Bitcoin (BTC) is demonstrating its resilience, consistently holding its ground above the $100,000. This strength comes despite a recent dip below that key psychological level. The cryptocurrency’s future price movements are now largely dependent on upcoming macroeconomic data reports, which are causing investors and traders to adopt a cautious stance. Read the full analysis from Pintu’s Trader Team in the article below.

Market Analysis Summary

- 🔀 The past week has seen BTC’s price activity largely characterized by a period of consolidation, with the cryptocurrency struggling to break significantly out of a relatively tight trading range.

- 🚏 A central theme of Fed Chair testimony was the uncertainty surrounding the impact of tariffs on inflation and the broader economy, and the Fed’s “wait-and-see” approach to interest rate adjustments.

- 📈 The latest figures of global flash PMI paint a nuanced picture, suggesting continued growth in key economies, albeit with varying degrees of momentum and underlying inflationary pressures that warrant close monitoring by central banks and policymakers.

- 🏠 The latest Existing Home Sales data for May 2025, released on June 23, 2025, presents a picture of a housing market still navigating a challenging environment marked by high mortgage rates and shifting inventory dynamics.

- 📉 The latest data released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reveals a significant decline in new home sales for May 2025.

Macroeconomic Analysis

Fed Chair Testimony

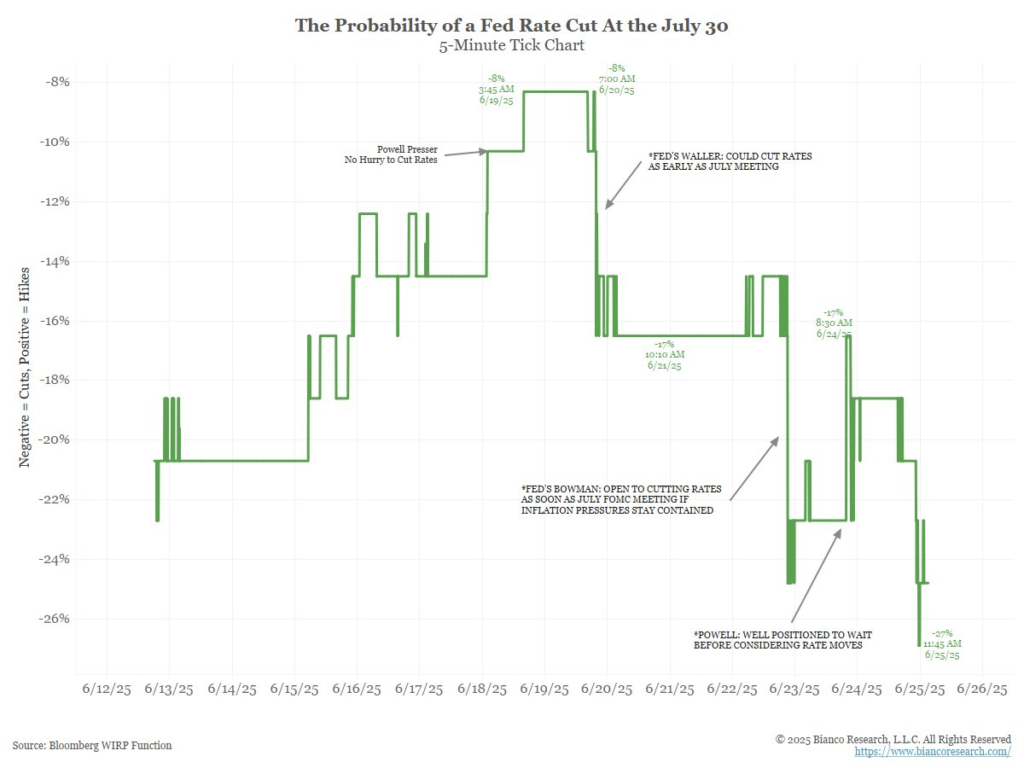

Federal Reserve Chair Jerome Powell delivered his semiannual Monetary Policy Report to Congress on June 24th and 25th, facing both the House Financial Services Committee and the Senate Banking Committee. A central theme of his testimony was the uncertainty surrounding the impact of tariffs on inflation and the broader economy, and the Fed’s “wait-and-see” approach to interest rate adjustments. Powell reiterated that despite a resilient and solid economy with a strong labor market (low unemployment and moderate wage growth), inflation remains somewhat elevated relative to the Fed’s 2% target.

Powell emphasized that while recent economic data is backward-looking, many economists, including those at the Fed, anticipate a “meaningful increase in inflation” over the course of the year due to newly imposed tariffs. He acknowledged that the effects of these tariffs could be either short-lived (a one-time price level shift) or more persistent, depending on their ultimate level and how quickly they pass through to consumer prices. He stressed the Fed’s commitment to preventing a one-time price increase from becoming an ongoing inflation problem, while also balancing its dual mandate of maximum employment and price stability.

Adding another layer of complexity to the economic outlook and the Fed’s independence, President Donald Trump has consistently expressed his desire to replace Jerome Powell as Fed Chair. While Powell’s term as chair is set to end in May 2026, Trump has repeatedly voiced his dissatisfaction with Powell’s leadership, particularly his reluctance to implement aggressive interest rate cuts. During and after the recent testimony, Trump renewed his attacks on Powell, even hinting that he has “three or four people” in mind as potential replacements for when Powell’s term expires. This ongoing pressure from a prominent political figure underscores concerns about the potential erosion of the Federal Reserve’s independence, a cornerstone of its effectiveness in managing monetary policy free from political influence.

The testimony’s impact on the economy and financial markets was notable. Powell’s cautious stance on interest rate cuts, prioritizing the need to assess the inflationary impact of tariffs, led investors to pare back expectations for an imminent rate cut as early as July. Instead, market participants shifted their focus to a potential rate reduction in September, with another possible later in the year. This “wait-and-see” approach, while consistent with the Fed’s recent policy statements, suggests that any rate cuts will be data-dependent and likely occur only after clearer signals emerge regarding inflation’s path. The recurring statements from Trump about replacing Powell, however, introduce an element of political risk into market calculations, as investors weigh the implications of a potentially less independent Fed that might be more amenable to political demands for lower interest rates, regardless of economic fundamentals.

Other Economic Indicators

- S&P Global Manufacturing & Services PMI: In the US, the composite output index registered a slight moderation to 52.8 in June, a two-month low, from 53.0 in May. This suggests a continued, albeit marginally slower, expansion in overall private sector activity. A deeper dive reveals a resilience in manufacturing, with the Flash US Manufacturing PMI holding steady at 52.0, mirroring May’s 15-month high and signaling sustained growth in factory output, a positive shift after a period of stagnation.

- Existing Home Sales: For May 2025, existing home sales rose by 0.8% from April to a seasonally adjusted annual rate of 4.03 million units. This slight uptick came in above market expectations, offering a minor positive surprise in a market that has largely struggled for momentum. On a year-over-year basis, however, sales were still down by 0.7% from May 2024, indicating that despite the monthly gain, the broader trend points to a constrained housing market

- New Home Sales: The latest data released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reveals a significant decline in new home sales for May 2025. Sales of newly built single-family homes plunged by 13.7% from April, reaching a seasonally adjusted annual rate of 623,000 units. This figure also represents a 6.3% decrease compared to May 2024, indicating a broader cooling trend in the new housing market. This substantial drop erases the gains seen in April and highlights the mounting challenges faced by prospective homebuyers.

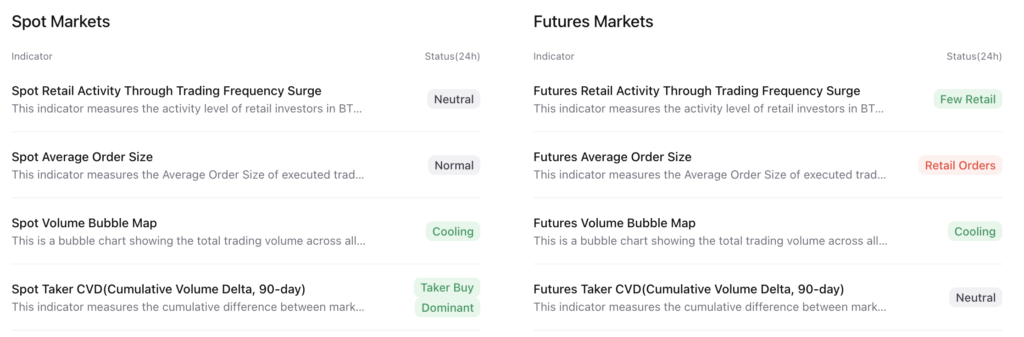

BTC Price Analysis

The past week has seen BTC’s price activity largely characterized by a period of consolidation, with the cryptocurrency struggling to break significantly out of a relatively tight trading range. After experiencing a downturn in the preceding weeks, pushing prices down from higher levels earlier in June, BTC has found some stability. However, this stability has come with notable resistance at key psychological and technical levels, preventing a strong bullish resurgence and leaving market participants in a state of cautious anticipation.

Throughout the week, BTC has traded predominantly within a defined channel, often oscillating between support and resistance points. While there haven’t been dramatic crashes, the attempts to reclaim higher ground have also largely faltered. This sideways movement indicates a tug-of-war between buyers looking to capitalize on perceived dips and sellers who may be taking profits or reacting to broader macroeconomic uncertainties. The lack of a decisive move in either direction suggests that both bulls and bears are currently in a standoff, waiting for a catalyst to determine the next major trend.

Several factors likely contributed to this consolidation. Macroeconomic cues, particularly evolving expectations around global interest rates and inflation, continue to exert influence. With central banks, including the Federal Reserve, providing mixed signals or maintaining hawkish stances, the appetite for riskier assets like BTC can be tempered. Furthermore, regulatory developments, even if not directly impactful on a daily basis, create an underlying current of uncertainty. The market’s reaction to recent economic data releases or any significant news from the traditional finance sector can also filter into crypto, impacting sentiment.

Looking ahead, the current price action is indicative of a market searching for direction. Key resistance levels remain crucial hurdles for bulls to overcome to signal a potential reversal or resumption of an upward trend. Conversely, a decisive break below established support could accelerate selling pressure. Traders are likely watching for significant volume shifts, a clear breakout from the current range, or major news events (e.g., further clarity on stablecoin regulation, institutional adoption news, or macroeconomic shifts) to dictate BTC’s trajectory in the short to medium term. The past week’s consolidation is a pause, but whether it’s a prelude to a breakout or a breakdown remains to be seen.

Altcoin Analysis

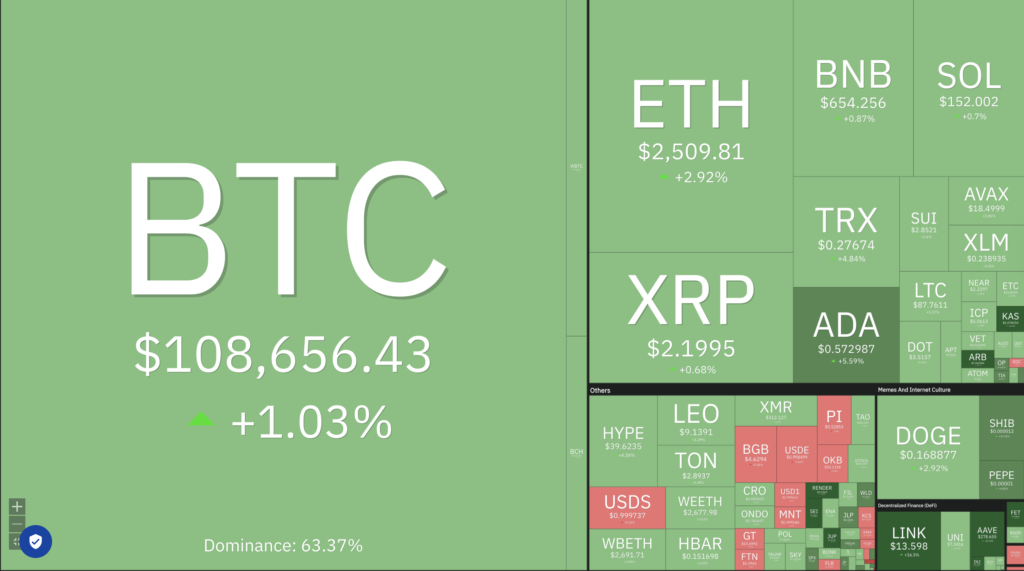

The wider crypto market has experienced a rather mixed and somewhat muted performance over the past week. While BTC largely consolidated within a narrow range, altcoins often amplified BTC’s movements, or at times, demonstrated independent trends influenced by project-specific news, technological developments, or shifting investor sentiment towards different sectors of the crypto ecosystem.

Many of the larger-cap altcoins, such as Ethereum (ETH), Solana (SOL), and others in the top 20 by market capitalization, generally mirrored BTC’s sideways movement. This often means that when BTC struggles for direction, capital tends to remain either in BTC or stablecoins, leading to lower volatility and less significant price appreciation for major altcoins. Ethereum, as the second-largest cryptocurrency, often acts as a bellwether for the broader altcoin market, and its recent performance would likely reflect the general market indecision, though it may have seen some short-lived surges related to specific news or technical indicators.

However, beneath the surface of the large-cap assets, the altcoin market is always a tale of diverse performance. Smaller-cap altcoins, particularly those in niche sectors like DeFi, gaming, or AI narratives, can show significant volatility and outlier performances. Some lesser-known tokens might have experienced pumps due to low liquidity, concentrated buying, or specific project milestones, while others might have seen sharp corrections. This divergence highlights the inherent speculative nature of the altcoin market, where risk and reward are amplified.

The overall sentiment in the altcoin market remains heavily influenced by BTC’s stability and any clear signals from macroeconomic trends. With global interest rate discussions and potential geopolitical shifts, the “risk-on” appetite necessary for a broad altcoin rally hasn’t fully materialized. While some analysts might point to technical indicators suggesting an “altcoin season” could be on the horizon, the past week has largely been a period of sideways trading and selective movements, rather than a broad, sustained uptrend for the vast majority of non-BTC cryptocurrencies. Investors are likely watching for a definitive move from BTC or a significant positive catalyst to inject fresh momentum into the broader altcoin landscape.

On-Chain Analysis

News About Altcoins

- Vitalik Buterin Warns: One-ID Digital Identity Projects Could Undermine Online Pseudonymity. Ethereum co-founder Vitalik Buterin voiced concerns over digital ID projects like Worldcoin, warning that their “one-person-one-ID” model—despite using privacy-preserving zero-knowledge proofs—could erode internet pseudonymity. While he acknowledged the benefits, such as distinguishing humans from bots, he argued that rigid implementation could force all online activity under a single public identity, risking privacy and user freedom. Buterin instead advocates for a pluralistic identity approach where no single entity controls ID issuance.

News from the Crypto World in the Past Week

- Trump Slams Debanking of Crypto Firms, Blames Biden-Era Regulators. President Donald Trump criticized the ongoing practice of “debanking” crypto companies in the U.S., calling it “very bad and very dangerous,” and attributed it to Biden-era regulators rather than the banks themselves. Trump, who claimed to be a personal victim of politically motivated banking restrictions, said regulators—not bank executives—hold real power over financial institutions. While he didn’t confirm plans for an executive order to ban debanking, reports suggest the current administration is considering one. Federal agencies under Trump have released documents hinting at past discouragement of crypto services by regulators, though no direct orders have been revealed.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Pudgy Penguins (PENGU) +64.55%

- Sei (SEI) +50.48%

- Maple Finance (SYRUP) +36.55%

- Arbitrum (ARB) +34.20%

Cryptocurrencies With the Worst Performance

- PAX Gold (PAXG) -3.28%

- Tehter Gold (XAUt) -3.12%

- Curve DAO Token (CRV) -1.45%

References

- RT Watson, Vitalik Buterin warns Sam Altman’s World digital IDs risk killing pseudonymity online, theblock, accessed on 29 June 2025.

- Sander Lutz, Trump Blames Biden for Banks Blocking Crypto: ‘There Is a Lot of Debanking’, decrypt, accessed on 29 June 2025.