A narrative or trend in the crypto world usually only lasts a few months or even a few weeks. Narratives in the first quarter of 2024 such as AI and memecoin managed to bring profits of more than 100%. Therefore, every quarter must have a different narrative that has the potential to bring profits to investors who discover it first. We will discuss some of the potential crypto narrative in Q2 2024 or April-June.

Article Summary

- L2 and Runes in Bitcoin: With the launch of new protocols like Runes and Merlin Chain, the Bitcoin ecosystem is showing significant growth with TVL and increasingly sophisticated infrastructure.

- 🐸 Memecoin Season on Solana: Memecoin continues to take the market by storm, with Solana becoming the new center of memecoin trading, promising high opportunities for traders and investors who love high volatility.

- Ethereum ETFs and L2 Competition: Discussions about Ethereum ETFs and competition between L2 platforms such as Base and Blast revived the Ethereum sector. In addition, potential airdrops from protocols like Eigenlayer and Friend.Tech could bring huge liquidity.

- 🤖 An AI narrative remains popular: AI continues to be a hot topic, with huge growth potential fueled by the integration of AI technology with blockchain and catalysts from large tech companies interested in AI.

Market Situation Beginning Q2 2024

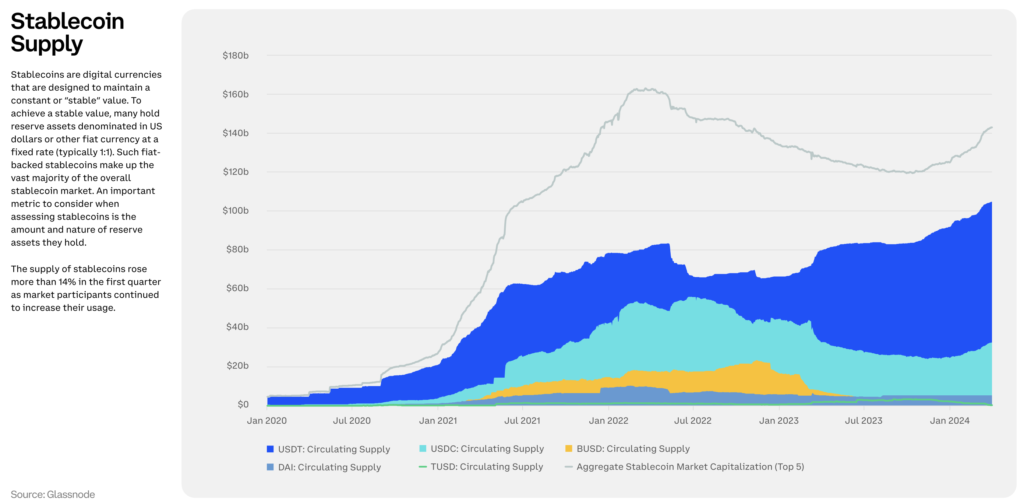

The stablecoin supply chart shows an upward trend which suggests we’ve been in a bull market since early 2024. As in the image below, Q1 of 2024 closed very positively with +68% for BTC. The altcoin market also experienced the same momentum with the TOTAL3 chart increasing by almost 50% in 3 months.

However, April presented a volatile situation compared to the first quarter. The heated conflict in Israel caused BTC to correct. By the end of April, Bitcoin had already experienced a 15% correction.

Like the previous 2 halvings, nothing happened on the day of the halving and BTC will likely correct further or go sideways. This is in line with what happened in 2020 where BTC went sideways post halving.

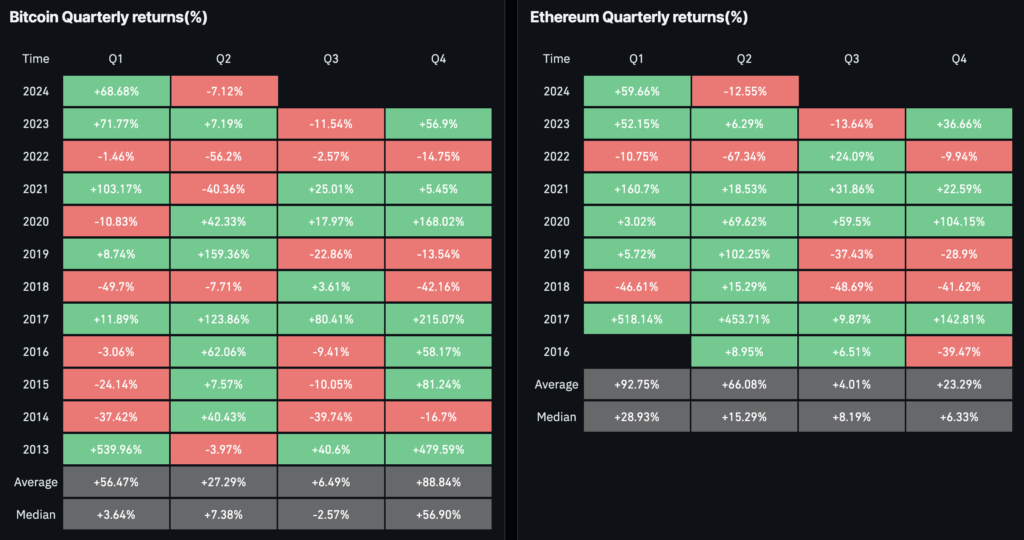

The above picture of BTC’s quarterly movement gives uncertainty to BTC’s prospects in Q2 of 2024. From 2020-2024, BTC experienced 2 red years in Q2 and 2 green years. The 50:50 percentage indicates that investors and traders should face Q2 with caution.

Crypto Narrative Prediction for the Second Quarter of 2024

The image above is 30-day data for assets in certain categories that can be considered narratives. Memecoin, RWA, and DeFi 3.0 have performed well in the last 30 days which means they are still popular narratives. We will look at 4 potential narratives for Q2 2024.

1. The Bitcoin ecosystem: Runes and L2

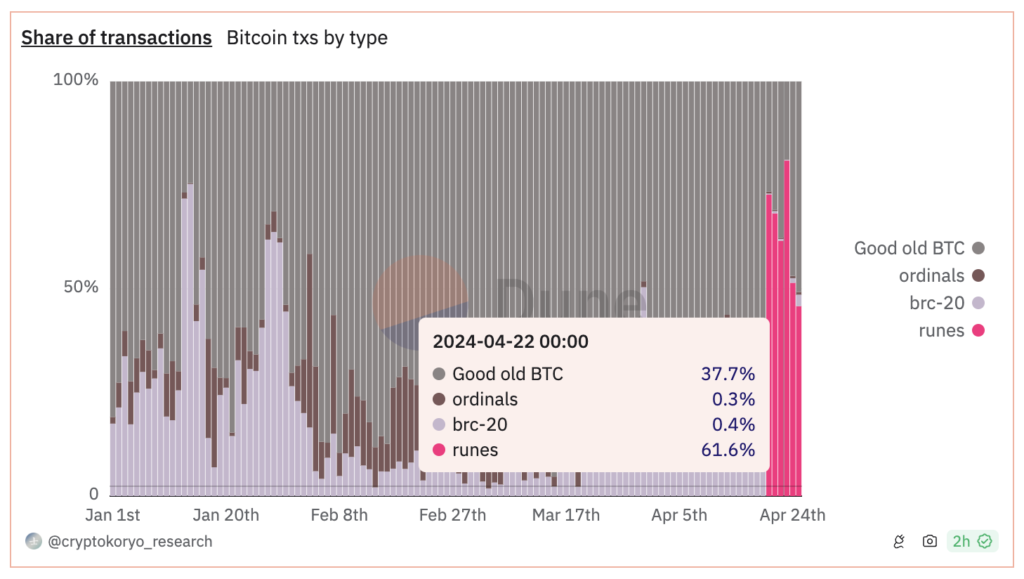

Runes is a fungible token protocol like ERC20 but in Bitcoin. Again, Runes is the brainchild of Casey Rodarmor who also created Ordinals, the first functional NFT in Bitcoin. Rodarmor created Runes to be easily run by other protocols and easily transferable by users. Runes’ on-chain footprint is also much smaller so it doesn’t add significantly to network congestion like Ordinals.

Since its launch on halving, Runes has taken over the Bitcoin ecosystem, surpassing Ordinals and BRC20. In addition, more and more protocols in Bitcoin provide Runes infrastructure such as BitVM, Magic Eden, and two BTC wallets, Xverse and UniSat. You can now buy Runes on Magic Eden or Ord.io. Currently, the Runes with the largest capitalization are DOG and RSIC which reach $333 and $207 million.

In addition to Runes, Bitcoin’s L2 ecosystem has also exploded in recent months. Previously, Stacks was the only popular Bitcoin L2. Now, many competitors have emerged such as Citrea, BVM, Merlin Chain, and SatoshiSync.

Of the many L2 Bitcoin ecosystems, Merlin Chain has the largest TVL with $1 billion. Since the beginning of April, Merlin has experienced a 1000% increase in TVL. BVM is also an interesting L2 protocol that allows the creation of new L2s. BVM has already facilitated the creation of 6 new L2s in Bitcoin.

The Bitcoin ecosystem could be a promising one in the second quarter of 2024. With infrastructure development just beginning to take place, many protocols in the ecosystem are not yet widely used and this is usually a big opportunity.

Altcoins to watch: BTC, MERL, and STX.

2. Solana and Memecoin Season

In recent months, Solana has become the main blockchain for trading memecoins, beating Ethereum. Some memecoins on Solana have even reached $1 billion market capitalization such as WIF, BOME, and MEW. Currently (April 26, 2024), WIF is the largest memecoin on Solana with a market capitalization of around $3 billion.

Memecoin is becoming a very attractive option for many investors and traders due to its potential. Leaders in the sector such as SHIB and DOGE have market capitalizations of $15 and $21 billion.

Why do many people become memecoin investors and traders instead of buying projects with clear fundamentals? First, memecoin is easy to understand without any difficult tech jargon. Secondly, memecoin is considered very fair as there are no tokens locked up for investors or teams. Typically, 100% of the supply of memecoins is already in the market.

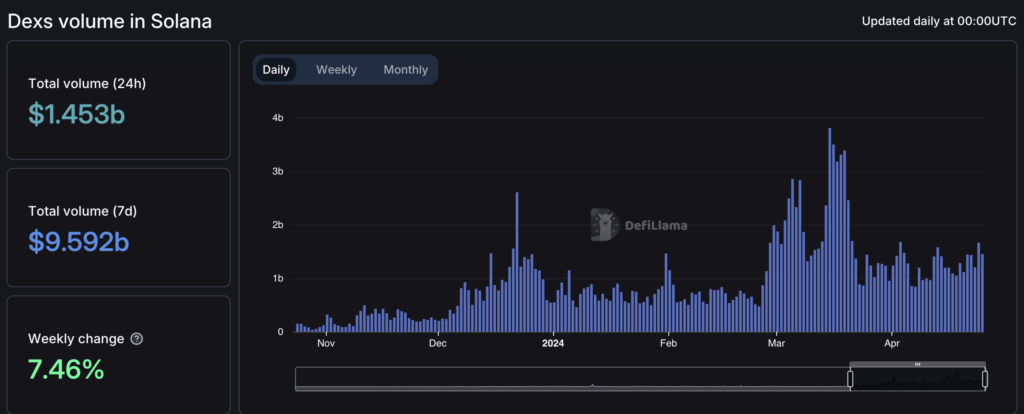

The easy-to-use DEX app and very low transaction fees make Solana the blockchain of choice for trading memecoins. As shown in the image above, Solana’s DEX volume has consistently been above the $1 billion mark for the past 2 months. The memecoin frenzy even created network congestion that forced the Solana team to plan update 1.18 to handle the volume.

With such consistent volume and community attention still high, the memecoin season on Solana still looks strong. In addition, many meme tokens on Solana have high volumes such as POPCAT, MEW, MANEKI, and SLERF. This shows that the bulk of memecoin traders have moved to Solana from Ethereum.

Must-watch altcoins: SOL, JUP, and WIF.

3. Ethereum ETF, Base, and L2 Competition

Since late 2023, several institutions have proposed ETF for spot ETH. Then, at the end of January 2024, BlackRock suddenly made a spot ETF filing for ETH. BlackRock’s filing revived hopes for a spot ETF due to its excellent record.

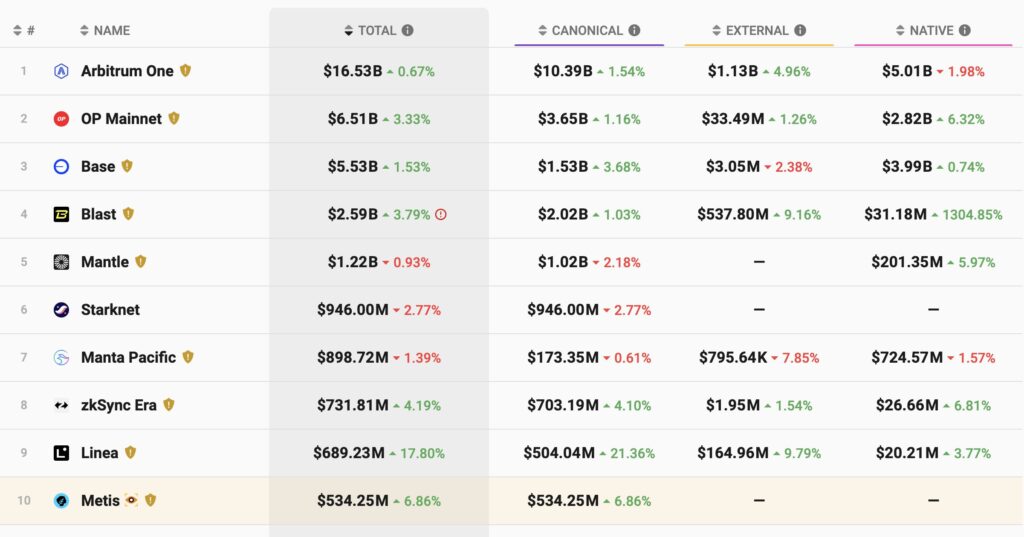

This ETF conversation brought the crypto community’s attention back to Ethereum, especially with the burgeoning L2 ecosystem. Base, Mantle, and Blast, despite only launching a few months ago, managed to shoot up to the top 5 L2 on Ethereum. New L2s like zkSync, Starknet, and Linea also make up the top 10 L2s on Ethereum.

Base is especially interesting because it managed to attract 2 fast-growing SocialFi apps, Friend.Tech and Warpcast. Base also successfully onboards several GameFi projects such as Frendpet, Heroes of Mavia, and Echelon Prime’s Parallel.

On the other hand, Blast has a high TVL because it utilizes liquid staking so that users automatically earn interest if they enter the Blast ecosystem. Moreover, Blast also promises airdrops for users moving their assets to Blast. The double incentive catapults the TVL of DeFi apps on Blast.

The expectation of ETH ETF acceptance is a big catalyst for the Ethereum ecosystem. As in the image above, the L2 competition is heating up as many new players have attracted millions of dollars to the network. In addition, many L2 projects do not have tokens, attracting many airdrop hunters.

Finally, the huge airdrop potential of Eigenlayer has also led many people to store their assets in the Ethereum ecosystem, especially restaking protocols. The number of airdrops on Ethereum has the potential to be a large injection of liquidity. MODE and FRIEND are two already confirmed tokens for the end of April.

In a bullish environment, airdrop season will usually be a huge liquidity flow that creates positive conditions for the ecosystem. Conversely, bearish market conditions will usually trigger a massive dump for tokens given out as airdrops. You can look at the charts of W, TNSR, and VENOM as examples of what happens with airdrop tokens given out in bearish conditions.

Must-watch altcoins: ETH, OP, ARB, PEPE (as the highest meme on Ethereum), and PENDLE (Ethereum’s DeFi Ecosystem).

4. AI Narratives Will Stay Popular

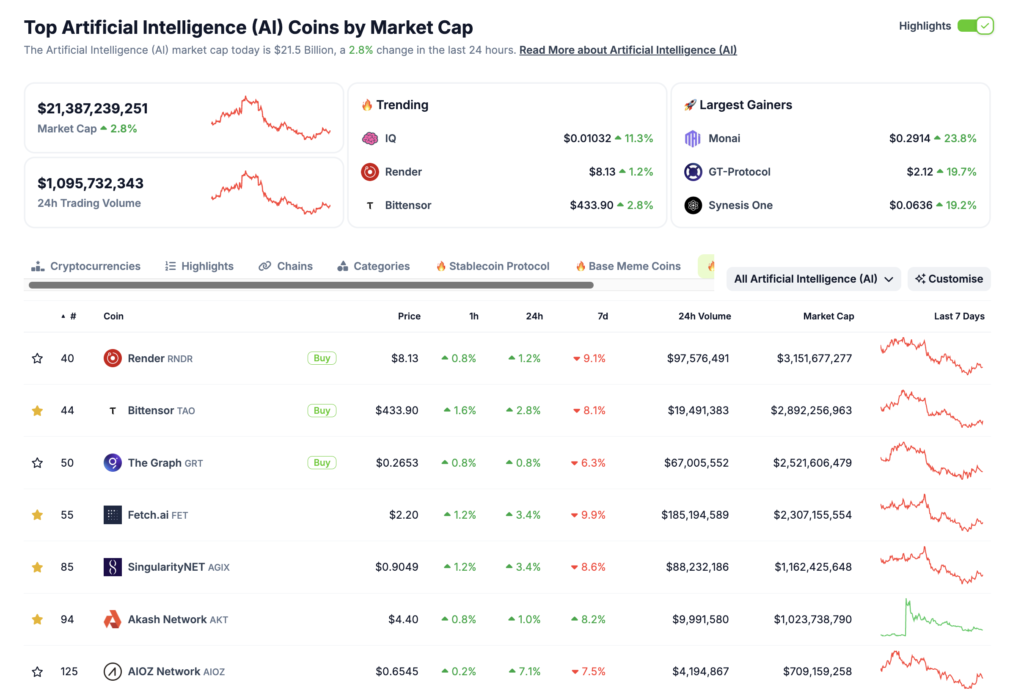

The AI or Artificial Intelligence sector is one of the highest-growing emerging sectors in the crypto world in the past year. Although the integration of AI and blockchain is still in its infancy, many investors and traders are already speculating that this sector has enormous potential.

The AI narrative has been popular since the first quarter of 2023 and still maintains its popularity today. One of the reasons for the strength of the AI narrative is the never-ending AI catalyst. Unlike other narratives in the crypto industry, AI is becoming a mainstream trend.

AI assets like RNDR, TAO, and NEAR usually see a rise alongside AI announcements from big companies like OpenAI or Nvidia. One of the biggest potential catalysts is the rumored launch of ChatGPT 5 in June or July 2024. In addition, we can also watch the launch of ASI (a combination of Ocean Protocol, Fetch.AI, and SingularityNet) to see the market response to 3 major crypto projects merging into one.

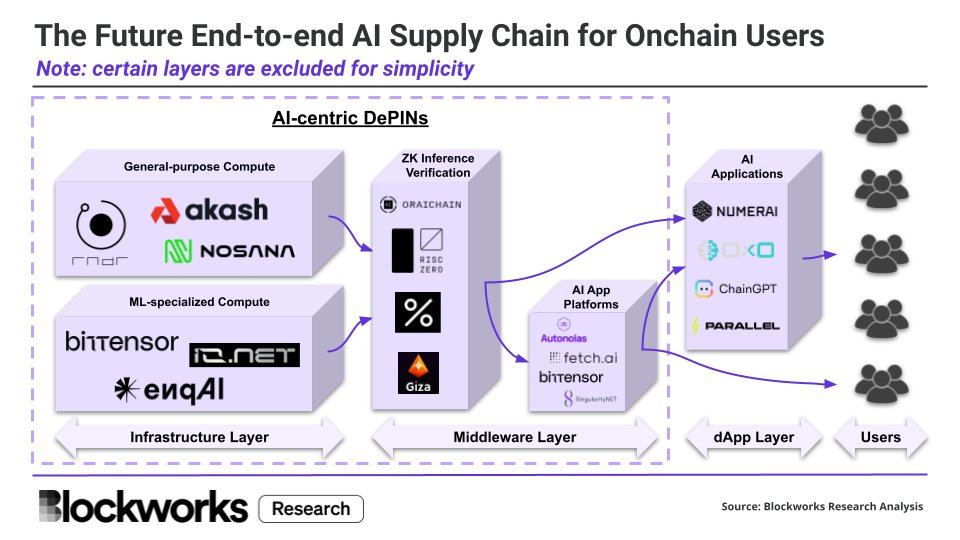

In addition, AI is also closely related to the Depin sector. Depin is a decentralized physical infrastructure such as cloud computing services or leasing computing resources (GPU or CPU). Many projects in the Depin sector are starting to expand into the AI sector such as Render and Akash which provide specialized computing services for AI model training and the like.

Currently, the AI sector collectively has a market capitalization of $20 billion. In comparison, the DeFi and memecoin sectors have market capitalizations of $94 and $54 billion. These figures show that the AI sector is still far below the other major sectors in the crypto industry.

With catalysts coinciding with the mainstream trend in the tech sector, the AI sector has great growth potential. However, it also comes with high investment risk as the sector is still in its early stages of development.

Must-watch altcoins: RNDR, AKT, TAO, NEAR, AGIX, and FET.

Crypto Market in the Second Quarter?

- Ethereum ETF: Like the BTC ETF case, the SEC has to accept or reject all ETF filings as they all use similar terms and documents. The first deadline for ETH ETF filings was VanEck’s May 23. If we follow the BTC ETF proposal timeline, approval will likely be delayed until BlackRock’s last deadline in August 2024.

- Airdrop Season Continues: Various protocols in the Solana and Ethereum ecosystems have a token launch for Q2. Mode season 1 will finish at the end of April and Kamino will release tokens on April 30. Also, LayerZero and zkSync hinted that their tokens will be launched in Q2.

- Macroeconomic Conditions: Since the beginning of 2024, the BTC ETF news has made cryptocurrencies move independently of the world’s macroeconomic conditions. Post ETF, Bitcoin, and other cryptocurrencies started responding negatively to economic data from the Fed.

Conclusion

The crypto narrative dynamics continue to shift every quarter, offering profit opportunities for responsive and careful investors. The second quarter of 2024 opens with tantalizing prospects, particularly in the Bitcoin ecosystem, Solana’s memecoins, Ethereum’s L2 sector, and the integration of AI with blockchain. Understanding and anticipating upcoming trends is essential to maximize returns with market conditions constantly changing. These crypto narratives show significant potential but also require caution and in-depth analysis to own the right assets.