Bitcoin is still in its downtrend. After dropping to $60,000, Bitcoin managed to hold at a strong support area, which is the price peak of the 2021 bull run. However, it is under pressure from global uncertainty, Fed policy, and CLARITY Act regulatory delays. Read our February 16, 2026, crypto market analysis below!

Article Summary

- Market Volatility and Risk-Off Sentiment: The crypto market experienced high volatility, with the total market capitalization down almost 50% from its peak in October 2025. This decline has been driven by the liquidation of leveraged positions, although there are signs of accumulation from institutions.

- Bitcoin Tests Critical Support: Bitcoin price corrected slightly on a weekly basis to $68,949 and is currently in a strong support zone (2021 bull run top point). Major institutions continue to project a long-term bullish target of $150,000-$189,000 by year-end.

- Ethereum Weakness and Altcoin Rotation: Ethereum looks more vulnerable, testing an important support boundary at $1,750-$2,000, which, if broken, could trigger a deeper drop. On the other hand, investor capital is starting to rotate into altcoins with specific narratives such as AI, DeFi, and tokenized gold as defensive assets.

- Macroeconomic Pressures: External factors weighed heavily on risk assets, including concerns over a hawkish new Fed Chair, regulatory delays, and US economic data that strengthened the value of the dollar. This marks the market’s shift from the “speculation era” to the reset phase.

Crypto Market Analysis February 16, 2026

The crypto market experienced a tumultuous week in the period from February 9 to 15, 2026. The total crypto market capitalization dropped by almost 50% from its peak in October 2025, reflecting the dominating risk-off sentiment. Bitcoin, as the main asset, saw a decline of almost 2% in the past week, while altcoins showed mixed movements with some significant gains amid high volatility.

The week started with signs of stabilization after the early February correction, where Bitcoin briefly rebounded from a low of $60,000 to the $68,000-$70,000 range. However, selling pressure remained strong, causing the global market capitalization to drop to around $2.49 trillion by mid-week.

This signaled an increase in trading activity, albeit largely driven by the liquidation of leveraged positions. Analysts refer to this as “orderly deleveraging”. Nevertheless, there are positive signals from institutional and on-chain accumulation that point to a potential short-term rebound.

Bitcoin (BTC) Analysis

Bitcoin managed to stay in the support area.

BTC remained the center of attention in the crypto market during the week of February 9-15, 2026. The price of BTC started at around $70,127 on February 9 and ended at $68,949 on February 15, recording a decline of around 1.7% on a weekly basis. However, the volatility in the middle of the week was very high: BTC briefly plummeted to $65,500 on Thursday before rebounding to above $68,000 after lower-than-expected US inflation data.

New resistance is emerging at levels around $71,000, with fear sentiment hitting its lowest level since 2022. Prediction markets such as Polymarket show a 48% probability BTC will reach $75,000 by the end of the month, with a volume of $44.6 million. Additionally, institutions such as Bernstein and Citi remain bullish, with price targets of $150,000-$189,000 year-end, supported by on-chain accumulation during consolidation.

Technically, Bitcoin is in the support zone formed from the ATH formed at the peak of the 2021 bull run. With the candlestick formation indicating a potential bounce, Bitcoin is likely to experience a recovery. However, negative sentiment on larger timeframes, along with global uncertainty, makes the market situation still uncertain.

Ethereum (ETH) and Altcoin Analysis

Ethereum tests important support amid selling pressure.

Besides Bitcoin, altcoins showed more mixed dynamics during the week. Ethereum (ETH) looked weaker, falling 4.6% from $2,104 on February 9 to $2,007 on February 15, with a weekly low of $1,899.

Ethereum itself is already at its daily support area, which is in the area between $1750 and $2000. However, there is currently no indication of a significant reversal. Ethereum needs to stay above the $1750 level. If Ethereum falls from this level, then there is potential for a decline to the $1400s.

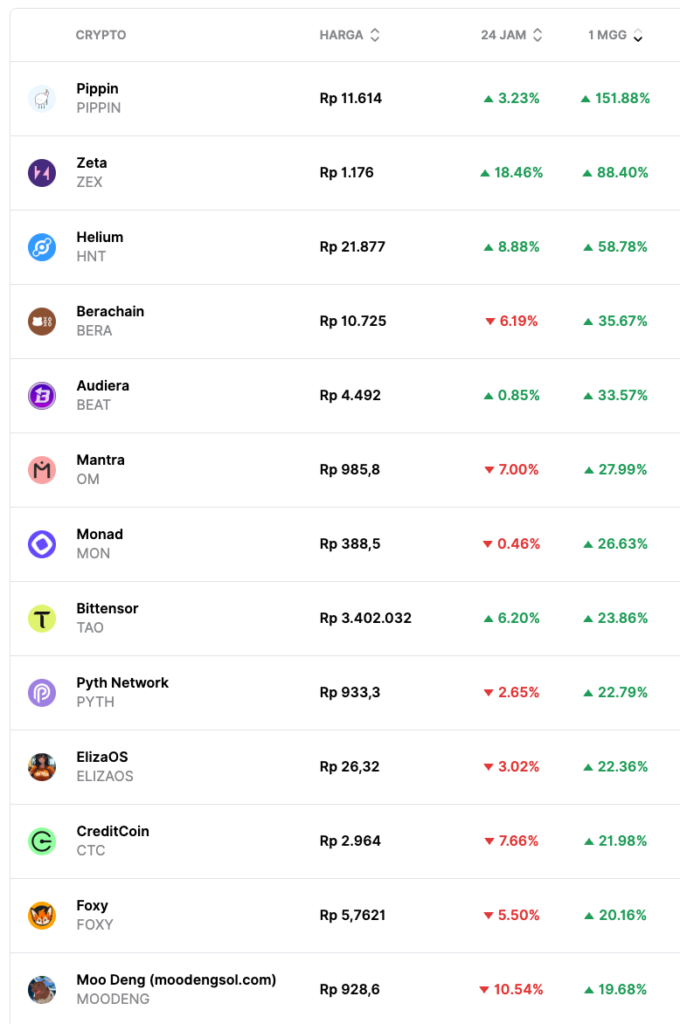

However, several trending altcoins recorded significant gains, reflecting capital rotation to themes such as AI, DeFi, and meme coins. Key trends in February 2026 include AI + data infrastructure, DEX perpetual growth, and tokenized gold as a defensive asset.

Overall, altcoins showed potential to rebound faster than BTC, especially in the DeFi and AI sectors, although DeFi’s TVL fell to $98 billion.

Macroeconomic Updates and Other News

Negative news included a huge loss for MicroStrategy, which held 713,502 BTC, with a GAAP loss of $17.4 billion as BTC prices fell to $60,000. Even so, CEOs Phong Le and Michael Saylor maintain a”never sell” strategy and plan to continue buying BTC every quarter. On the other hand, the Government of Bhutan sold more than $22 million BTC, fueling sell-off speculation.

Overall, Bitcoin showed resilience, but it remains vulnerable to external factors such as Fed policy and geopolitics. The nomination of Kevin Warsh as a hawkish Fed Chair sparked concerns, as he is perceived to be less aggressive in monetary policy.

Macroeconomic factors played a crucial role in crypto selling pressure this week. Lower-than-expected 2.4% US CPI inflation data prompted BTC’s rebound above $68,000 and changes in rate cut predictions. In addition, AI fever affected crypto miners who switched to AI/high-performancecomputing.

The US jobs data (NFP 50,000 vs expectations of 66,000) did not show a significant slowdown. Instead, it strengthened the US dollar and reduced the attractiveness of risk assets such as crypto. In addition, the delay of the CLARITY Act in Congress adds to regulatory uncertainty. Overall, the macroeconomy shows a transition from distribution to reset, with the crypto “speculation era” considered over.