Take Profit and Stop Loss are commonly used methods by traders and investors in their trading activities. These strategies are designed to help maintain positions, maximize profits, and effectively minimize losses.

By using Take Profit and Stop Loss, traders and investors can make more accurate decisions and protect their positions from market fluctuations. If you apply correctly, these methods can significantly enhance risk management and improve potential profitability in short-term and long-term trading. Are you curious about the best strategies for Take Profit and Stop Loss? Find out more in the following article.

Article Summary

- 💸 Take Profit is a method to secure profits by closing positions at previously set level to manage the risk of market fluctuations.

- 🚨 Stop Loss is a method to limit losses by automatically closing positions when price reach a specified level.

- 💡 Effective Take Profit and Stop Loss strategies can be determined through technical analysis and risk management.

- 🔎 Learn how to use Take Profit and Stop Loss effectively in the Futures Market.

What Are Take Profit and Stop Loss?

Take Profit (TP) is a strategy used to secure profits by closing positions at previously set levels, helping to mitigate market fluctuations risks. By using TP, you can sell assets above the entry price according to your planned profit target, maintaining discipline and managing capital more effectively for future trading.

On the other hand, Stop Loss (SL) is designed to limit losses by automatically closing positions when the price reaches a level below the entry point. SL plays a crucial role in protecting capital from significant losses caused by unpredictable market movements. It also helps manage risk and maintain emotional stability when dealing with uncertain market conditions.

TP and SL can be applied simultaneously to enhance risk management and ensure consistency in maximizing profit potential. Alternatively, you may choose to apply only one of the two, depending on your specific trading needs.

How to Determine Effective Take Profit and Stop Loss

TP and SL are crucial strategies in trading, whether in the spot or futures markets. Both help you manage risk and secure profits in line with the pre-set targets. Below are some practical ways to determine Take Profit and Stop Loss:

1. Support and Resistance

Technical analysis can guide you in identifying market patterns during bullish or bearish trends. Specifically, technical analysis such as Support and Resistance lines analysis play a crucial role as references for entering positions and setting Take Profit or Stop Loss levels effectively.

Tips: Set your TP slightly above the Resistance level to lock in profits and protect your position from volatility market. Likewise, set your SL below the Support level to limit potential losses if the market trend turns bearish.

2. Fibonacci

Additionally, you can use Fibonacci when trading crypto to determine your take-profit levels. Fibonacci Retracement helps you identify ideal TP areas based on whether the market is up trend or down trend. This tool is shown in ratios such as 0.236 (23.6%), 0.618 (61.8%), 0,786 (78,6%), 1 (100%), 1.618 (161.8%), and 2.618 (261.8%).

Tips: Ideally, the Fibonacci ratio of 0.618 can be used as a Take Profit level, especially during market corrections. This ratio often represents a significant reversal point across various asset classes and is commonly referred to as the "Golden Ratio."

3. Risk Reward Ratio

You can effectively set TP and SL targets using the Risk Reward Ratio to protect your assets from significant losses. This concept helps traders assess the potential gains and losses they are willing to accept in a trading transaction, enabling them to take more measured and disciplined positions.

Example:

- Entry Position: You have a capital of 1,000 USDT and set a rule to risk 1% of your capital on a single trade. This means the maximum loss you are willing to tolerate is 10 USDT.

- Stop Loss:If you buy 1 SOL at a price of $130, you can set your stop loss at $120 (a 7.69% drop = –10 USDT = 1% of your total capital).

- Take Profit: Based on your technical analysis, you set your take-profit target at $150 (a 15.38% increase = +20 USDT = 2% of your total capital).

You are applying a 1:2 Risk Reward Ratio, meaning that by risking 10 USDT (1% of your capital), you aim to get 20 USDT (2% of your capital). This ratio is considered ideal for implementing a disciplined TP and SL trading strategy.

Read the full article about Risk Reward Ratio on Pintu Academy

You can apply the methods mentioned above to set TP and SL in the Futures Market, whether for long or short positions, using Limit or Market Orders. These settings aim to secure profits and minimize losses based on your risk tolerance. TP and SL can be set to automatically close part or all of your positions when the price reaches a predetermined level.

There are 3 keys price terms you need to understand while you set the TP and SL:

- Mark Price is a reference price used for profit and loss valuation as well as risk management in perpetual trading. The mark price is calculated from a weighted average of index prices from global crypto exchanges adjusted for funding.

- Trigger Price is a specific price level that acts as a trigger to activate orders in the market.

- Limit Price is a predefined price set by the trader for executing a buy or sell order.

How to Use Take Profit and Stop Loss in Pintu Futures

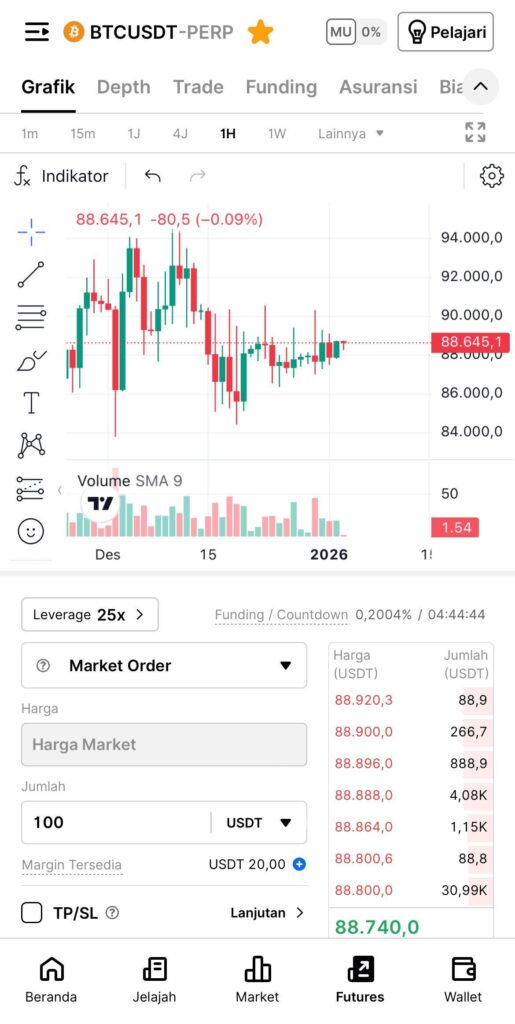

1. Go to the Pintu Futures page, then select a trading pair, choose the order type (Market, Limit, or Stop), and enter the position size.

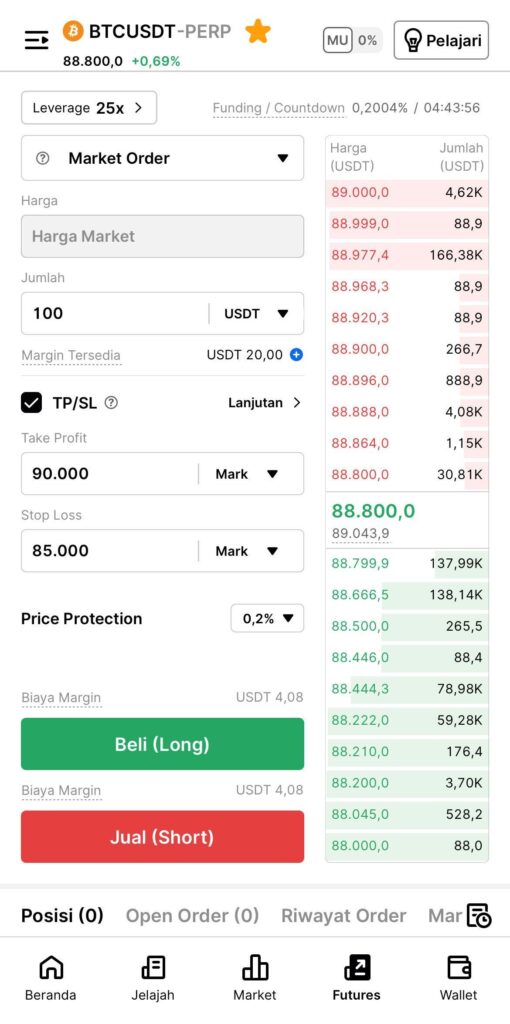

2. Enable the ‘TP/SL’ option, set the Take Profit (TP) and Stop Loss (SL) prices, choose Buy (Long) or Sell (Short), and confirm the transaction.

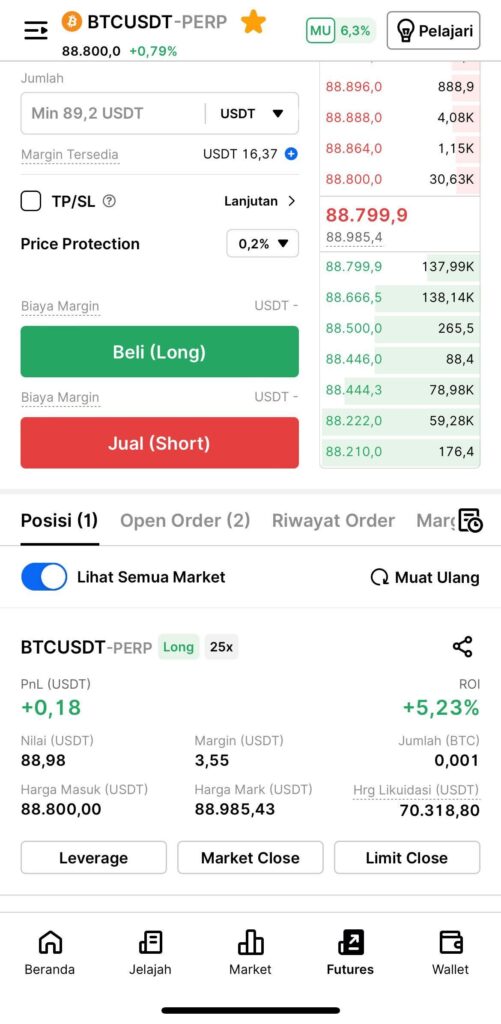

3. Congratulations! You have opened a position and set the Take Profit (TP) and Stop Loss (SL). To adjust the TP and SL prices, go to the ‘Open Order’ page.

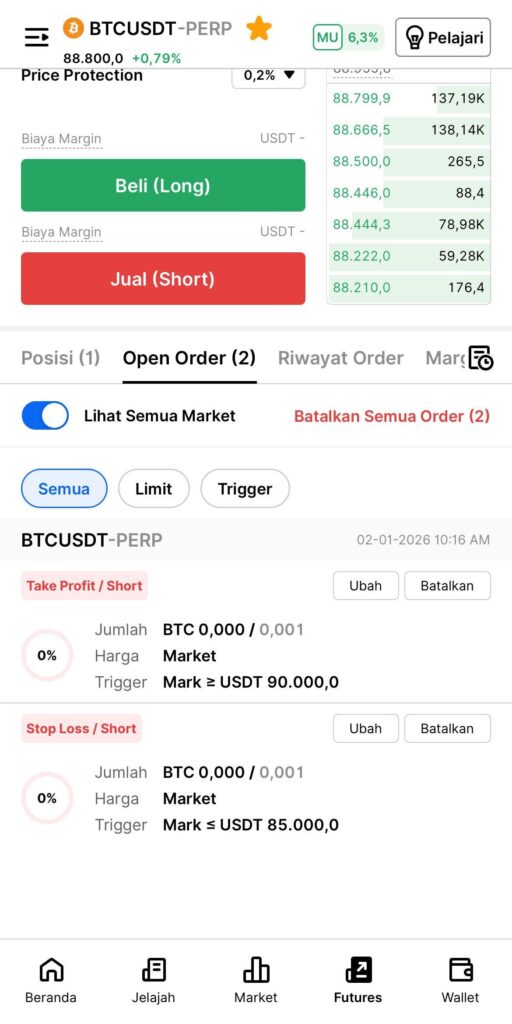

4. From this page, you can modify the TP and SL prices by selecting the ‘Edit’ button.

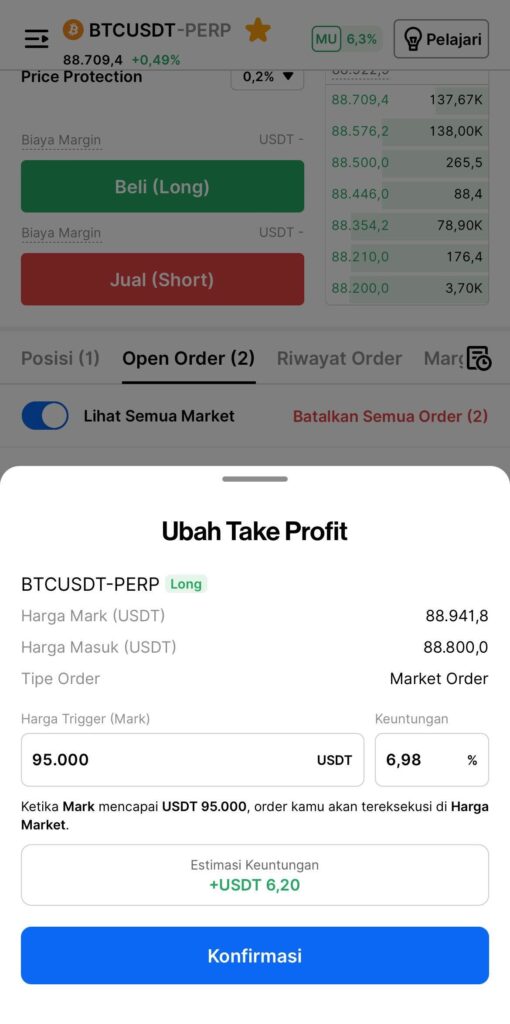

5. Set the Take Profit (TP) price you want to change, then select ‘Confirm.’

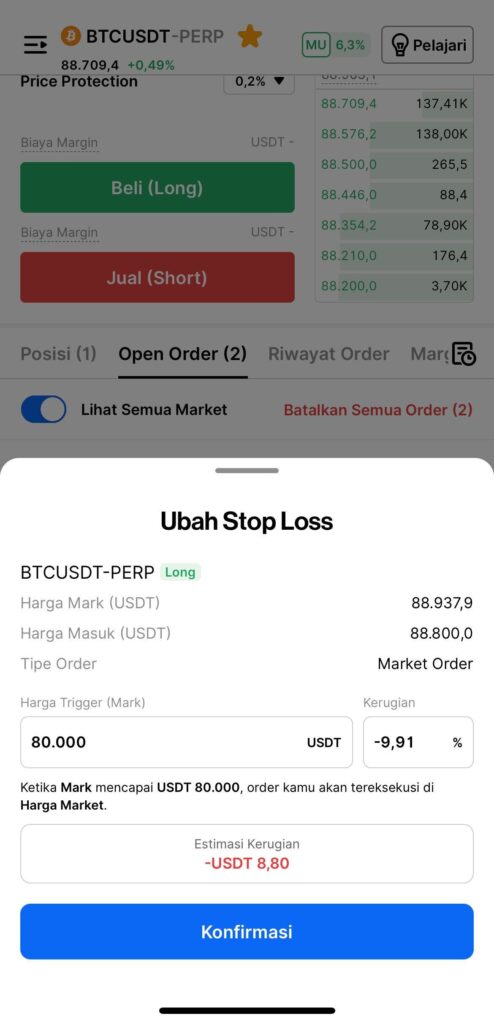

6. You can also change the Stop Loss (SL) price, then select ‘Confirm.’

You have successfully used the TP and SL features and configured them while holding an active position on Pintu Futures. With this update, you can respond more effectively to market conditions.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Conclusion

Take Profit and Stop Loss are essential trading tools designed to help traders manage risk and secure profits with discipline. By leveraging technical analysis tools such as Support, Resistance, and Fibonacci, along with implementing sound risk management strategies, traders can effectively determine TP and SL levels for better trading outcomes.