Bitcoin (BTC) started the first week of August 2024 with a significant price drop after closing the month of July with a positive increase. This decline was caused by various factors such as the weak US employment report, tensions in the Middle East, and the decreasing likelihood of Donald Trump winning the election. See the full analysis below.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 📉 BTC broke below 50 day EMA support, it is now supported by the 0.5 Fibonacci retracement line.

- 🔻 Personal income and spending in the US in July fell short of expectations and tended to slow down.

- 🔴 The Personal Consumption Expenditure (PCE) price index continued to slow in June 2024, drawing the Fed closer to confidence that inflation is on track towards the 2-percent target.

- 📝 Federal Reserve Chair Jerome Powell stated on Wednesday that interest rates could be reduced as early as September if the U.S. economy continues on its projected path.

Macroeconomic Analysis

Personal Income

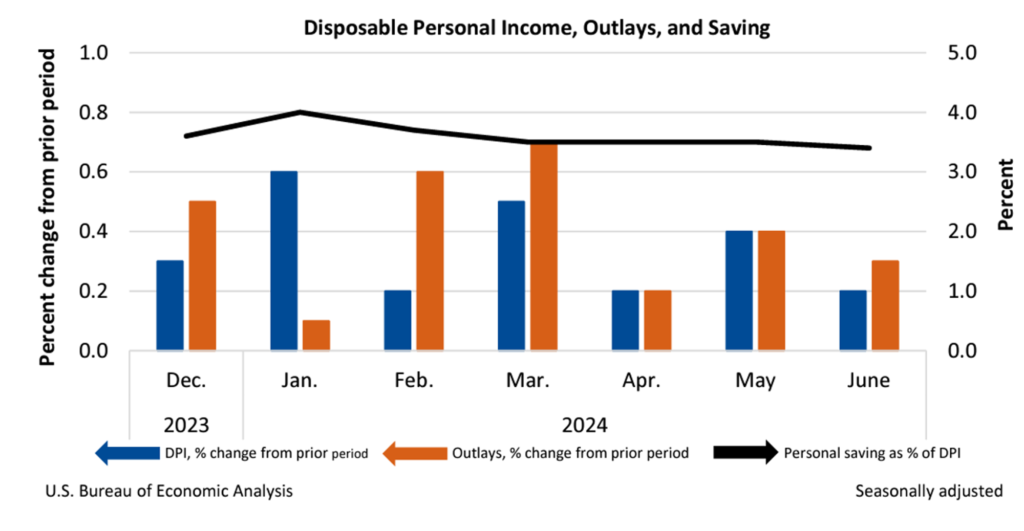

According to official figures released Friday, Americans’ personal income growth and personal spending both decelerated in June compared to the previous month.

The US Bureau of Economic Analysis reported that personal income rose by $50.4 billion, or 0.2%, in June. This increase was below market expectations of 0.4% and marked a slowdown from the 0.4% increase recorded in May.

Disposable personal income, which is personal income minus current taxes, increased by $37.7 billion, or 0.2%, in June, down from a 0.5% rise in May.

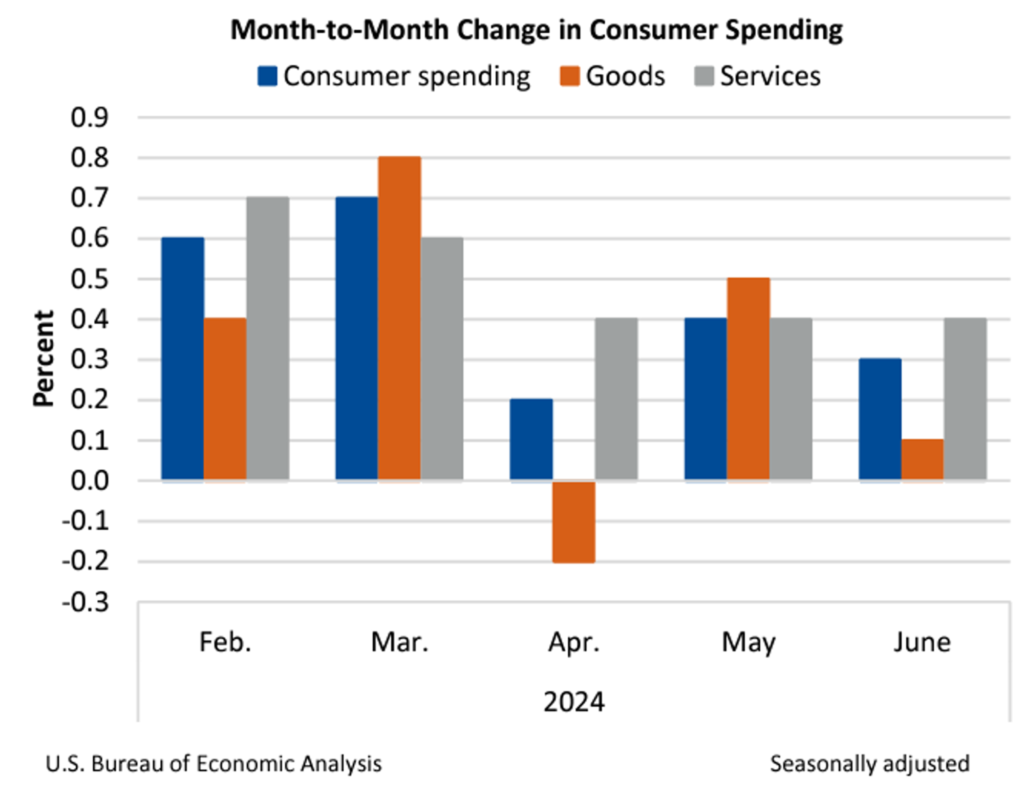

Personal spending, or personal consumption expenditures (PCE), grew by $57.6 billion, or 0.3%, in June, matching market expectations but slowing from the 0.4% increase in May.

The $57.6 billion increase in current-dollar PCE in June reflected an increase of $53.1 billion in spending for services and an increase of $4.5 billion in spending for goods.” Within services, significant contributors were international travel and housing and utilities, while within goods, pharmaceutical products, medical products, and recreational goods were notable contributors.

Other Economic Indicators

- Core PCE Index: The Fed’s preferred annual inflation indicator, the core PCE price index, held steady at 2.6% in June. The Personal Consumption Expenditure (PCE) price index continued to slow in June 2024, drawing the Fed closer to confidence that inflation is on track towards the 2-percent target.

- Michigan Consumer Sentiment: US consumer sentiment declined in July to an eight-month low as high prices continued to impact views on personal finances. The University of Michigan’s final July sentiment index dropped to 66.4 from 68.2 in June, with a preliminary reading of 66.

- JOLTS Job Openings: According to the Bureau of Labor Statistics’ latest Job Openings and Labor Turnover Survey, the number of open positions slightly decreased in June, hiring activity declined, layoffs remained low, and the number of people quitting their jobs reached a three-year low, as per the data released on Tuesday. This is another indication that the once extremely hot labor market is not only stabilizing but possibly moving towards a downturn.

- ADP Employment Change: Private job growth slowed further in July, while the pace of wage gains hit a three-year low, payroll processing firm ADP reported Wednesday. Companies added just 122,000 jobs in July, marking the slowest pace since January and falling short of the upwardly revised 155,000 jobs added in June. Economists had expected a gain of 150,000 jobs.

- Fed Interest Rate: Federal Reserve Chair Jerome Powell stated on Wednesday that interest rates could be reduced as early as September if the U.S. economy continues on its projected path. This positions the central bank near the end of its over two-year effort to combat inflation, coinciding with the nation’s presidential election campaign. The Fed concluded its latest two-day policy meeting by maintaining its benchmark interest rate in the 5.25%-5.50% range, which was established a year ago.

- Initial Jobless Claim: According to Labor Department data released Thursday, initial claims rose by 14,000 to 249,000 for the week ending July 27. This exceeded the median forecast of 236,000 applications in a survey of economists, with significant increases reported in states like Michigan and Missouri.

BTC Price Analysis

Crypto prices experienced a widespread decline on Thursday, with BTC dropping to as low as $60K. This occurred despite Fed Chair dovish stance following Wednesday’s FOMC meeting, suggesting that interest rate cuts could happen as early as September.

BTC broke below 50 day EMA support, it is now supported by the 0.5 Fibonacci retracement line. Traders betting on a crypto price increase were forced to settle their positions quickly late Wednesday as the cryptocurrency market plummeted. Crypto liquidations surged in the last 24 hours, totaling $230.94 million. During this period, long liquidations amounted to $208.01 million, representing the majority of positions betting on a price rise. Additionally, $22.95 million in short positions were also liquidated.

💡 On Monday morning (August 5), the price of Bitcoin plummeted to $53,000. Contributing factors included the poor performance of equities, with the S&P 500 falling by 4.4% and Japan’s Nikkei 225 index dropping by 6.7%.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling less holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivatives: Long-position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic Indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Solana Overtakes Ethereum in Monthly DEX Volume. Solana’s Decentralized Exchange (DEX) volume surged to $55.876 billion in July, eclipsing Ethereum’s $53.868 billion for the same period. This significant milestone marks the first time Solana has outperformed Ethereum in monthly DEX volume. The achievement is attributed to Solana’s faster network speed and lower transaction fees, which have attracted a growing number of DeFi users. In contrast, Ethereum’s DEX volume declined due to higher transaction costs. The surge in Solana’s DEX volume has boosted investor confidence in the SOL token.

News from the Crypto World in the Past Week

- MicroStrategy to Raise $2 Billion for Bitcoin Investment. MicroStrategy has announced plans to sell up to $2 billion worth of its Class A shares. The proceeds will be used to purchase additional Bitcoin and for general corporate purposes, according to a recent SEC filing. The company, led by Michael Saylor, currently holds a Bitcoin treasury valued at over $14 billion, consisting of 226,500 BTC. Despite reporting consecutive quarterly losses from its software business, MicroStrategy remains steadfast in its commitment to Bitcoin, reinforcing its position as the world’s largest publicly traded Bitcoin holder.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Aave (AAVE) +11,05%

Cryptocurrencies With the Worst Performance

- dogwifhat (WIF) -36,05%

- Brett (BRETT) -30,20%

- Ethena (ENA) -29,34%

- Pepe (PEPE) -27,77%

References

- Mike Millard, MicroStrategy seeks to sell $2bn of class A shares, buy more Bitcoin, dlnews, accessed on 4 August 2024.

- Crypto News Land, Solana Tops Ethereum in July’s DEX Volume, Signaling a New DeFi Trend, Coinmarketcap, accessed on 4 August 2024.