Bitcoin (BTC) surged to a record high of $100,000, but has since retreated. The crypto market remains divided between bearish and bullish outlooks. With BTC now trading below $100,000, two potential scenarios could unfold. See more analysis from the Pintu Trader Team.

Market Analysis Summary

- 📝 Looking ahead, the current price action suggests two potential scenarios: A rebound could see BTC retesting the $95,119 level as a support/resistance flip, with the next target at the $99,514 resistance level or failure to hold above $92,654 could drive BTC toward the psychological support at $90,742.

- 🏭 The Manufacturing PMI registered 49.3 percent in December, an increase of 0.9 percentage points from November’s reading of 48.4 percent.

- ⬆️ The Institute of Supply Management has published its December Services PMI, with the headline composite index reaching 54.1, surpassing the forecast of 53.5.

- 📊 The U.S. trade deficit in goods and services widened to -$78.2 billion in November, slightly below the consensus estimate of -$78.3 billion.

- 📈 The ADP National Employment Report, a key gauge of U.S. non-farm private sector employment, revealed an increase of 122K jobs in the latest reporting period.

Macroeconomic Analysis

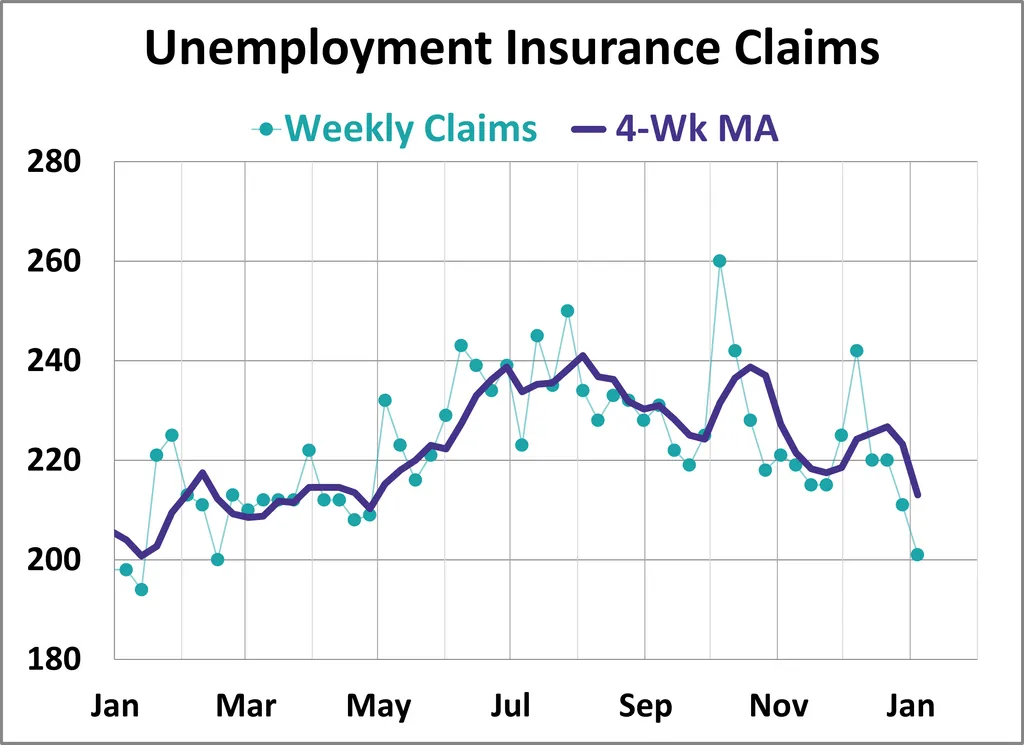

Initial Jobless Claim

The number of Americans filing new unemployment claims fell to an 11-month low last week, signaling a resilient labor market despite slower hiring trends causing some laid-off workers to face extended periods of unemployment.

A gradually cooling labor market may provide the Fed with room to keep interest rates steady in January, even as inflation remains elevated. In December, the Fed signaled a more moderate pace of rate cuts this year compared to September, when it initiated its policy easing cycle.

Fed Governor Christopher Waller stated on Wednesday that further rate cuts are anticipated, though their pace will depend on progress in reducing inflation while maintaining labor market stability.

The Labor Department reported on Wednesday that initial claims for state unemployment benefits dropped by 10,000 to a seasonally adjusted 201,000 for the week ending January 4, the lowest level since February 2024. This figure was better than economists’ expectations of 218,000, according to a Reuters poll. The report was released a day early due to federal offices closing on Thursday to honor former President Jimmy Carter, who passed away on December 29 at the age of 100.

Although unemployment claims tend to be volatile around the start of the year, they have remained at levels indicative of low layoffs, which are helping to sustain the labor market and broader economy. The four-week moving average of claims, which accounts for seasonal fluctuations, fell by 10,250 to 213,000 last week.

Minutes from the Fed’s December 17-18 meeting, released on Wednesday, revealed that policymakers view labor market conditions as “gradually easing” with “no signs of rapid deterioration.”

Other Economic Indicators

- ISM Manufacturing PMI: The Manufacturing PMI registered 49.3 percent in December, an increase of 0.9 percentage points from November’s reading of 48.4 percent. Despite this, the overall economy continued to expand for the 56th consecutive month, following a single month of contraction in April 2020. (Historically, a Manufacturing PMI above 42.5 percent over time generally indicates expansion in the broader economy.)

- ISM Services PMI: The Institute of Supply Management (ISM) has published its December Services Purchasing Managers’ Index (PMI), with the headline composite index reaching 54.1, surpassing the forecast of 53.5. This marks the sixth consecutive month the index has remained in expansion territory.

- Balance of Trade: The U.S. trade deficit in goods and services widened to -$78.2 billion in November, slightly below the consensus estimate of -$78.3 billion, up from a revised -$73.6 billion in October (-$73.8 billion previously reported), according to data released by the U.S. Census Bureau on Tuesday.

- JOLTS job opening: The U.S. Bureau of Labor Statistics (BLS) reported on Tuesday that job openings reached 8.09 million at the end of November, according to the Job Openings and Labor Turnover Survey (JOLTS). This figure exceeded market expectations of 7.7 million and was higher than the 7.83 million openings recorded in October. The rise in job openings is generally positive for the USD, as it reflects active recruitment by businesses, which can drive consumer spending and support economic growth.

BTC Price Analysis

The total cryptocurrency market capitalization has declined to $3.28 trillion as bearish sentiment continues to dominate the market. BTC has slipped below the $94,000 threshold, reflecting the broader downtrend. On the 4h BTC price chart, the bearish reversal from the $102,557 supply zone continues to build momentum. BTC has already breached the $95,119 support level and is currently testing the next support at $92,654.

Despite a modest 0.35% recovery in the last 4 hours, a rejection of lower prices offers a glimmer of optimism. However, the ongoing correction has resulted in bearish crossovers of key exponential moving averages (EMA), including the 50 and 100 EMA as well as the 20 and 200 EMA. These crossovers confirm a bearish trend and suggest the potential for further selling pressure.

In contrast, the RSI is showing signs of bullish divergence, hovering slightly above the oversold region. This divergence indicates a possible reversal in the near term, even as Bitcoin’s price continues to fall. Adding to the market turbulence, BiTC spot ETFs have witnessed the second-largest outflow on record. On January 8, BTC ETFs saw outflows totaling $582.90 million.

Meanwhile, other ETFs reported no significant changes during Wednesday’s trading session. Looking ahead, the current price action suggests two potential scenarios:

Bullish Recovery: A rebound could see BTC retesting the $95,119 level as a support/resistance flip, with the next target at the $99,514 resistance level.

Bearish Breakdown: Failure to hold above $92,654 could drive BTC toward the psychological support at $90,742.

Market participants will need to monitor these key levels closely as BTC’s price action unfolds.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a Belief phase where they are currently in a state of high unrealized profits.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- DOGE: An Ambitious Project to Cut US Government Regulation and Spending. Elon Musk and Vivek Ramaswamy have been appointed to lead the Department of Government Efficiency (DOGE), an initiative announced by President-elect Donald Trump aimed at reducing the federal budget deficit by cutting excessive regulations, eliminating wasteful spending, and restructuring federal agencies. Although not an official government department, DOGE will operate independently, receiving no government funding, and will propose cost-cutting measures through Congress and executive orders. The initiative has drawn attention due to its acronym, which coincides with Elon Musk’s favorite cryptocurrency, Dogecoin—a connection that has also boosted the coin’s value. Additionally, DOGE will be supported by several Silicon Valley entrepreneurs to address technical challenges and ensure effective implementation. Despite some criticism, the initiative has gained traction in Congress, highlighted by the formation of a special caucus to back its proposals. To keep the public informed, Musk and Ramaswamy plan to launch a “DOGEcast” podcast, providing weekly updates on the project’s progress.

News from the Crypto World in the Past Week

- Thailand Trials Bitcoin Payments in Phuket to Simplify Tourist Transactions. Thailand will begin a trial program allowing Bitcoin payments in Phuket, a popular tourist destination, to simplify transactions for foreign tourists and eliminate the need for currency exchange. The program was announced by Deputy Prime Minister and Minister of Finance Pichai Chunhavajira, who explained that the trial complies with applicable laws and aims to improve Thailand’s competitiveness in the tourism sector. Under the program, tourists can register their Bitcoin with a local exchange, verify their identity, and use it for payments that are automatically converted to baht. In addition to simplifying transactions, the initiative is also expected to attract tourists who hold cryptocurrency.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- XRP (XRP) +5.99%

Cryptocurrencies With the Worst Performance

- Virtuals Protocol (VIRTUAL) -33.78%

- THORChain (RUNE) -31.95%

- Ethena (ENA) -29.80%

- dogwifhat (WIF) -26.39%

References

- Liz Napolitano, Elon Musk and DOGE: What You Need to Know About the Department of Government Efficiency, decrypt, accessed on 12 Januari 2025.

- Bilal Hasan, Thailand Introduces Bitcoin Payments for Tourists in Popular Phuket, livebitcoinnews, accessed on 12 Januari 2025.