There are popular perpetual DEX (Decentralized Exchange) platforms such as Hyperliquid, Avantis, Aster, and Jupiter, but what is a perpetual DEX? Perpetual DEX is a decentralized perpetual trading platform that allows users to trade contracts on crypto assets, with the option to go long or short and use leverage. This article will discuss the latest developments of perpetual DEX, from its key features, metrics, to its risks.

Article Summary

- Hyperliquid Recent Updates: Hyperliquid launched HIP-3, a mechanism that allows developers to build decentralized applications that integrate directly with perpetual futures.

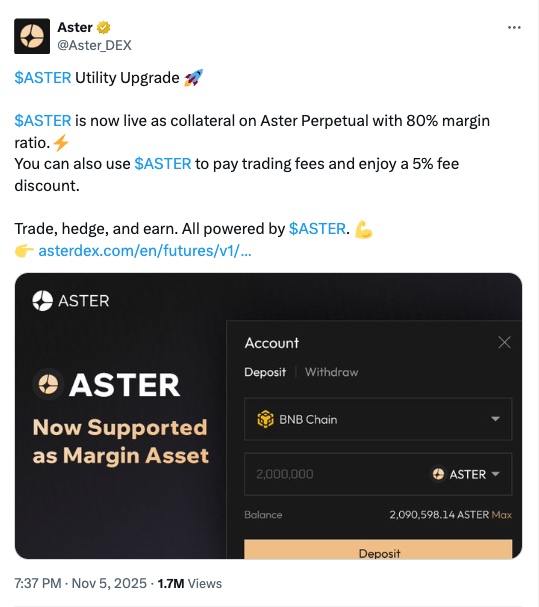

- Aster’s Latest Updates: Aster has expanded the use of their own token as margin collateral on the platform*.

- Avantis Latest Updates: Avantis announced a token buyback program based on 2 Milestones. Milestone 1, buybacks will be made if they earn an average daily revenue of $200,000. Milestone 2, the buyback will take place if they earn an average daily revenue of $500,000.

- Jupiter Latest Updates: Jupiter increased the maximum position value limit for all listed assets.

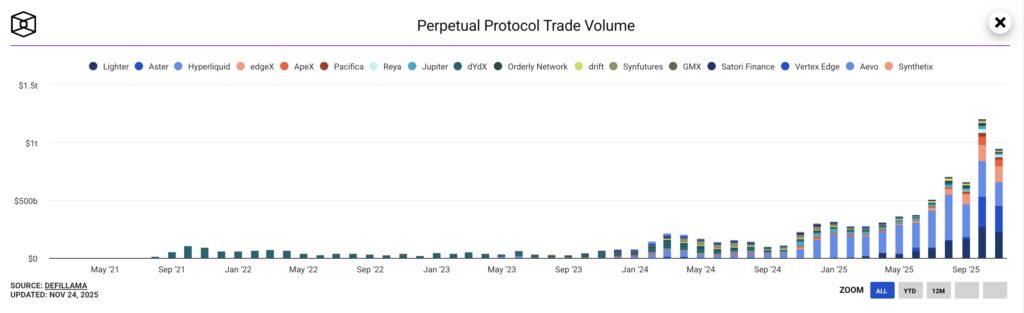

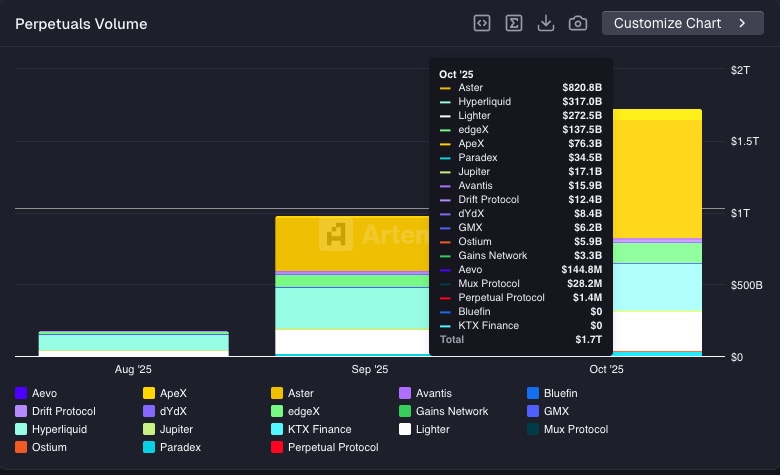

Perpetual DEX War: Who Dominates?

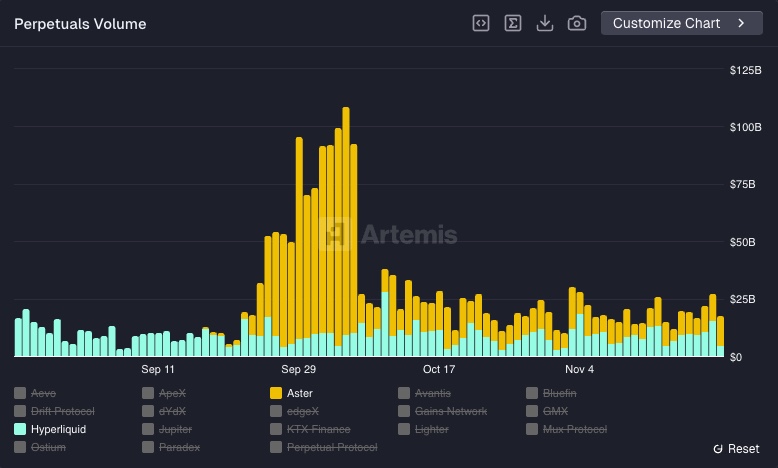

Based on average trading volume data for the last 30 days, Lighter leads the DEX perpetual market with a market share of 21.6% and a volume of $10 billion. In second place, Aster has a market share of 20.8% with a volume of $9.7 billion, followed by Hyperliquid with 19.5% and a volume of $8.8 billion. These three platforms look to be the main trading hubs in the DEX perpetual sector.

In addition to showing the scale of the volumes, this data also gives a signal about their quality. Lighter and Aster are recorded as having “LIKELY” status, meaning that their volumes are potentially affected by non-organic activity. Hyperliquid, on the other hand, has a “no” status, indicating that its volume growth is more natural and comes from organic trading activity.

Read the full article on the Decentralized Perpetual Trading Protocol Ecosystem at Pintu Academy.

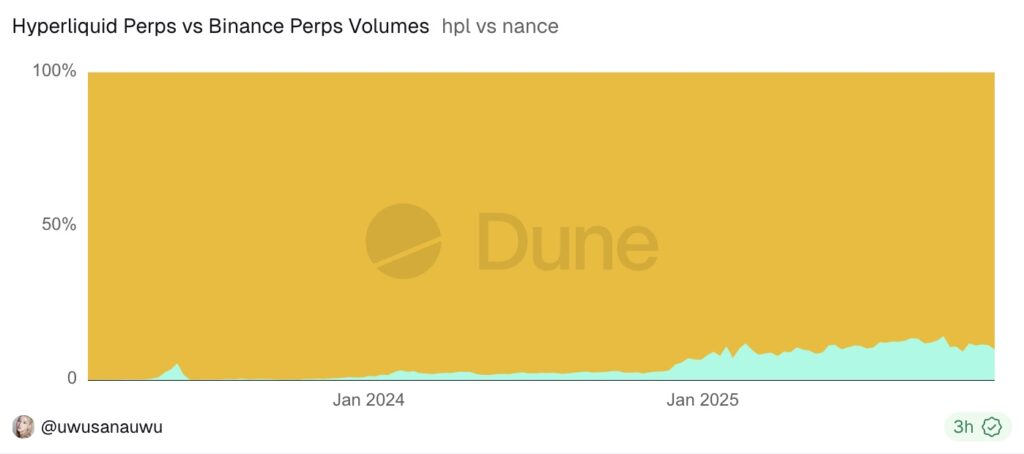

DEX vs CEX Trading Volume Comparison

When compared to Binance’s perpetual trading volume, it can be seen that Hyperliquid’s position is still much smaller. The chart shows Binance’s dominance in almost sweeping the entire perpetual futures market share, while Hyperliquid has only started to show a gradual increase in volume since early 2024.

Why the comparison with Hyperliquid?

Over the past year, Hyperliquid has shown a clear dominance in the DEX perpetual market. The trading volume growth chart shows a consistent increase and is starting to outpace other protocols that have come before it. Not only does this reflect volume growth, but it also signals that Hyperliquid is beginning to establish itself as a DEX perpetual leader. The comparison with Binance is relevant as it is still the main benchmark in the overall perpetual market.

1. Hyperliquid

Hyperliquid is a trading platform for perpetual futures and spot that also functions as a Layer-1 blockchain. As a Layer-1 network, Hyperliquid provides HyperEVM that allows developers to build and develop decentralized applications (dApps) directly within the Hyperliquid ecosystem.

Read the full article on What is Hyperliquid at Pintu Academy.

Hyperliquid Key Features

- Perpetual Futures and Spot with Deep Liquidity: Hyperliquid offers high liquidity in the spot and perpetual futures markets. As such, Hyperliquid can process transactions of large value or size with low slippage.

- Diverse Contract Options: Through HIP-3, users can now open long or short positions with up to 20x leverage on popular stock-based contracts such as Nvidia, Google, and Tesla in the Hyperliquid ecosystem.

- HyperCore: HyperCore is the engine behind Hyperliquid’s onchain spot and perpetual market mechanisms. This engine can handle market transactions of up to 200,000 orders per second and is responsible for the margin system, order book, matching to get the best price to the price oracle in Hyperliquid.

- HyperEVM: HyperEVM is part of the Hyperliquid blockchain that allows developers to build decentralized finance (DeFi) applications on the Hyperliquid network. HyperEVM is also compatible with the Ethereum Virtual Machine (EVM), making it easier for developers of applications on the Ethereum network to migrate or extend the reach of their applications to the Hyperliquid network without having to build from scratch.

Hyperliquid Latest Updates

Recently, Hyperliquid released HIP-3 (Hyperliquid Improvement Proposal 3) as an important step in the development of their perpetual ecosystem. This proposal shows Hyperliquid’s seriousness to become the leading DEX perpetual protocol, especially in terms of market innovation and development flexibility.

Through HIP-3, developers can build their own perpetual futures and set various important parameters, ranging from market definition – which is now not only limited to crypto assets as long as it continues to use the perpetual mechanism, leverage limits, andorder books belonging to the Hyperliquid infrastructure. With mechanisms like this, Hyperliquid becomes the main foundation for the growth of applications built in the future.

However, in order to run perpetual futures on the mainnet, developers must stake a minimum of 500,000 HYPE, or approximately $18 million based on prices as of November 18, 2025. This value is estimated and may change depending on the market price of HYPE. The minimum staking amount is also dynamic and subject to change as the HIP-3 ecosystem grows and matures.

In other words, this move could encourage wider use of HYPE. The more applications built through HIP-3, the greater the staking requirements, resulting in fewer HYPE coins in circulation. This could potentially create a more sustainable economy for HYPE within the Hyperliquid ecosystem.

How Advantageous is Hyperliquid as a DEX Perpetual?

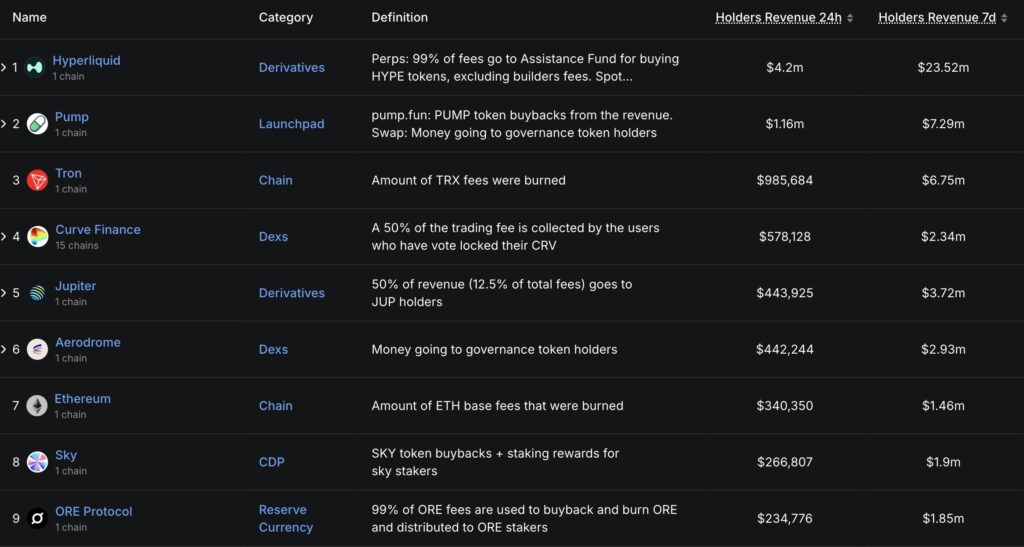

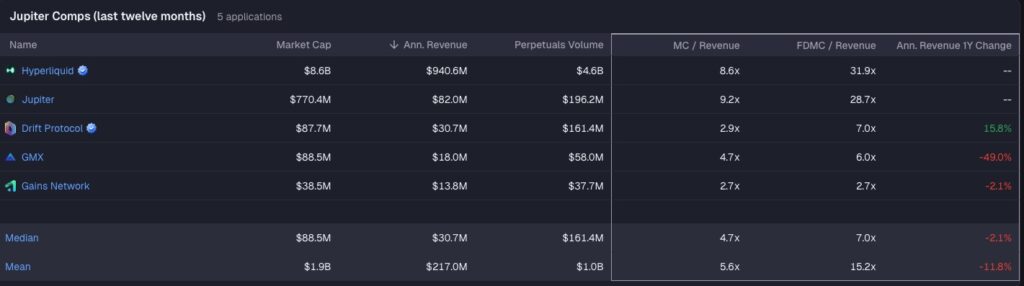

Hyperliquid is a perpetual DEX that has had consistent revenue growth in recent quarters. The largest revenue was in the 3rd quarter of 2025 reaching up to $284 million, making Hyperliquid the DEX perpetual leader in terms of revenue when compared to other competitors such as Jupiter, Aster, and Avantis.

The reason why many traders choose Hyperliquid is not only because of its technological performance, but also because of its very strong community approach. This is reflected in the airdrop allocation of 31% of HYPE’s total token supply – a move that demonstrates their commitment to the “Community First” principle.

Interestingly, if we compare Hyperliquid’s revenue over the last 7 days with several major protocols such as Ethereum, pump.fun, and Curve (CRV), the results are quite striking. The revenue of the three protocols is still below Hyperliquid – in fact, the total has not been able to rival Hyperliquid’s revenue. This puts Hyperliquid not only as the perpetual DEX with the largest revenue, but also as one of the crypto projects with the highest revenue in the entire web3 ecosystem.

Interestingly, Hyperliquid’s annual revenue is even slightly higher than that of NASDAQ. This achievement feels even more remarkable when considering the fact that Hyperliquid is only operated by around 11 employees.

While Hyperliquid’s revenue has been impressive in recent quarters, most of that revenue has not gone to profit. Instead, the revenue collected is allocated to the HYPE coin buyback program.

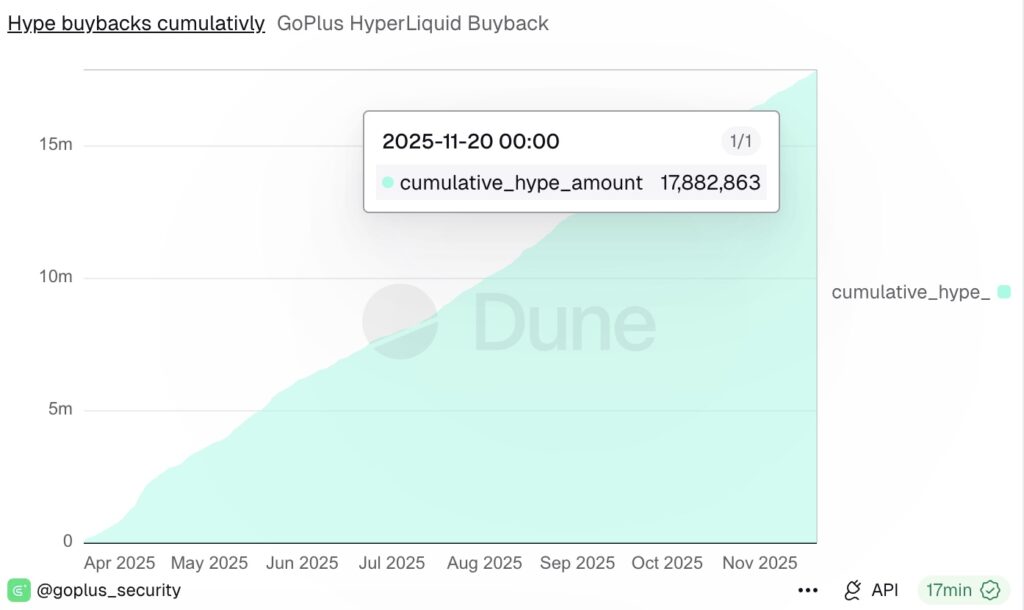

As of November 20, 2025, over 17.8 million HYPE tokens have been bought back by the team. Some of these have been burned to reduce the circulating supply, while the rest are allocated to support the future growth of the ecosystem.

Behind the Growth, What are the Risks of Hyperliquid?

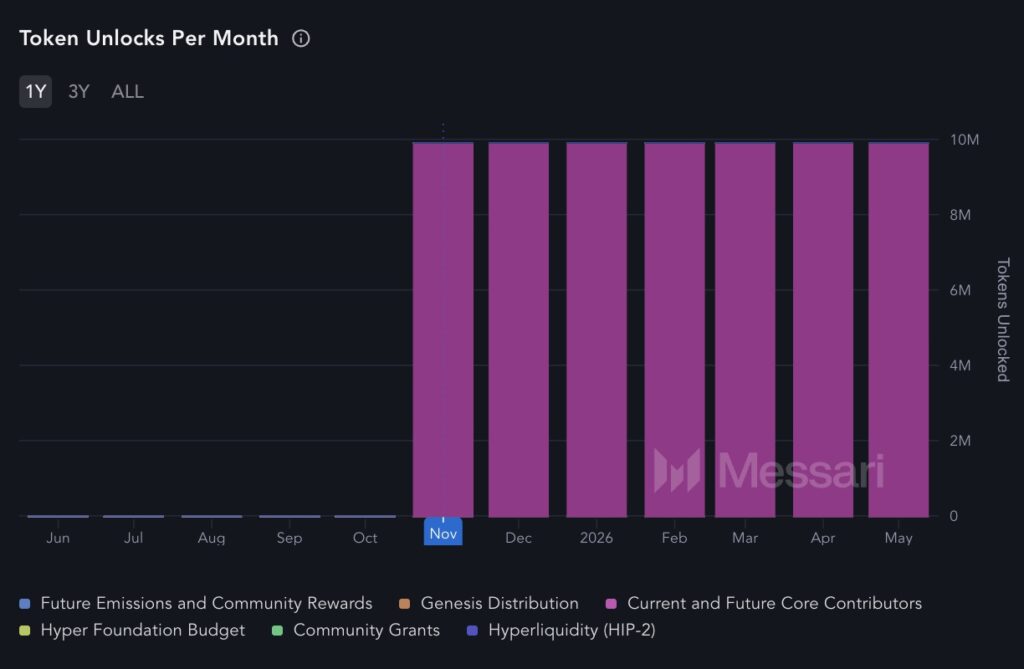

So far, Hyperliquid has had considerable positive sentiment from the community and demonstrated its position as a DEX perpetual leader – both in terms of growing revenue and strong technical reputation. However, it is important to note that Hyperliquid still has a sizable token unlock schedule, with approximately 9.92 million coins or $329 million equivalent to be released every month until May 2026.

In addition, another risk arises because Hyperliquid is a perpetual DEX that is not under official regulatory supervision. This means that all potential risks such as bugs or smart contract vulnerabilities that could cause losses are the responsibility of the user.

2. Aster

Aster is a new perpetual DEX on the BNB network that provides perpetual futures and spot trading services. The project has been getting a lot of attention since the launch of their native token, ASTER, as well as public support from one of the most well-known figures in the crypto world, CZ, which helped increase Aster’s exposure in the community.

Key Features of Aster

- Spot and Perpetual Futures Market with High Leverage: Aster offers spot and perpetual futures markets with leverage of up to 1001x, along with competitive transaction fees. In addition to cryptocurrencies, Aster also offers stock contracts, real-world assets (RWAs) and pre-markets, giving traders a wider range of market options.

- Aster Earn: An interest-bearing product that focuses onyield-bearing collateral. Through this product, users can earn passive income by staking, even while still trading on the platform.

By providing leverage of up to 1001x, Aster is one of the highest leveraged perpetual DEXs compared to Hyperliquid, Avantis, or Jupiter. However, leverage this high is not recommended for beginners, due to its extreme risk level and the ability to liquidate positions with just a slight price movement.

Aster’s Latest Updates

Aster recently made an announcement regarding the additional uses of the ASTER token. This token can now be used as margin collateral, payment of trading fees, as well as providing a 5% discount on trading fees for users.

Aster, Hyperliquid’s Biggest Competitor?

From September 24 to October 6, 2025, Aster’s trading volume jumped dramatically to the $100 billion mark. However, as of this writing, there is no official explanation of the main factor behind the spike. After that period ended, the trading volume experienced a significant decline again and now continues to compete with Hyperliquid.

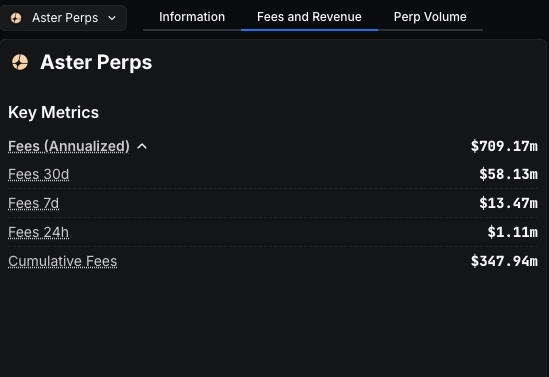

Sure, when compared to Hyperliquid, Aster seems to be taking market share that was previously dominated by Hyperliquid. However, what about the revenue generated from transaction fees? Is it on par or even able to rival Hyperliquid?

As it turns out, Aster’s annual fees reached $709 million, which is a huge amount of revenue, although it has yet to surpass Hyperliquid. However, this achievement still needs to be analyzed further, especially to see whether the growth came from organic activities or not.

What are the Risks of Aster?

Aster has some risks that need to be considered, especially for token-holding investors. Based on onchain analysis, token holdings are currently concentrated in just 6 wallets with a proportion of about 96% of the total supply, indicating a very high degree of centralization.

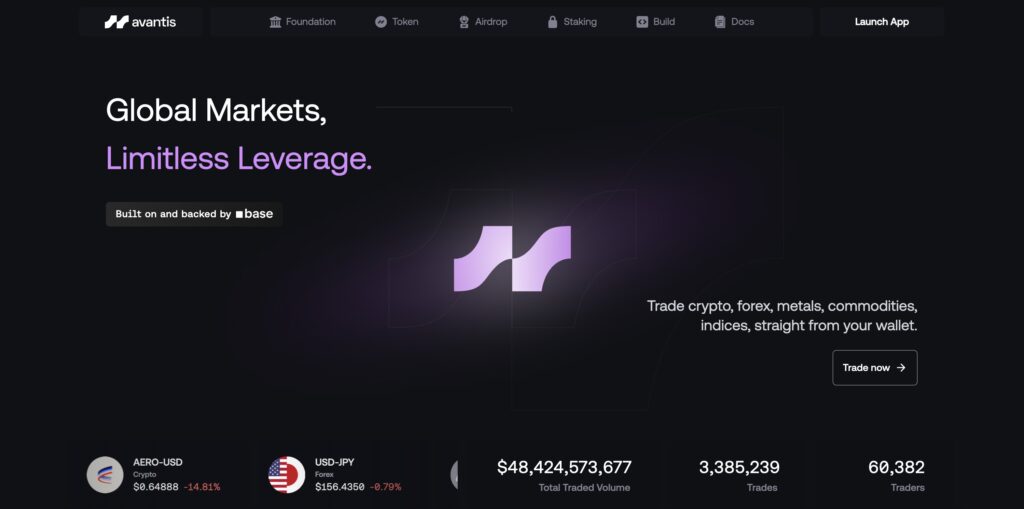

3. Avantis

Avantis is a DEX perpetual platform that provides a variety of perpetual futures contracts, ranging from crypto, equities, to forex. The protocol is built on the Base network, so it can operate onchain 24/7 and be accessed at any time by anyone.

In terms of funding, Avantis managed to raise a total investment of $12 million from a number of well-known investors such as Pantera Capital, Founders Fund, Base Ecosystem Fund, and several other venture capitals.

Avantis Key Features

- Perpetual Futures Up to 500x: Avantis’ main service is perpetual futures with a wide selection of contracts ranging from crypto, equities, commodities, and forex with up to 500x leverage.

- Earn With APY Up to 27%: Users can participate by staking USDC and AVNT assets and earn varying returns.

- Asset Borrowing: Users can borrow assets such as USDC with a choice of collateral, such as BTC or ETH. In addition, users who use this feature also have the potential to earn rewards.

One of the most striking features of Avantis is that the wide range of contracts ranging from stocks, commodities, to forex makes Avantis offer a broader approach than the typical DEX perpetual market.

With this approach, Avantis is positioning itself as a bridge between RWAs and blockchain. This opens up the potential for Avantis to reach a wider segment of traders, not just limited to crypto traders.

Avantis Latest Updates

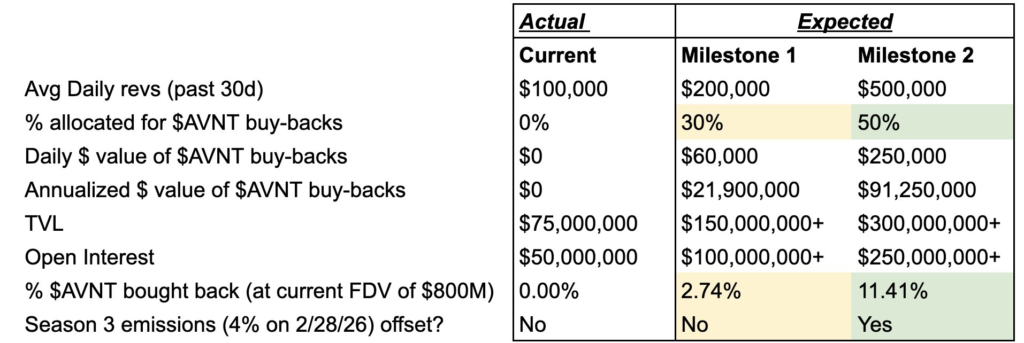

On November 4, 2025, Avantis announced the launch of the AVNT token buyback dashboard. This dashboard allows users to monitor the extent to which Milestones have been achieved, while demonstrating the team’s commitment to the growth of the Avantis ecosystem.

The buyback program will be carried out based on the milestones achieved by Avantis, here are the details:

- Milestone 1: Buyback will be conducted if Avantis’ average daily revenue is above $200,000, the team will allocate 30% of the transaction fee to conduct the buyback.

- Milestone 2: If Avantis’ average daily revenue is above $500,000, the team will allocate 50% of the transaction fee to buyback.

The dashboard can be accessed through Avantis’ official website, through this link: Avantis buyback dashboard.

So far, Avantis has realized a number of developments according to their roadmap. One of the most exciting is the implementation of free long, short andholding costson contracts with leverage of up to 500x.

However, this fee-free mechanism only applies if a trader incurs a loss, so there is no charge at all. Conversely, if a trader makes a profit, then position fees and “holding costs” will be charged when the position is closed.

Trading Volume & Users Up: Is the Activity Organic?

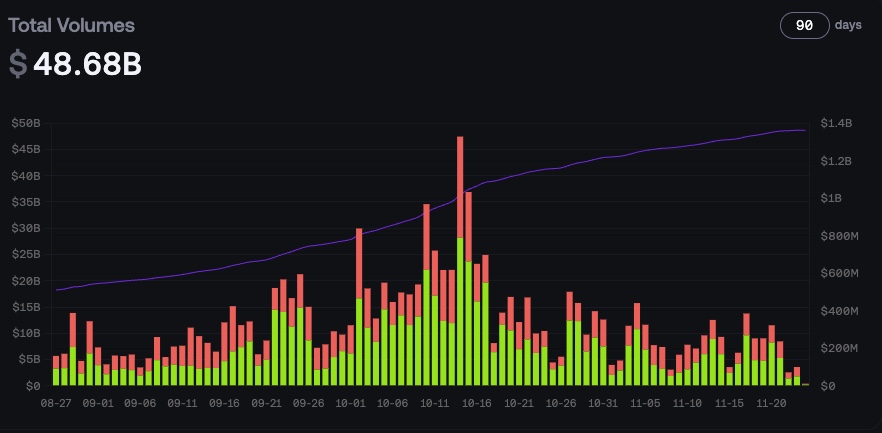

Avantis has recorded a total cumulative trading volume of $48 billion. In the last 90 days, trading volumes have been dominated by long positions from traders, as the market corrected.

Since the launch of the AVNT token on September 9, trading volumes experienced a significant increase until mid-October. After that, volumes fell back to levels similar to the initial token launch period.

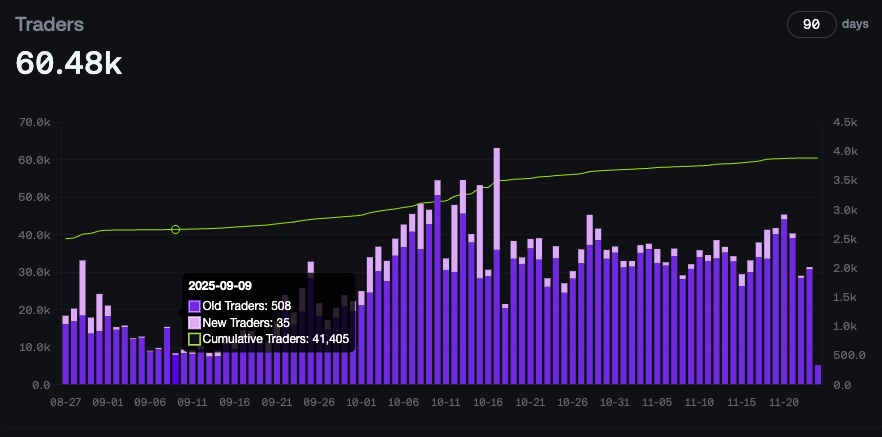

In terms of growth, Avantis has recorded a total of 60,480 users. The increased trading volume in the middle of October was also seen in line with the increase in the number of returning users as well as the continued growth of new users following the launch of the AVNT token.

This pattern indicates that the increase in trading volume and number of traders that occurred after the token launch is most likely coming from real traders, rather than airdrop farming. This means that Avantis products are being utilized more organically.

What are the Risks of Avantis?

The security of Avantis’ smart contracts has been audited by Zellic and Zokyo. However, since Avantis operates as a perpetual DEX, no organization can absolutely guarantee its security. Therefore, users still need to be cautious of risks such as bugs or security holes that may appear.

In addition, Avantis offers extremely high leverage of up to 500x. This high leverage is not recommended for beginners, as one small mistake can lead to liquidation or loss of all capital.

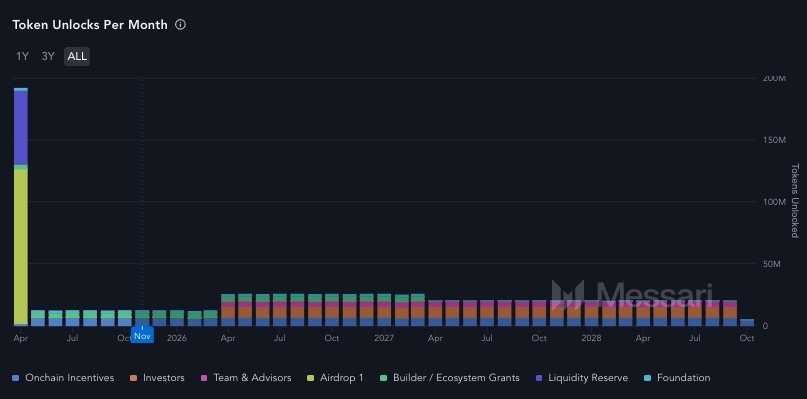

In terms of token performance, AVNT has experienced a sharp correction of up to 85% from its highest price, even though only about 25% of the total supply of 1 billion tokens is currently circulating in the market. Avantis also has a monthly token unlock schedule that runs until October 2028, so additional pressure on the price is still possible if token adoption and usability do not grow significantly.

4. Jupiter

Jupiter is the largest decentralized finance platform on the Solana network that provides various services such as assetswaps, lending & borrowing, prediction markets, and perpetual futures. The platform was founded in October 2021 by two developers under the pseudonyms “Meow” and “Siong”, who initially introduced Jupiter as a swap infrastructure for Solana.

Since its launch, Jupiter has positioned itself as a DEX aggregator that helps users get the best price when exchanging assets. Over time, Jupiter has continued to introduce new products, including perpetual futures trading, which is now one of its main pillars.

Read the full article on What is Jupiter (JUP)? at Pintu Academy.

Jupiter’s Key Features:

- Jupiter Perps: A service that offers perpetual futures trading with up to 250x leverage for three main assets: SOL, BTC, and ETH. Unlike other platforms that offer multiple contracts, Jupiter takes a focused approach by only offering these three types of contracts.

- Asset Exchange: Another excellent feature is the instant asset swap service. There are 2 types of methods namely market and limit, market for instant asset swap options and limit for asset swap by setting your own price and the transaction will be executed only if the price is reached.

- Lending and Borrowing: Jupiter provides lending and borrowing services with various interest rates.

- Jupiter Prediction Market: A service that allows users to make predictions on various events.

Jupiter’s Latest Updates

In September 2025, Jupiter released important updates regarding fees and position size limits on their perpetual futures feature. Here’s a summary of the improvements:

- Price impact costs were reduced to 60% less than before.

- The maximum position size limit is larger, with traders now able to open positions of up to:

-Maximum $10 million for SOL

-Maximum $20 million for BTC & ETH

This could certainly attract more professional traders who are used to opening large-sized positions as the cost of price impact is significantly reduced.

Jupiter: From Biggest DEX to Perpetual Futures, Can it Repeat the Success?

Jupiter is the DEX king of the Solana ecosystem, dominating trading volumes with cumulative aggregator volumes totaling over $1 trillion.

Interestingly, Jupiter has also consistently achieved perpetual futures trading volumes above $10 billion over the past 3 months. This makes Jupiter the top 10 largest DEX perpetual in terms of trading volume surpassing Avantis. This is impressive given that Jupiter only offers three perpetual futures contracts: SOL, BTC, and ETH.

In terms of revenue over the past year, Jupiter managed to record revenue of around $82 million. This amount is actually quite high, but still far below the revenue achieved by Hyperliquid, even though Jupiter has more products and features. This is quite reasonable, because from the beginning Jupiter was built, they had a main focus on being an asset exchange aggregator with the best price for users, before expanding to other products.

What are the Risks of Jupiter?

Jupiter has various decentralized financial products such as swaps, lending & borrowing, and perpetual futures that run using smart contracts. Although each product has passed several security stages, users still need to understand that risks remain such as bugs or potential hacks, especially since Jupiter operates entirely in the onchain ecosystem.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

How to Buy HYPE, ASTER, AVNT, and JUP Coins at Pintu

After knowing the latest developments of Hyperliquid, Aster, Avantis, and Jupiter, you can start investing by buying them on the Pintu app. Here’s how to buy HYPE, ASTER, AVNT, and JUP coins on the Pintu app:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up your Pintu balance using your preferred payment method.

- Go to the market page and search for HYPE/ASTER/AVNT/JUP.

- Click buy and fill in the amount you want.

- You now have HYPE/ASTER/AVNT/JUP coins!

In addition, you can also invest in other crypto assets such as BTC, ETH, and others without having to worry about fraud through Pintu. In addition, all crypto assets on Pintu have gone through a rigorous assessment process and prioritize the principle of prudence.

Download Pintu crypto app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions, on Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly!

Conclusion

The DEX perpetual war continues to rage on, both in terms of product development and technological innovation. While each platform such as Hyperliquid, Aster, Avantis, and Jupiter offers easy access and a wide range of features, they all come with risks-both in terms of the platform and the token as an investment. As a user or investor, it is important to understand the characteristics of each platform and choose the one that best suits your needs, risks, and goals.

References

- “About Hyperliquid”, Hyperliquid Docs, accessed on November 20, 2025.

- Kathleen Kinder, “Hyperliquid Shatters Records with $106M Revenue Surge in August”, CoinLaw, accessed on November 20, 2025.

- Amit Chahar, “What is Hyperliquid? A Guide to the New Perpetuals DEX”, NFTevening, accessed on November 20, 2025.

- Avantis Docs, https://docs.avantisfi.com/, accessed on November 21, 2025.

- Loke Choon Khei, edited by Vera Lim, “What Is Jupiter (JUP)? Solana’s largest DeFi Superapp”, accessed on November 24, 2025.

- “What is Aster?”, Aster Docs, accessed November 24, 2025.