Last week, the crypto market was taken by surprise when the U.S. Securities and Exchange Commission (SEC) approved an ETH (Ethereum) Exchange-Traded Fund (ETF). This approval led to a significant increase in the price of ETH, which surged by more than 20%, and also boosted Bitcoin (BTC) prices by about 5%. This development injects fresh optimism into the crypto industry, which has been grappling with interest rate uncertainties and various geopolitical challenges. Check out the full analysis below.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- ✍🏻 BTC tests next key resistance at $70,500 to confirm continued gains.

- 👀 The Fed is holding off on interest rate cuts, emphasizing the need to see more positive economic data before making a decision.

- 🏡 Sales of previously owned homes dropped by 1.9% in April compared to March, reaching 4.14 million units on a seasonally adjusted annual basis.

- 💼 1.79 million Americans were collecting jobless benefits during the week ending May 1.

Macroeconomic Analysis

Fed Minutes

Fed officials expressed heightened concerns about inflation at their most recent meeting, with members indicating they were not confident enough to proceed with interest rate reductions. Minutes from the April 30-May 1 policy meeting of the FOMC, released on Wednesday, revealed policymakers’ apprehension about the appropriate timing to ease rates.

The meeting followed several reports showing that inflation was more persistent than officials had anticipated at the beginning of 2024. The Fed targets a 2% inflation rate, but all indicators showed price increases significantly exceeding that goal.

On Tuesday, Fed Governor Waller mentioned that while he does not anticipate the FOMC needing to raise rates, he emphasized that he will require “several months” of positive data before considering a vote to cut.

Last week, Chair Jerome Powell conveyed sentiments that were less hawkish but reiterated that the Fed will need to be patient and let restrictive policy do its work as inflation remains elevated.

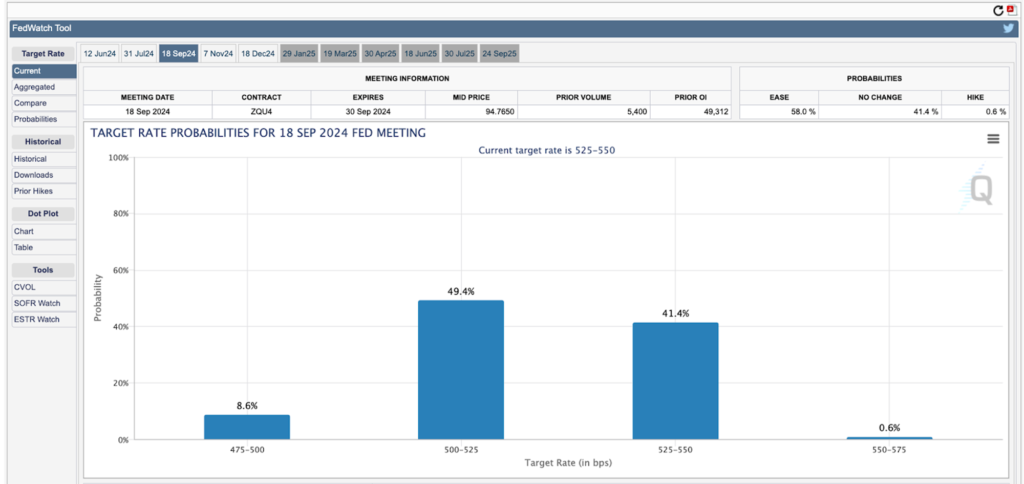

Markets have continued to adjust their expectations for rate cuts this year. As of Wednesday afternoon, following the release of the minutes, futures pricing indicated about a 60% chance of the first rate cut occurring in September, although the probability of a second cut in December decreased to just above a 50-50 chance.

Other Economic Indicators

- Existing Home Sales: In April, sales of existing homes fell 1.9% compared to March, reaching a seasonally adjusted annual rate of 4.14 million units. This decline was against expectations of an increase in sales, as reported by the National Association of Realtors. The decline also reflects a 1.9% annualized decline since April 2023. The decline in sales, based on closing contracts signed in February and March, coincided with a jump in mortgage rates to around 7%. Housing inventory at the end of April rose to 1.21 million units with a monthly increase of 9% and an annualized increase of 16% representing 3.5 months of supply. The most active market segment was homes priced over $1 million, with a 34% year-on-year increase in supply.

- Jobless Claims: Jobless claims for the week ending May 18 fell by 8,000 to 215,000, a decrease from 223,000 in the previous week. The four-week average of claims increased by 1,750 to 219,750. About 1.79 million Americans received unemployment benefits during the week ending May 11, up 8,000 from the previous week and 84,000 more than the same period in 2023.

- S&P services: The US S&P Global Composite PMI improved to 54.4 in May’s flash estimate, up from 51.3, indicating that business activity in the US private sector continued to grow at a faster pace than in April. Meanwhile, the S&P Global Manufacturing PMI rose to 50.9 from 50.0 during the same period, signaling an expansion in the manufacturing sector. Additionally, the S&P Global Services PMI increased to 54.8 from 51.3.

- New Home Sales: Data from the US Commerce Department showed that new home sales fell 4.7% to a seasonally adjusted annual rate of 634,000 units, a significant drop from the revised March rate of 665,000 units. Economists expected new home sales to continue to fall, predicting a rate of 679,000 units. It is even expected that the actual figure will be even lower. The decline in new home sales is due to rising mortgage rates and rising home prices, which together erode the affordability of many potential buyers.

BTC Price Analysis

BTC’s price began a downward correction towards the end of the week after gaining so much as 7.8% in the beginning of the week. Towards the mid week, we fell below the $70,000 support zone. BTC bears managed to push the price below a critical support level at $68,800, triggering bearish movements that led the price to dip toward $66,250.

A low was established at $66,250, and the price is now consolidating its losses. There was a minor increase above the $67,250 level. The first major resistance could be $68,800, with a key bearish trend line forming resistance at $69,200 on the hourly chart.

The next key resistance could be $70,000. A clear move above the $70,000 resistance might send the price higher. In this scenario, the price could rise and test the $70,500 resistance level.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As OI increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- JPMorgan Anticipates Spot Ethereum ETFs to Trade Ahead of November Amid Political Tensions. JPMorgan predicts that trading of recently approved spot Ethereum (ETH) exchange-traded funds (ETFs) will begin trading much sooner than November, emphasizing the political significance of crypto leading up to the 2024 U.S. presidential election. This follows the U.S. Securities and Exchange Commission’s (SEC) approval of 19b-4 forms for eight spot Ethereum ETF applicants, including Grayscale, Bitwise, BlackRock, and others. Despite the ongoing S-1 registration process, analysts foresee trading to begin in the coming weeks. The approval was likely facilitated by the removal of staking references, a contentious issue under the Howey test, which assesses whether staking constitutes an investment contract. Additionally, this development coincided with the House passing the FIT 21 bill, which could shift crypto oversight to the Commodity Futures Trading Commission, although its future in the Senate and stance from the Biden administration remain uncertain.

News from the Crypto World in the Past Week

- Trump Embraces Cryptocurrency in Lead-Up to 2024 Election. In a notable shift, former President and 2024 leading Republican candidate Donald Trump expressed strong support for cryptocurrencies in a post on Truth Social today, just before his scheduled appearance at the Libertarian National Convention. “I am very positive and open minded to cryptocurrency companies, and all things related to this new and burgeoning industry. Our country must be the leader in the field,” wrote Trump, emphasizing his stance in capital letters and contrasting it with President Biden’s purportedly anti-crypto position. This marks a significant change from his 2021 skepticism when he advocated for stringent regulations on cryptocurrencies. Trump’s pivot comes after his successful Trump-branded NFT trading cards and as crypto policy gains traction on the campaign trail. His comments aim to appeal to pro-crypto voters and potentially draw support away from third-party candidate Robert F. Kennedy Jr.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Pepe (PEPE) +54,66%

- Uniswap (UNI) +41,63%

- Ondo (ONDO) +38,60%

- Lido DAO (LDO) +36,45%

Cryptocurrencies With the Worst Performance

- Arweave (AR) -14,52%

- Fantom (FTM) -10,42%

- Akash Network (AKT) -9,68%

- ORDI (ORDI) -8,27%

References

- Zack Abrams, Donald Trump, once a Bitcoin skeptic, declares support for crypto in Truth Social post, theblock, accessed on 26 May 2024.

- Yogita Khatri, JPMorgan expects spot Ethereum ETFs to begin trading ‘well-ahead of November’, theblock, accessed on 26 May 2024.