After weeks of uncertainty, BTC has finally resumed its bullish momentum, breaking above the $85,000 resistance level. However, ongoing tensions around U.S. President Donald Trump’s tariff policies remain a key driver of market volatility. Check out the full analysis from the Pintu’s trader team.

Market Analysis Summary

- 🟢 BTC finally broke above its resistance level, briefly reaching a price of $85,778. The main driver behind this price surge was President Trump’s newly released guidelines on reciprocal tariffs, which included exemptions for electronic goods.

- 🚨 The minutes from the Federal Open Market Committee (FOMC) meeting held on March 18-19, 2025, were released on April 9, revealing a shift in sentiment among Federal Reserve officials regarding the economic outlook.

- 💼 In March 2025, the U.S. economy added 228,000 jobs, significantly exceeding expectations and marking a notable rebound from the previous month’s revised figure of 117,000.

- ⬆️ As of March 2025, the U.S. unemployment rate stands at 4.2%, a slight increase from 4.1% in February.

Macroeconomic Analysis

Tariffs and Trade War

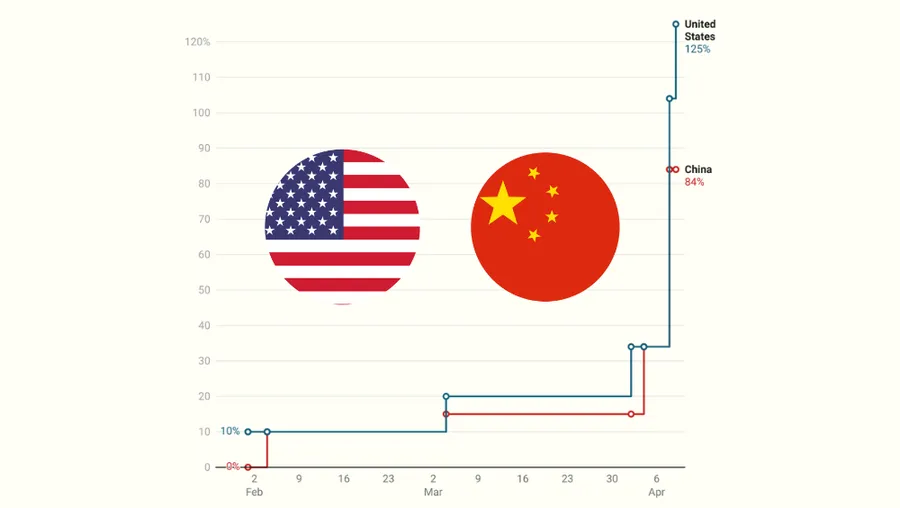

On April 9, 2025, the U.S. sharply raised tariffs in its ongoing trade war, mainly targeting China. President Trump increased tariffs on Chinese imports to an effective rate of 104%, following earlier hikes—including a 10% baseline tariff on all imports starting April 5, and a 54% rate for Chinese goods.

These new tariffs affect imports from 86 countries, with rates ranging from 11% to 84%. China faces the highest tariffs, making it the most affected. The announcement caused U.S. stock markets to drop, as investors worried about the economic impact. In response, China called the tariffs “a mistake on top of a mistake” and vowed to retaliate.

Trump then announced a temporary pause on tariffs for over 75 countries willing to negotiate with the U.S., aiming to reduce the burden on American consumers and businesses. However, this pause does not apply to China, which has already hit back with its own 84% tariffs on U.S. goods, escalating the conflict further.

The implications of these tariffs are profound, affecting various sectors such as agriculture, manufacturing, and retail. U.S. companies that rely on Chinese imports for components or finished goods are likely to face higher costs, which may be passed on to consumers in the form of increased prices. Retailers like Walmart and Target have already begun pressuring suppliers to absorb some of these costs. Meanwhile, industries such as agriculture are bracing for retaliatory measures from China that could impact their exports significantly.

As this trade war unfolds, both sides are likely to experience economic strain. The uncertainty surrounding these tariffs could lead to reduced investment and consumer spending in both countries. Analysts are closely monitoring how these developments will affect global trade dynamics and whether negotiations can eventually lead to a resolution that alleviates some of the economic pressures stemming from this ongoing conflict.

Other Economic Indicators

- Tariff Effects on Broad Economy: The recent escalation of tariffs imposed by the U.S. government under President Trump’s administration is expected to have significant effects on the broader economy, capital and equity markets, bonds, and foreign exchange (forex) markets. The comprehensive tariff policy, which includes a 10% minimum tariff on imports from various countries and higher rates specifically targeting China, Canada, and Mexico, is projected to raise consumer prices substantially.

- Fed Powell Speech: In his recent speech on April 4, 2025, Federal Reserve Chair Jerome Powell addressed the economic outlook amid rising uncertainties due to new tariffs imposed by President Donald Trump. Powell highlighted that the recent tariffs, which include a sweeping 10% levy on all imports, are expected to contribute to higher inflation while potentially dampening economic growth. He emphasized the Fed’s commitment to its dual mandate of achieving maximum employment and stable prices, noting that the current economic indicators suggest solid growth but with increasing risks stemming from trade policies.

- FOMC Minutes: The minutes from the Federal Open Market Committee (FOMC) meeting held on March 18-19, 2025, were released on April 9, revealing a shift in sentiment among Federal Reserve officials regarding the economic outlook. The discussions highlighted growing concerns about stagflation risks, as the newly imposed tariffs by the U.S. government were anticipated to elevate inflation while simultaneously dampening economic growth and demand. The FOMC noted that uncertainty surrounding the economic landscape had heightened, prompting a reassessment of previously optimistic projections for inflation and growth.

- Non-Farm Payrolls: In March 2025, the U.S. economy added 228,000 jobs, significantly exceeding expectations and marking a notable rebound from the previous month’s revised figure of 117,000. This increase was well above the forecasted 135,000 jobs and represents the strongest job growth observed in three months.

- Unemployment Rate: As of March 2025, the U.S. unemployment rate stands at 4.2%, a slight increase from 4.1% in February. This change reflects a modest rise in the number of unemployed individuals, which increased by approximately 203,000 to reach around 7.1 million

BTC Price Analysis

Over the past week, BTC has traded a wide range between $74,400 and $83,500, reflecting market consolidation amid broader macroeconomic uncertainties. As of April 10, 2025, BTC is priced at $81,689.66, marking a slight decline of 1.08% from the previous day. The weekly price range has been between $81,449.43 (day low on April 10) and $85,237.59 (weekly high on April 2). This stability follows a period of heightened volatility in March, suggesting that traders are cautiously monitoring external factors such as inflation concerns and geopolitical developments.

The price movements this week began with BTC trading at $82,526.42 on April 3, following a drop from $85,237.59 the previous day—a decline of approximately 3.18%. This decrease was attributed to profit-taking and reduced trading volumes as investors reacted to macroeconomic pressures. Throughout the week, BTC hovered around the $82,000 level before dipping slightly below $81,500 on April 10. Despite these fluctuations, the overall trading volume has remained robust at approximately $79 billion, indicating sustained interest in BTC.

The broader cryptocurrency market mirrored BTC’s performance during this period. ETH, for instance, saw modest declines alongside BTC as investor sentiment remained cautious. Analysts have noted that the correlation between BTC and traditional equity markets has strengthened recently, with macroeconomic trends such as inflation expectations and Fed policy decisions influencing crypto prices.

Technical analysis suggests that BTC is currently consolidating near key support levels around $81,500 while facing resistance at $85,000. Breaking above this resistance could signal renewed bullish momentum, while a drop below support might lead to further declines.

The good news is that on April 13, 2025, BTC finally broke above its resistance level, briefly reaching a price of $85,778. The main driver behind this price surge was President Trump’s newly released guidelines on reciprocal tariffs, which included exemptions for items such as smartphones, computers, chips, and other electronic goods.

On-chain metrics indicate that institutional investors continue to accumulate BTC during this consolidation phase, reflecting confidence in its long-term value despite short-term volatility.

In summary, BTC’s price movements over the past week highlight its resilience amid external pressures and market uncertainty. While short-term volatility persists, long-term sentiment remains cautiously optimistic as institutional interest supports stability in the cryptocurrency market. Traders are closely watching critical support and resistance levels for indications of future price trends.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Vitalik Buterin Proposes New Roadmap to Enhance Privacy on the Ethereum Network. On April 11, Vitalik Buterin released a new roadmap aimed at enhancing privacy on the Ethereum network, combining short-term solutions with long-term upgrades. He advocates for integrating privacy features directly into Ethereum wallets—such as a default “send from shielded balance” option—without requiring users to download separate privacy wallets. Buterin also proposes major changes to DeFi and DApps, suggesting a one-address-per-application model to prevent activity tracking, even if it comes at the cost of convenience. The roadmap includes technical updates like EIP-7701, which enables anonymous transactions without relays, and FOCIL to prevent censorship of private transactions. For blockchain communication, he recommends short-term use of Trusted Execution Environments (TEE), eventually transitioning to Private Information Retrieval (PIR) systems. Additional infrastructure proposals include proof aggregation, mixnet integration, and using separate RPC connections per DApp to ensure maximum user privacy.

News from the Crypto World in the Past Week

- Trump Exempt Tariffs on Tech Products, Bitcoin Surges Past $85,000. U.S. President Donald Trump has eased tariffs on a range of tech products such as smartphones, chips, and semiconductors, offering relief to the tech sector that has been hit hard by the trade war. The move sparked a rally in tech stocks and the closely correlated crypto market, with Bitcoin breaking past $85,000 on April 12. Trump also announced a 90-day pause on reciprocal tariffs and lowered the tariff rate to 10% for countries that did not retaliate against U.S. goods. However, analysts like Max Keiser argue that the move won’t be enough to reverse rising bond yields, while Raoul Pal sees the tariff policy as a negotiation tactic amid ongoing macroeconomic uncertainty with China.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- JasmyCoin (JASMY) +71.20%

- Helium (HNT) +49.69%

- Curve DAO Token (CRV) +38.63%

- Render (RENDER) +35.39%

Cryptocurrencies With the Worst Performance

- MANTRA (OM) -86.16%

- EOS (EOS) -14.86%

- Tezos (XTZ) -14.44%

- Cosmos (ATOM) -6.80%

References

- Vince Quill, Trump exempts select tech products from tariffs, crypto to benefit?, Cointelegraph, accessed on13 April 2025.

- Adrian Zmudzinski, Vitalik Buterin unveils roadmap for Ethereum privacy, Cointelegraph, accessed on13 April 2025.