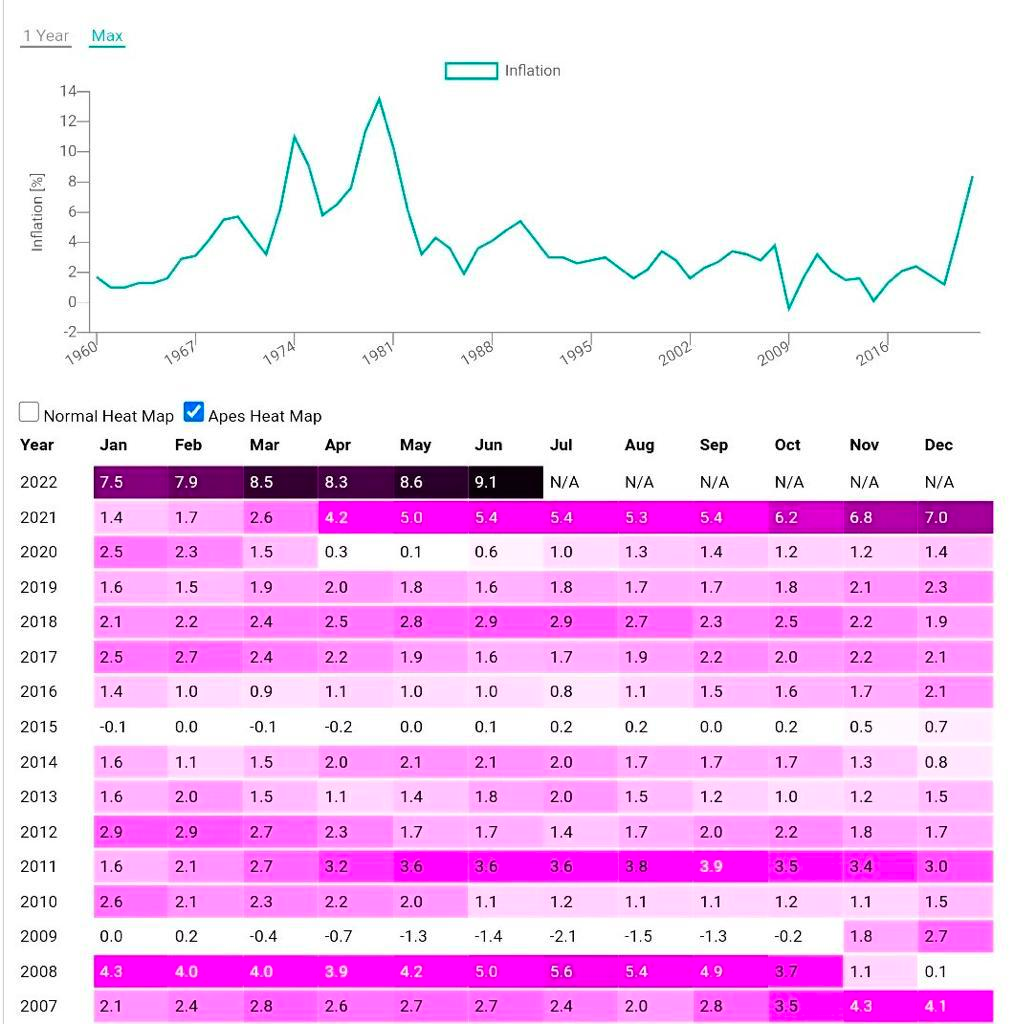

Inflation in the United States (US) in June 2022 shot above projections and was at the level of 9.1%. How will US inflation impact the crypto sector? Pintu’s team of traders has collected data about the price movements in the crypto market over the past week, which is summarized in the Market Analysis below. However, kindly note that all information from the market analysis below is for educational and informational purposes only, and not financial advice.

Market Analysis Summary

- ⚠ US inflation in June 2022 reached 9.1% which was the highest figure in 41 years. The Consumer Price Index (CPI) data causes the stock market and the cryptocurrency market to be volatile.

- 🚀 The price of Ethereum (ETH) increased by 20% last week, following the announcement of The Merge implementation target which is planned for September 19, 2022.

- 🔀 Looking at Bitcoin’s 4-day chart, a death cross is expected to occur in mid-August 2022. However, this does not mean that the bear market will end. Sideways are likely to continue with the final estimate of the bear market occurring in October-December 2022.

BTC Price Movement 10-16 July 2022

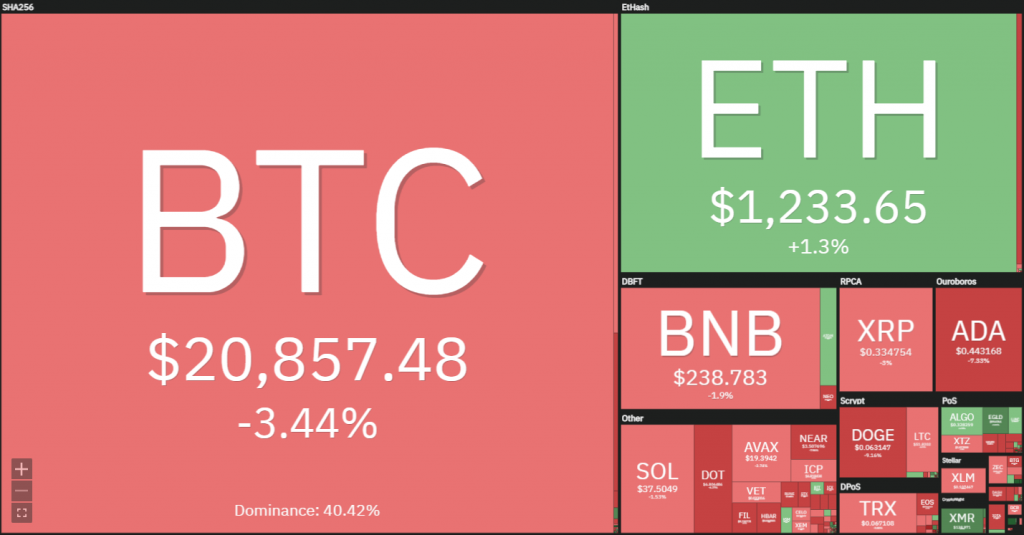

After the Consumer Price Index (CPI) data came out with a record high in four decades of 9.1%, the crypto market experienced volatility and fell below $19,000 for a short period of time before climbing back up again. As seen in the chart below, BTC is barely touching the 21-week EMA resistance line at the time of writing (July 16, 2022).

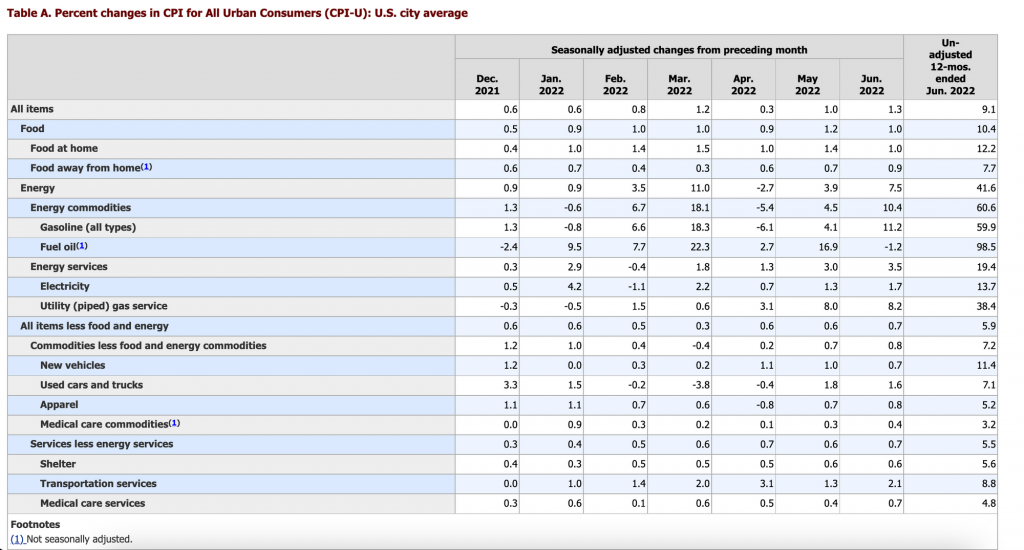

The CPI data is out with its record-setting numbers. The consumer price index increased 9.1% from a year ago in June, above the 8.8% Dow Jones estimate. This marks the highest rate in nearly 41 years. The recession threat is rising very fast.

The equities market slumped following the data, as with the crypto market while government bond yields surged. Much of the inflation rise came from gasoline prices, which increased 11.2% in the month.

As with the inflation rate, the DXY surged following the news. It reached 109.3 at its peak before retracing to 108. Expect the dollar to further strengthen as the expectation of the Fed raising its fund rate by 75 bps at month’s end increases.

Let’s take a look at the death cross that is going to occur on the 4-day chart of BTC. Looking at the chart below, note that in the death cross that occurred on the previous two occasions, the bottom or the lowest point occurred about 52 days before the cross occurred. If we assume that the candle on June 18 is bottom, then the cross over point is expected to occur in the 2nd week of August 2022.

Of course, with the occurrence of a death cross, does not mean that the bear market will end. The sideways market is likely to continue. As previously mentioned, the end of the bear market is likely to occur between October-December 2022.

💡 A death cross is a price chart pattern when the shorter-term moving average crosses the longer-term moving average below it. This indicates a downward trend in prices.

BTC Dominance stands at 43.5% after dropping by 1.3% from its peak earlier this week. This is mostly caused by the ETH’s merge trial, soon after we can see altcoins follow suit. MATIC, UNI, QNT, EGLD, LDO, CRV, and AAVE have all seen good gains as well over the week.

On-Chain Analysis

- 📊 Exchange: Exchange reserve continues to call, it indicates lower selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 👨💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is decreasing significantly compared to the cost they put in. This could indicate that price is undervalued along with the increasing miner’s motive to hold their coins.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

- 📑 Derivatives: Short position traders are dominant and are willing to pay long traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As OI decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

News From the Altcoins World

- ⛓ Ethereum On Track For Mid-September Merge: According to Defiant.io, Ethereum Developers have targeted implementation of The Merge on September 19 which was announced in a conference call held on Thursday, July 14, 2022. The Merge is the highly anticipated Ethereum transition, with change of proof-of-work consensus mechanism to proof-of-stake. This change is expected to cut blockchain energy use and, therefore, carbon emissions, by 99%.

Other Important News From The Crypto World

- 💥 Celsius Applies for Bankruptcy Protection: Celsius, a cryptocurrency lending platform that last month stopped withdrawing all users, has filed for bankruptcy protection. Celsius has $167 million to continue certain operations during the restructuring process. However, the withdrawal of user assets will continue to be suspended following this submission.

Cryptocurrency Performance Over The Past Week

References

- Aleksandar Gilbert, Ethereum Still On Track For Mid-September Merge, The Defiant, accessed on July 18, 2022

- Camilla Russo, Crypto Lender Celsius Files for Bankruptcy Protection, The Defiant, accessed on July 18, 2022