Article Summary

- Bearish Trend Dominance in Bitcoin: Bitcoin closed January 2026 with 4 consecutive months of losses and is at risk of entering a long-term bear market phase.

- Altcoins at Critical Levels & DeFi Declines: Ethereum and Solana are testing psychological resistance levels at $2,150 and $100, respectively.

- Shift to Safe Haven: Global uncertainty due to President Trump’s threat of trade tariffs made investors turn to gold (reaching a record ~$5,600) and abandon riskier assets such as crypto.

- Fed Policy Pressure: Market sentiment was hit by the appointment of Kevin Warsh as the new Fed Chair and the on-hold interest rate policy. This fueled fears of the end of the era of easy liquidity that propped up risky assets.

Over the past week, the crypto market as a whole showed volatility with massive declines across various crypto assets. This closes the first month of 2026 with significant losses.

In addition, gold and silver also experienced significant volatility, with both precious metals experiencing a perceived unnatural rise, followed by the largest drop in their history in 1 day. This signaled global uncertainty and negative investor sentiment towards cryptocurrencies and a desire for a safe haven.

Overall, market sentiment indicates that the market is in a phase of fear. Technical analysis shows a very bearish trend across various assets.

Bitcoin (BTC) Analysis

4 Months of Consecutive Red Closes.

Bitcoin closed January with a bearish candle at $78,741. Historically, when Bitcoin drops below the 21 EMA of the 1-month, there is a long bear phase, with minimal price movement and volume after a massive drop.

The decline that occurred since October 2025 was the realization of a warning that appeared a few months earlier with a bearish divergence on the RSI on the 1-month timeframe.

Meanwhile, on the 1-week timeframe, Bitcoin has the potential to form a head and shoulders pattern with neckline confirmation in the $73,500-74,000 area.

Some crucial aspects to consider:

- Structurally, on the 1-week timeframe, Bitcoin formed a lower high, which is part of the downtrend market structure.

- Bitcoin is forming a potential head and shoulders pattern, which is a strong indication of a bearish reversal. Currently, the $73,000-$74,000 level is worth watching. Because if there is a breakdown from that level, the head and shoulders pattern will be confirmed.

The prediction is that Bitcoin will experience a recovery this week. However, what needs to be considered is the negative sentiment on larger timeframes, along with global uncertainty amidst regulatory and geopolitical pressures, unless there is a catalyst that can make the market bullish again.

Ethereum (ETH) Analysis

Testing Important Support Amid Selling Pressure.

Similar to Bitcoin, Ethereum experienced a significant drop earlier this week. Ethereum experienced a breakdown of the $2600 resistance level and is currently testing the $2150 level, which acts as support.

Technically, there is potential for Ethereum to experience a bounce from here, as seen from the large volume in this area. Ethereum’s RSI has entered the oversold area on the 1-day timeframe.

Solana Analysis (SOL)

Surviving on a Psychological Level.

Solana also experienced a significant decline last week. Currently, Solana is struggling at around $100, which is a psychological level. If Solana can recover and make a bounce from this area, it can bring its ecosystem along for the ride, such as RAY tokens, JUP, and others.

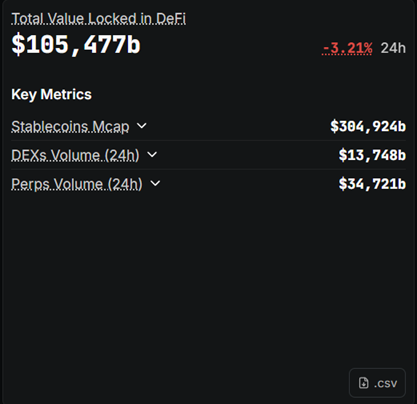

On-Chain Analysis: TVL drop in DeFI

TVL data across all DeFi networks. Source Defillama.com.

In the past week, the locked value (TVL) on the network of all decentralized finance networks has decreased. In the last 24 hours alone, the TVL value dropped by 3%, and in the last month, the TVL value across the protocol dropped by about 15%. This indicates that investors are starting to lose faith in decentralized finance.

However, it could be that the drop in TVL values is due to a drop in the values of assets locked in various protocols.

Macro Analysis

At the end of January 2026, global financial markets were faced with a series of macro uncertainties. One of the main drivers was US President Donald Trump’s threat of trade tariffs against Canada and the European Union, which sparked concerns about a new trade war. This threat not only pressured tech stocks but also prompted investors to turn to traditional safe-haven assets such as gold, which hit a record of nearly $5600 per ounce on January 29, 2026.

On the other hand, cryptocurrencies such as Bitcoin have seen a sharp decline, suggesting that crypto is still considered a risky asset rather than a hedge against inflation or geopolitical uncertainty.

At the same time, the Federal Reserve (Fed) kept interest rates on hold in its first meeting of 2026, with hawkish rhetoric emphasizing inflation concerns. Trump’s nomination of Kevin Warsh as the new Fed Chair over the weekend further added to the uncertainty. Warsh is known as a critic of Quantitative Easing (QE) policies and a proponent of deregulation, which could change global liquidity dynamics.

This announcement immediately triggered a drop in crypto prices, as markets anticipated the end of the stimulus era that had been supporting risky assets. The crypto community discussion on X highlighted how these geopolitical tensions have not deterred the adoption of stablecoins in a country like Canada, despite the potential for capital flight. However, overall, this uncertainty has strengthened crypto’s correlation with traditional markets, where a rising US dollar and falling tech stocks directly pressured BTC and Ethereum (ETH).

This macro impact may not just be temporary; it will shape crypto’s long-term trajectory. Trade uncertainty and Fed policy could accelerate crypto deregulation in the US, such as Nasdaq’s proposal to remove position limits on BTC and ETH ETF options, potentially increasing institutional liquidity.

However, if macro deteriorates, such as the recession signaled by the US labor market data, crypto could experience a deeper correction. On the positive side, the growth of stablecoins shows the potential of crypto as a financial access tool for the unbanked, especially amid global turbulence.