It’s a festive week in Indonesia as the country just celebrated its 79th Independence Day, but unfortunately, the mood in the crypto industry is far from celebratory, with the market remaining in a slump. However, mounting evidence suggests a potential interest rate reduction in September, which could be a bullish catalyst for Bitcoin (BTC). A deeper analysis follows.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🔴 BTC is struggling to climb above $61,000, setting up the 0.5 Fibonacci retracement line as resistance.

- 🟢 U.S. PPI Increases Below Expectations, Rate Cut Likely Following Next FOMC Meeting.

- 📉 Price increases slowed more than anticipated in July, bringing the Consumer Price Index below 3% for the first time in over three years.

Macroeconomic Analysis

Producer Price Index (PPI)

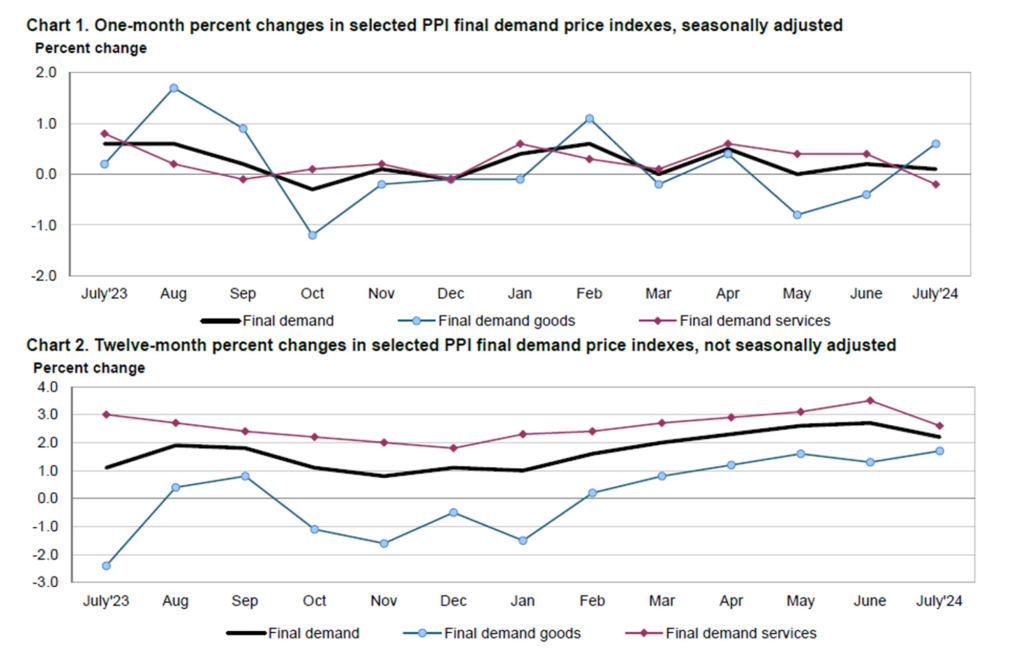

U.S. producer prices increased less than expected in July as an energy-driven rebound in the cost of goods was tempered by cheaper services, indicating that inflation continued to moderate in support of an interest rate cut next month.

US producers’ year-on-year inflation eased to +2.2% in Jul-24, the lowest in 3 months and slightly below market expectations of +2.3%. Services prices, which account for 67.2% of the index weightage, rose by +2.6%, the slowest in 5 months. Conversely, goods prices saw a +1.7% uptick, the highest in 16 months.

Against the previous month, the US PPI inflation softened to +0.1% month-on-month, missing market expectations for it to remain at +0.2%. Core PPI was unchanged from previous month after rising +0.3% in the previous two months, falling short of market’s projection of +0.2% inflation. The broad easing of price pressures within the supply chain signaled further moderation in the US inflation. MIDF said it now foresees the Fed will likely start easing its policy rate as soon as the next FOMC meeting in Sep-24 on the back of recent signs of slowing inflation and concerns over slowing economic growth.

Other Economic Indicators

- Consumer Price Index (CPI): Consumer prices rose by 2.9% over the 12 months ending in July, down from June’s 3% annual increase, according to the latest CPI report from the Bureau of Labor Statistics released on Wednesday. On a monthly basis, prices increased by 0.2% after a 0.1% decline the previous month. Economists had predicted a 0.2% monthly rise and a 3% annual increase. This development sets the stage for the Fed to consider a rate cut next month.

- Retail Sales: Retail sales in July exceeded Wall Street’s expectations, alleviating concerns about a significant slowdown in the U.S. economy. Retail sales increased by 1% in July, while economists had anticipated a 0.4% rise. Meanwhile, June’s retail sales were revised down to a 0.2% decline from the previous estimate of flat sales, according to Census Bureau data.

- Jobless Claim: The U.S. job market continues to show resilience as unemployment claims declined last week, despite ongoing economic challenges such as high interest rates and inflation. Initial jobless claims dropped by 7,000 to 227,000, indicating that labor market conditions remain stable even as concerns about an economic slowdown persist.

BTC Price Analysis

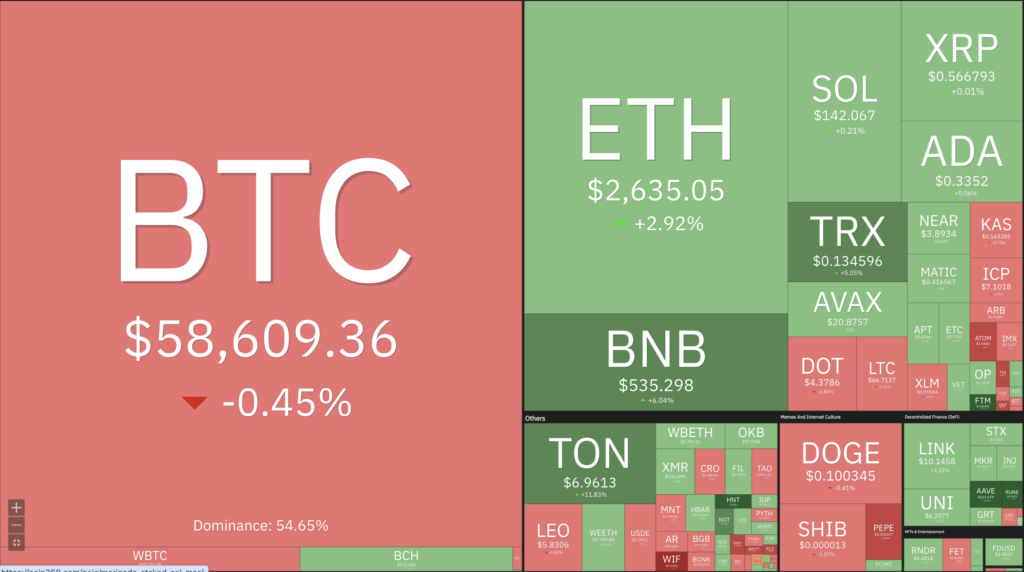

BTC is struggling to climb above $61,000, setting up the 0.5 Fibonacci retracement line as resistance. The current trading setup indicates that BTC is moving within a bearish pattern, triggering lower targets below $55,000. As bulls fail to sustain the upward trend, the likelihood of the price testing lower support levels increases. Despite these bearish signals, there remains a slim chance of a bullish reversal.

Recently, BTC entered a descending channel, where it dropped to a resistance level before breaking it, leading to lows below $55,000. Although there was a brief retest, the price quickly resumed its decline. BTC eventually fell to a support level, breached it, and exited the pennant formation. The token is now approaching local support around $57,600, and if the bulls fail to maintain this level, the bears may push the price back below $55,000.

Unfortunately, the Gaussian channel has turned bearish in the short term, with the trend maintaining a steep downward trajectory. Additionally, the RSI has bottomed out and is struggling to rise above support. As a result, BTC is expected to remain under bearish pressure, initially testing lower targets below $58,000. If the bulls are unable to trigger a rebound, the price could face significant selling pressure, potentially falling to around $54,500 in the coming days.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling less holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long-position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As OI increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- $DOGS Airdrop Sees Overwhelming Response with 3.5 Million Claims in 10 Hours. The crypto community has been taken by surprise with the extraordinary response to the $DOGS token airdrop, with over 3.5 million people claiming their tokens within the first ten hours. The company announced this milestone via their official Telegram channel, further fueling enthusiasm among the DOGS community. Participants are encouraged to claim their tokens through the app, while those opting for on-chain claims are advised to wait until August 20th for the process to be completed. This massive response underscores the growing interest in the $DOGS ecosystem.

News from the Crypto World in the Past Week

- Massive Bitcoin Transfer to Coinbase Sparks Speculation. The US government’s recent transfer of 10,000 Bitcoin to Coinbase, valued at nearly $600 million, has sent ripples through the cryptocurrency market. While the exact implications of this move remain uncertain, analysts like Ryan Lee believe that it is unlikely to cause a significant sell-off. Nevertheless, the transfer has generated considerable interest and speculation regarding potential price movements in the Bitcoin market.

- Trump’s Odds Surge on Polymarket, Rivals Harris in US Election. Over the weekend, Donald Trump’s odds on Polymarket spiked from 44% to 49%, matching Kamala Harris, whose odds dropped from 54% to 49%. Despite recent polls showing Harris leading in Michigan and Pennsylvania, Polymarket users are increasingly favoring Trump. Meanwhile, other prediction markets like Betfair and PredictIt still place Harris ahead by a larger margin, although mathematical models indicate a close race, with Harris maintaining a slight edge.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- THORChain (RUNE) +22,70%

- Aave (AAVE) +19,31%

- Helium (HNT) +16,91%

- Fantom (FTM) +10,49%

Cryptocurrencies With the Worst Performance

- dogwifhat (WIF) -22,00%

- Brett (BRETT) -18,77%

- MANTRA (OM) -15,82%

- Akash Network (AKT) -14,06%

References

- The Crypto Times, DOGS Airdrop Sees 3.5 Million Claims in Just 10 Hours, Coinmarketcap, accessed on 18 August 2024.

- Editorial Staff, US gov’t $590M Silk Road Bitcoin transfer to Coinbase unlikely to be sold — Analyst, Cointelegraph, accessed on 18 August 2024.

- Zack Abrams, Trump’s odds of winning presidency spike on Polymarket despite recent polls favoring Harris, Theblock, accessed on 18 August 2024.