Bitcoin (BTC) hit an all-time high and has since been in a consolidation phase over the past week, holding strong above $100,000, which indicates a bullish market. Check out the full analysis from the Pintu’s Trader Team.

Market Analysis Summary

- 👀 Technical indicators show that BTC is currently facing resistance near $104,896. Support levels are observed around $103,398, providing a floor for price declines.

- 📕 The AI-related token sector has attracted attention, partly due to anticipation of Nvidia’s upcoming earnings report, which could impact sentiment around AI-driven blockchain projects like FET, RENDER, and AGIX.

- 🏠 In April 2025, new home sales in the United States surged significantly, reaching a seasonally adjusted annual rate of 743,000 units.

- 💬 The latest speech and press conference by Federal Reserve Chair Jerome Powell, delivered in early to mid-May 2025, reaffirm the Fed’s cautious but steady approach to monetary policy amid a mixed but generally solid economic backdrop.

- 📉 In April 2025, new orders for durable goods in the United States declined sharply by 6.3% compared to the previous month, following a strong rebound in March when orders surged by 7.6%.

Macroeconomic Analysis

Fed Chair Speech

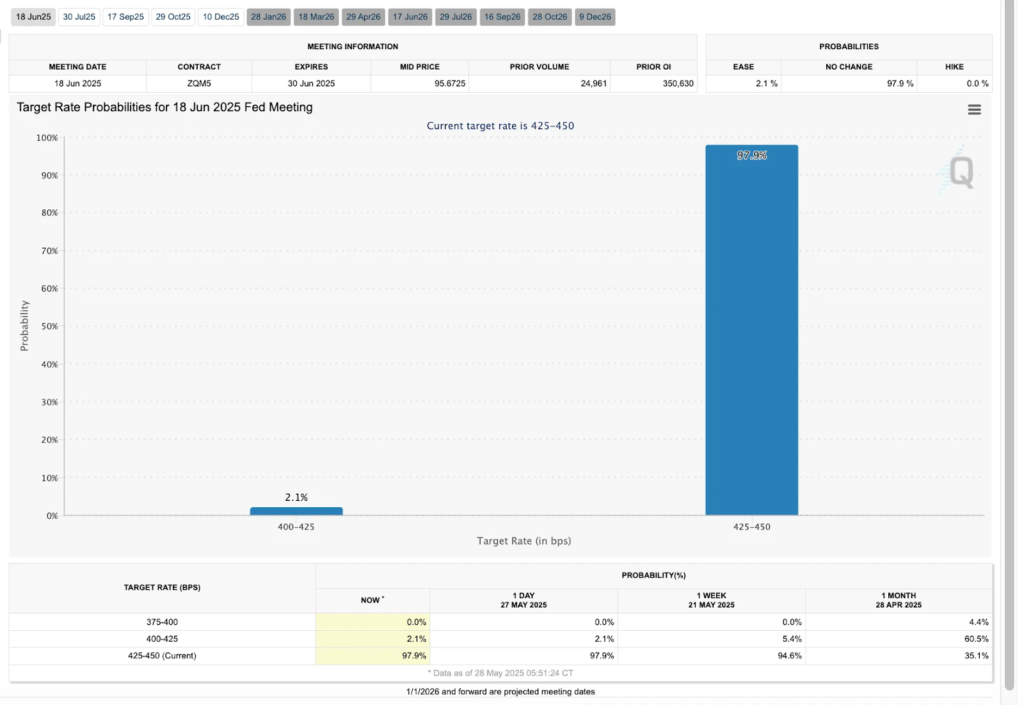

The latest speech and press conference by Federal Reserve Chair Jerome Powell, delivered in early to mid-May 2025, reaffirm the Fed’s cautious but steady approach to monetary policy amid a mixed but generally solid economic backdrop. Powell emphasized the Fed’s dual mandate of achieving maximum employment and stable inflation, noting that while inflation has declined significantly, it remains somewhat above the 2 percent target. The labor market continues to show strength, with unemployment remaining low and job creation steady, indicating that the economy is resilient despite heightened uncertainty from trade policy and other factors.

In the May 7 press conference, Powell explained that the Federal Open Market Committee (FOMC) decided to keep interest rates unchanged, reflecting a balanced assessment of risks. He highlighted that the economy grew at a solid pace last year but experienced a slight GDP dip in the first quarter of 2025, largely due to unusual swings in net exports driven by businesses adjusting imports ahead of potential tariffs. Despite these distortions, private domestic demand remained robust. Powell stressed that the current monetary policy stance is moderately restrictive but not overly so, and the Fed is in a good position to respond flexibly to future economic developments.

Powell also addressed the uncertainty surrounding the timing and scale of future policy moves, indicating that the Fed will remain patient and data-dependent. He acknowledged that while negative sentiment and some early signs of layoffs have appeared in certain sectors, overall labor market conditions remain strong, with wages growing and unemployment claims stable. This cautious stance reflects the Fed’s effort to balance the risks of higher inflation against the potential for rising unemployment, without rushing into rate changes until clearer economic signals emerge.

Beyond monetary policy, Powell’s recent remarks at Princeton University underscored broader themes of leadership, responsibility, and public service. While not directly focused on economic policy, these speeches reflect Powell’s view of the Fed’s role as serving the American people’s long-term economic well-being and the importance of thoughtful, principled decision-making in uncertain times.

In summary, Chair Powell’s latest communications convey a message of steady vigilance: the U.S. economy remains fundamentally strong, inflation is improving but not yet fully controlled, and the Fed is prepared to act as needed while maintaining a patient, data-driven approach. This balanced tone aims to support ongoing economic growth while guarding against inflationary pressures, reflecting the complexity of navigating post-pandemic and geopolitical challenges in 2025.

Other Economic Indicators

- New Home Sales: In April 2025, new home sales in the United States surged significantly, reaching a seasonally adjusted annual rate of 743,000 units. This marked a robust 10.9% increase from March’s 670,000 units and represented the highest sales level since February 2022. The increase exceeded market expectations, which had forecasted sales around 690,000 units, signaling strong demand in the housing market despite ongoing economic uncertainties.

- Durable Goods: The durable goods sector showed mixed signals in early 2025: a strong rebound in March followed by a notable pullback in April driven by transportation equipment. The data reflects ongoing uncertainty in the manufacturing sector amid tariff concerns and supply chain issues. While shipments remain steady, the softness in new orders suggests businesses are adopting a wait-and-see approach to capital expenditures, which could temper manufacturing growth in the near term.

BTC Price Analysis

Over the past week, BTC has experienced relatively stable price action with slight fluctuations around the $103,000 to $110,000 range. Starting from May 31, 2025, BTC reached a high near $110,000, marking one of the peak levels in recent weeks. Following this peak, the price saw some modest pullbacks but generally maintained above $103,000, indicating a consolidation phase after the recent rally.

This stability after a strong rally suggests that BTC is currently in a phase where buyers and sellers are balancing out, with neither side pushing the price dramatically higher or lower. The price remains well above its 50-day and 200-day moving averages, which are around $95,580 and $94,133 respectively, signaling that the medium-term trend is still bullish. The trading volume has also been robust, supporting the price levels and indicating sustained interest from market participants.

The recent price action can be attributed to several factors, including positive market sentiment driven by institutional adoption and broader acceptance of cryptocurrencies as an asset class. Additionally, macroeconomic conditions such as moderate inflation and stable interest rates have encouraged investment flows into risk assets like BTC. However, traders remain cautious due to potential regulatory developments and geopolitical uncertainties that could impact market dynamics.

Technical Indicators Analysis

Technical indicators show that BTC is currently facing resistance near $104,896, which it tested but failed to decisively break last week. Support levels are observed around $103,398, providing a floor for price declines. This range-bound movement suggests that traders are waiting for new catalysts, such as economic data releases or policy announcements, to drive the next significant price move.

In summary, BTC’s price over the past week has been characterized by consolidation near recent highs, supported by strong volume and positive medium-term trends. While short-term volatility remains, the overall outlook appears cautiously optimistic as BTC holds key support levels and awaits fresh market drivers to resume a potential upward trajectory.

Altcoin Analysis

Over the past week, the wider cryptocurrency market beyond BTC has exhibited a generally sideways or consolidative price action, with some altcoins showing modest gains while others experienced slight pullbacks. ETH, the largest altcoin by market capitalization, traded mostly in the $2,400 to $2,600 range, showing resilience but not yet breaking decisively above key resistance levels. Other major altcoins like Solana, Cardano, and Hyperliquid have recorded positive performance, supported by ongoing developments in their ecosystems and renewed investor interest in Defi and Web3 projects.

This relative stability comes amid a backdrop of cautious optimism, as the market awaits several important macroeconomic events scheduled for the end of May 2025, including U.S. Consumer Confidence data, Federal Reserve minutes, GDP revisions, and inflation indicators. These data points are expected to influence investor sentiment and could trigger significant volatility in crypto prices. The market’s current sideways movement reflects a “wait and see” approach by investors, balancing positive fundamentals in blockchain innovation against uncertainties in monetary policy and global economic outlook.

Market capitalization for the entire crypto sector hovered around $3.56 trillion, with BTC dominance remaining strong but altcoins gradually reclaiming some market share as investors diversify. Notably, the AI-related token sector has attracted attention, partly due to anticipation of Nvidia’s upcoming earnings report, which could impact sentiment around AI-driven blockchain projects like FET, RENDER, and AGIX. Positive earnings from Nvidia may spur rallies in these tokens, while any disappointment could lead to sector-wide corrections.

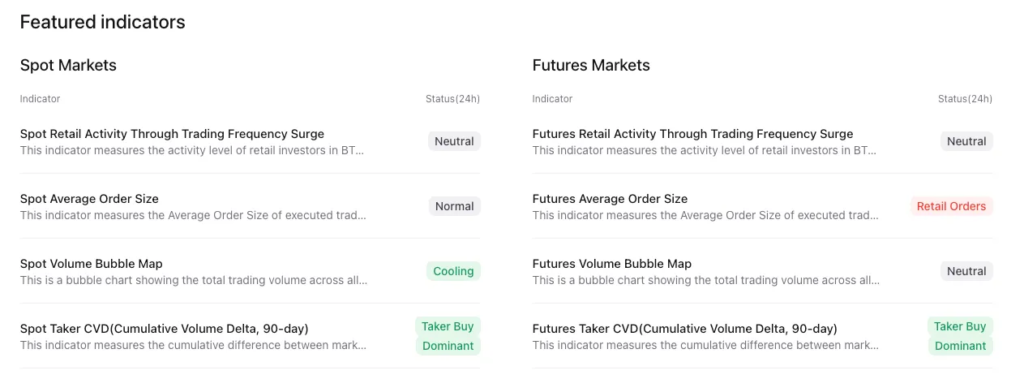

Trading volumes have remained healthy, indicating sustained investor engagement despite the lack of a clear directional trend. The market’s current pattern suggests consolidation after recent rallies, with technical indicators pointing to key support and resistance zones that traders are closely monitoring. This phase could set the stage for either a breakout to new highs or a correction, depending on how upcoming economic data and regulatory news unfold.

In summary, the wider crypto market outside BTC has been relatively stable but poised for potential movement as major economic events approach. While altcoins show pockets of strength, overall market participants remain cautious, awaiting clearer signals from macroeconomic indicators and corporate earnings. This environment calls for flexible trading strategies and close attention to both fundamental and technical developments in the coming week.

On-Chain Analysis

News About Altcoins

- AAVE Rebounds Amid Market Volatility as DeFi Demand Surges. AAVE has shown strong resilience amid global market volatility, rebounding from a 15% drop to stabilize around $248–$250, driven by growing interest in DeFi yield markets. Its integration with Pendle and a $2M GHO loan by the Ethereum Foundation highlight rising institutional adoption and strategic use of crypto assets. With $25.41B in TVL and bullish technical patterns like ascending triangle and cup-and-handle, AAVE is well-positioned to break the $250 resistance and maintain its lead as the largest decentralized lending protocol.

News from the Crypto World in the Past Week

- Tether Emerges as Crypto’s Most Profitable Firm, Amasses Billions in Bitcoin and Gold. Tether, the world’s largest issuer of the USDT stablecoin, revealed holdings of over 100,000 Bitcoin (worth more than $10 billion) and more than 50 tons of gold, while reporting a record $13 billion profit in 2024—making it arguably the most profitable firm in crypto. Speaking at Bitcoin 2025 in Las Vegas, CEO Paolo Ardoino clarified that gold complements fiat, not Bitcoin. Tether’s Q1 2025 report confirmed $7 billion in BTC and $6 billion in gold reserves. Meanwhile, firms like Cantor Fitzgerald and Twenty One Capital are also stockpiling Bitcoin, as institutional interest fuels BTC’s surge to a new all-time high above $109,000.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Quant (QNT) +14.91%

- SPX6900 (SPX) +11.03%

- Toncoin (TON) +4.52%

- Zcash (ZEC) +2.19%

Cryptocurrencies With the Worst Performance

- dogwifhat (WIF) -22.27%

- Pudgy Penguins (PENGU) -21.13%

- Fartcoin (FARTCOIN) -20.98%

- Kaspa (KAS) -20.71%

References

- Shaurya Malwa, AAVE Rebounds From 15% Drop as DeFi Yield Markets Gain Momentum, coindesk, accessed on 1 June 2025.

- RT Watson, Tether holds over 100,000 bitcoin and 50 tons of gold, CEO says, theblock, accessed on 1 June 2025.