Once again, the world is rattled by a geopolitical conflict, this time between Iran and Israel. As expected, the crypto market reacted, with Bitcoin (BTC) experiencing a price correction. Despite this, BTC remains resilient, holding firmly above the $100,000 mark. Check out the full analysis from Pintu’s Trader Team.

Market Analysis Summary

- 👀 BTC price is currently testing support levels around $104,500 to $106,250, which are crucial zones to watch

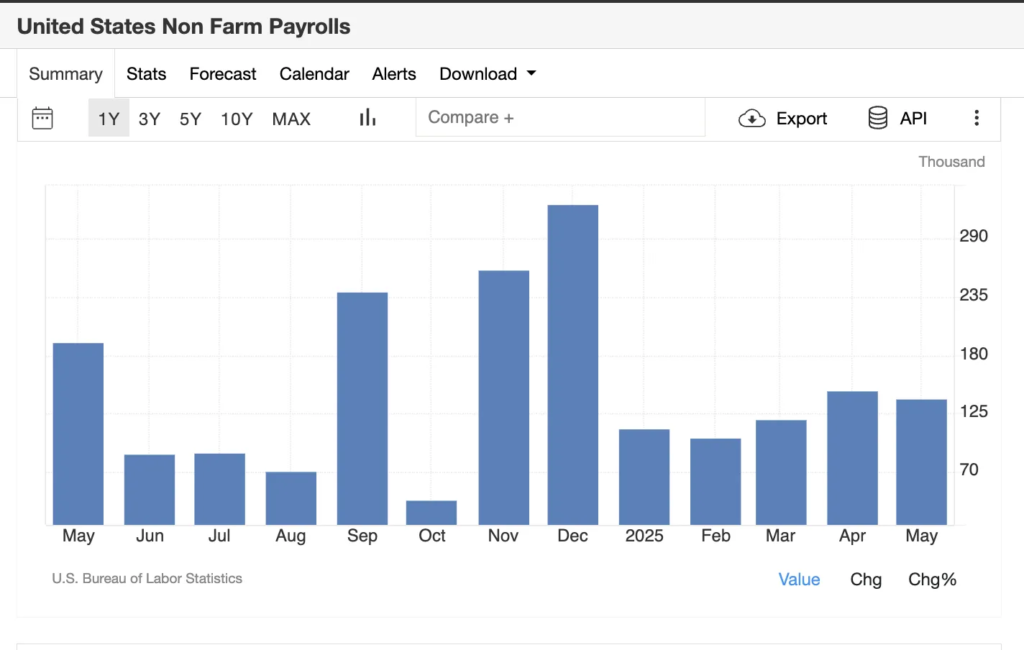

- 📈 The latest U.S. nonfarm payroll report, released by the Bureau of Labor Statistics on June 6, 2025, showed that total nonfarm payroll employment increased by 139,000 in May.

- 💼 The latest data from the U.S. Bureau of Labor Statistics shows that the national unemployment rate (U-3) for May 2025 stands at 4.2%.

- 👍🏻 The latest US initial jobless claims for the week ending June 7, 2025, remained steady at a seasonally adjusted 248,000, marking an eight-month high and unchanged from the previous week.

- 📊 The latest U.S. Producer Price Index (PPI) for May 2025 showed a month-over-month increase of 0.13%, marking a rebound from April’s decline of -0.24%.

Macroeconomic Analysis

Non-Farm Payroll

The latest U.S. nonfarm payroll report, released by the Bureau of Labor Statistics on June 6, 2025, showed that total nonfarm payroll employment increased by 139,000 in May. This growth was slightly above consensus expectations of 130,000, reflecting a labor market that remains resilient despite broader economic headwinds, such as negative GDP growth in the first quarter of 2025 and persistently low consumer sentiment. The monthly payroll gain is close to the 12-month average of 144,000, though it is notably slower than the robust job growth seen in previous years.

Employment gains in May were driven primarily by the health care, leisure and hospitality, and social assistance sectors. Health care led the way with 62,000 new jobs, surpassing its recent monthly average, with significant additions in hospitals and ambulatory health care services. Leisure and hospitality added 48,000 jobs, mainly in food services and drinking places, while social assistance employment rose by 16,000, concentrated in individual and family services.

However, not all sectors performed well. Federal government jobs continued to decline, losing 22,000 in May and 59,000 since January. Industries like manufacturing, retail, and construction saw little to no change.

Despite the job gains, the unemployment rate stayed at 4.2%, with 7.2 million people unemployed. The broader U6 rate—which includes underemployed and discouraged workers—also remained unchanged at 7.8%. These stable figures suggest the job market is cooling but still in decent shape historically.

Wages increased in May. Average hourly earnings rose 0.4% to $36.24, and annual wage growth climbed to 3.9%—the first rise this year after months of slowing. While positive for workers, this wage growth could contribute to inflation as companies monitor labor costs amid ongoing uncertainty. The average workweek stayed at 34.3 hours.

It’s also important to note that job figures for March and April were revised down by a total of 95,000 jobs. This, combined with slower growth in May, shows the labor market is still growing, but at a slower and less steady pace as the U.S. faces more economic headwinds.

Other Economic Indicators

- Unemployment Rate: The latest data from the U.S. Bureau of Labor Statistics shows that the national unemployment rate (U-3) for May 2025 stands at 4.2%. This figure has remained relatively stable in recent months, reflecting a labor market that, while slowing, still demonstrates resilience amid broader economic challenges. The number of unemployed individuals is estimated at around 7.2 million, and the unemployment rate has hovered in a narrow range since mid-2024, despite economic headwinds such as negative GDP growth and low consumer sentiment.

- Jobless Claim: The latest US initial jobless claims for the week ending June 7, 2025, remained steady at a seasonally adjusted 248,000, marking an eight-month high and unchanged from the previous week. This figure was higher than economists’ expectations of 240,000 claims. The 4-week moving average of initial claims rose to 240,250, the highest since August 2023, indicating a relatively weaker hiring rate.

- PPI: The latest U.S. Producer Price Index (PPI) for May 2025 showed a month-over-month increase of 0.13%, marking a rebound from April’s decline of -0.24%. This modest rise indicates that producer prices are increasing but at a slower pace than the long-term average of 0.21%. The PPI measures the average change in selling prices received by domestic producers for their output and is a key indicator of inflationary pressures at the wholesale level.

BTC Price Analysis

Over the past week, BTC showed a mixed performance with a notable peak followed by a sharp correction. The price reached a weekly high of around $110,653 on Monday, June 9, 2025, reflecting a strong bullish momentum early in the week. This surge was part of a roughly 10% rally from June 6 to June 10, driven by positive market sentiment and institutional interest. However, after this peak, BTC faced resistance near the $111,000 level and started to lose momentum, leading to a consolidation phase below this key resistance zone.

Today, June 13, 2025, BTC experienced a significant price decline, dropping about 4.15% within 24 hours to trade near $103,371. The intraday low touched around $103,600, marking a sharp pullback from the earlier weekly high. This decline was influenced by rising geopolitical tensions, particularly between Iran and Israel, which triggered risk-off sentiment among investors, causing a sell-off in risk assets including cryptocurrencies. Trading volume also surged by 32% to $67.32 billion, indicating heightened market activity amid the sell-off.

Technical Analysis

From a technical perspective, this correction is considered a normal retracement following the strong rally earlier in the week. BTC’s price action showed signs of short-term exhaustion as it failed to break and hold above the $111,000 resistance, with indicators like MACD and RSI suggesting momentum cooling. The price is currently testing support levels around $104,500 to $106,250, which are crucial zones to watch. A break below these supports could signal further downside, while reclaiming levels above $108,300 may prompt another attempt to challenge the $110,000 resistance.

Despite today’s decline, the broader trend for BTC remains cautiously optimistic. The market capitalization remains robust at around $2.06 trillion, and the long-term moving averages still support a constructive outlook. Analysts suggest that as long as BTC stays above the $104,500 support zone, the potential for recovery and continuation of the bullish trend remains intact. However, volatility is expected to persist in the near term due to geopolitical uncertainties and the expiration of significant BTC options contracts today, which could further influence price swings.

In summary, BTC’s past week was marked by a strong rally followed by a sharp correction today amid geopolitical risks. The current price decline to around $103,371 reflects a risk-off environment and technical pullback after hitting resistance near $111,000. While short-term volatility is elevated, the medium-term outlook remains constructive if key support levels hold, with investors closely monitoring how BTC navigates these critical zones in the coming days.

Altcoin Analysis

Over the past week, the broader cryptocurrency market excluding BTC showed mixed performance with some altcoins experiencing mild declines amid a generally subdued trading environment. ETH, the second-largest crypto by market cap, traded sideways but edged down about 2.2%, hovering near $2,753.40 as of June 12, 2025. This slight drop reflected cautious investor sentiment amid macroeconomic uncertainties and geopolitical tensions affecting global markets.

Other major altcoins such as Ripple (XRP) and Binance Coin (BNB) also faced pressure. XRP’s price movement is closely watched ahead of a critical SEC decision on spot ETFs expected around June 17, which could act as a catalyst for significant price volatility. Despite some optimism about Ripple’s legal progress, analysts note a 60% chance of delay, contributing to restrained buying interest3. Binance Coin, which had seen a massive rally earlier in the year, showed signs of consolidation around $661.94, with trading volumes steady but without fresh upward momentum.

Other tokens like Dogecoin (DOGE), Cardano (ADA), and TRON (TRX) experienced minor declines ranging from 0.06% to 0.67%, reflecting a cautious market mood. These modest pullbacks suggest traders are awaiting clearer signals from regulatory developments and broader economic indicators before committing to new positions.

Market volatility was further dampened by external factors including a weaker US dollar and subdued inflation data, which have generally supported risk assets but also introduced uncertainty. Heightened geopolitical tensions in the Middle East added to the cautious stance among crypto investors, leading to sideways trading patterns and reduced volatility in many altcoins.

Overall, the broader crypto market over the past week has been characterized by consolidation and cautious trading, with key altcoins maintaining levels near recent ranges but lacking strong directional momentum. Investors appear to be in a wait-and-see mode ahead of important regulatory decisions and global economic developments that could shape the next significant price moves in the sector

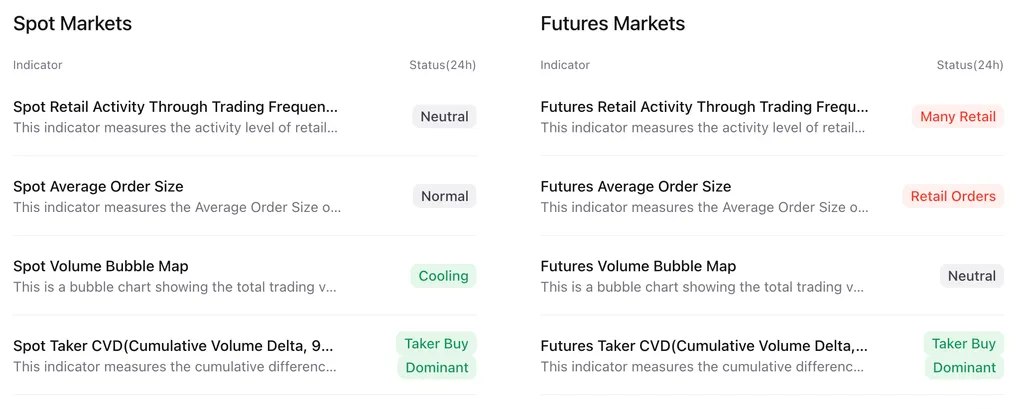

On-Chain Analysis

News About Altcoins

- Approval Signals: Multiple Firms File Updated Spot Solana ETF Applications to SEC. Several major investment firms, including Franklin Templeton, Galaxy Digital, VanEck, Grayscale, and Fidelity, submitted updated S-1 filings to the SEC on Friday for proposed spot Solana ETFs. This move is seen by analysts as a strong signal that the SEC may be moving closer to approving these products, with a possible timeline of two to four months. The updates address SEC concerns over in-kind redemptions and staking mechanisms, as issuers push for ETFs that include staking rewards. While the SEC has historically been cautious with altcoin-based ETFs, the listing of SOL futures on the CME and increasing industry pressure may improve the chances for approval.

News from the Crypto World in the Past Week

- Strategy Adds 1,045 BTC as Price Nears All-Time High, Total Holdings Reach 582,000 BTC. Strategy, formerly known as MicroStrategy, has acquired an additional 1,045 Bitcoin worth $110.2 million at an average price of $105,426, bringing its total holdings to 582,000 BTC. This marks the ninth consecutive week of Bitcoin purchases by the firm, coinciding with BTC prices nearing their all-time high around $112,000. The acquisition is backed by a new $1 billion stock offering aimed at funding further Bitcoin purchases and corporate expenses. Strategy’s bold move has inspired other companies like Metaplanet and The Blockchain Group to adopt similar Bitcoin accumulation strategies.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Aerodrome Finance (AERO) +51.25%

- Jito (JTO) +24.86%

- Fartcoin (FARTCOIN) +21.84%

- SPX6900 (SPX) +18.12%

Cryptocurrencies With the Worst Performance

- Kaspa (KAS) -13.71%

- Zcash (ZEC) -12.62%

- Celestia (TIA) -12.40%

- Injective (INJ) -12.36%

References

- Adrian Zmudzinski, Strategy adds 1,045 Bitcoin for $110M in latest purchase, cointelegraph, accessed on 14 June 2025.

- Daniel Kuhn, Prospective SOL ETF issuers submit updated S-1 filings, hinting at potential listing, theblock, accessed on 14 June 2025.