Real World Assets (RWA) have emerged as a rapidly growing category within the crypto space, experiencing a surge in interest throughout 2023–2024 and continuing to evolve as a key driver of real-world blockchain adoption.

Ethereum has established itself as the dominant ecosystem for various RWA projects, including Ondo Finance, Maple Finance, and the latest entrant in crypto RWA, BlackRock BUIDL. This article explores their latest developments.

Article Summary

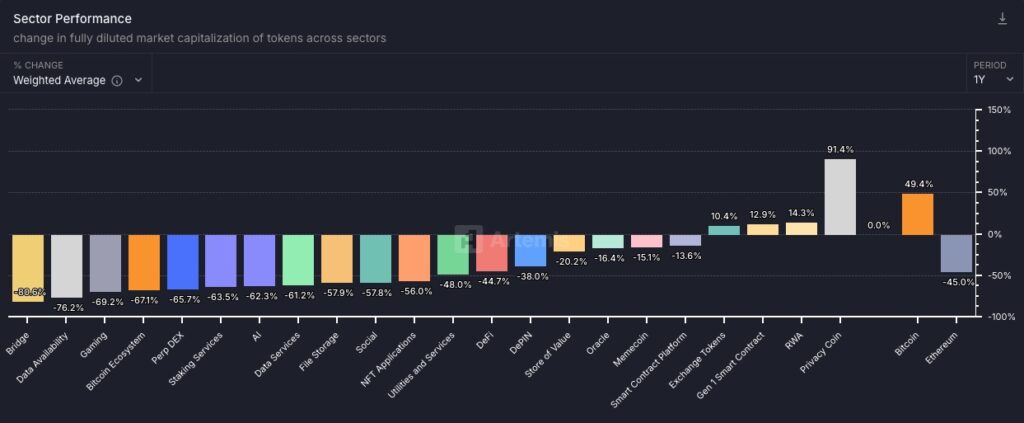

- 🌟 The RWA sector has been one of the few with positive growth, while many other sectors saw corrections ranging from 13% to 80% over the past year.

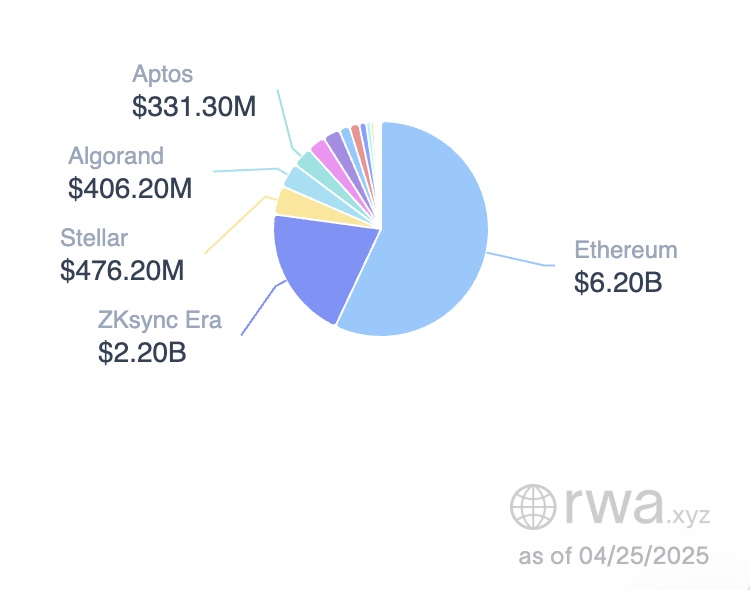

- 📊 Ethereum has become the primary network for numerous RWA projects in recent years, with the sector’s market capitalization reaching approximately $6.2 billion.

- 🏆 Ondo Finance, Maple Finance, and BlackRock BUIDL are among the RWA projects that have recorded significant increases in total value locked (TVL).

RWA Sector Performance

Over the past year, the RWA sector has ranked among the top three best-performing sectors, alongside Bitcoin and Privacy Coins. According to performance data, RWA recorded a 14.3% increase in fully diluted market capitalization.

It is one of the few sectors that posted positive growth, while many others saw corrections ranging from 13% to as much as 80% over the same period. One of the key drivers behind this strong performance is the emergence of major projects like Ondo Finance, which successfully partnered with institutional giants such as BlackRock, helping boost market confidence in the sector.

Ondo Finance’s success is certainly no coincidence—the project was built on the Ethereum ecosystem, which has long served as the central hub for many RWA initiatives. So, what makes Ethereum so dominant in this space?

Ethereum as the “Home” for RWA Projects

Ethereum has served as the primary network for many RWA projects in recent years, with the sector’s market capitalization reaching approximately $6.2 billion, according to data from RWA.xyz.

Despite its reputation for high transaction costs (gas fees), many RWA projects continue to choose Ethereum as their foundation. This is due to several key advantages, including deep liquidity, strong institutional trust, multichain compatibility, robust infrastructure, and a wide range of token standards such as ERC-20, ERC-721, and ERC-3643.

These strengths reinforce Ethereum’s position as the preferred choice over alternatives like Solana, even though Solana offers lower transaction fees.

Beyond Ondo Finance, other projects such as Maple Finance and BlackRock BUIDL have also selected Ethereum as the network on which to build their products and expand their market reach.

RWA Ecosystem Update: Ondo Finance, Maple Finance, and BlackRock BUIDL

1. Ondo Finance

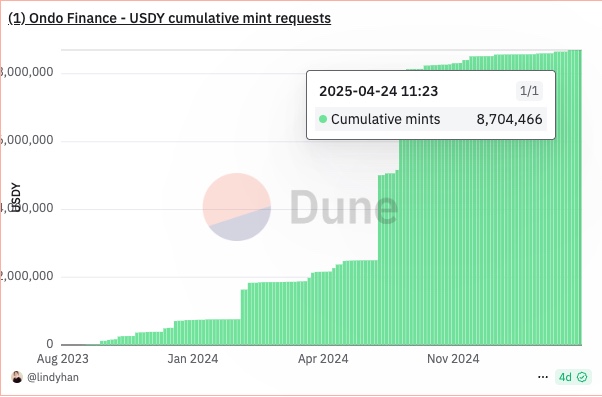

Recently, Ondo’s Total Value Locked (TVL) reached a new all-time high of $1 billion, reflecting strong interest from both retail and institutional investors in its yield-generating products—US Dollar Yield (USDY) and Ondo Short-Term US Government Treasuries (OUSG), backed by U.S. Treasury bonds. These two products have significantly contributed to the platform’s growing TVL. In addition, Ondo recently launched USDY on the Stellar network, further boosting liquidity by opening access to new participants in the ecosystem.

Since 2023, the total amount of USDY minted has surged more than 65 times by April 2025. This sharp increase reflects growing investor demand for yield-generating assets backed by tokenized U.S. Treasuries and bank deposits—products offered by Ondo Finance. The spike in USDY issuance aligns with the continuous growth in Ondo’s TVL.

In early February 2025, Ondo introduced two major initiatives:

- Ondo Chain – a custom-built, Proof-of-Stake Layer-1 blockchain specifically designed to support asset tokenization.

- Ondo Nexus – an instant liquidity infrastructure for third-party tokenized Treasuries, which has now officially launched.

2. Maple Finance

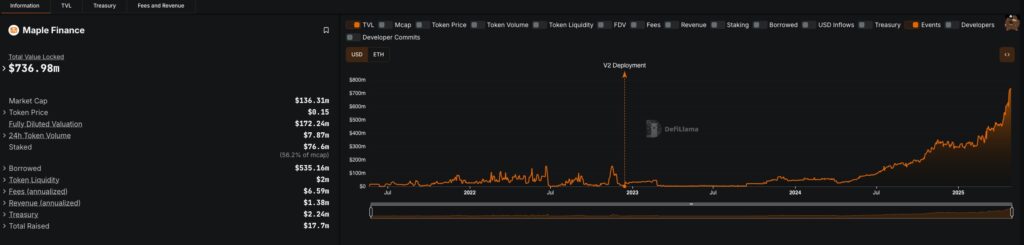

Maple Finance is a blockchain-based lending platform built on Ethereum that connects investors with institutional borrowers. Before Maple, there were no blockchain platforms offering institutional lending services using a bank-like model—only faster, more transparent, and more efficient. This innovation has positioned Maple as one of the pioneers in bridging traditional finance with blockchain technology, while also strengthening the role of Real World Assets (RWA) within the DeFi ecosystem.

Maple Finance’s TVL has grown significantly from 2021 to 2025, reaching $736.98 million.

In mid-2024, Maple Finance launched a new product called Syrup, which allows users to earn yield from institutional borrowers through a permissionless lending model. In other words, Syrup gives everyday DeFi users access to double-digit yields that were previously available only to accredited investors. This innovation has contributed significantly to the growth of Maple’s TVL.

In recent months, Syrup pools denominated in USDC have delivered net returns of around 15.7% APY to lenders—well above the average across the DeFi market.

These high yields come from overcollateralized loans issued to verified institutions, backed by crypto assets such as BTC and ETH used as excess collateral.

3. Securitize – BlackRock BUIDL

BlackRock BUIDL is a newly launched tokenized money market fund by BlackRock, issued in digital form and operating on the Ethereum blockchain. Its full name is the BlackRock USD Institutional Digital Liquidity Fund, and it is designed to provide yield from U.S. dollar-denominated assets while maintaining price stability. In other words, BUIDL transforms the traditional structure of money market funds—typically investing in low-risk assets such as short-term U.S. Treasury bills—into a digital version on the blockchain.

Beyond Ethereum, BUIDL has expanded its availability to five additional blockchain networks: Arbitrum, Solana, Optimism, Polygon, and Aptos, enhancing its cross-chain accessibility.

In parallel, Securitize and Ethena Labs have jointly introduced Converge, a new institutional-grade blockchain built to bridge decentralized finance (DeFi) with traditional finance. Backed by partners like Pendle, Aave, and Maple. Converge aims to provide an Ethereum-compatible, scalable, and regulatory-compliant settlement layer—offering a robust infrastructure to support broader institutional adoption of blockchain-based financial products.

Currently, BlackRock’s BUIDL holds the highest TVL among all RWA projects in the market, reaching approximately $2.79 billion. This figure reflects strong investor demand for tokenized real-world assets—especially products like BUIDL that offer both stability and U.S. dollar-denominated yields. The surge in TVL also highlights how tokenization can serve as a practical solution for bringing traditional assets onto the blockchain in a more transparent and efficient way.

The Growing Potential of the RWA Sector

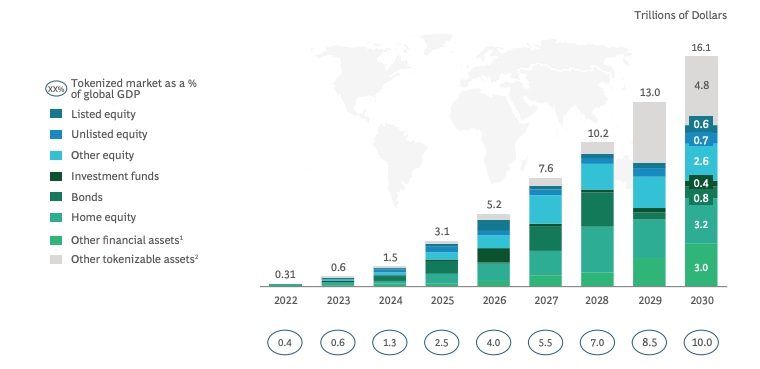

The potential of the RWA sector is expected to surge significantly in the coming years. According to a report by BCG and ADDX, the total market value of tokenizable assets could reach $16 trillion by 2030, equivalent to 10% of global GDP.

From a market size of approximately $0.6 trillion in 2023, projections indicate a more than 25-fold increase within just seven years. This is a strong signal that blockchain isn’t just about crypto anymore—it’s about transforming how we own and trade real-world assets in a faster, more transparent, and more efficient way.

Conclusion

RWA is increasingly proving its potential as a bridge between traditional finance and blockchain technology. Projects like Ondo, Maple, and BUIDL are not only bringing real-world assets on-chain but also unlocking new opportunities for both institutional and retail investors.

Supported by maturing infrastructure, rising institutional adoption, and a projected market value of $16 trillion by 2030, the RWA sector is well-positioned to become one of the core pillars of Web3 adoption going forward. In short, RWA is more than just a trend—it’s laying the foundation for a financial future that is more open, efficient, and accessible to all.

Buy Cryptocurrencies on Pintu Pro Web!

Interested in investing in cryptocurrency? Through Pintu, you can buy cryptocurrencies such as Ondo, BTC, and many others without the fear of scams. Furthermore, you can buy them directly in your browser through: https://pintu.co.id/pro/id/markets. In Pintu Pro web, you can trade both Futures and spot!

The Pintu app is also compatible with popular digital wallets such as MetaMask, making your transactions even more convenient. Go ahead and download the Pintu app on the Play Store or App Store today! Your security is guaranteed, as Pintu is regulated and supervised by OJK and CFX.

In addition to trading, Pintu also allows you to learn more about crypto through a wide range of articles on Pintu Academy, updated weekly!

All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References:

- Maple Finance, Syrup by Maple: Bringing Real Yield to DeFi, accessed on April 30, 2025.

- Ondo Finance Blog, Ondo Monthly Spotlight: February 2025, accessed on April 30, 2025.

- Businesswire, BlackRock Launches Its First Tokenized Fund, BUIDL, accessed on May 1, 2025.

- Securitize, accessed on May 1, 2025.