The price of bitcoin (BTC) appears to be stagnating, with no clear indicators to drive its value higher the past week. This stagnation can be attributed to the uncertain regulations surrounding exchange-traded funds (ETFs) for trading crypto assets. Combined with regulatory hurdles and a generally lackluster market, concerns arise about whether the crypto market is entering a bearish phase.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

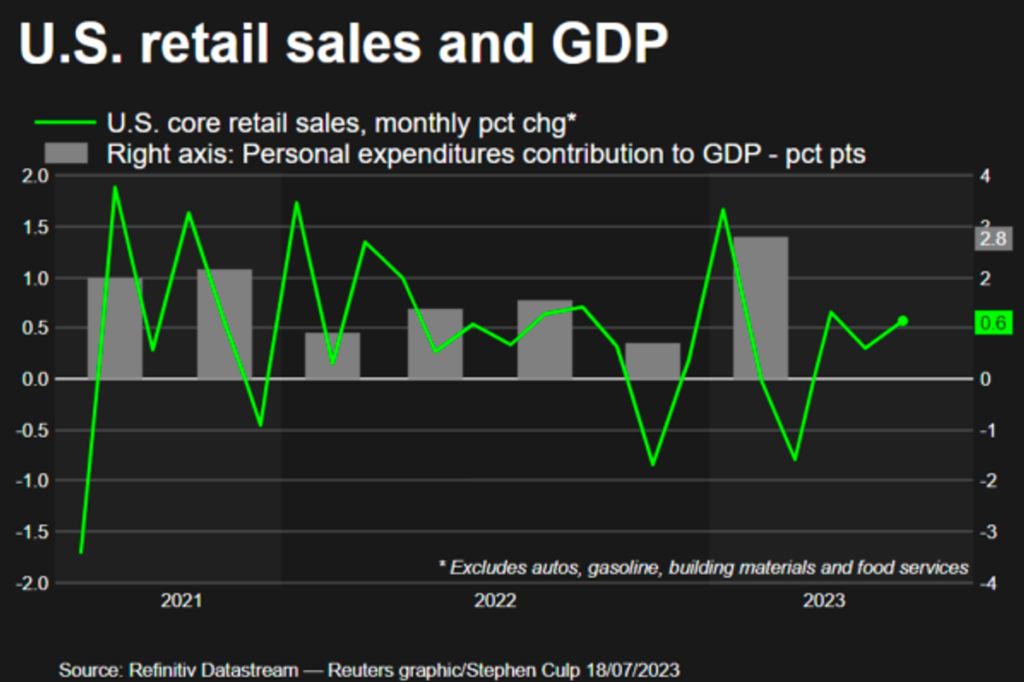

- 🦾 U.S. retail sales rose just 0.2% in June, but consumers continued to spend in other areas, potentially fueling stronger economic growth.

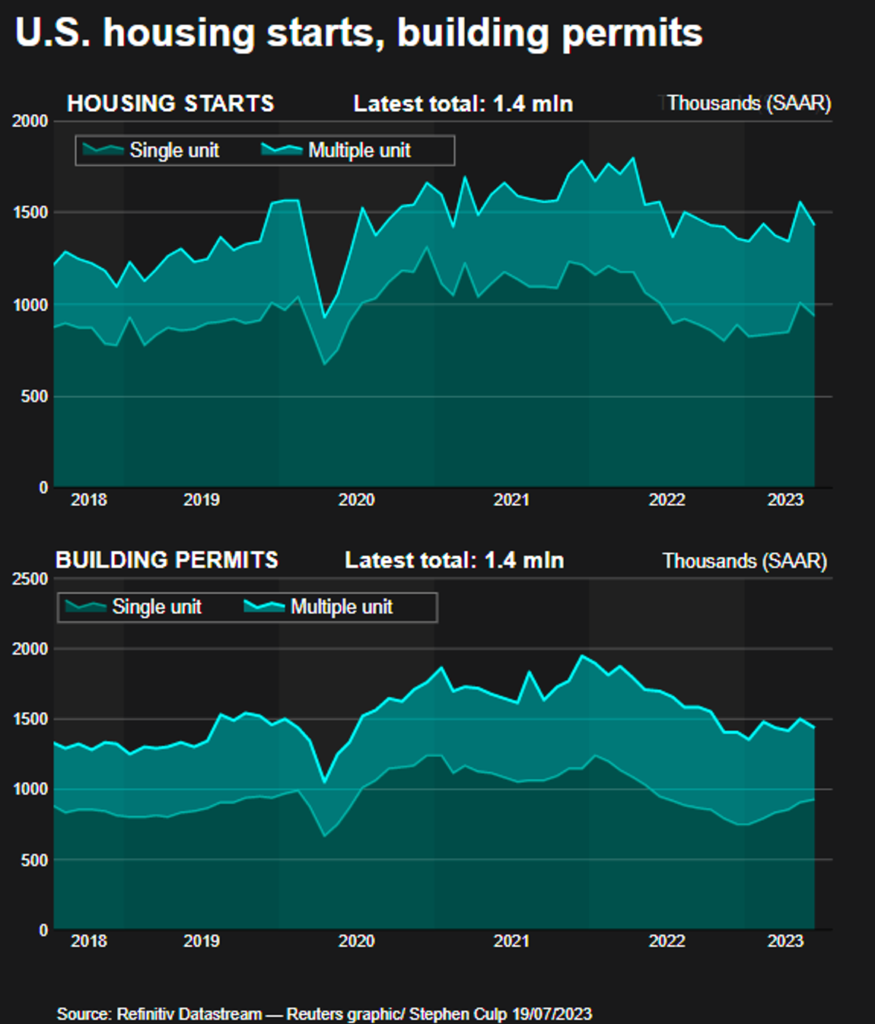

- 🏠 U.S. building permits fell 3.7% in June from May, indicating less favorable conditions in the housing sector.

- 📉 US jobless claims have fallen to a two-month low. This suggests strong demand for workers despite a slowdown in job creation.

- 💪🏻 The U.S. labor market is strengthening as companies continue to retain workers despite slowing wage growth. This is critical to supporting consumer spending and economic optimism.

- ✍🏻 Bitcoin (BTC) continues to hover around the $30,000 level, and bitcoin’s dominance trend continues to decline. The overall crypto market capitalization is currently at the 100-week exponential moving average (EMA) resistance line, which if broken could potentially trigger a crypto rally.

Macroeconomic Analysis

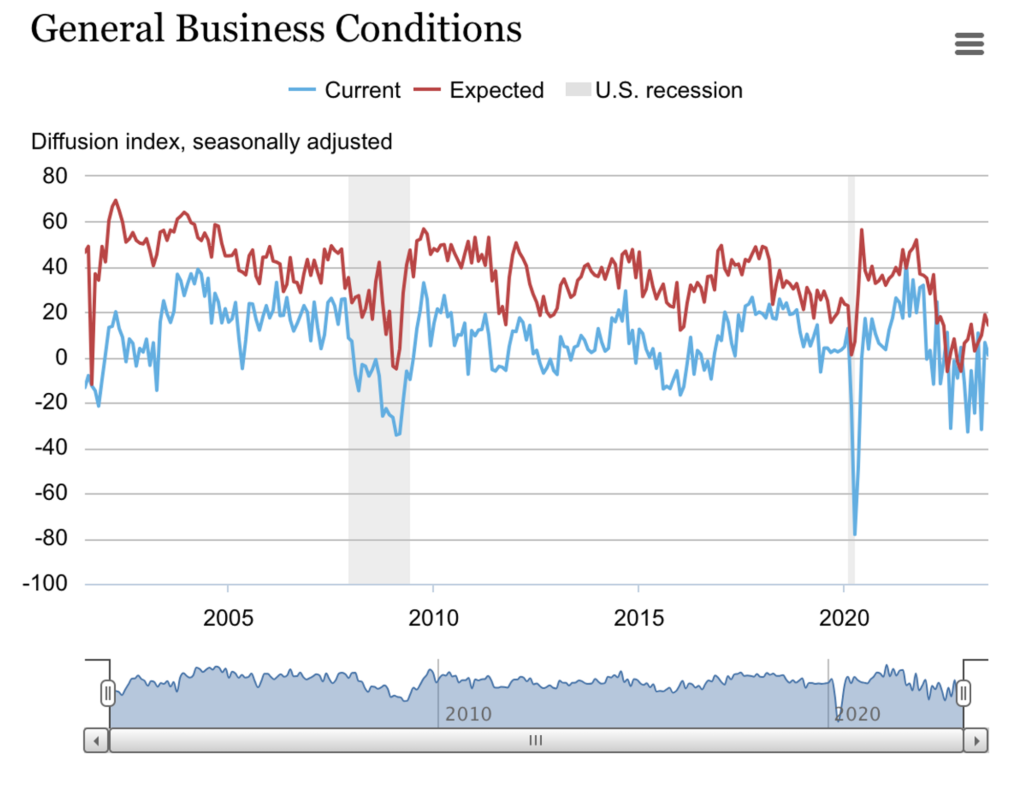

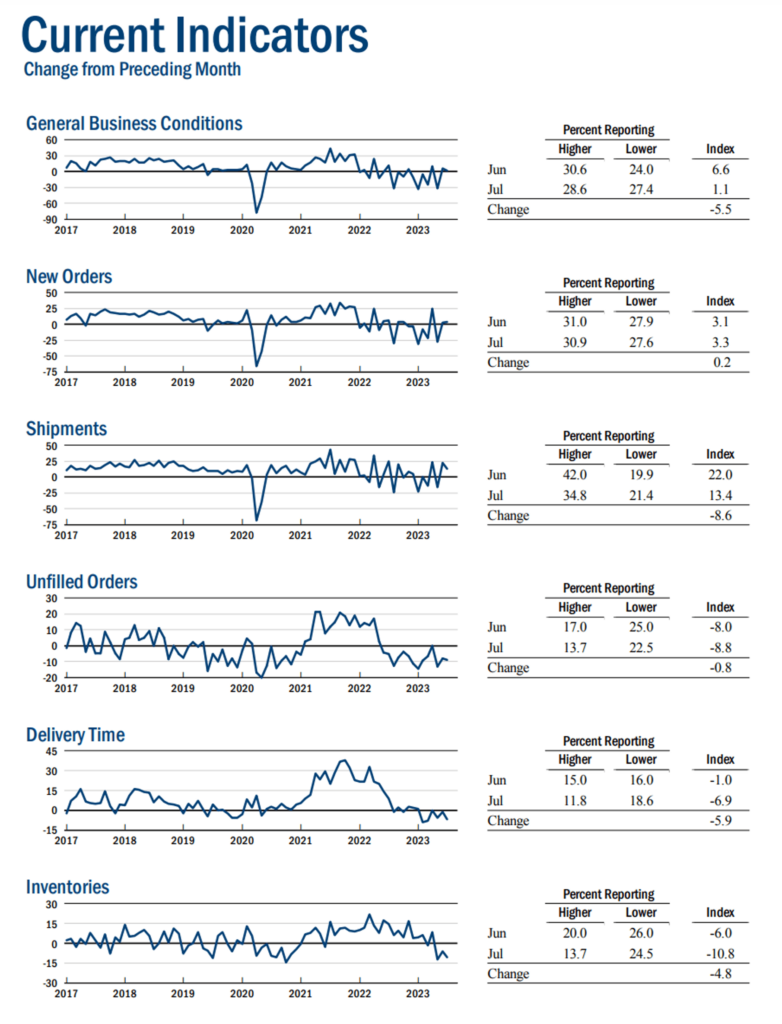

The Federal Reserve Bank of New York released data on the Empire State Manufacturing Index, which is based on a survey of 200 manufacturers in New York State. The survey results showed that the diffusion index for general business conditions fell to 1.1 points, a decrease of 5.5 points from the previous month.

The diffusion index is a way to summarize economic information from survey results because it's easy to understand and correlates with economic activity over time.

This decline was better than the expected -4.3, indicating that the index remained in expansionary territory for the second consecutive month. Despite the decline, any reading above 0.0 indicates improving conditions.

There was also a decline in the future business conditions index, which stands at 14.3, indicating that while conditions are expected to improve, caution still prevails. In addition, the Capital Expenditure Index fell five points to 2.9, indicating that investment plans continue to weaken.

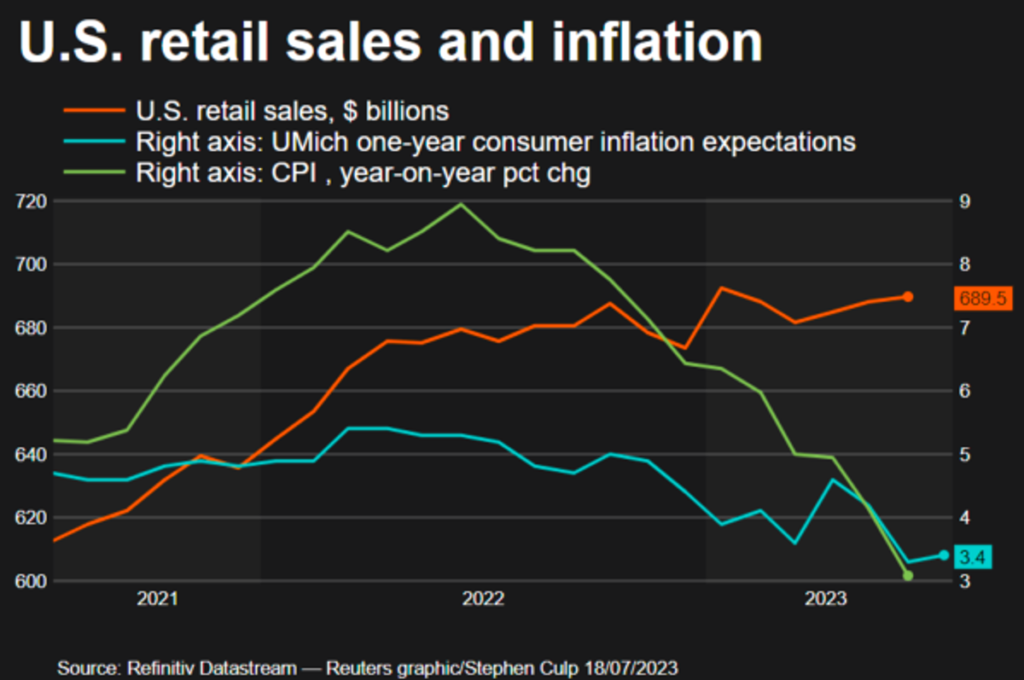

U.S. retail sales in June rose only 0.2%, less than expected, due to a decline in sales at gas stations and building materials stores. However, consumers maintained their spending in other areas, which could lead to more solid economic growth in the second quarter.

Economists were expecting a 0.5% increase in retail sales. It is important to note that retail sales are primarily composed of goods and were not adjusted for inflation in June, when they rose 1.5% year-over-year.

The Commerce Department’s report on Tuesday presented a mixed picture, pointing to consumer resilience but also to a slowdown in spending growth momentum. However, the report did not change expectations that the Federal Reserve will raise interest rates again in July.

Core retail sales rose 0.3% in May. The strong increase in June and upward revisions to May’s core retail sales suggest that consumer spending, which accounts for more than two-thirds of the U.S. economy, continued to expand last quarter. However, there is a possibility that the pace of growth in consumer spending will be slower than in the first quarter, which was the fastest in almost two years.

In contrast to the slight increase in retail sales. The latest data from the U.S. Census Bureau in June shows that the seasonally adjusted annual rate for privately owned housing units, measured by building permits issued, reached 1,440,000 units, or down 3.7% from the figure recorded in May, which was 1,496,000 units.

There was also a decline in U.S. jobless claims, which fell last week to the lowest level in two months. The drop indicates strong demand for workers despite a slowdown in hiring.

The Labor Department’s report on Thursday showed that initial jobless claims fell by 9,000 to 228,000. These claims were lower than the expected 242,000.

However, continuing claims, which include individuals who have been receiving unemployment benefits for more than a week, rose sharply by 33,000 to 1.75 million for the week ending July 8, the largest increase in more than three months.

These data illustrate the resilience of the labor market, where companies are maintaining their workforces even as wage growth has slowed in recent months. A robust labor market plays a critical role in supporting consumer spending and instilling optimism in the economy, which could help stave off a recession.

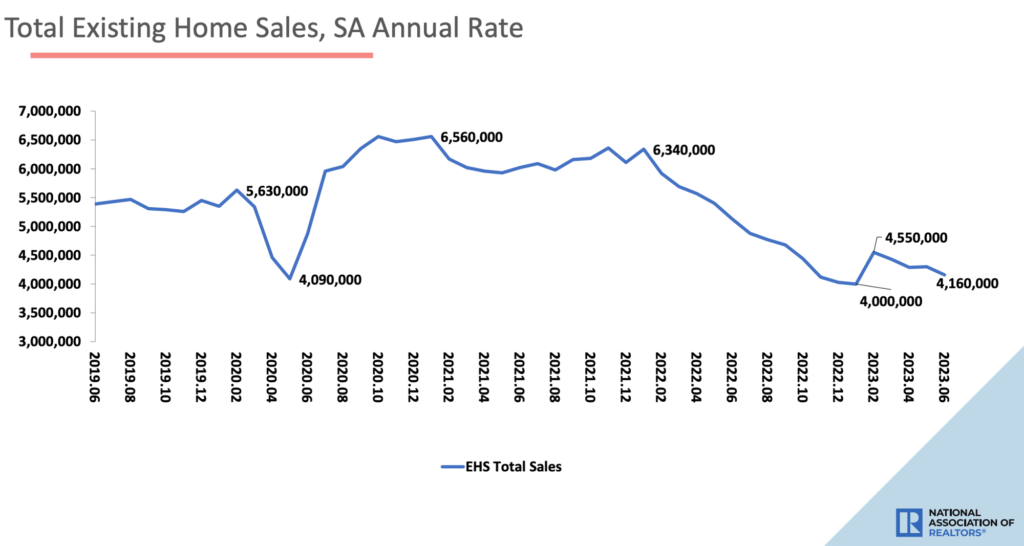

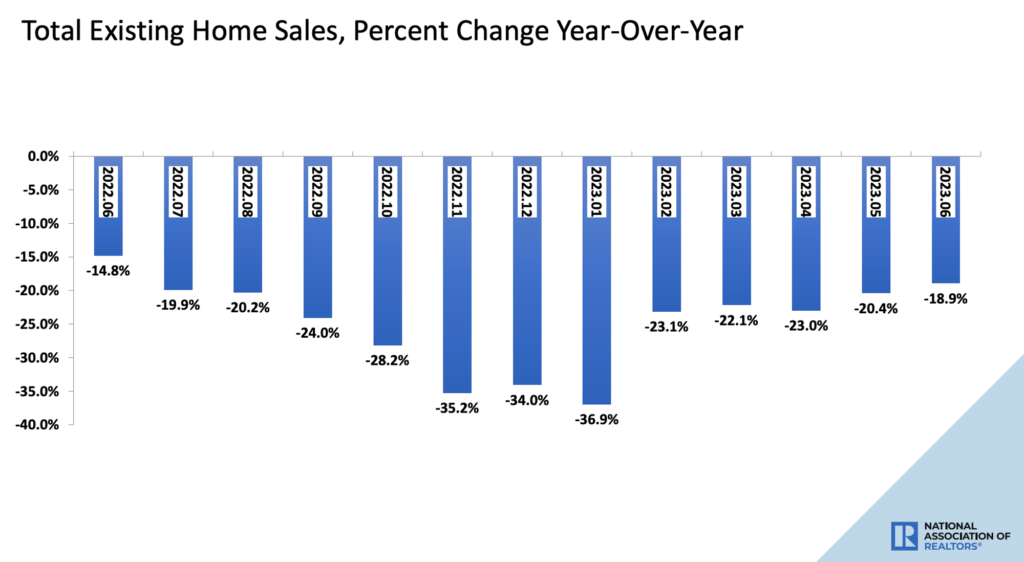

Despite a strengthening labor market, sales of existing U.S. homes fell 3.3% in June. According to a report from the National Association of Realtors, these sales reached a seasonally adjusted annual rate of 4.16 million units.

However, compared to June 2022, sales were down a significant 18.9%, marking the slowest sales pace for the month of June since 2009.

The slowdown in the housing market is due to a lack of supply. At the end of June, there were only 1.08 million homes for sale, down 13.6% from a year earlier. Typically, a balanced market for buyers and sellers would require a six-month supply, but currently the inventory only covers 3.1 months.

BTC Price Analysis

BTC continues to trade sideways, with a high of $30,000. This relative stagnation is due to regulatory uncertainties regarding ETFs and crypto asset storage. The SEC is currently reviewing a proposal for a spot ETF. Another regulatory hurdle relates to unclear rules in the US, where Nasdaq decided to suspend the launch of a cryptocurrency custody solution.

As can be seen in the chart below, BTC spent the last week below the 21-day EMA line. Currently, BTC has the same EMA line as resistance at $30,000 and support at $29,200.

Bitcoin’s dominance trend has been steadily declining for the past two weeks. However, this decline is still within a higher range than the 47% resistance line. It’s expected that Bitcoin Dominance will continue to decline until it falls below the 47% resistance line.

The total crypto market cap is at the 100-week EMA resistance line, which has failed to break the previous resistance line in the four months to mid-April 2023. In order to prepare for a crypto rally, the crypto market cap must be able to break through this resistance line.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Investors are in a Anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- The Mantle Network, a Layer-2 Ethereum solution powered by BitDAO, has finally launched its mainnet at the Ethereum Community Conference in Paris. After six months of intensive testing and development, the network has successfully completed more than 14 million on-chain transactions. The Mantle network operates with a modular structure, an optimistic rollup design, and data availability facilitated by the EigenLayer protocol. Mantle aims to achieve a balance between high performance, low cost and the security of Ethereum’s decentralization. This opens up opportunities for advanced blockchain gaming, DeFi, and social protocols without significant fees.

- Chainlink launched its Cross-Chain Interoperability Protocol (CCIP). The protocol allows applications to use Chainlink’s Decentralized Oracle Networks (DONs) as facilitators for cross-chain message transfers. These messages are nothing more than arbitrary data but can be used to construct complex logic and standards such as smart contract calls, governance votes, and token transfers.

- Uniswap has launched UniswapX, a new trading protocol that combines on-chain and off-chain liquidity through a Dutch auction mechanism. UniswapX has an innovative approach that aims to improve execution quality and provide users with a better trading experience. The Dutch auction feature in UniswapX introduces a competitive market for market makers, referred to as fillers within the UniswapX ecosystem, to execute user orders. The basic concept of a Dutch auction allows fillers to respond to user quotes obtained off-chain through a request-for-quote (RFQ) system. This off-chain interaction allows fillers to efficiently source the necessary liquidity to fill user orders.

News from the Crypto World in the Past Week

- The U.S. Securities and Exchange Commission (SEC) is set to begin its review process for bitcoin ETF trading. Applications have been submitted by six companies, including BlackRock, Bitwise, Fidelity, WisdomTree, VanEck and Invesco Galaxy. In accordance with the rules, the review process will officially begin once all submitted materials are published in the Federal Register. The review period is set at 45 days, with a possible extension of up to 240 days.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Maker (MKR) +27.67%

- Stellar (XLM) +20.03%

- Chainlink (LINK) +18.60%

- Synthetix (SNX) +13.57%

Cryptocurrencies With the Worst Performance

- Rocket Pool (RPL) -15.10%

- Lido DAO (LDO) -14.79%

- GMX (GMX) -11.92%

- Frax Share (FXS) -8.54%

References

- Amitoj Singh, Sandali Handagama, Deadlines for U.S. Spot Bitcoin ETF Approvals Come Into Sight, Coindesk, accessed on 22 July 2023.

- Santiago Pinto, Sonya Ravindranath Waddell, Why Use a Diffusion Index?, Richmonfed, accessed on 22 July 2023.

- Kemal El Moujahid, CCIP Officially Launches on Mainnet, Blog.chain.link, accessed on 22 July 2023.

- Alessandro Adami, Crypto: Uniswap launches open-source protocol UniswapX, Cryptonomist, accessed on 22 July 2023.

- Mantle, Mantle Network Mainnet Alpha: Launch Highlights, accessed on 22 July 2023.