Bitcoin (BTC) failed to regain its footing and has been on a downward trend for two consecutive weeks. BTC briefly touched a low of $53,905, representing a 23.03% price drop from its 30-day high of $70,035.

BTC also lacks support from fundamental and sentiment factors. The Bitcoin Spot ETF market is showing a limited inflow of funds. Sentimentally, there are indications that the likelihood of the Fed cutting interest rates is diminishing. Fed Chairman Jerome Powell’s underlying rising financial instability hurt the crypto market.

These unfavourable market conditions caused the total cryptocurrency market cap to plummet to $1.981 trillion on July 5, 2024. Fortunately, as of this writing, it has rebounded to the $2.07 trillion range.

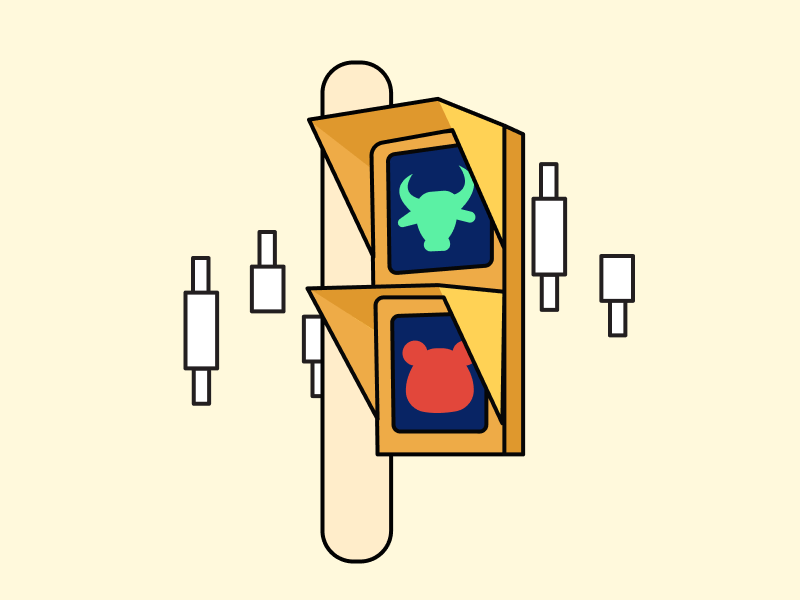

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

Jupiter (JUP) ➡️ Bullish 🚀

JUP token is among the cryptocurrencies with the potential to be bullish this week. One positive catalyst is submitting a proposal to reduce JUP’s long-term emissions and supply by 30%. The reduced supply allocation will be taken from the core team’s holdings.

Jupiter does not have any direct investors in JUP. As a result, this move is expected to reduce the burden on the Fully Diluted Volume (FDV) and address concerns about the high emission rate. The proposal also aims to stimulate community understanding of JUP’s tokenomics.

The proposal’s voting process will begin this month. If a majority of Jupiter DAO members approve the proposal, the reduction in JUP supply could be a positive catalyst for the price movement of its token.

Currently, JUP is trading at Rp 11,709. In the past week, it has reached a high of Rp 14,635 and a low of Rp 10,602.

Ethereum (ETH) ➡️ Bullish 🚀

Ethereum (ETH) is once again a token to watch this week as the market closely follows the progress of the ETH spot ETF. On Monday, July 8, investment managers such as VanEck, Grayscale, Fidelity, BlackRock, 21Shares, Franklin Templeton, and Bitwise resubmitted their amended S-1 registrations for spot ETH ETFs.

While the SEC approved the ETH spot 19b-4 ETF filing on May 23, 2024, S-1 approval is required before they can start trading their spot ETH ETFs.

Bloomberg ETF analyst Eric Balchunas believes this is not a significant development as the SEC has yet to ask investment managers to submit their fee details. Therefore, the next step is for the SEC to request fee information, and investment managers must resubmit their filings.

"Once complete, the spot ETH ETF can start trading. We have no prediction of the launch date as we don't know the SEC's plans. Hopefully, we'll hear soon. But if I had to force a prediction, it would be July 18, 2024," Eric said in a tweet.

If all goes according to plan and there are positive developments about the spot ETH ETF, it could be a positive catalyst for the ETH.

Galxe (GAL) ➡️ Uncertain⚖️

Galxe has announced the launch of its own layer 1 network, Gravity. It is an omnichain network designed to provide a more efficient, scalable, and secure mechanism for governing complex cross-chain interactions with minimal friction.

Along with the introduction of Gravity Chain, Galxe plans to migrate its token, GAL, to G on July 9, 2024. This migration aims to unify and optimize the user experience across their entire ecosystem. In the future, the G token will serve as a utility token for both the Gravity and Galxe ecosystems.

Once the on-chain migration process is complete, GAL tokens held by users will be destroyed, and G tokens will be sent to each user’s wallet at a ratio of 1:60. The migration portal will be open from July 9 to the next year to ensure that GAL holders can complete the process.

This migration process brings uncertainty to the short-term price movement of the GAL token.

Xai (XAI) ➡️ Bearish 📉

XAI token is among the cryptocurrencies with the potential to experience a bearish trend this week. The sentiment that could put pressure on its price is the upcoming token unlock that XAI will be conducting. This layer-3 protocol, specifically designed for AAA gaming, will unlock 198.4 million XAI tokens, representing 71.59% of its total supply, for the team, investors, and ecosystem.

With XAI’s current price at $0.34, this token unlock equals $60.76 million. Given the large amount of token unlock, the sudden surge in XAI supply could put pressure on its price. This is especially true if investors and the team decide to sell their holdings.

Currently, XAI is trading at Rp 5,526, down 7.44% in the past 24 hours. In the past week, it has reached a high of Rp 6,666 and a low of Rp 4,477.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Binary X (BNX): 🔼55,17% (Rp 20.038)

- Notcoin (NOT): 🔼15,77% (Rp 268)

- Mantra (OM): 🔼13,39% (Rp 14.887)

Cryptocurrencies With the Worst Performance

- Apeiron (APRS): 🔽45,94% (Rp 4.394)

- Entangle (NGL): 🔽45,00% (Rp 3.503)

- Tenet (TENET): 🔽43,12% (Rp 164)