Bitcoin (BTC) has kept up its strong momentum, hitting a new record high of roughly $111,000. This performance debunks the “sell in May and go away” myth often repeated in the crypto industry. Check out the full analysis from the Pintu’s Trader Team.

Market Analysis Summary

- 🎯 Analysts point to a target above $120,000 as the next resistance level, though caution remains due to mixed signals on longer timeframes.

- 🟢 Analysts remain cautiously optimistic about altcoin prospects. Many projects are benefiting from technological upgrades, growing user bases, and favorable market sentiment following BTC’s strong performance

- 🏠 U.S. housing starts rose 1.6% month-over-month in April 2025 to a seasonally adjusted annual rate of 1.361 million units.

- 🏘️ U.S. building permits fell sharply in April 2025, dropping 4.7% month-over-month to a seasonally adjusted annual rate of 1.412 million units.

- 📉 U.S. consumer sentiment continued its downward trend in May 2025, with the University of Michigan’s preliminary index dropping to 50.8 from 52.2 in April.

Macroeconomic Analysis

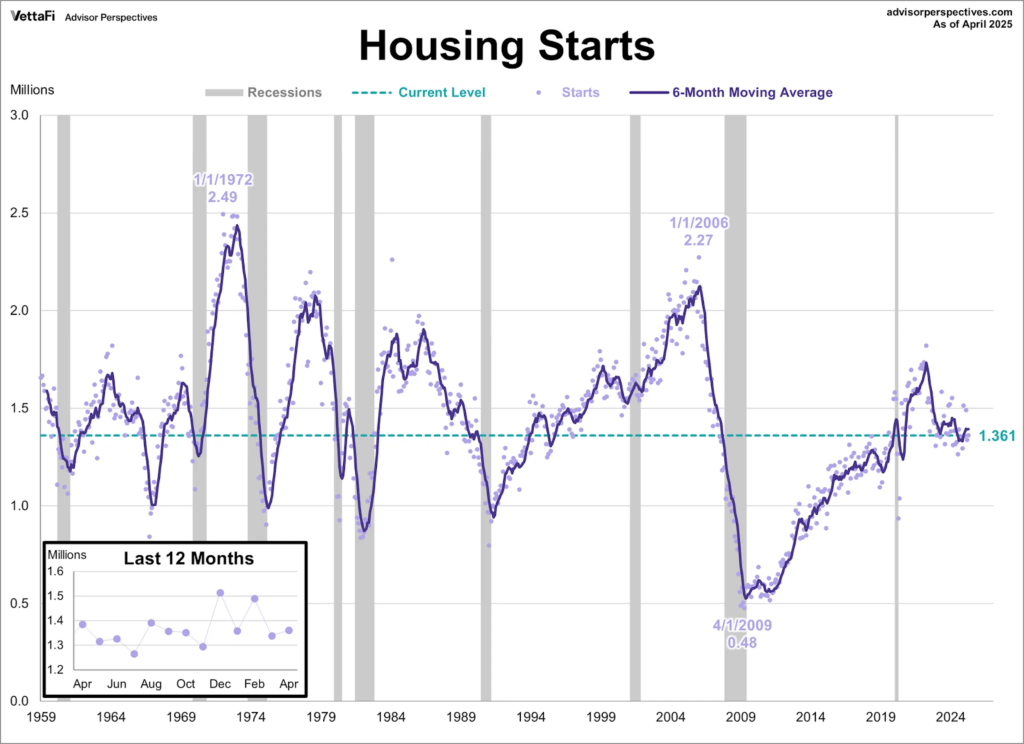

Housing Starts

U.S. housing starts rose 1.6% month-over-month in April 2025 to a seasonally adjusted annual rate of 1.361 million units, rebounding from a sharp decline in March. Despite this modest recovery, the figure came in slightly below market expectations and remains 1.7% lower than the level seen in April 2024. The overall increase was driven by a significant jump in multi-unit (five or more units) housing starts, which rose 11.1% to 420,000 units, while single-family housing starts—the core of the market—fell 2.1% to a nine-month low of 927,000 units.

Regionally, the data showed mixed performance. Housing starts increased in the South (up 10.9%) and the Northeast (up 12.9%), but declined sharply in the Midwest (down 10.8%) and the West (down 16.1%). The softness in single-family starts reflects ongoing challenges for homebuilders, including elevated mortgage rates near 7%, high construction and labor costs, and increased competition from existing home inventory. These factors are making builders more cautious, especially as consumer confidence and buyer traffic for new single-family homes remain subdued.

Building permits, a leading indicator of future construction, also declined 4.7% in April to an annual rate of 1.412 million, suggesting continued headwinds for new home construction in the coming months. The overall picture indicates that while the housing market is seeing some resilience in multi-family construction, the single-family segment remains under pressure due to affordability concerns and broader economic uncertainty.

Other Economic Indicators

- Building Permits: U.S. building permits fell sharply in April 2025, dropping 4.7% month-over-month to a seasonally adjusted annual rate of 1.412 million units. This marks the lowest level in eleven months and comes in below market expectations of 1.45 million permits. The decline was the largest since March 2024, reflecting the impact of higher mortgage rates and tariffs on imported materials, both of which have dampened demand for new construction.

- Michigan Consumer Sentiment: U.S. consumer sentiment continued its downward trend in May 2025, with the University of Michigan’s preliminary index dropping to 50.8 from 52.2 in April—well below market expectations and marking the second-lowest reading on record, after June 2022. This is the fifth consecutive monthly decline and represents a nearly 30% drop since January, reflecting deepening concerns among Americans about the economy and their financial prospects. The decline was broad-based, with both the current conditions index and the expectations gauge worsening, and current assessments of personal finances falling sharply on the back of weakening incomes.

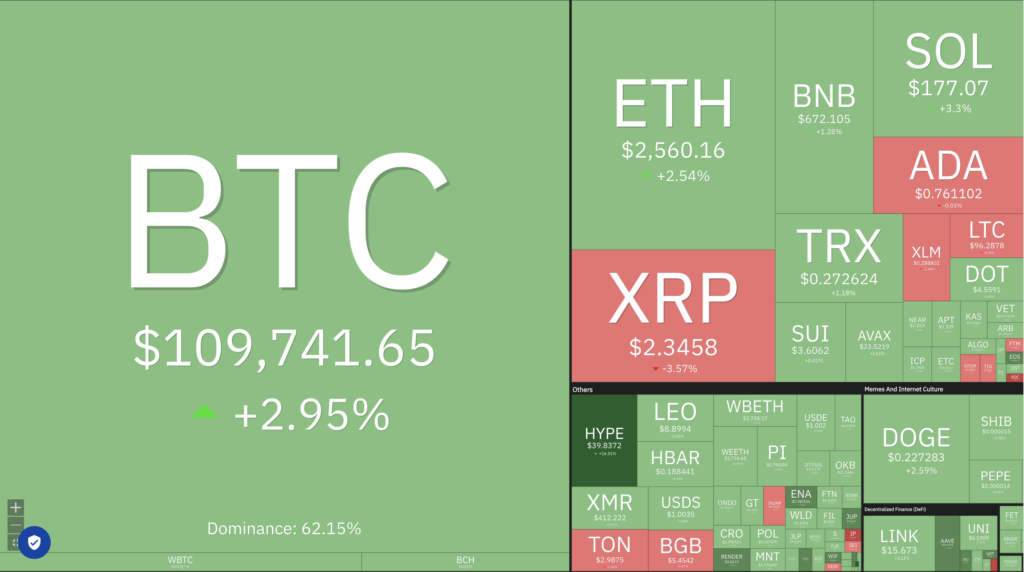

BTC Price Analysis

Over the past week, BTC has demonstrated a strong upward momentum, culminating in a new all-time high above $111,000 on May 22, 2025. The price steadily climbed from around $106,700 earlier in the week to an intraday peak of approximately $111,886, before settling near $110,900. This represents a gain of over 4% within the week, supported by increased trading volume, which nearly doubled typical levels, indicating robust market interest and participation. The rally broke through key resistance levels, including $105,000 and $110,000, signaling renewed bullish sentiment among investors.

Technical Indicators Analysis

BTC recently broke out of an ascending channel formed in early May, signaling strong momentum and accumulation. While weekly indicators like RSI and MACD show bearish divergences—typically warning of a pullback—shorter-term six-hour charts reveal hidden bullish signals and a parabolic pattern, suggesting the correction may be over. Analysts are eyeing $120,000+ as the next key resistance, though mixed signals on higher timeframes call for caution.

The rally has been bolstered by strong sentiment. CNBC’s Jim Cramer called BTC a “safe-haven asset” amid ongoing economic uncertainty, including Moody’s downgrade of U.S. debt. This boosted BTC’s appeal as a hedge. With the average realized price for 2025 investors at ~$93,266, most holders are in profit, reinforcing confidence. BTC’s market cap has hit ~$2.19 trillion, with daily volumes up 70%, reflecting surging interest.

Near-term forecasts remain bullish, with projections ranging from $116,000 to $138,000 by late May. The Fear & Greed Index at 70 shows strong market optimism, often preceding further gains. Still, the presence of bearish divergences on longer timeframes suggests the possibility of a correction. Traders should watch key support at $105,000 and resistance near $130,000.

In summary, BTC’s rally to new all-time highs is driven by technical breakouts and positive sentiment. While short-term momentum remains strong, mixed technical signals call for measured optimism. Overall, strong volume, news support, and bullish projections point to continued upside, though volatility persists.

Altcoin Analysis

Over the past week, several altcoins have shown notable price movements and renewed investor interest, driven by both technical developments and positive news. NEAR Protocol (NEAR) rose about 5.2%, trading around $3.02, supported by solid market capitalization and increased volume, reflecting growing adoption of its scalable blockchain platform. Solana (SOL) also gained 2.7%, reaching approximately $178, buoyed by ongoing network upgrades and optimism about its role in decentralized finance and NFTs. These gains come amid a broader bullish sentiment in the crypto space following BTC’s rally above $110,000, which often acts as a catalyst for altcoin momentum.

Smaller altcoins saw strong gains last week. Pi Coin (PI) jumped over 100% amid hype around a mid-May ecosystem update and Binance listing rumors, with rising community interest—especially in regions like Finland. Sui rallied 20%, breaking $4 for the first time since January, driven by increased on-chain activity and institutional demand, with over one million new wallets created daily.

Arbitrum (ARB) surged 51% in five days to around $0.47, but faces short-term pressure from a large token unlock on May 16. Sonic (ex-Fantom) rose 22% on expectations of a sharding upgrade, while Jupiter (JUP) gained nearly 40% thanks to a new DAO-linked revenue-sharing model that boosted liquidity and investor confidence.

Looking ahead, analysts remain cautiously optimistic about altcoin prospects. Many projects are benefiting from technological upgrades, growing user bases, and favorable market sentiment following BTC’s strong performance. However, risks remain from regulatory uncertainties, token unlock events, and broader macroeconomic factors. Investors are advised to monitor key technical levels and upcoming developments closely, as these will likely influence price trajectories. Overall, the altcoin market is showing signs of renewed vitality, with select tokens poised for further gains amid improving fundamentals and positive news flow.

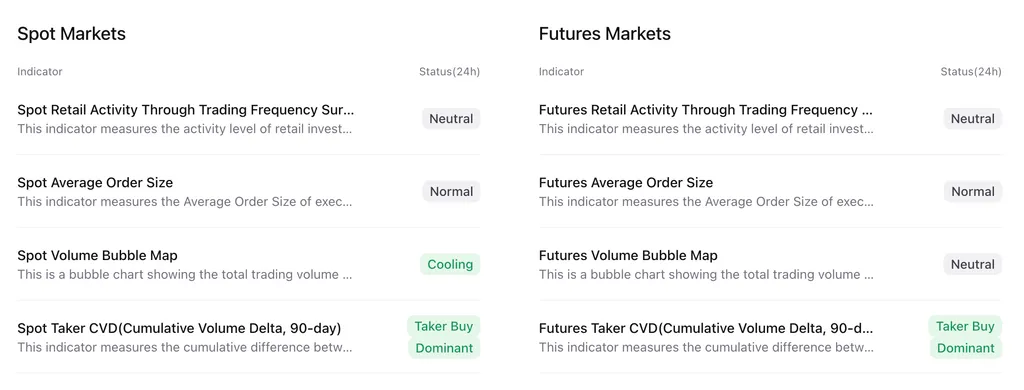

On-Chain Analysis

News About Altcoins

- Cetus Hack Drains $260 M: Sui’s Decentralization Put to the Test. On May 22, 2025, Cetus Protocol—the flagship DEX on the Sui blockchain—suffered a $260 million exploit after attackers manipulated its in-house oracle with spoof tokens, warping pool prices and siphoning real SUI and USDC. Sui’s TVL fell from $2.13 billion to $1.92 billion; SUI slid ~14 %, and many ecosystem tokens crashed up to 97 %. Although contracts were halted swiftly, Sui validators coordinated to freeze roughly $162 million of the stolen funds, sparking debate over validator-level control on a supposedly decentralized network. Cetus has posted a $6 million white-hat bounty while a multi-agency investigation—joined by security firms, exchanges, and regulators—continues.

News from the Crypto World in the Past Week

- Americans Hold More Bitcoin Than Gold as U.S. Government Doubles Global Gold Reserve Share in BTC. Recent data reveal a decisive investment shift: individual Americans now hold more Bitcoin than gold, with nearly half of the world’s BTC owners residing in the United States and controlling about 40% of the total supply. At the same time, the U.S. federal government has expanded its Bitcoin cache to a level that represents twice the global market share of official gold reserves, putting it well ahead of China and other nations. This mounting dominance underscores Bitcoin’s continued outperformance over both U.S. equities and gold as a preferred store of value and growth asset.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- SPX6900 (SPX) +28.25%

- Worldcoin (WLD) +26.61%

- Aave (AAVE) +21.33%

- dogwifhat (WIF) +18.06%

Cryptocurrencies With the Worst Performance

- Pyth Network (PYTH) -11.03%

- Story (IP) -10.45%

- Sonic (S) 9.21%

- XDC Network (XDC) -6.92%

References

- Ankish Jain, Cetus Protocol hack and Sui exploit: The full story behind the $260 million breach, Crypto.news, accessed on 24 May 2025.

- DeepNewz, Bitcoin Ownership Among Americans Surpasses Gold, U.S. Outpaces China with 40% of Bitcoin and Federal Holdings Double Gold Market Share, thedefiant, accessed on 24 May 2025.