The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), is consolidating as it awaits a potential interest rate cut in September offering a window of opportunity for investors. Read the full analysis from Pintu’s Trader Team in the article below.

Market Analysis Summary

- 📊 BTC’s price fluctuations in the range of $107,000, $110,642, and $113,237 reflect its sensitivity to macroeconomic indicators.

- 👀 Analysts are closely watching ETH’s key support around $4,200 and resistance levels near $4,530 and $4,800.

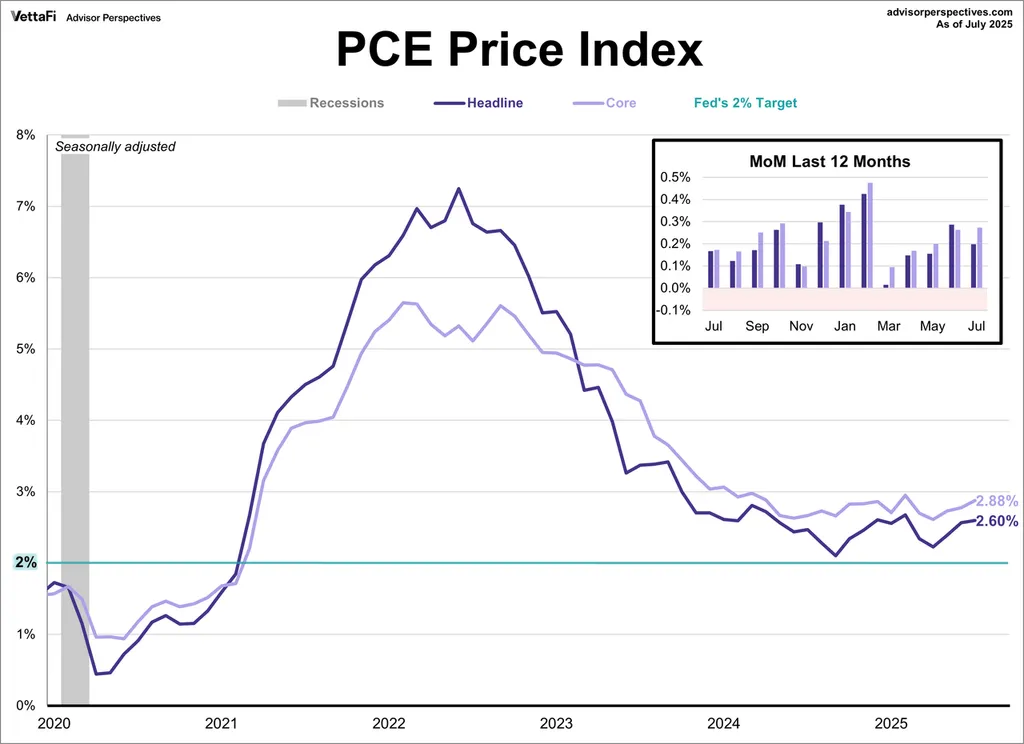

- ⚠️ The U.S. core PCE index in July 2025 still showed pressure, with a monthly increase of 0.3% and an annual increase of 2.9%. This condition is likely to make the Fed cautious in deciding the interest rate cuts.

Macroeconomic Analysis

U.S. Core PCE Inflation Data for July

The U.S. core PCE inflation data in July showed similar performance to June, including:

- A month-over-month increase of 0.3%, which if sustained would annualize well above the 2% target, meaning inflationary pressures are not yet fully under control.

- The year-over-year figure rose from 2.8% to 2.9%, reinforcing the idea that disinflation progress has slowed.

For policymakers, these figures complicate the debate about when and how aggressively to cut interest rates. While broader economic conditions show signs of softening in the labor market, the persistence of inflation keeps the Fed cautious about easing too soon.

For the wider economy, the latest data carries dual implications. On one hand, continued spending and resilient demand support growth, but this same resilience is contributing to sticky inflation. As a result, households and businesses face an extended period of higher borrowing costs if the Fed delays rate cuts.

Other Economic Indicators

- Personal Income & Spending: In July 2025, U.S. personal income rose by 0.4% month-over-month, supported mainly by higher wages and salaries, while disposable income adjusted for inflation grew more modestly at 0.2%. At the same time, personal spending increased by 0.5% in nominal terms, with real spending, which strips out inflation, advancing 0.3%.

- Goods Trade Balance: In July 2025, the U.S. goods trade deficit widened sharply to $103.6 billion, up approximately 22% from June’s figure of $84.9 billion. The increase was driven largely by a surge in imports, which climbed 7% to about $281.5 billion, while exports slipped slightly to around $178 billion.

- Michigan Consumer Sentiment: Consumer sentiment in the U.S. slipped in August 2025, with the index descending to the high-50s from around the low-60s the previous month. While sentiment had hovered above recent lows earlier in the year, the decline reflects a growing sense of unease among households

- S&P and ISM Manufacturing PMI: The S&P Global U.S. Manufacturing PMI rebounded strongly, climbing into expansion territory at 53.0, marking the most robust improvement since May 2022. This momentum was driven by surging new orders, factory restocking, and improved hiring, signaling that production activity was heating up as businesses prepared for rising demand.

- JOLTS Job Openings: In July 2025, U.S. job openings declined to 7.181 million, marking the lowest level in nearly a year. This drop of 176,000 positions from June was below economists’ expectations and indicates a cooling labor market.

- Jobless Claims: In the week ending August 30, 2025, initial jobless claims in the United States rose to 237,000, marking the highest level since June. This increase of 8,000 from the previous week’s revised figure of 229,000 suggests a softening in the labor market, as more individuals are seeking unemployment benefits for the first time

- Services PMI: In August 2025, the U.S. services sector demonstrated resilience, as indicated by the S&P Global Services PMI, which registered at 54.5, slightly below the earlier flash estimate of 55.4 but still reflecting robust expansion.

BTC Price Analysis

Over the past week, BTC’s price has experienced notable fluctuations, reflecting a complex interplay of market dynamics. Starting the week at approximately $107,000, BTC saw a significant surge, reaching a peak of $113,237.0. This rally was driven by increased investor optimism, partly fueled by expectations of a potential interest rate cut by the Federal Reserve. However, the momentum proved short-lived, as the price retraced to around $110,642.0, indicating a market that remains cautious and sensitive to macroeconomic indicators.

ETH Price Analysis

Over the past week, ETH has experienced a slight decline in value, trading around $4,315 as of September 5, 2025. This represents a decrease of approximately 3.81% from the previous week. The price movement has been influenced by various factors, including ETF outflows and the typically weaker market seasonality observed in September. Despite this downturn, ETH’s price remains above the $4,000 mark, indicating a level of resilience in the market.

ETH Technical Analysis

The recent price action has led to a consolidation phase, with ETH trading within a defined range between $4,200 and $4,500. This sideways movement suggests a market awaiting a catalyst to drive significant price action.

Analysts are closely monitoring key support levels around $4,200 and resistance levels near $4,530 and $4,800. A breakout above these resistance levels could signal renewed bullish momentum, while a drop below support might indicate further downside potential.

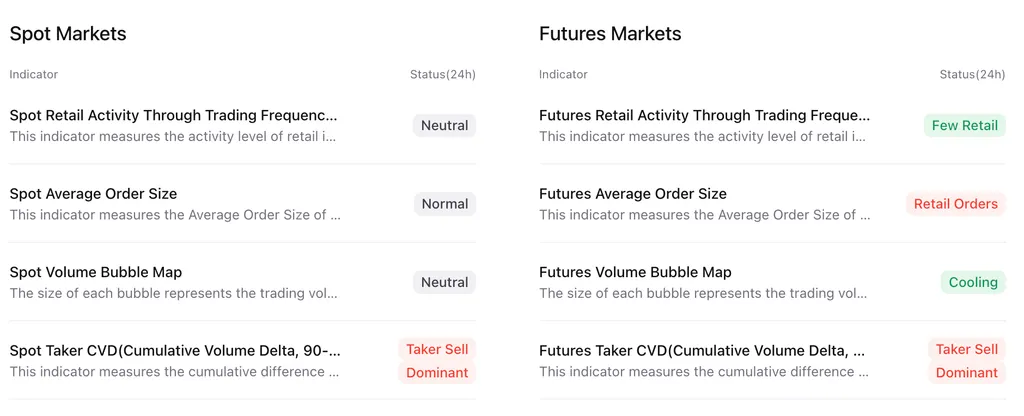

On-Chain Analysis

News About Altcoins

- Hyperliquid Opens Proposals for Native USDH Stablecoin. Hyperliquid has launched proposals for teams to create a “Hyperliquid-first” USDH stablecoin, with validators voting over five days to select the best team. Native Markets submitted a GENIUS Act-compliant proposal with fiat gateways and profit-sharing for the Hyperliquid Assistance Fund, while Hyperstable emphasized its prior efforts in building a stablecoin ecosystem. Despite community debates, this initiative highlights Hyperliquid’s commitment to fostering innovation and aligning with evolving regulations, as stablecoins continue to be one of the strongest use cases in crypto today.

News from the Crypto World in the Past Week

- Michael Saylor Joins Bloomberg Billionaire Index with $7.37B Net Worth. Michael Saylor, co-founder and executive chairman of Strategy, has entered the Bloomberg Billionaire 500 Index with an estimated net worth of $7.37 billion, rising $1 billion since the start of 2025. His fortune, mostly tied to Strategy equity, reflects the company’s aggressive Bitcoin accumulation of over 659,000 BTC worth $72.9 billion. While Strategy’s shares have gained nearly 12% year-to-date, they remain down 12.4% over the past month. Saylor joins fellow crypto billionaires like Coinbase’s Brian Armstrong and Binance’s CZ, further solidifying the growing influence of crypto leaders in global wealth rankings.

Cryptocurrencies With the Best Performance

- MemeCore (M) +208.78%

- Pump.fun (PUMP) +38.08%

- Zcash (ZEC) +16.89%

- Worldcoin (WLD) +12.21%

Cryptocurrencies With the Worst Performance

- Conflux (CFX) -13.90%

- Pyth Network (PYTH) -11.57%

- Bonk (BONK) -9.61%

- Kaspa (KAS) 8.98%

References

- Ryan S. Gladwin, Hyperliquid Seeks Proposals to Launch USDH Stablecoin—But Some Call Foul Play, decrypt, accessed on 7 September 2025.

- Clara Lyons, Michael Saylor’s fortune jumps $1B amid billionaire index inclusion, cointelegraph, accessed on 7 September 2025.