Crypto investors are still anticipating one of the market’s biggest catalysts: an interest rate cut by the Federal Reserve (Fed). In the meantime, Bitcoin (BTC) has shown resilience, holding firmly above the key psychological level of $100,000. What could be next as we enter Q4? Read the full analysis from Pintu’s Trader Team in the article below.

Market Analysis Summary

- 🗒️ BTC has successfully broken above $113,500, with potential to reach targets in the $118,000–$120,000 range in the coming weeks.

- 🚀 Financial institutions project a strong outlook for ETH, with year-end targets ranging from $7,500 to $10,000–$12,000.

- 📈 Solana (SOL) is positioned for further gains after breaking resistance near $220–$221, with a potential target around $300 if the bullish trend continues.

Macroeconomic Analysis

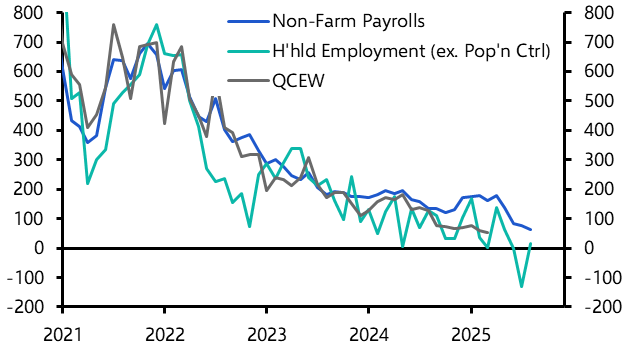

Non Farm Payroll

The August 2025 nonfarm payroll and wage data raised concerns, with details as follows:

- Total nonfarm payrolls rose by only 22,000, falling sharply below expectations.

- The unemployment rate climbed to 4.3%, the highest level in several years.

- Private-sector payrolls added about 38,000 jobs, led by health care, social assistance, leisure and hospitality, and retail trade.

The weaker payroll figures and downward revisions have increased worries about a potential economic slowdown or even recession risk. Investors and analysts now widely expect the Federal Reserve to respond with interest rate cuts in the coming months to support growth. A softer labor market, together with moderate wage inflation, indicates reduced pressure on the Fed to maintain tight monetary policy, and markets are increasingly pricing in at least a quarter-point rate cut at the next meeting.

Other Economic Indicators

- Unemployment Rate: In August 2025, the official unemployment rate (U-3) rose to 4.3%, up slightly from July’s 4.2% and reaching its highest level in several years. This modest but notable uptick suggests that job creation is slowing and that businesses may be adopting a more cautious approach to hiring.

- PPI: In August 2025, the Producer Price Index (PPI) for final demand slipped 0.1% month-over-month, its first decline in several months, after modest increases earlier in the summer. On a year-over-year basis, producer prices rose 2.6%, down from previous readings. Financial markets responded favorably to the report, as expectations for potential interest rate cuts increased.

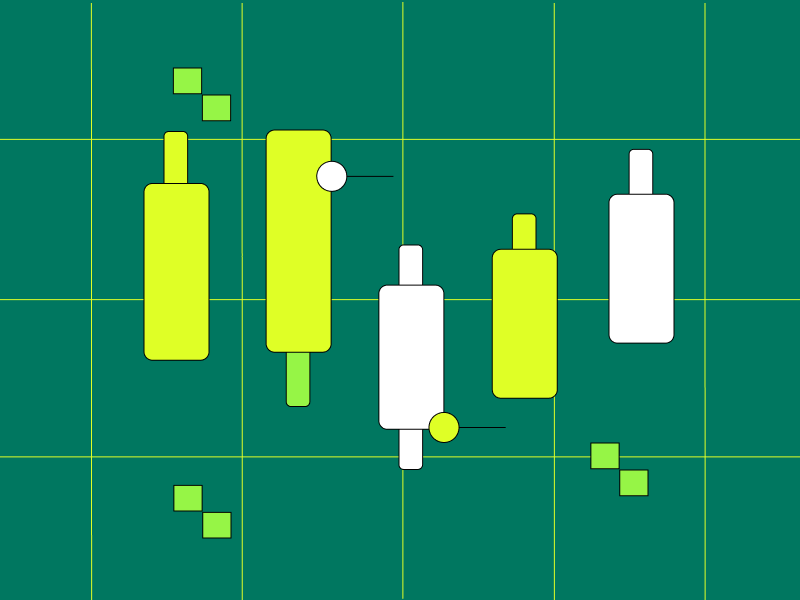

BTC Price Analysis

Over the past week, BTC traded in the $113,000–$116,000 range, showing a strong recovery in mid-September. The intraday low near $110,812 indicates that BTC is consolidating within a tight range. This consolidation reflects a balance between buying pressure from long-term holders and selling pressure from traders taking profits after recent gains. Holding above $110,000 is crucial to maintain market confidence and avoid a sharper correction.

BTC Technical Analysis

Traders and investors can monitor the following BTC technical analysis points:

- Strong support exists between $106,000 and $100,000, particularly around the 200-day moving average, which is viewed as a critical line of defense by traders.

- A breakout above $113,500 could trigger renewed bullish momentum, opening the path toward targets in the $118,000–$120,000 range in the coming weeks.

- The medium- to long-term outlook remains optimistic, with analysts projecting a move toward $118,000 by the end of the month if support levels hold.

- A more bullish scenario envisions a potential rally toward $150,000 or higher, depending on institutional participation and broader macroeconomic developments.

ETH Price Analysis

ETH traded in the $4,400–$4,600 range, showing moderate upward momentum after recent pullbacks. Intraday swings touched a low around $4,279, reflecting a period of relative stability and consolidation. This trading activity suggests that short-term volatility is easing, potentially paving the way for the next directional move as investors await new catalysts.

ETH Technical Analysis

From a technical perspective, traders and investors can monitor the following key points:

- ETH appears to have broken out of a descending triangle pattern and is holding firm above the $4,320–$4,325 support zone. This base has been defended multiple times, highlighting growing buyer interest.

- Last week, ETH managed to break resistance near $4,500, opening potential upside targets in the $4,700–$4,950 range.

- On the downside, a slip below $4,200 could expose deeper support levels around $4,050–$3,900.

- Forecasts from financial institutions project a strong outlook, with year-end targets ranging from $7,500 to $10,000–$12,000, depending on macroeconomic trends and regulatory developments.

ETH is facing competitive pressure from emerging blockchains and ongoing questions about its upgrade roadmap and scalability. Some analysts have pointed out a “midlife crisis” narrative, with rival networks gaining traction thanks to faster speeds and lower costs. Nevertheless, ETH remains fundamentally bullish in the medium to long term if its structural upgrades proceed as planned.

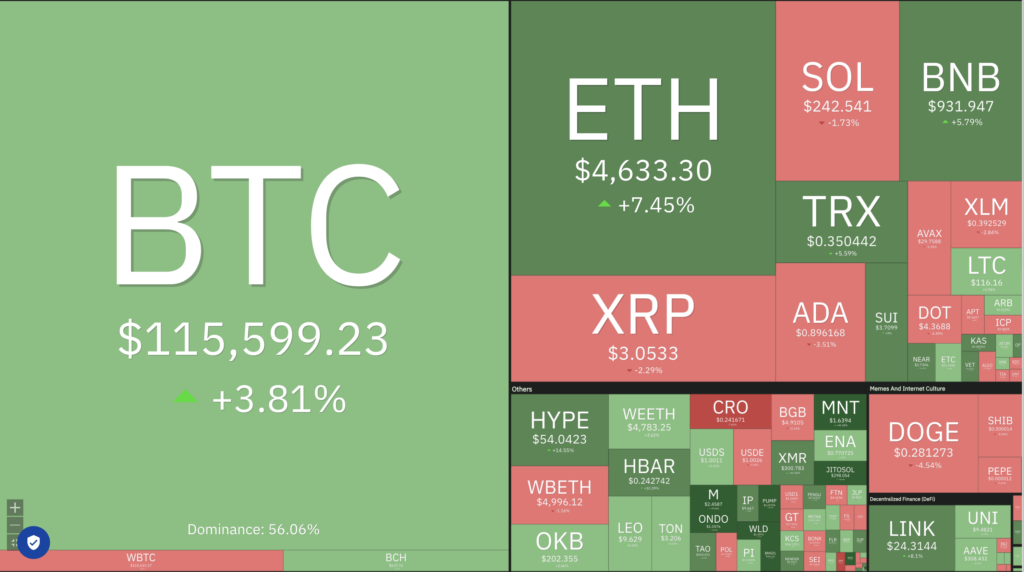

Analysis Altcoin

In August 2025, the broader cryptocurrency market experienced notable developments, signaling a shift in investor focus towards altcoins. The total market capitalization of altcoins surpassed $1 trillion for the first time, reflecting a significant increase in investor interest and capital inflow into these assets. Here are the key notes on altcoin price movements:

- Remittix (RTX) emerged as a standout performer, attracting significant attention due to its innovative approach to cross-border remittances. The project raised over $24 million through token sales and is set to launch its Beta Wallet, which supports multiple cryptocurrencies and fiat currencies. This development positions Remittix as a promising contender in the altcoin market, offering real-world utility and addressing a substantial global payments market.

- Binance Coin (BNB) has shown resilience, trading around $903.

- XRP has held steady at around $3.00.

- Solana (SOL) is positioned for further gains after breaking resistance near $220–$221. Momentum indicators and moving averages point to a potential target of around $300 if the bullish trend continues.

Looking ahead, the altcoin market’s trajectory appears promising, with analysts projecting potential market capitalizations reaching up to $1.5 trillion by the end of 2025. This optimistic outlook is supported by factors such as increasing institutional interest, technological innovations, and the maturation of blockchain ecosystems

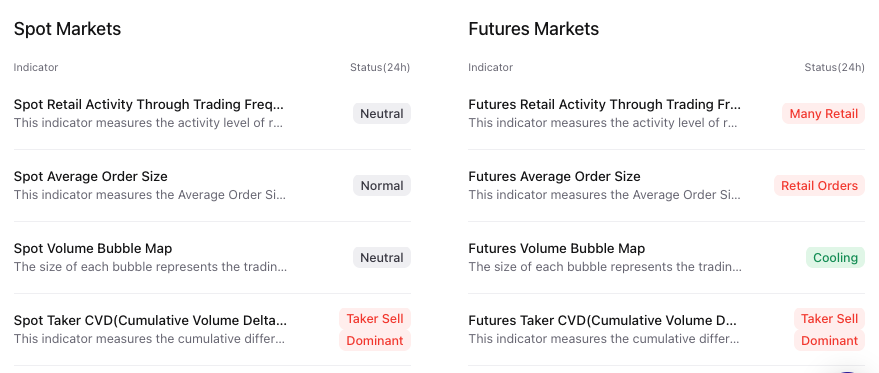

On-Chain Analysis

News About Altcoins

- Arthur Hayes Shifts From Memecoins to High-Yield DeFi Bets. After a year of diving into memecoins like PEPE and MOTHER, BitMEX co-founder Arthur Hayes is pivoting toward decentralized finance protocols that generate real yield for tokenholders. Calling memecoins “too risky,” Hayes is backing projects such as EtherFi, Ethena, and Hyperliquid, predicting returns of 34x, 51x, and up to 130x respectively. His thesis emphasizes revenue, product-market fit, and value distribution to tokenholders over hype or VC backing. While still bullish on Bitcoin—with a $700,000 target by decade’s end—he believes the biggest upside now lies in DeFi protocols positioned to capture capital inflows from stablecoins and onchain markets.

News from the Crypto World in the Past Week

- New SEC Chair Paul Atkins: “Crypto’s Time Has Come”. Paul Atkins, the newly appointed SEC chair, has declared the end of the “weaponization” of regulation under Gary Gensler, signaling a pro-innovation shift in US crypto policy. Speaking at the OECD roundtable, Atkins unveiled Project Crypto, an initiative to modernize securities rules so that most tokens are treated as non-securities, replacing ad hoc enforcement with clear, predictable regulation. He emphasized minimal but effective oversight to protect investors without stifling entrepreneurs, praised the EU’s MiCA framework as a model, and outlined plans for collaboration with other regulators to support innovation through unified trading platforms. Atkins concluded with a vision of America reclaiming leadership in digital asset innovation under transparent, forward-looking regulation.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Pump.fun (PUMP) +69.01%

- Worldcoin (WLD) +61.78%

- Mantle (MNT) +40.90%

- Dogecoin (DOGE) +34.01%

Cryptocurrencies With the Worst Performance

- Four (FORM) -30.78%

- Cronos (CRO) -7.08%

- XDC Network (XDC) 1.19%

- UNUS SED LEO (LEO) 0.19%

References

- Ronaldo Marquez, SEC Chair Declares ‘Crypto’s Time Has Come’ In Latest Statement – Get The Full Scoop, cryptorank, accessed on 14 September 2025.

- Kyle Baird, Arthur Hayes says he’s hanging up his memecoin hat in favour of high-yield DeFi plays, dlnews, accessed on 14 September 2025.