The crypto market, particularly Bitcoin (BTC) and Ethereum (ETH), is showing an upward trend driven by substantial inflows into exchange-traded funds (ETFs). On May 16, BTC spot ETFs recorded a net inflow of $608.4 million. From a technical perspective, BTC remains on a bullish track. Check out the full analysis from the Pintu’s Trader Team.

Market Analysis Summary

- 🟢 BTC’s consolidation above $100,000 alongside ETH’s significant rally underscores renewed investor confidence.

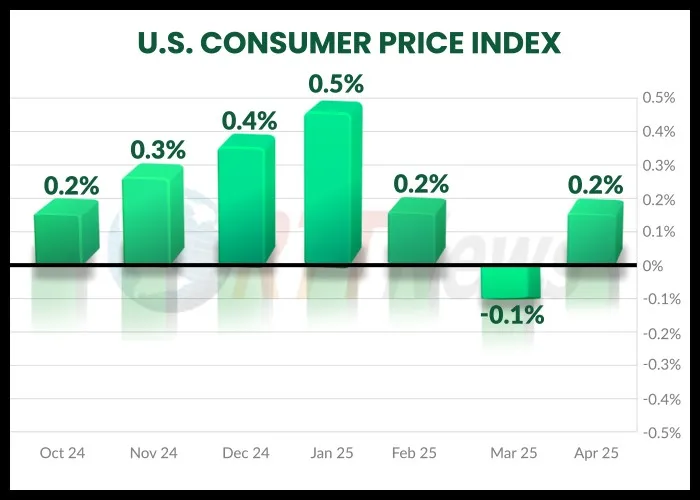

- 👍🏻 Headline inflation (CPI) rose 0.2% MoM and 2.3% YoY. Core inflation increased 0.2% MoM and 2.8% YoY. Figures suggest that inflationary pressures in the U.S. have continued to ease, with both headline and core rates at multi-year lows.

- 💼 Continuing jobless claims, which represent the number of people receiving unemployment benefits after their initial claim, edged up to 1,881,000 for the week ending May 3, 2025.

- 🔻 The U.S. Producer Price Index (PPI) for final demand fell unexpectedly by 0.5% in April 2025, marking the largest monthly decline in five years.

- 💬 The latest speech by Federal Reserve Chair Jerome Powell, delivered on May 15, 2025, emphasized the Fed’s cautious and patient approach amid ongoing economic uncertainties, particularly related to trade policy and supply shocks.

Macroeconomic Analysis

Inflation rate

The latest data for April 2025 shows that the U.S. Consumer Price Index (CPI) increased by 0.2% on a seasonally adjusted basis compared to the previous month, following a 0.1% decline in March. Year-over-year, the headline inflation rate (all items CPI) rose by 2.3%, which is the lowest annual increase since February 2021. This annual rate is a slight decrease from the 2.4% recorded in March, indicating a continued moderation in overall price growth.

For core inflation-which excludes the often-volatile food and energy categories-the index rose by 0.2% month-over-month in April, up from a 0.1% increase in March. On a year-over-year basis, core inflation remained steady at 2.8%, unchanged from the previous month and matching market expectations. This marks a four-year low for the core inflation rate, reflecting subdued underlying inflationary pressures in the U.S. economy.

The monthly increases in both headline and core inflation were primarily driven by higher shelter costs, which rose 0.3% in April and accounted for more than half of the all-items monthly increase. Energy prices also contributed, rising 0.7% over the month, while food prices declined slightly by 0.1%. Other notable contributors to the monthly core increase included medical care, motor vehicle insurance, education, and personal care, while prices for airline fares, used cars and trucks, and apparel fell.

Other Economic Indicators

- Jobless Claims: The latest data for U.S. jobless claims indicates continued stability in the labor market. For the week ending May 10, 2025, initial jobless claims were unchanged at a seasonally adjusted 229,000, matching both the previous week’s figure and market expectations. This figure remains within the range seen throughout the year and is consistent with historically low levels of layoffs, reflecting ongoing employer reluctance to reduce headcount amid hiring challenges and economic uncertainty.

- Retail Sales: The latest U.S. retail sales data for April 2025 shows a modest increase of 0.1% month-over-month, following a strong upwardly revised 1.7% surge in March. This slight gain indicates a significant slowdown in consumer spending growth compared to the previous month, suggesting that the pre-tariff shopping rush has largely ended. Despite the slowdown, the April result still slightly exceeded market expectations, which had forecasted no change or a flat reading.

- PPI: The U.S. Producer Price Index (PPI) for final demand fell unexpectedly by 0.5% in April 2025, marking the largest monthly decline in five years. This drop followed an unchanged reading in March that was revised upward. The decline was primarily driven by a 0.7% decrease in prices for final demand services, while prices for final demand goods remained unchanged. This marks a significant shift as the service sector’s margins, especially in trade services such as wholesaling and retailing, saw broad-based declines, including a notable 6.1% drop in machinery and vehicle wholesaling margins.

- NY Empire State Manufacturing Index: The latest NY Empire State Manufacturing Index for May 2025 declined to -9.2 from -8.1 in April, marking the third consecutive month of contracting manufacturing activity in New York State. Although the index fell, it performed better than the forecasted -10, indicating that while business conditions remain weak, the decline was less severe than expected. This suggests continued but modest deterioration in manufacturing business activity in the region.

- Powell Speech: The latest speech by Federal Reserve Chair Jerome Powell, delivered on May 15, 2025, emphasized the Fed’s cautious and patient approach amid ongoing economic uncertainties, particularly related to trade policy and supply shocks. Powell noted that longer-term interest rates are likely to remain higher as the economy evolves and policy adapts to new challenges. He highlighted that the current stance of monetary policy is moderately restrictive but well positioned to respond as more data becomes available.

BTC Price Analysis

Over the past week, BTC has shown a modest upward trend, gaining approximately 1.26% in value. Starting from around $102,900 on May 9, 2025, the price gradually climbed to about $104,200 by May 16, 2025. This steady increase reflects a relatively stable market with moderate bullish sentiment among investors during this period.

Technical Indicators Analysis

Daily price movements within the week exhibited some volatility but remained within a narrow range. For instance, on May 11, BTC reached a high near $104,630 before slightly pulling back in subsequent days. The lowest point during the week was around $97,700 on May 8, indicating a rebound from that dip. Overall, the price has been consolidating above the $100,000 mark, which serves as a psychological support level.

Trading volume remained robust throughout the week, with daily volumes often exceeding $40 billion, suggesting sustained investor interest and liquidity in the market. The average price over the last 50 and 200 days stands near $89,941 and $91,959 respectively, indicating that the current price is well above these moving averages, a bullish technical signal.

Market capitalization for BTC remains strong at over $2 trillion, underscoring its dominant position in the cryptocurrency space. The year-to-date high reached $109,114, showing that while BTC has not quite reached that peak in the past week, it remains within striking distance, supported by ongoing institutional interest and macroeconomic factors favoring digital assets.

In summary, BTC’s price over the last week has been characterized by steady gains, strong trading volumes, and consolidation above key support levels. While volatility persists, the overall trend suggests cautious optimism among traders, with BTC maintaining its position as a leading digital asset amid a dynamic market environment.

Wider Crypto Market

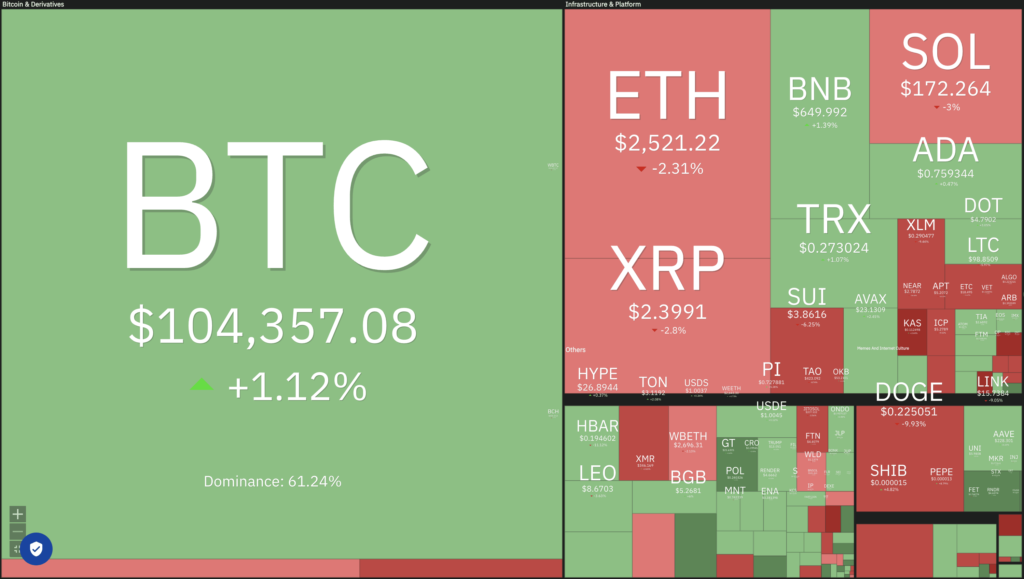

Over the past week, the cryptocurrency market has experienced a strong rally, with total market capitalization increasing by nearly $283 billion, or about 9.8%, pushing the overall market cap above the $3 trillion threshold to approximately $3.18 trillion. This surge was largely driven by renewed investor optimism stemming from geopolitical developments, including a potential easing of trade tensions between the U.S. and China, as well as a new trade deal between the U.S. and the U.K. These factors have reduced risk aversion and boosted demand for digital assets as alternative stores of value.

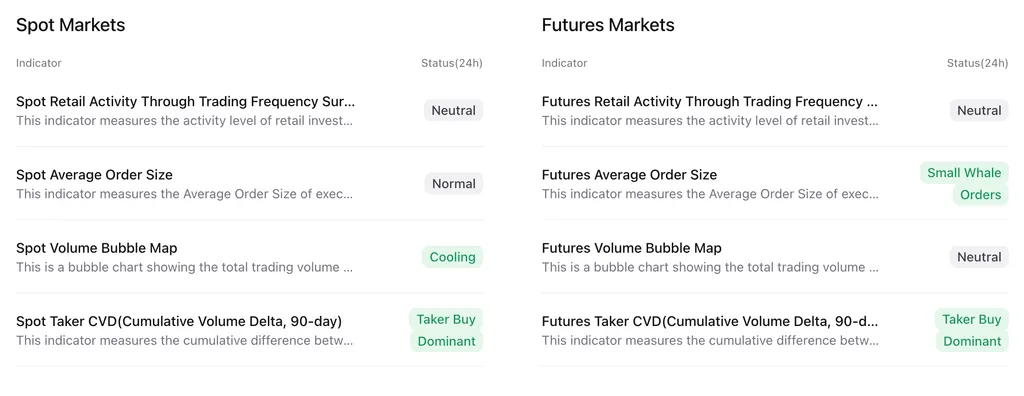

Institutional interest remained strong, with significant inflows into BTC ETF and large on-chain accumulation by major investors. For example, spot BTC ETFs recorded net inflows of $117 million, and BTC spot ETFs collectively purchased nearly six times the number of coins mined during the same period. This institutional demand has been a key driver of BTC’s sustained strength.

ETH also showed impressive performance, rallying by nearly 11% during the week, marking its best weekly gain since 2021. This surge was supported by the successful activation of the ETH mainnet’s Pectra upgrade, which improved network efficiency and investor confidence. ETH related funds saw inflows of $149 million, reflecting growing interest in the second-largest cryptocurrency amid positive macroeconomic news and ongoing technological improvements.

Altcoins broadly benefited from the positive market sentiment, with tokens like Solana rising by 7% and other altcoins seeing inflows totaling over $62 billion in market capitalization. The rotation of capital into altcoins suggests investors are seeking growth opportunities beyond BTC and ETH, especially as trade tensions appear to ease and the macroeconomic environment stabilizes. However, some altcoins remain volatile due to scheduled large token unlocks and ongoing market dynamics.

In summary, the past week in the crypto market has been marked by strong gains, driven by easing geopolitical risks, robust institutional demand, and technological progress. BTC’s consolidation above $100,000 alongside ETH’s significant rally underscores renewed investor confidence. Meanwhile, altcoins have started to attract more capital, indicating a broader market recovery and rotation toward diversified crypto assets.

On-Chain Analysis

News About Altcoins

- Pump.fun Launches Revenue Sharing for Coin Creators – Earn $5,000 per $10 Million in Trading Volume. Pump.fun has introduced a new revenue-sharing feature that allows coin creators to earn 0.05% of trading volume in SOL on PumpSwap, equivalent to $5,000 for every $10 million in trading volume. This feature applies to newly issued tokens, those still in the bonding curve, and tokens already transitioned to the PumpSwap trading pool. Previously, creators primarily profited from early sales, often leading to pump-and-dump behavior. By implementing this model, Pump.fun aims to foster sustainable community development and creative projects in the Solana memecoin ecosystem rather than speculative token sales.

News from the Crypto World in the Past Week

- Arthur Hayes Predicts Bitcoin to Hit $1 Million by 2028. Former BitMEX CEO Arthur Hayes predicts Bitcoin could reach $1 million by 2028, citing foreign capital outflows from the U.S. and a potential dollar devaluation as key catalysts. In his latest blog post, Hayes discusses how shifting U.S. economic policies under a new president and rising inflation will drive global investors toward Bitcoin as a hedge. He also projects Bitcoin to hit $150,000 this year before altcoins rally.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Four (FORM) +20.05%

- dogwifhat (WIF) +13.25%

- Kaspa (KAS) +4.89%

- TRON (TRX) +4.17%

Cryptocurrencies With the Worst Performance

- Optimism (OP) -17.58%

- Celestia (TIA) -16.19%

- Lido DAO (LDO) -15.77%

- Uniswap (UNI) -15.10%

References

- Shaurya Malwa, Pump.fun Launches Revenue Sharing for Coin Creators in Push to Incentivize Long-Term Activity, Coindesk, accessed on 18 May 2025.

- Mat Di Salvo, Money Printer Go Brr? Arthur Hayes Thinks It’s Coming—And Bitcoin Will Go Nuts, decrypt, accessed on 18 May 2025.