DAI minting can be collateralized with various assets, including real-world assets (RWAs). MakerDAO implements several mechanisms to benefit the protocol to stabilize DAI and make it sustainable. MakerDAO has plans for a new iteration of Maker V3, called Endgame. Endgame will be a massive update of MakerDAO that affects various aspects of the protocol, including governance, token economy, and the introduction of SubDAO.

How to Buy the MKR Token on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for MKR.

- Click buy and fill in the amount you want.

- Now you are a MakerDAO investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Jake Pahor, “MakerDAO- Research Report”, Substack, accessed on 12 October 2023.

- HFA Research Team, “MakerDAO: the Sleeping Giant”, Substack, accessed on 12 October 2023.

- Ouroboros Capital, “MKR: Burn Baby Burn”, Substack, accessed on 12 October 2023.

- Peary, “MakerDao”, CMS Holdings Substack, accessed on 13 October 2023.

- “Overview – Maker Endgame Documentation”, MakerDAO, accessed on 13 October 2023.

- “The 5 phases of Endgame – General Discussion”, The Maker Forum, accessed on 13 October 2023.