Futures trading allows you to open positions with significantly larger value through the use of leverage. However, the higher the leverage you use, the more important it becomes to manage your margin wisely to ensure your positions remain sustainable in various market conditions. In this article, we’ll cover the definition of leverage, the key risks to watch out for, and strategies for using high leverage effectively. With a better understanding, you’ll be able to make more calculated trading decisions.

Article Summary

- 🔎 Understanding Leverage: One of the core concepts in futures trading that allows you to open positions with a higher value than your available capital.

- 💡 Understanding the risks: Knowing the risks in futures trading is an important step to make a wise decisions.

- 🛠️ Safe Strategies: Set risk limits, use margin wisely, set stop-losses, avoid overtrading, and conduct regular evaluations.

Understanding Leverage

Before diving into how to manage risk, it’s important to first understand what leverage is.

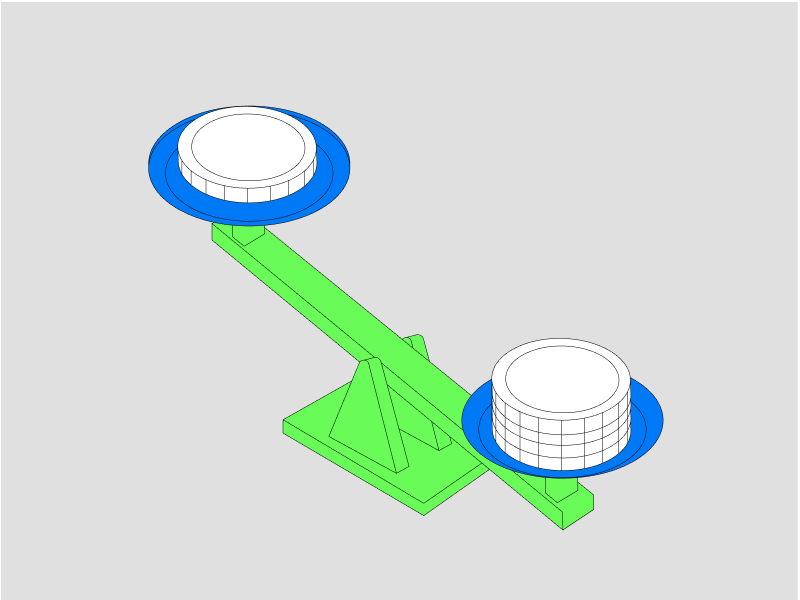

Leverage is a feature that allows you to open positions larger than the amount of capital you actually have. For example, with 10x leverage, you can open a position worth 1,000 USDT using only 100 USDT in capital.

This feature can increase your profit potential, but it also amplifies the impact of every price movement, both in terms of possible gains and potential losses. Even a small move in the wrong direction can lead to your position being closed (liquidated) if your margin is not sufficient.

If you’re new to futures trading and want to try using high leverage, there’s no need to worry. This article is here to help you understand the basics more clearly so you can make smarter decisions going forward.

Read on to learn more about how leverage works.

Strategies for High-Leverage Futures Trading

When trading on Pintu Futures, you’ll have access to 25x leverage by default. This means you can open positions up to 25 times larger than your available margin. With the right approach, 25x leverage can be a powerful tool. In this article, we’ll show you how to manage your margin wisely and trade responsibly, even with high leverage.

1. Set Risk Limits Per Position

Avoid using too much margin in one position. For example, if you’re just starting out, consider allocating up to 20% of your total capital as initial margin per position to manage exposure more effectively. This helps protect your capital, so a single loss won’t significantly impact your overall balance.

Example case:

| Margin Balance | USDT 500 |

|---|---|

| Jumlah Posisi | 1. ETHUSDT-PERP 2. BTCUSDT-PERP |

| Position Size Per Asset | USDT 2.500 |

| Total Position Size | USDT 5.000 (USDT 2.500 x 2) |

| Total Initial Margin | USDT 200 (i.e. 20% per position for a total of 40% – 200/500) |

| Maintenance Margin | USDT 50 |

| Available Margin | USDT 450 |

| Effective Leverage | 10x (25x leverage, but we only use 40% capacity – therefore 25x x 0.4 = 10) |

| Margin Mode | Cross margin |

| Remarks | The trader only used a small portion of the margin to open positions, while the rest remains available as a risk buffer in case the market moves unfavorably. |

Referring to the example above, by using only an initial margin of USDT 200 out of a total account balance of USDT 500, so you’re not putting your entire balance at risk. However, because Pintu Futures uses a cross margin system, the available margin in your account is shared across all open positions. If one of the positions experiences a large floating loss, the loss could exceed the initially planned risk limit of USDT 200, but as long as you don’t lose more than USDT 450 (which is about a 9% loss of your total portfolio value), your account will remain safe.

In comparison, if you had traded the full 25x leverage, your account can only suffer a 3% total portfolio value loss before you are liquidated. So by simply adjusting the investment amount and your position size, you are effectively managing the leverage of your positions and reducing the overall risk of liquidation.

Make sure to regularly monitor your unrealized PnL across all positions to make sure all your positions stay under control, and allocate margin based on the level of risk you’re willing to take.

2. Calculate Your Margin Accurately

Many beginners do not fully understand how to calculate margin when using high leverage. As a result, they often open positions that are too large relative to their available capital, without leaving enough margin to absorb short term price movements. This miscalculation makes their positions highly vulnerable to liquidation, as there is not enough of a “cushion” to withstand market fluctuations.

Example case:

| Description | Scenario 1: Fully Deployed Margin | Scenario 2: Partially Deployed Margin |

| Margin Balance | USDT 500 | USDT 500 |

| Number of Positions | 1 (BTC) | 1 (BTC) |

| Leverage | 25x | 25x |

| Total Position Value | USDT 12.500 | USDT 4.500 |

| Total Initial Margin (IM) 4% of initial entry cost of position | USDT 500 | USDT 180 |

| Maintenance Margin (MM) 1% of initial entry cost of position | USDT 125 | USDT 45 |

| Available Margin Margin Balance – IM & MM | USDT 375 | USDT 455 |

| Effective Leverage Total Position Value / Margin Balance | 25x | 9x |

| Margin Usage Ratio Maintenance Margin / (Maintenance Margin + Available Margin) x 100% | 25% | 9% |

| Remarks | The risk is significantly higher since a 3% adverse price movement can lead to liquidation. Although the trader still has available margin to open other positions, the risk being taken is substantially large. | The risk is more manageable because only a portion of the margin is allocated. This allows greater flexibility and better protection against liquidation. |

Although Pintu Futures provides leverage of up to 25x, traders can manage how much margin they want to allocate. For example, as shown in Scenario 2 of the table above, by allocating USDT 180 in margin, a trader can open a position worth USDT 4,500. This results in an effective leverage of approximately 9x, with a margin usage ratio of 9%, which carries significantly lower risk compared to using the maximum available margin.

Since not all of the account balance is used as margin, the remaining funds remain available as available margin. This provides traders with greater flexibility to either open additional positions or withstand floating losses without immediately triggering a liquidation risk.

Below simulation table demonstrates how the 2 scenarios of margin allocation will perform if the market were to drop 1, 2 and 3%

| Market Down | Scenario 1: PnL | Scenario 1: Margin Ratio | Scenario 2: PnL | Scenario 2: Margin Ratio |

| 〰️ 0% | 0 | 25% | 0 | 9% |

| 🔻 1% | -125 | 33% | -45 | 9.8% |

| 🔻 2% | -250 | 50% | -90 | 10.9% |

| 🔻 3% | -375 | 100% (Liquidated) 🔥 | -135 | 12.3% |

3. Always Use Take-Profit and Stop-Loss

In high-leverage futures trading, setting a take-profit and stop-loss is a step that should never be ignored. By setting a stop-loss, you can automatically limit potential losses without having to react in panic when the price moves beyond expectations. Meanwhile, a take-profit helps secure gains according to the targets you have set. This habit supports discipline and keeps your trading strategy on track without being disrupted by momentary emotions.

In addition, you can also calculate take-profit and stop-loss levels based on a risk-to-reward ratio. This ratio is useful to ensure that potential gains are balanced with the possible losses. For example, with a 1:3 ratio, it means that for every potential USDT 100 loss, the target profit should be at least USDT 300.

Additionally, consider using limit orders to execute both take-profit and stop-loss, especially in highly volatile markets. Using limit orders can help reduce the price impact on your execution, which often occurs when prices move rapidly. This way, you have better control over the entry and exit prices.

This approach helps maintain the consistency of your strategy over the long term, because even if not all positions go according to plan, you can still manage risk in a more disciplined way.

4. Manage Emotions and Avoid Overtrading

Trading with high leverage makes your balance fluctuate very rapidly, even within minutes. This situation often triggers emotional pressure, from fear of loss to an excessive desire for fast gains. Many traders end up opening positions repeatedly without careful consideration, simply to recover previous losses or chase profits impulsively.

This habit is known as overtrading and carries a very high risk because it can drain your capital quickly. To avoid it, stick to the trading plan you have made, limit the number of positions you open, and take breaks to clear your mind before making the next entry. This way, you will be able to control your emotions better and keep your trading decisions rational.

5. Choose Assets with the Right Considerations

Selecting the right asset is crucial when you use high leverage. It is best to prioritize assets with a relatively large market capitalization, for example above $1 billion, such as BTC or SOL. Large-cap assets generally have more stable price movements, making the risk of liquidation easier to manage. On the other hand, if you are a beginner trader, you should avoid assets with high volatility, as these conditions can trigger unpredictable price swings.

You can also take advantage of market momentum by paying attention to the funding rate. A large funding rate, typically ranging from positive or negative 0.5% to 2%, can indicate that sentiment around an asset is strongly leaning in one direction. When the funding rate is negative, it means the majority of traders are opening short positions, so traders who go long receive funding. In short:

- A negative funding rate → most traders are currently shorting.

- A positive funding rate → most traders are currently longing.

By understanding this funding rate, you can better read market tendencies and adjust your entry or exit strategy accordingly.

6. Take a Break After Consecutive Losses

When facing a string of losses, it is natural to feel the urge to open a new position right away to recover the losses. However, decisions made under pressure often worsen the situation. Instead, pause your trading activity, take time to calm down, and reassess your strategy. This break helps restore your focus and objectivity, allowing for more rational and measured decisions when you re-enter the market. It’s a healthier approach than rushing in and potentially increasing both your losses and mental strain.

Conclusion

Futures trading with 25x leverage does offer the potential to manage larger positions than your available capital, but the risks cannot be taken lightly. Understanding how leverage works, how to calculate margin, and the risk of liquidation are essential skills before deciding to enter futures trading. With discipline in setting risk limits, using stop-losses, and avoiding rushing after losses, you can reduce the negative impacts of high leverage that often cause traders to lose their capital in a short time.

In the end, futures trading is not just about chasing big opportunities but also about maintaining the sustainability of your capital and your mental resilience for the long run. With a solid strategy, regular evaluation, and the courage to pause when conditions are unfavorable, you can use high leverage more responsibly. Always prioritize education, planning, and discipline so that every trading decision stays rational and well-measured.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.