Bitcoin (BTC) has reached a new all-time high (ATH) of nearly $110,000. What’s next for BTC? Data suggests that retail investors have yet to begin accumulating. Read the full analysis by the Pintu Trader Team.

Market Analysis Summary

- 📝 BTC recently hit an all time high of $109,588, but its price has since declined by 8%, partly due to a drop in retail trading activity.

- 🏠 Housing starts jumped by 15.8% to an annual rate of 1.499 million in December, rebounding from a 3.7% decline in November.

- 🏢 Building permits declined by 0.7% in December, falling to an annual rate of 1.483 million after a 5.2% surge in November, which was revised to 1.493 million.

- 📈 Applications for jobless claims increased by 6,000 to 223,000 last week.

- 📊 Unemployment benefit claims have climbed to their highest level in more than three years, indicating challenges in finding new jobs even as the economy remains strong.

Macroeconomic Analysis

Trump’s Inaguration

President Trump has been in office for only three days, but his administration’s actions and the potential impact of his policy agenda are already being reflected in the markets.

The S&P 500 and Nasdaq 100 have climbed nearly 2% since Trump assumed office on Monday, with both indexes approaching record highs last seen in early December. However, the effects have been more significant in specific market segments, including crypto market, the dollar, and techn stocks, as Trump rolls out a series of executive orders and sets his policy priorities.

Technology stocks have surged this week, fueled by Trump’s announcement of a $500 billion infrastructure initiative, nicknamed “Stargate.” Standing alongside AI and tech leaders such as Sam Altman of OpenAI and Masayoshi Son of Softbank Group, Trump unveiled a plan to invest heavily in AI infrastructure. The initiative will involve Oracle, Softbank, OpenAI, and MGX, with initial technology partners including Nvidia, Microsoft, and Arm Holdings.

The plan includes building data centers across the U.S. and is projected to create over 100,000 jobs. “AI seems to be very hot. It’s what a lot of smart people are focusing on, and this will bring unprecedented prosperity to our country,” Trump said, calling it the “golden age of America.”

Following the announcement, shares of AI-focused companies rallied sharply, with Arm Holdings up 15% and Oracle gaining 11%.

Meanwhile, stocks tied to space exploration and travel have extended gains since Trump’s election victory in November. His well-known support for space exploration—highlighted by the establishment of the Space Force during his first term—and his close ties with SpaceX founder Elon Musk have driven investor enthusiasm for the sector. Trump reiterated his commitment to space in his inauguration speech, declaring, “We will pursue our manifest destiny into the stars, launching American astronauts to plant the Stars and Stripes on the planet Mars.” Stocks such as Intuitive Machines, Redwire, and Rocket Labs USA have seen impressive gains of 23%, 43%, and 23%, respectively, since Trump took office.

In contrast, electric vehicle (EV) stocks have struggled. Trump’s first-day revocation of 78 executive orders included rolling back a mandate requiring 50% of U.S.-manufactured cars to be electric by 2030. He also directed his administration to review and potentially eliminate “unfair subsidies” and market distortions favoring EVs. Smaller EV companies like Lucid and Rivian saw their stocks drop 12% and 10%, respectively, while Tesla shares have dipped 2%, despite Elon Musk’s close relationship with Trump.

Crypto, however, have benefited from Trump’s presidency. Bitcoin hit a new all-time high of nearly $110,000 shortly after his inauguration and has gained over 2% since Monday. Dubbed the “crypto President,” Trump has hinted at a more favorable regulatory environment for the crypto industry and even teased the creation of a national bitcoin reserve. While he didn’t mention crypto in his inaugural speeches, the SEC announced the formation of a task force to collaborate with the industry on clearer regulations, boosting optimism for the sector.

Currency markets have seen mixed movements since Trump took office. The U.S. dollar index has slightly weakened overall, but the dollar has strengthened against the Mexican peso and Canadian dollar. This comes in response to Trump’s threat to impose a 25% tariff on goods imported from both countries starting February 1—a more hawkish stance than expected. However, Trump’s campaign-trail rhetoric about universal tariffs appears to be on hold for now, which has softened inflation expectations and, in turn, reduced pressure on the dollar against other currencies.

Other Economic Indicators

- Housing Starts: A report from the Commerce Department on Friday revealed that new residential construction in the U.S. surged far beyond expectations in December. According to the report, housing starts jumped by 15.8% to an annual rate of 1.499 million in December, rebounding from a 3.7% decline in November, which was revised to 1.294 million. Economists had predicted a smaller increase of 2.4% to an annual rate of 1.320 million, up from the previously reported 1.289 million for November.

- Building Permits: Building permits declined by 0.7% in December, falling to an annual rate of 1.483 million after a 5.2% surge in November, which was revised to 1.493 million. Building permits, a leading indicator of future housing demand, were expected to drop by 3.0% to an annual rate of 1.460 million from the initially reported 1.505 million in November. The decline in building permits was primarily driven by a 5.0% drop in multi-family permits, which fell to an annual rate of 491,000 in December after soaring 15.4% to 517,000 in November.

- Jobless Claim: The Labor Department reported on Thursday that jobless claims rose by 6,000 to 223,000 for the week ending January 18, exceeding analysts’ expectations of 219,000 new claims. Weekly jobless claims are widely regarded as an indicator of layoff trends. The number of Americans receiving unemployment benefits for the week of January 11 rose by 46,000 to 1.9 million, the highest level since November 2021.

BTC Price Analysis

BTC recently hit an all time high of $109,588, but its price has since declined by 8%, partly due to a drop in retail trading activity.

With waning demand from retail investors, BTC’s price could face further downward pressure in the short term.

Retail Traders Pull Back on Bitcoin Accumulation

retail traders, who often drive smaller but significant market moves have reduced their Bitcoin accumulation over the past month.

The report highlights that on-chain activity for BTC transactions worth $10,000 or less has dropped by 19.34% in recent days. This decline was observed even as Bitcoin reached its ATH of $109,588 on Monday, indicating reduced participation from retail investors during this period.

This trend is particularly noteworthy given BTC’s heightened volatility. Typically, periods of significant price swings see increased on-chain activity as retail investors buy dips or take profits during rallies. However, the reduced transaction activity suggests that retail traders are not engaging with BTC as actively as expected under such market conditions.

Additionally, despite the excitement surrounding the ATH, retail investors are not holding their BTC positions for long. Data from IntoTheBlock shows that this group has shortened their holding periods by 15% over the past month, signaling declining confidence among smaller investors.

When retail traders reduce holding periods, it often indicates caution and a lack of confidence, leading to more frequent buying and selling cycles. This dynamic can increase market volatility and contribute to further downward pressure on BTC’s price.

BTC Price Outlook: Could $94,000 Be the Next Support Level?

Without significant participation from retail traders, the BTC market may struggle to sustain its upward momentum. If retail investors continue selling, Bitcoin’s price could drop to $94,523 as the next key support level.

Conversely, if retail traders resume accumulation, BTC could regain its momentum, attempt to reclaim its ATH, and potentially push beyond it.

The next price movements will largely depend on whether smaller investors regain confidence and re-engage with the market.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Grayscale and Coinshares File for Litecoin ETFs, Driving LTC Price Surge. Asset managers Grayscale and Coinshares have submitted proposals to the SEC to offer Litecoin ETFs, following Canary Capital’s earlier move. Grayscale filed a 19b-4 form to convert its Grayscale Litecoin Trust into an ETF, while Coinshares submitted an S-1 form to offer an LTC ETF. These actions add to the growing optimism surrounding potential approval, particularly under the new SEC administration, which is perceived as more receptive to crypto assets.In addition to the Litecoin filing, Coinshares also filed for an XRP ETF, and Grayscale continued its push with filings for Bitcoin Adapters and Solana ETFs. This news spurred Litecoin’s price to climb as high as $122, providing a significant bullish outlook for its ecosystem amidst previous bearish pressure from large-scale sell-offs by whales and a decline in the network’s hash rate. Analysts predict Litecoin may be approved before XRP and Solana due to its status as a non-security.

News from the Crypto World in the Past Week

- Eric Trump Optimistic About the US Economy and Cryptocurrency Investments. Eric Trump, son of President Donald Trump, has expressed strong optimism about the future of the United States economy, particularly in the energy, technology, and cryptocurrency sectors. In a tweet, he stated that this is the best time to invest in the US, which he believes now has “limitless potential” after breaking free from various constraints. Eric also criticized the economic condition under President Joe Biden’s administration but predicted a strong economic recovery in the near future. Additionally, he revealed his personal cryptocurrency holdings, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Sui (SUI), with the inclusion of Sui surprising the crypto community due to its relatively recent popularity.

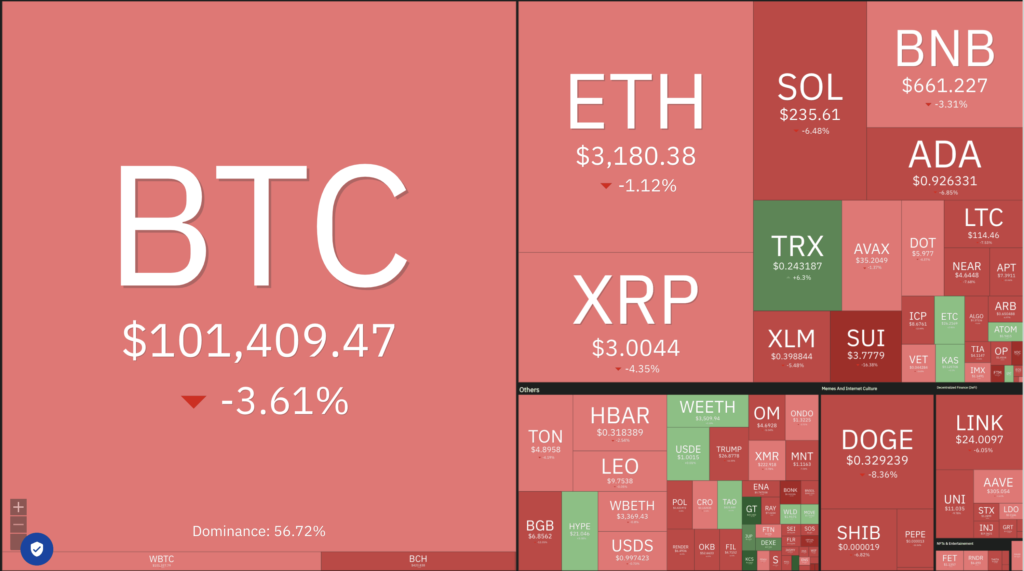

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- MANTRA (OM) +24.96%

- Lido DAO (LDO) +24.96%

- Mantle (MNT) +14.68%

- Raydium (RAY) +14.05%

Cryptocurrencies With the Worst Performance

- THORChain (RUNE) -22.00%

- dogwifhat (WIF) -19.45%

- Virtuals Protocol (VIRTUAL) -18.82%

- Uniswap (UNI) -17.33%

References

- Navdeep Singh, There has never been a better time to invest in crypto, says Donald Trump’s son Eric, Economictimes, accessed on 25 January 2025.

- Boluwatafie Adeyemi, Breaking: Grayscale & Coinshares File For Litecoin ETF With US SEC, Coingape, accessed on 25 January 2025.