Crypto investors are entering early September with a more optimistic outlook as the Federal Reserve is expected to cut interest rates for the first time in 2025. So, what does this mean for Bitcoin (BTC) and Ethereum (ETH)? Read the full analysis from Pintu’s Trader Team in the article below.

Market Analysis Summary

- 🔑 Analysts have projected BTC’s price potential to $125,000 in September.

- 🟢 Analysts predict some near-term volatility but remain bullish on ETH’s broader outlook, with forecasts indicating the potential for ETH to reach between $4,600 and $5,300 in the coming weeks.

- ✅ Powell signaled that the Fed is likely to proceed cautiously but is now inclined toward cutting interest rates in the upcoming September 2025 meeting to address these rising labor market risks.

Macroeconomic Analysis

Jackson Hole Symposium

The latest Jackson Hole Economic Policy Symposium was held from August 21-23, 2025, under the theme “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.”

- The 2025 symposium focused especially on how shifting labor market dynamics, demographic changes, and productivity trends pose challenges for economic policy.

- Federal Reserve Chair Jerome Powell delivered a key speech that highlighted rising risks in the labor market alongside persistent inflation concerns.

- At the same time, he acknowledged that inflation risks remain elevated due to ongoing tariff-induced price pressures, though these may be diminishing.

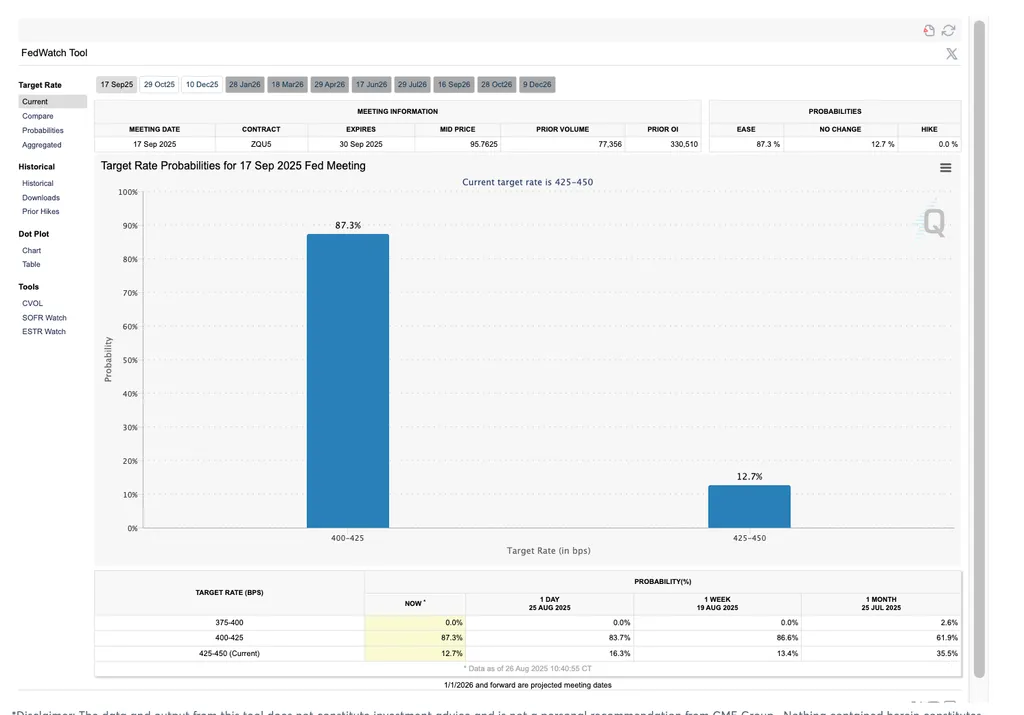

- Powell signaled that the Fed is likely to proceed cautiously but is now inclined toward cutting interest rates in the upcoming September 2025 meeting to address these rising labor market risks.

The market reacted positively to Powell’s speech, with US stock indexes rallying and expectations rising for a quarter-point rate cut at the Federal Reserve’s September meeting. Traders also assigned growing probabilities to additional rate cuts by the end of 2025.

Other Economic Indicators

- Existing and New Home Sales: In July 2025, existing home sales in the United States experienced a modest increase of 2% month-over-month, reaching a seasonally adjusted annual rate (SAAR) of 4.01 million units, according to the National Association of Realtors (NAR)

- Durable Good Orders: In July 2025, new orders for U.S. durable goods fell by 2.8% from the previous month, extending the sharp decline observed in June which was revised to a 9.4% drop. This decline was largely driven by a steep fall in orders for transportation equipment, particularly non-defense aircraft

- S&P global manufacturing and services PMI : The latest S&P Global US Manufacturing Purchasing Managers’ Index (PMI) for August 2025 showed a strong rebound, rising sharply to 53.3 from 49.8 in July, well above market expectations of 49.5.

BTC Price Analysis

Over the past week, BTC (BTC) price showed notable fluctuations within a range roughly between $110,000 and $118,000. On August 27, 2025, BTC was priced around $111,843, showing a mild 1.5% increase from the previous day and a considerable 77.75% gain from the same time last year. The price had seen highs exceeding $117,000 during mid-August, peaking near $118,400, followed by some volatility with price pullbacks down to the low $110,000s. Overall, the price action demonstrated a generally bullish.

BTC Technical Analysis

Analysts have projected BTC’s price potential to reach between $110,460 and $121,184 for August 2025, with September expected to bring further upside with forecasts approaching $125,000. This trajectory is supported by technical analysis suggesting strong momentum if the price can sustain above key support levels around $116,000. The optimism is reinforced by increasing institutional interest, declining US interest rates, and regulatory developments such as cryptocurrency inclusion in retirement savings options like 401(k)s, which enhance BTC’s investment appeal as a store of value or hedge.

ETH Price Analysis

Over the past week, ETH (ETH) price experienced notable volatility with a general upward trend. On August 27, 2025, ETH was priced around $4,602, reflecting a 5.04% increase from the previous day and a significant 71.53% rise from the same time last year. The week saw ETH fluctuate between roughly $4,300 and $4,800, with some short-term pullbacks below $4,200 early in the week that raised concerns about potential corrections. However, the price rebounded strongly, supported by healthy trading volumes and technical indicators suggesting continued momentum.

ETH Technical Analysis

Analysts predict some near-term volatility but remain bullish on ETH’s broader outlook, with forecasts indicating the potential for ETH to reach between $4,600 and $5,300 in the coming weeks. Key technical supports include exponential moving averages (EMAs) around $4,276 to $4,487, which have helped sustain upward momentum. Additionally, growing inflows into ETH spot ETFs and increased interest from institutional investors have underpinned price strength. These developments suggest ETH’s ongoing adoption as a valuable digital asset and a platform for decentralized finance (DeFi) and smart contracts.

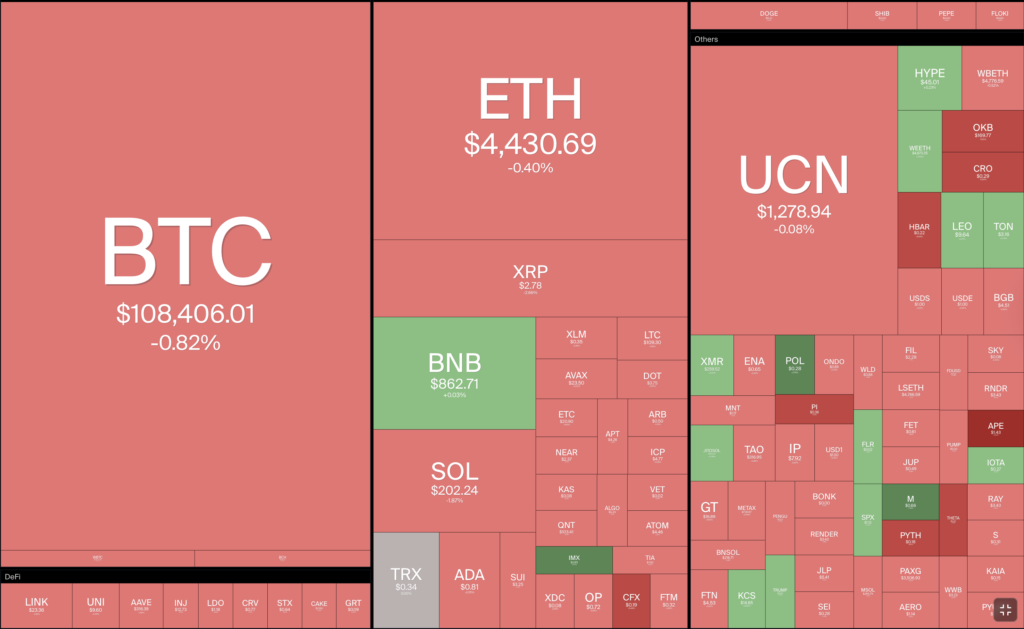

Altcoin Analysis

In the past week of August 2025, the wider crypto market excluding BTC (BTC) and ETH (ETH) showed strong signs of renewed momentum, with several altcoins outperforming the two dominant cryptocurrencies. The overall altcoin market capitalization surged by around 1.5%, accompanied by a sharp 34% increase in trading volumes, signaling increased investor interest and liquidity. Institutional inflows favored altcoins significantly, with some projects linked to emerging technologies like AI and expanded decentralized finance (DeFi) ecosystems gaining particular attention. However, the altseason index indicating the dominance of altcoins over BTC remains moderate, suggesting this rally is still in its early stages.

Technically, many altcoins showed strong support levels according to EMA and favorable price/volume action, pointing to sustained momentum in the near term. The growing adoption of real-world use cases—ranging from gaming and social NFTs to stablecoins and cross-border payments—provides a solid fundamental backdrop that could fuel further price appreciation. Moreover, regulatory clarity emerging from legislative initiatives like the GENIUS Act and anticipated SEC rulings on ETFs have reduced uncertainty for institutional investors, enhancing confidence in altcoin investment.

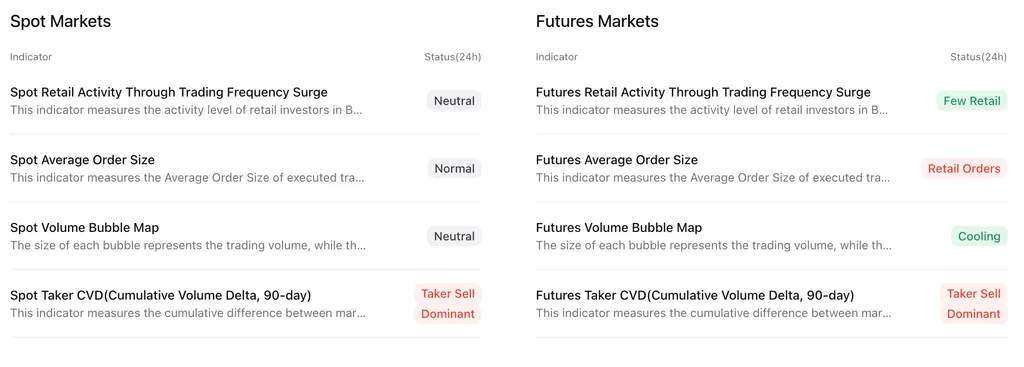

On-Chain Analysis

News About Altcoins

- U.S. Publishes Economic Data on Blockchains, Boosting PYTH and LINK. The U.S. government has begun publishing GDP data across eight blockchains—Bitcoin, Ethereum, Solana, Tron, Stellar, Avalanche, Arbitrum, and Polygon—using Pyth and Chainlink oracles, signaling deeper engagement with DeFi. The move sent PYTH soaring 52% to a $1 billion market cap, while LINK rose 2.8% to $17 billion, supported by Chainlink’s new reserve buyback program that lifted holdings to 193,076 LINK ($4.8 million). Base, Coinbase’s Ethereum Layer 2, was notably excluded, while Stellar was the smallest network included with $144M TVL.

News from the Crypto World in the Past Week

- Ethereum’s Onchain Activity Hits Multi-Year Highs Amid Treasury Accumulation and ETF Demand. Ethereum posted a string of multi-year peaks in August, with adjusted onchain transfer volume surpassing $320 billion—the highest since May 2021 and the third-largest ever—alongside record 30-day transactions, near-ATH active addresses, and strong TVL. This surge was fueled by corporate treasuries tripling their ether holdings to over $12 billion, increased spot ETH ETF trading, and transaction fees near five-year lows following network upgrades like Dencun (EIP-4844) and Pectra. Validator churn and restaking flows also added to network activity, while analysts highlight Ethereum’s undervaluation despite ETH/BTC strength. ETH traded around $4,337 by late August, about 12% below its ATH.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Cronos (CRO) +87.16%

- Pyth Network (PYTH) +53.76%

- Story (IP) +34.96%

- Pump.fun (PUMP) +14.40%

Cryptocurrencies With the Worst Performance

- Pendle (PENDLE) -20.13%

- Aerodrome Finance (AERO) -18.87%

- Lido DAO (LDO) -17.71%

- SPX6900 (SPX) -16.30%

References

- Naga Avan-Nomayo, Ethereum onchain volume tops $320 billion in August, highest since mid-2021, theblock, accessed on 31 August 2025.

- Squiffs, US Government Taps Chainlink and Pyth to Publish Economic Data Onchain, thedefiant, accessed on 31 August 2025.