The negative trend for Bitcoin and altcoins has continued for seven days. BTC has fallen to $53,000 and is currently trading between $54,000 and $55,000. Bitcoin’s situation has worsened due to the lack of positive catalysts and outflows from spot BTC ETF markets.

According to Farside data, there have been eight consecutive days of outflows from spot BTC ETFs. A total of $1.18 billion has been withdrawn during this period. The total cryptocurrency market capitalization is now only $1.91 trillion, compared to around $2.1 trillion at the end of August.

Market sentiment has also not improved recently. Debates about the condition of Bitcoin miners persist, and enthusiasm for meme coins has waned. The unstable conditions could increase volatility in the cryptocurrency market this week. Moreover, the release of the CPI data this week could influence macroeconomic conditions and investor behavior.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions

Solana (SOL) ➡️ Bullish 🚀

The SOL token has the potential to be in an upward trend this week. One of the positive catalysts that could drive its price up is the Solana Breakpoint 2024 event, scheduled for September 20-21.

Solana Breakpoint is an annual gathering organized by the Solana Foundation to bring together developers, investors, and Solana enthusiasts worldwide. Through this event, the Solana community can meet, network, and get the latest information about the development of the Solana ecosystem.

So why can Solana Breakpoint catalyze the rise in the SOL price? The answer is that the price of SOL has historically risen during these specific Solana conferences.

In 2023, Solana Breakpoint was held from October 30 to November 1. The price of SOL rose from $25 on October 20, 2023, to $47 on November 1, 2023. Meanwhile, Solana Breakpoint 2022 occurred from November 5-7, 2022. The price of SOL increased from $28 on October 25 to $39 on November 5.

Based on this trend, the price of SOL may rise again ahead of the start of Solana Breakpoint 2024.

SushiSwap (SUSHI) ➡️ Uncertain⚖️

SushiSwap is set to make waves with the launch of its memecoin launchpad, Dojo, on September 10. In this launch, SushiSwap is collaborating with Goat Trading. SushiSwap claims that Dojo is a safer and easier-to-use product for traders.

One of the advantages offered by Dojo is that tokens born from Dojo will remain within the Sushi V3 realm. Using Sushi V3, they leverage liquidity in narrow ranges, allowing users to sell tokens without slippage. This aims to prevent memecoin prices from plummeting after launch.

Additionally, Dojo imposes higher requirements. They mandate that new tokens have an initial market capitalization of $15,000, significantly higher than other platforms in the $5,000 range. This step is taken to make it more difficult for snipers and to prevent predatory trading behavior.

So far, the SUSHI token has reacted positively to the news of Dojo’s launch. It has strengthened by 11.30% in the past seven days to Rp 9,565. However, traders may take advantage of it to sell the news at the time of launch. Thus, the SUSHI token could be corrected. Therefore, SUSHI is in an uncertain category this week.

Celestia (TIA) ➡️ Uncertain⚖️

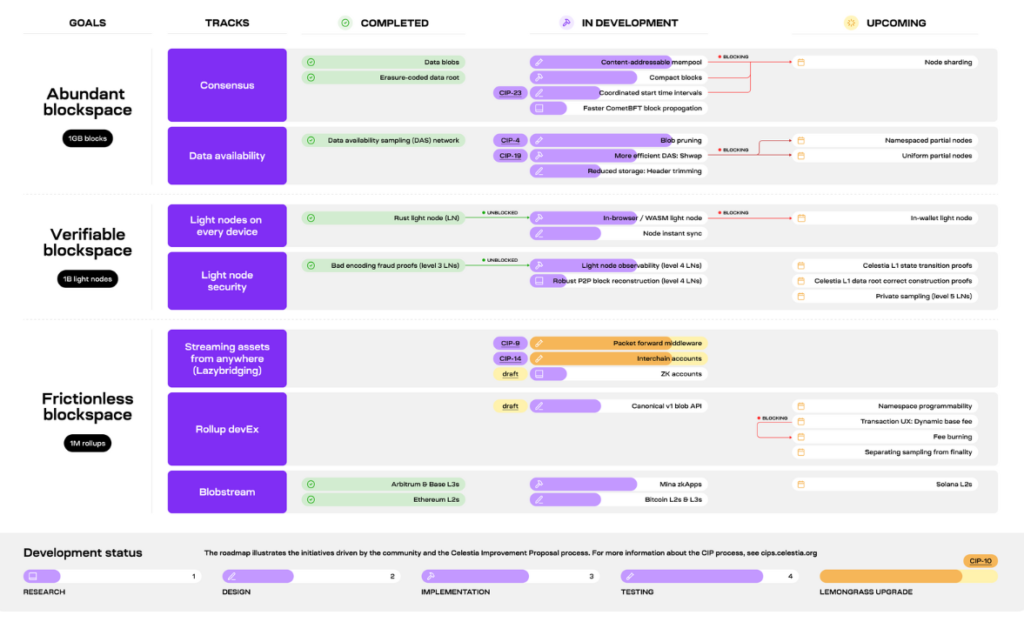

Celestia announced its latest roadmap last week. The roadmap outlines Celestia’s plan to increase its scalability by increasing the block size to 1 gigabyte. This step aims to significantly improve the data throughput on the Celestia rollup ecosystem.

The Celestia developer team claims that a 1-gigabyte block can increase Celestia’s transaction processing capacity faster than Visa. This breakthrough is expected to open up new possibilities that were previously thought to be impossible.

“This unlocks onchain applications and capabilities that were previously considered unviable, such as verifiable web apps and fully-onchain gaming,” Celestia said.

It could be a big deal if Celestia successfully executes all the programs in its roadmap. Moreover, Celestia is gradually eroding Ethereum’s data availability layer provider position. Data from Blockworksres shows that Celestia’s market share has grown from 10% to 41.2% in the last three months.

However, the price of TIA has not responded positively to the launch of the latest roadmap. In the past seven days, the price of TIA has depreciated by 8.30% to Rp 64,593.

Starknet (STRK) ➡️ Uncertain⚖️

Starknet will be conducting its first governance vote next week. The proposal focuses on identifying two aspects of the staking mechanism in Starknet. The first aspect involves the minting mechanism, which will determine the creation and distribution of new tokens in the Starknet ecosystem. It will also be the center of incentives for participants.

The second aspect involves a protocol for adjusting the parameters of the minting mechanism, allowing for modifications to minting over time to ensure the balance and sustainability of Starknet.

If the voting process goes as planned, Starknet aims to launch the staking program in October. This news is undoubtedly a positive sentiment that could strengthen STRK’s fundamentals. However, it isn’t easy to measure its impact, considering that this process will still take quite a long time.

Token Unlock Agenda This Week

Pintu Academy will feature a list of protocols for token unlocks this week. Here is the list:

| Protocol Names | Token Unlock Schedule | Total of Token Unlock | Token Unlock Value | Token Unlock Allocation |

|---|---|---|---|---|

| Xai (XAI) | 09 September 2024 | 35,88 million XAI | $8,47 million | Core team dan Investors |

| Aptos (APT) | 11 September 2024 | 11,31 million APT | $65,26 million | Community members and investors |

| Starknet (STARK) | 15 September 2024 | 64 million STRK | $27,44 million | Investors dan early contributors |

Furthermore, some other protocols that will conduct token unlock this week are io.net (IO), Ethena (ENA), Cyber (CYBER), and Render (RNDR). Notably, the total token unlock value this week exceeded $114 million.

In general, the token unlock agenda will increase the supply in circulation. If the holder of the unlocked token decides to sell their holdings and there is no offsetting demand, the token price will likely plummet. The greater the number of tokens unlocked, the greater the potential pressure generated.

However, a well-planned token unlock schedule can also strengthen the sustainability of a project. As the protocol evolves, token unlocks can motivate team members, boost community engagement, and promote ecosystem growth.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Apecoin (APE): 🔼36,39% (Rp 12.804)

- Scallop (SCA): 🔼35,45% (Rp 3.538)

- BinaryX (BNX): 🔼23,67% (Rp 23.226)

Cryptocurrencies With the Worst Performance

- Self Chain (SLF): 🔽25,63% (Rp 6.833)

- Inspect (INSP): 🔽23,37% (Rp 302)

- Gaimin (GMRX): 🔽21,38% (Rp 14,93)

References

- Zummia Fakhriani, Halau Praktik Pump & Dump, SushiSwap Luncurkan Launchpad Meme Coin Dojo, BeinCrypto, accessed on 9 September 2024.

- Alex O’Donnel, Celestia unveils roadmap to 1-gigabyte blocks, Coin Telegraph, accessed on 9 September 2024.