Managing risk in perpetual futures trading is not only about setting take profit and stop loss, but also how traders can manage position size and leverage used. In this article, we will discuss what leverage is, the difference between using low and high leverage, its benefits and how to manage it.

Article Summary

- 🔎 Definition of Leverage: a tool that can magnify the value of a trading position far above the capital.

- ⚙️ Use of Leverage: The higher the leverage used the more risk a trader is prepared to take.

- 💡 Manageable leverage gives traders flexibility based on their risk management.

- 💸 Leverage opens up the potential for profits that are much higher than the capital you have, but if you can’t manage the risks, you could end up losing a lot of money or even losing it all.

Definition of Leverage

Leverage is a tool in the perpetual futures market that allows traders to open positions much larger than their capital. Perpetual futures have long and short positions, long meaning buying the contract in the hope that the price will increase and short meaning selling the contract in the hope that the price will decrease.

Traders in the perpetual futures market can utilize leverage tools to go both long and short. Generally, leverage on each exchange may vary depending on rules and regulations.

Leverage Example: Ari has 500 USDT capital and wants to open a BTCUSD-PERP asset position with 10x leverage, this way the total value of the position Ari has will be 5,000 USDT.

In addition, it should be noted that the amount of leverage also affects liquidation, such as the example above where a 10% price movement if it is against the opened position can be subject to liquidation. Here is the calculation:

| Leverage | Capital/Margin | Position Value | PnL (Profit and Loss) | Description |

| 10x | 500 | 5,000 USDT | -500 (10% of position value) | Leverage= position value/capital Price moves against the position by up to 10% and is liquidated. |

Read more about leverage in this article: What is Leverage in Futures Trading?

Differences in Using Low vs. High Leverage

Leverage on various exchanges can vary, and each level of leverage carries different risks. Here are the different uses of leverage.

Low Leverage Usage

- 1x Leverage: This leverage is used for traders who don’t want to use leverage but want to utilize a short position type, which is not available in the spot market. The risk of liquidation is very small because in theory the price needs to fall close to 100% against the position. However, the exact limit still depends on the Maintenance Margin, so liquidation can still occur before the drop reaches that point.

- 2x Leverage: Suitable for traders with strict risk management but want to take advantage of the opportunities from leverage. At 2x leverage, a price movement of around 50% against the position can lead to liquidation.

- 3x Leverage: A 33% price movement can liquidate a position. Vice versa, if a trader opens a long position with 3x leverage and the price increases by 33% then the trader earns 100% of the capital used.

- 4x Leverage: This leverage is used by experienced traders who are disciplined about using stop losses. A price movement of 25% against the position may trigger liquidation.

- 5x Leverage: Generally used by traders who are quite aggressive and rely on tight calculations. At this leverage, a 20% movement can liquidate a position.

High Leverage Usage

- 10x Leverage: The leverage that traders often use is high-risk, as even a 10% price movement against a position can lead to liquidation.

- 15x Leverage: At this leverage, a move of around 6.67% can liquidate a position. The risk is very high as the daily volatility of crypto often reaches this figure.

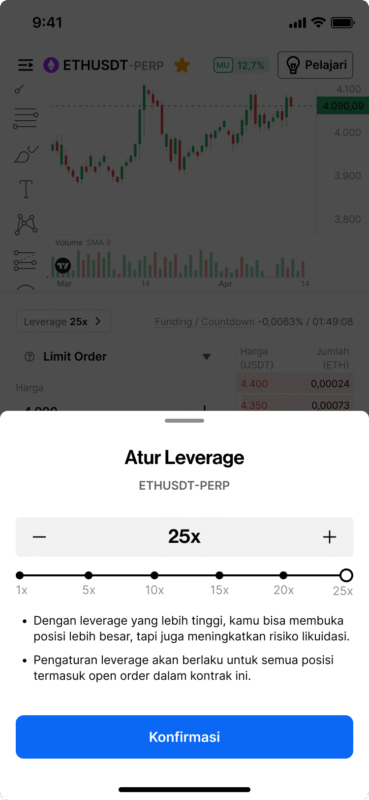

- 25x Leverage: Liquidation can occur if the price moves about 4% against the position. This leverage is not very suitable for beginners, especially since crypto volatility can reach such levels in just a matter of hours.

Important Notes:

Each exchange has a different Maintenance Margin requirement. On Pintu Futures, the Maintenance Margin is set at 1% of the position value for contract options with a maximum leverage of 25x, and 2.5% of the position value for contract options with a maximum leverage of 10x.

This means that the liquidation based on the price movement of the different uses of leverage above is estimated using the basic formula (1 ÷ leverage). Actual results may vary slightly after deducting Maintenance Margin.

Benefits of Managing Leverage Wisely

In perpetual trading, each trader needs to understand their own capacity to make decisions and have a thorough risk management calculation. By managing leverage wisely, traders can gain the following important benefits:

1.Can Understand Risk Better

Each level of leverage carries different risks, and traders can choose according to how much risk they are prepared to take. By understanding the estimated liquidation percentage of price movements, traders can adjust their leverage, position size, and capital employed. This helps traders have a much clearer and measurable risk-reward calculation.

2.Maintaining Trader’s Mental Poise

The lower the leverage used, the lower the risk a trader faces. By setting a low leverage on each transaction, traders can focus more without worrying too much about volatile price movements. However, the use of low leverage must still be accompanied by good risk management, such as the use of Stop Loss.

3.Better Trading Strategy Decisions

By knowing the percentage of price that can liquidate a position, traders can study the price movement history of the crypto asset they want to trade and adjust it for a more mature strategy. For example, by using low leverage such as 2x on large-cap assets such as BTC, traders can see that BTC’s price movement history rarely corrects up to 50% in the last 1 week, making it suitable for day trading strategies.

How to Manage Leverage at the Futures Door

After understanding the differences and benefits of low and high leverage, Pintu Futures now provides an Adjustable Leverage feature that allows you to adjust the leverage size from 1x to 25x. Check out how to use it below:

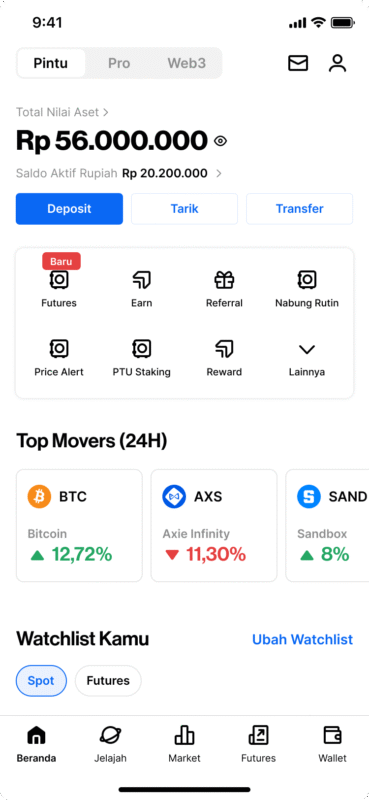

- Make sure you have updated the Pintu app to the latest version, then open the app.

- Tap the Futures menu in the Pintu app.

- Select the contract you wish to trade.

- Select “Leverage 25x” and set the leverage according to your trading strategy and tap “Confirm“.

How to Use the Web Futures Door

In addition to spot trading on the Pintu Pro feature, you can also trade Futures on the Pintu app. Here are the steps to use Pintu Futures on Pintu Web:

- Go to https://pintu.co.id/

- Click the Futures button.

- Click Trading Futures on Desktop.

- Then click Register or Login if you have already registered.

You can also access Pintu Futures directly through the Pintu app, by selecting the Futures tab on the main page, or access it through the Market page on Pintu.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

Basically, leverage is just a tool for traders to open positions according to the risk they are ready to accept. The use of both low and high leverage gives an idea of how much potential profit and risk is possible. While high leverage can result in huge profits with just a few percent price movement, the risks are also comparable. By managing leverage wisely, traders can also determine a position size that suits their ability to stay in the market over the long term.