Crypto investors and traders are becoming weary of Bitcoin’s (BTC) price movement, which has been stuck around the $80,000 range and has yet to break through the $85,000 level. Is there still a glimmer of hope for the crypto market going forward? Check out the full analysis from Pintu’s trader team.

Market Analysis Summary

- 🚨 Traders have been closely monitoring key resistance levels, particularly around $81,902.78, as well as support levels near $76,605.75.

- 📈 The U-6 unemployment rate in the United States climbed to 8.0% in February 2025, which is up from 7.5% the previous month.

- 💼 In February 2025, the U.S. economy added 151,000 jobs according to the latest non-farm payroll (NFP) report released by the Bureau of Labor Statistics.

- ⬆️ The latest Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics, released on March 11, 2025, revealed that U.S. job openings increased to 7.74 million in January.

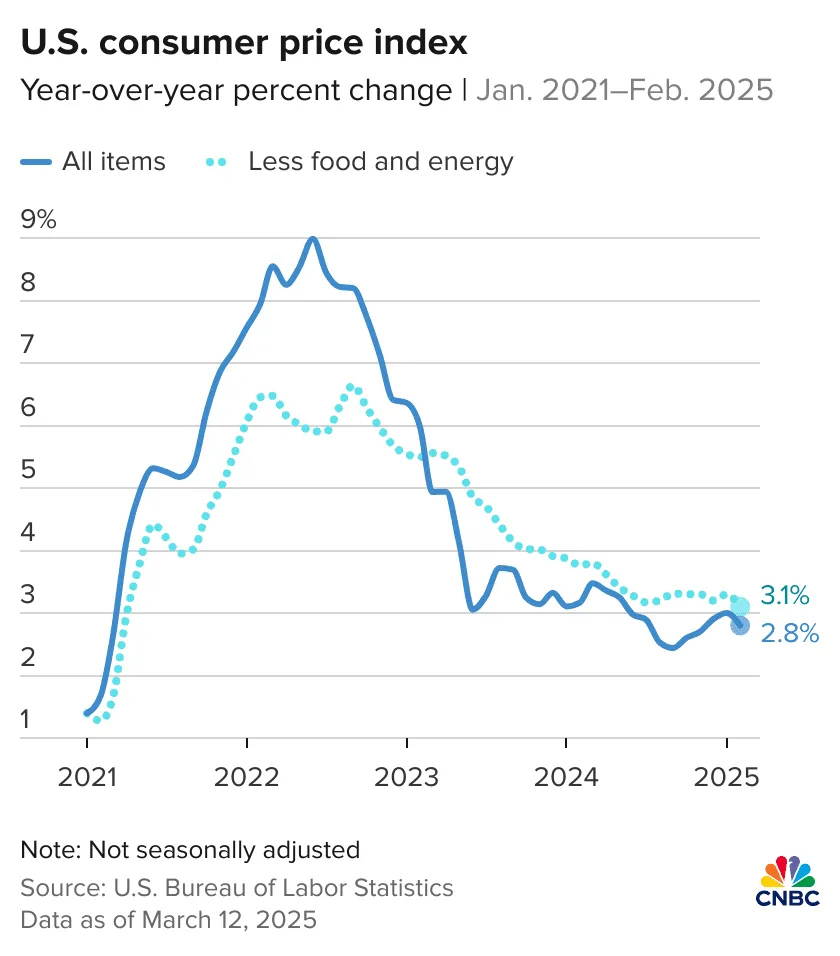

- 📉 The Consumer Price Index (CPI) for February 2025 showed that inflation eased to 2.8%, which was lower than expected.

Macroeconomic Analysis

Inflation Rate

The Consumer Price Index (CPI) for February 2025 showed that inflation eased to 2.8%, which was lower than expected. The CPI, which measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services, rose 0.2% in February on a seasonally adjusted basis. Over the last 12 months, the all items index increased 2.8% before seasonal adjustment. Economists had anticipated increases of 0.3% for both the overall and core indices, projecting annual inflation of 2.9%.

Excluding food and energy costs, the core CPI also rose 0.2% in February, resulting in a 12-month rate of 3.1%. This was also below economists’ expectations of 0.3% increases on both headline and core figures. The 3.1% annual increase in core CPI was the most modest since April 2021.

The slowdown in inflation was attributed to a reduction in price pressures for essential items. The easing of inflation in February provided relief to equity markets, alleviating immediate worries about stagflation. The Federal Reserve may have room to lower policy rates in the coming months if economic indicators continue to weaken.

Other Economic Indicators

- U-6 Unemployment Rate: The U-6 unemployment rate in the United States climbed to 8.0% in February 2025, which is up from 7.5% the previous month. The U-6 unemployment rate averaged 10.07% from 1994 to 2025. The highest rate was 23.00% in April 2020, and the record low was 6.50% in December 2022. Trading Economics’ global macro models project the U-6 unemployment rate to be 8.00% by the end of the current quarter, trending around 8.20% in 2026 and 8.10% in 2027.

- Unemployment Rate: In February 2025, the unemployment rate in the United States rose slightly to 4.1%, up from 4.0% in January. This increase comes as the economy added 151,000 jobs during the month, which was below analysts’ expectations of around 160,000 new positions. The job gains for January were also revised downward, indicating a cooling labor market amid ongoing economic uncertainties related to government layoffs and policy changes.

- Non-Farm payroll: In February 2025, the U.S. economy added 151,000 jobs according to the latest non-farm payroll (NFP) report released by the Bureau of Labor Statistics. This figure was slightly below economists’ expectations, which had predicted an increase of around 170,000 jobs.

- Fed Chair Powell Speech: On March 7, 2025, Federal Reserve Chair Jerome Powell delivered a speech at the University of Chicago Booth School of Business during the U.S. Monetary Policy Forum. In his remarks, Powell emphasized that despite elevated uncertainty in the economic landscape, the U.S. economy remains in a solid position, characterized by a strong labor market and inflation moving closer to the Federal Reserve’s long-term goal of 2%. He noted that GDP growth was robust, expanding at a 2.3% annual rate in the fourth quarter of the previous year, primarily driven by resilient consumer spending.

- JOLTS Job Opening: The latest Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics, released on March 11, 2025, revealed that U.S. job openings increased to 7.74 million in January. This represents a rise of 232,000 from the revised December figure of 7.51 million. The increase signals renewed optimism among employers at the start of the year, though some economists caution that this data precedes recent policy changes that could impact the labor market.

BTC Price Analysis

Over the past week, BTC has experienced notable price fluctuations, reflecting a mix of bullish and bearish sentiment in the market. As of March 12, 2025, BTC was trading around $80,827.04 after reaching a high of approximately $83,785 earlier in the week. The price action has been characterized by volatility, with significant movements influenced by technical indicators and macroeconomic factors. Traders have been closely monitoring key resistance levels, particularly around $81,902.78, as well as support levels near $76,605.75.

The recent price movement can be attributed to several factors. Positive developments in the cryptocurrency market, such as increased institutional interest and favorable regulatory news, initially fueled optimism. However, this was countered by macroeconomic pressures including new tariffs imposed by the U.S., which have contributed to a risk-off sentiment among investors. Additionally, strong Non-Farm Payroll reports raised concerns about potential tightening monetary policy from the Fed, leading to sell-offs in various risky assets, including Bitcoin.

Market sentiment has also been influenced by the actions of large investors or “whales,” who have been actively accumulating BTC despite recent price declines. This accumulation typically signals long-term confidence in BTC’s value; however, it has not been sufficient to counteract prevailing selling pressure in the short term. Reports indicate that over 22,000 BTC have been purchased by these whales in recent days, suggesting that while there is optimism about Bitcoin’s future potential, immediate price movements remain susceptible to broader market dynamics.

Technical analysis has played a crucial role in shaping traders’ expectations for BTC’s price trajectory. The presence of overbought and oversold conditions indicated by the Relative Strength Index (RSI) has led to erratic trading patterns. For instance, after hitting resistance at $81,902.78 earlier in the week, Bitcoin saw a retracement as bearish signals emerged from key technical indicators such as the MACD. This volatility reflects traders’ uncertainty about whether Bitcoin will break through resistance or face further downward pressure.

As traders look ahead, the next few days will be critical for assessing BTC’s ability to maintain its position within the current trading range or initiate another upward move toward previous highs. Analysts suggest that if BTC can successfully break above key resistance levels and sustain momentum, it may pave the way for a more bullish outlook in the coming weeks. Conversely, failure to hold above support levels could lead to further declines and increased caution among investors as they navigate this complex market landscape.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Pavel Durov’s Passport Returned, TON Society Celebrates Victory for Freedom of Speech. The TON Society celebrated the return of Pavel Durov’s passport by French authorities on March 15 as a victory for freedom of speech, online privacy, and innovation. After receiving permission from French officials, the Telegram founder left France for Dubai. Since his arrest on August 24, 2024, the TON Society has actively defended Durov, emphasizing his unwavering commitment to free speech and transparency. The organization had previously criticized Durov’s detention and urged intervention from the UN, EU, and other international organizations. Durov’s arrest sparked concerns among crypto and free speech advocates over potential state pressure on decentralized technology and privacy rights. French President Emmanuel Macron denied political motives behind the arrest and reaffirmed France’s commitment to freedom of expression.

News from the Crypto World in the Past Week

- Bitcoin Demand Plummets Amid Macroeconomic Uncertainty. According to data from CryptoQuant, Bitcoin demand has experienced a significant decline in 2025, entering negative territory with a reading of -142 on March 13. This drop is driven by macroeconomic concerns such as geopolitical tensions, persistently high inflation above the Federal Reserve’s 2% target, and fears of an impending recession. The post-election euphoria faded after the Crypto Summit at the White House on March 7. Despite CPI inflation data coming in lower than expected on March 12, Bitcoin’s price continued to fall. Crypto ETFs recorded outflows of $4.75 billion over the past four weeks, with BTC alone seeing outflows of $756 million. The total crypto market capitalization (Total3) has plunged by 27% since January 2025, while Bitcoin’s price has dropped over 22% from its peak of $109,000 to below $84,000. Analyst Matthew Hyland warned that Bitcoin must close above $89,000 on the weekly timeframe to avoid a deeper correction down to $69,000.

- Bitcoin ETF Investor Behavior Resembles GME and AMC Speculators. Recent analysis reveals that Bitcoin ETF investor behavior is more akin to speculators like those in GME and AMC stocks, rather than calculated investors in the style of Warren Buffett. Data from Velodata and Farside Investors indicate that large ETF outflows often coincide with local Bitcoin price lows, while inflows tend to occur at price peaks, reflecting a pattern of buying tops and selling bottoms. Over the past three weeks, Bitcoin ETFs have recorded cumulative outflows of $3.7 billion, with BTC prices dropping 10.5% and briefly hitting $76,500. Despite this, U.S. Bitcoin ETFs have still accumulated net inflows of $35 billion, with BlackRock’s IBIT leading the way, accounting for $39 billion of the total $57 billion inflows. Meanwhile, Grayscale’s GBTC has seen the largest outflows, with $22 billion exiting since ETF approval in January 2024.

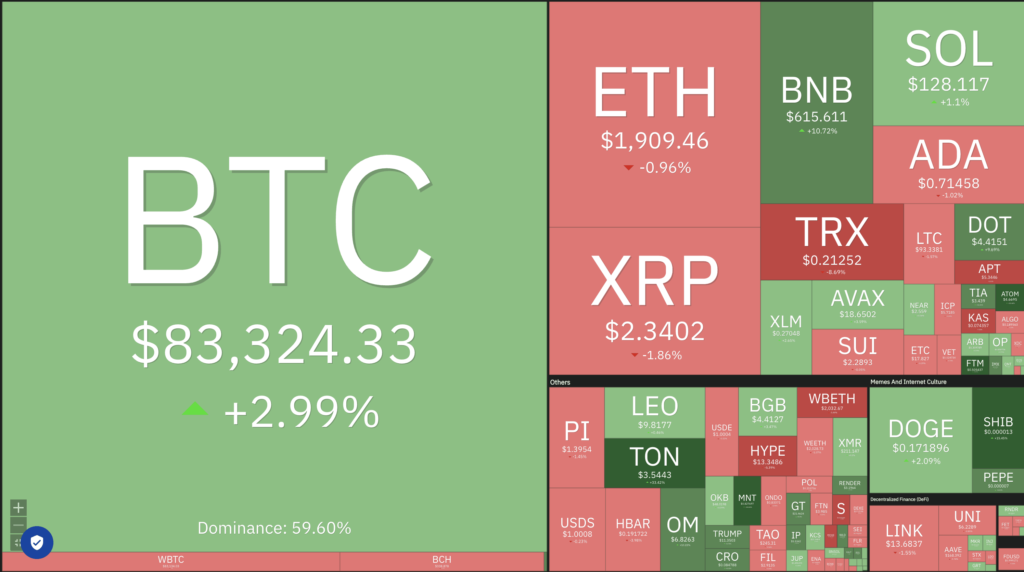

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- BinaryX (BNX) +52.25%

- Toncoin (TON) +30.90%

- Helium (HNT) +24.17%

- Mantle (MNT) 23.13%

Cryptocurrencies With the Worst Performance

- Ethena (ENA) -16.19%

- Aave (AAVE) -10.19%

- Ethereum Name Service (ENS) -10.16%

- TRON (TRX) -9.83%

References

- Vince Quill, Bitcoin apparent demand reaches lowest point in 2025 — CryptoQuant, Cointelegprah, accessed on 15 March 2025.

- Squiffs, Institutions are Top Blasting and Bottom Selling Bitcoin Just Like Us, Thedefiant, accessed on 15 March 2025.

- Vince Quill, TON Society celebrates Pavel Durov leaving France as free speech win, Cointelegprah, accessed on 16 March 2025.