The crypto market experienced positive momentum after Bitcoin and altcoins rallied over the weekend. BTC finally broke through the $61,500 level (50-day MA), which had recently been a strong resistance level.

Moreover, BTC also crossed the 0.50 Fibonacci retracement level ($60,500), a significant level for a potential trend reversal. The rise in BTC and most altcoins can be linked to the recent release of the FOMC minutes. Following the report, the US Dollar Index (DXY) experienced a decline. This is interpreted as a weakening US dollar, driving investors towards riskier assets such as stocks and crypto.

Technically, BTC’s stochastic indicator is in oversold territory, with the current price near a two-week low, suggesting a possible trend reversal.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions

Stacks (STX) ➡️ Bullish 🚀

Over the past week, the price of STX has surged by 26.49% to Rp 27,758. Upon further investigation, this increase has been fueled by Stacks’ upcoming launch of the Nakamoto Upgrades on August 28th.

This update will significantly enhance Stacks’ performance. One notable change is the production of new blocks every few seconds, a substantial increase from the previous 10-minute interval. This will provide Stacks users a smoother UX for high-volume transactions and advanced DeFi applications.

In addition to the Nakamoto upgrades, Stacks plans to introduce the sBTC product. Through sBTC, Stacks will provide users with an efficient Bitcoin-based payment alternative. Moreover, this update will enable Stacks to serve as a bridge for a wide range of DeFi applications.

This positive news is expected to strengthen Stacks’ fundamentals, which could bolster the price of STX in the long term. It’s not unlikely that the STX rally will continue this week, especially considering the positive momentum in the overall crypto market. However, investors should remain cautious of a potential “sell the news” event that could put downward pressure on the price of STX.”

Drift Protocol (DRIFT) ➡️ Bullish 🚀

DRIFT has also been another token that has performed positively over the past week, with a gain of over 50%. In addition to the more favorable crypto market conditions, the rise in DRIFT’s price can also be attributed to the growing interest in the 2024 US Presidential Election Predictions Market (PM).

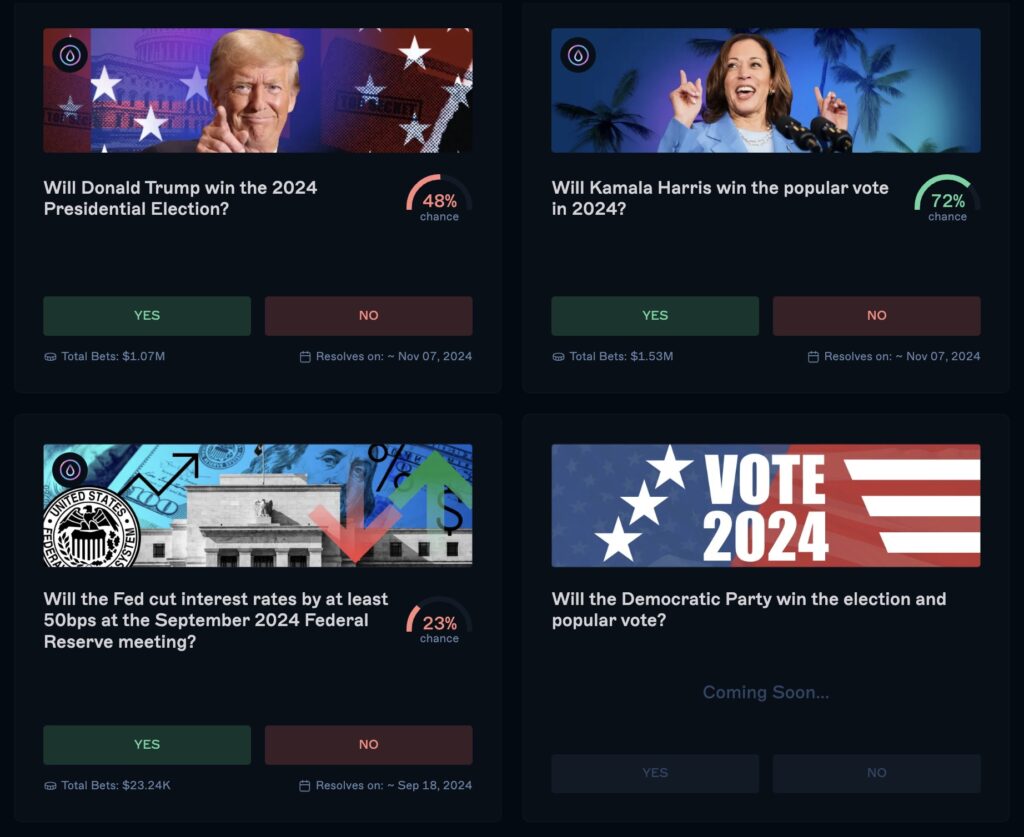

Recently, Drift launched its PM product called Bullish on Everything (BET). Currently, users can only bet on three topics: who will be the next US President, who will win the popular vote, and whether the Fed will cut interest rates by 50 basis points.

Since its launch, this Solana-based PM has recorded significant volume. According to its official website, the combined total liquidity for these three PMs has reached $1.75 million. Furthermore, Drift Protocol reportedly plans to expand its PM into the sports industry.

Drift Protocol’s entry into the sports sector will open up a vast market, given the thriving PM industry in sports. This could be a positive catalyst for Drift’s fundamental value in both the short and long term.

Clearpool (CPOOL) ➡️ Uncertain⚖️

Last week, Clearpool announced the creation of Ocean, a Layer-2 network focused on Real World Assets (RWAs). Ocean offers a compliance layer with a decentralized identity system to facilitate Know-Your-Customer (KYC) requirements.

The Clearpool team stated that this compliance layer will enable interoperability between permissionless RWA protocols, thereby driving significant growth in the RWA sector. They argued that current RWA protocols have limited composability, resulting in a poor user experience.

With this compliance layer, users will only need to onboard once, and protocols can manage KYC requirements represented by decentralized identity tokens. Each token is linked to a user’s address.

“This approach allows anonymous and permissioned users to coexist, unlocking significant potential for the RWA ecosystem,” said the Clearpool Team.

Given that this initiative was announced last week, the positive catalyst may begin to fade this week. However, there is still a possibility that the CPOOL token price will continue to rise. Therefore, the CPOOL token is categorized as uncertain for this week.”

The Open Network (TON) ➡️ Uncertain⚖️

In a shocking turn of events, Telegram CEO Pavel Durov was arrested on August 25th at Bourget Airport in France. According to Reuters, French authorities took Durov into custody immediately upon his arrival.

Telegram issued a statement declaring its compliance with European Union laws, including the Digital Services Act. They emphasized that Durov has nothing to hide and travels frequently in Europe.

“It is absurd to claim that a platform or its owner is responsible for the abuse of that platform,” Telegram stated in an official release, as quoted by Reuters.

Following Durov’s arrest, the price of the TON token plummeted by 20%, followed by a nearly 50% decrease in Total Value Locked (TVL). This development has made the TON token’s movement uncertain for this week.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Inspect (INSP): 🔼155,61% (Rp 528)

- Popcat (POPCAT): 🔼54,76% (Rp 11.080)

- Artificial Superintelligence Alliance (FET): 🔼53,45% (Rp 21.377)

Cryptocurrencies With the Worst Performance

- Pixelverse (PIXFI): 🔽29,58% (Rp 117)

- Syscoin (SYS): 🔽24,10% (Rp 2.008)

- Scallop (SCA): 🔽23,38% (Rp 3.416)

References

- Sage Young, Drift’s New Predictions Market Not Trying to ‘Vampire Attack’ Polymarket, Says Co-Founder, Unchained Crypto, diakses pada 26 Agustus 2024.

- Samuel Haig, Clearpool Unveils RWA-Focused Layer 2, The Defiant, diakses pada 26 Agustus 2024.

- Brian Danga, TON Plunges 20% on Reports of Telegram CEO Pavel Durov’s Arrest in France, Daily Coin, diakses pada 26 Agustus 2024