In recent months, much of the crypto community’s conversation has revolved around Ethereum and the layer 2 sector. Optimism and Arbitrum are in fierce competition to attract new teams creating innovative protocols. Their TVL numbers continue to rise and have reached the top six. With this trend, activity on most layer 1 projects has dropped dramatically. The crypto community even mentioned that most layer 1s are ghost chains with no user activity. However, there has been a lot of talk about Solana lately. Solana stands out as the only Layer 1 blockchain with a significant level of user activity within the DeFi sector. The Solana DeFi ecosystem has been gaining attention, and new protocols are emerging on its platform. Then, what about the Solana DeFi ecosystem? What are the new protocols in Solana DeFi?

Article Summary

- 🔨 Although the crypto community mostly discusses Ethereum and the layer 2 sector, Solana is emerging as one of the layer 1 projects with significant user activity. On-chain activity shows that Solana is far from “dead” and has huge active addresses and transactions.

- ⚙️ Solana DeFi ecosystem is showing recovery, with many new protocols emerging and attracting the interest of the crypto community such as Marginfi, Marinade Finance, Jito, Drift, and Hxro.

- 📈 Marginfi, a decentralized lending protocol on the Solana network, saw a 379% increase in TVL in July, driven by its new point system that measures users’ contributions to the Marginfi ecosystem.

- ⚖️ With the emergence of various new protocols, Solana shows promising potential for future growth and innovation.

Is the Alt L1 Era Dead?

In an interview with crypto content creator Ignas, Sanket, Polygon’s Head of Growth, explained that Ethereum has already won the Layer 1 competition. Sanket adds that Ethereum is the defacto winner of the L1 race with the various layer 2 offering scalability solutions to improve its performance. So, is this statement true? Data from Solana says otherwise.

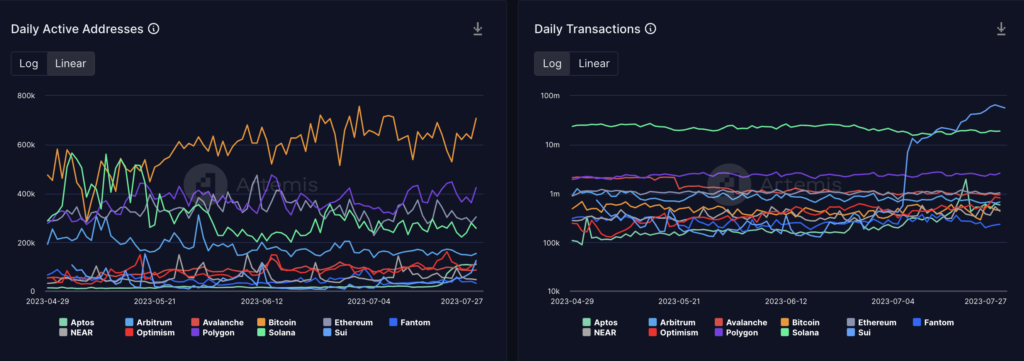

The data above represents the network activity of several L1 and L2 networks. Solana’s daily active address count is 257K, which puts Solana in 4th place after Bitcoin, Polygon, and Ethereum. This puts Solana well ahead of other L1s like Sui, Near, Aptos, and Avalanche. Solana’s address activity is also still above Arbitrum and Optimism, two L2 projects that have been very popular recently.

If you look at the graph on the right, Sui's soaring network activity is due to a game called 8192 that logs every user action as a transaction. This was part of an incentive campaign from the Sui team.

On the other hand, Solana’s daily transactions are far above all its competitors. On July 26, 2023, Solana recorded 18.8 million transactions. In comparison, Solana’s closest competitors are Ethereum and Polygon which had 1 million and 2.6 million transactions. The data shows that the Solana network is far from dead.

Finally, since the beginning of 2023, Solana has only experienced one instance of downtime. Compare this to the more than 10 total network downtime in 2022. This improvement in network performance is due to QUIC updates that prevent critical failures during congestion.

What’s With Solana’s DeFi Sector?

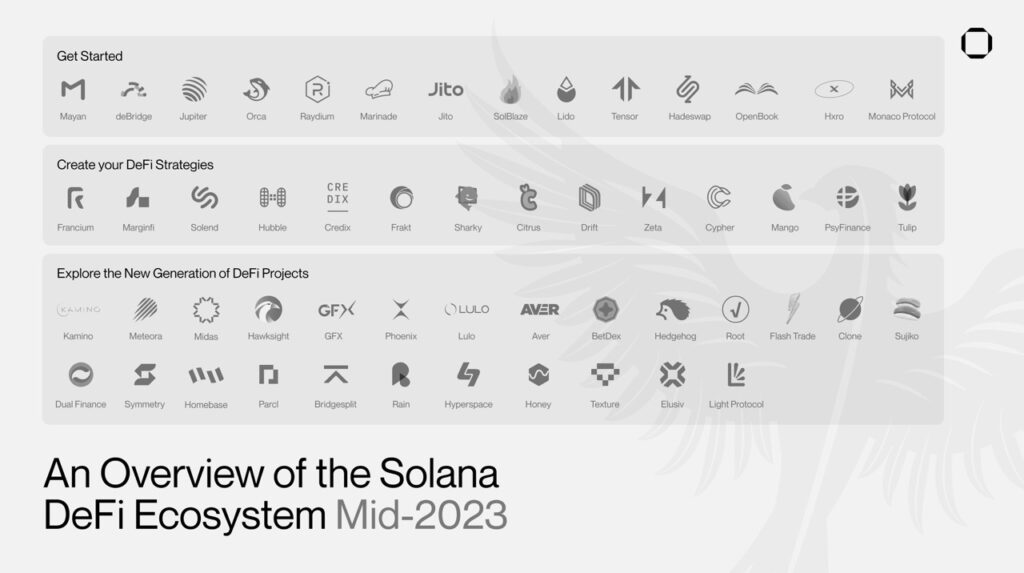

Since early July 2023, talk of Solana DeFi projects has been spreading. This is also supported by the hype around Solana Firedancer which has just completed its first milestone. In addition, the Solana DeFi ecosystem is starting to recover after dropping more than 90% since the FTX fallout and the highs in the 2021 bull market.

If you look at the image above, you will be unfamiliar with the majority of the protocols. We will discuss some of the new DeFi protocols in the third row of the image above. These protocols have sparked new interest of many in the crypto community who are curious about Solana. Many new DeFi applications provide alternatives and innovations compared to old Solana DeFi projects such as Raydium, Serum, and Solend.

5 New DeFi Protocols in Solana

1. Marginfi

Marginfi is a decentralized lending protocol on the Solana network. The current main product of marginfi is mrgnlend where users can borrow and lend with interest rates.

In addition, marginfi emphasizes sophisticated risk management and displays the transparency of risks taken by each user. Marginfi displays each asset or pool with a high risk so that users can choose assets that match their risk tolerance.

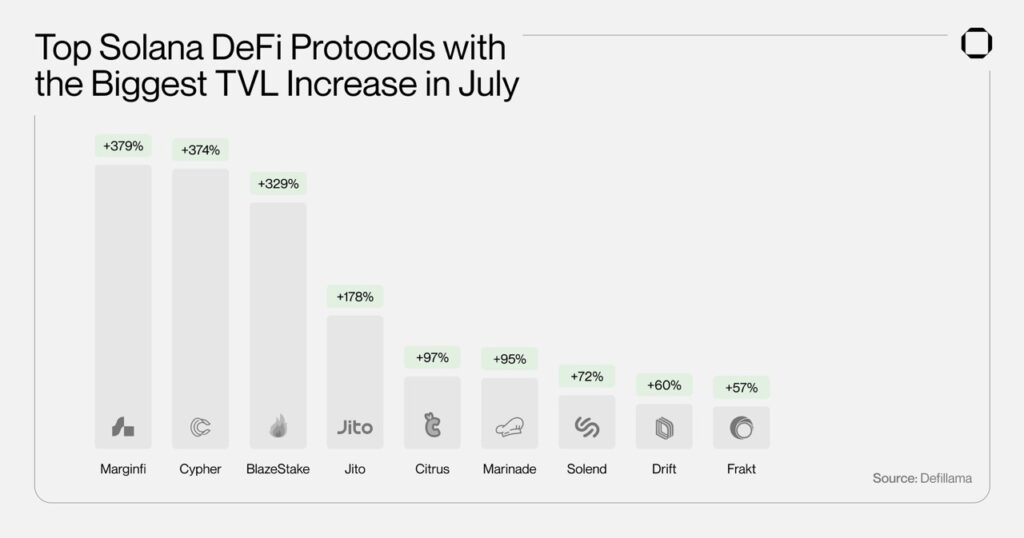

Currently, marginfi has a TVL of 19.46 million dollars. One of the reasons why marginfi can experience a 379% increase in July is points. Marginfi introduced a point system as a measure to assess a user’s contribution to the marginfi ecosystem. This point system will be used by marginfi as a criterion for dropping airdrops. So, this successfully attracted many people to use marginfi.

2. Marinade Finance and Jito

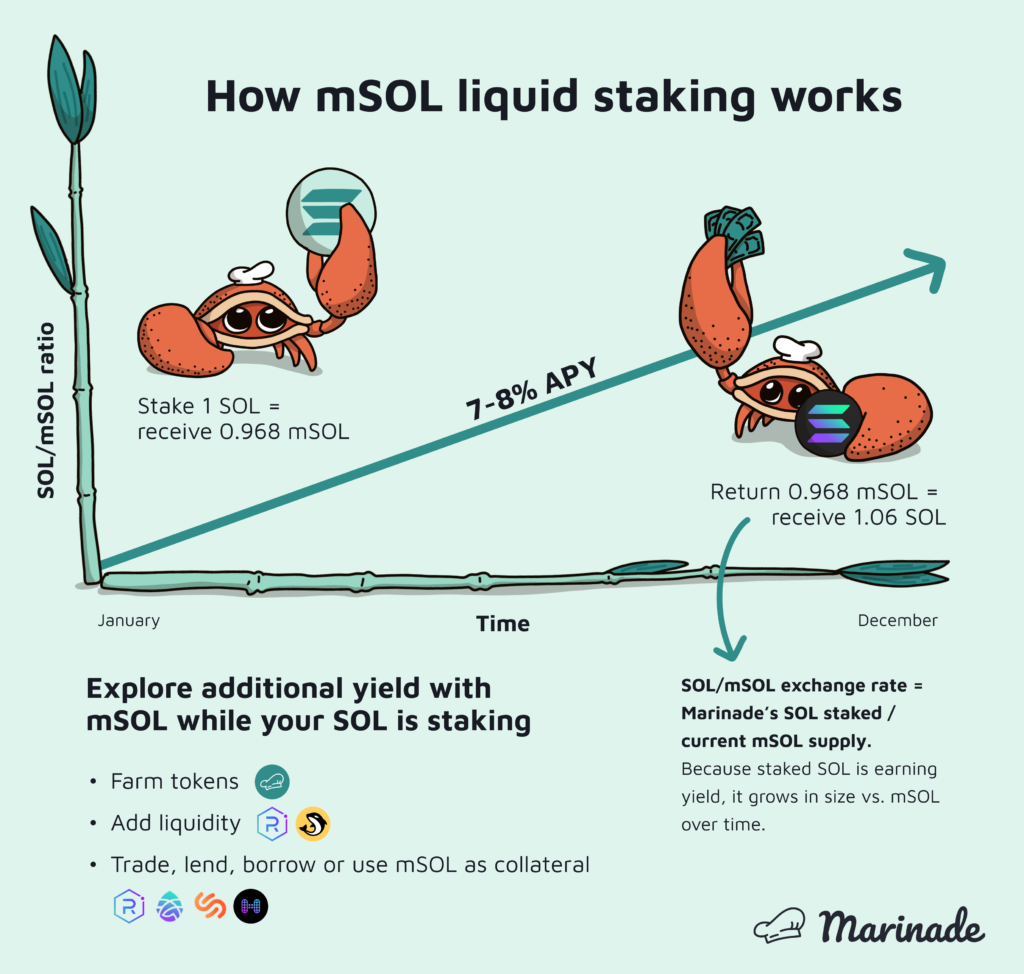

Marinade Finance and Jito are two of Solana’s most popular liquid staking protocols. Jito has a TVL of $33 million while Marinade has the highest TVL in Solana at $160 million dollars. Both offer their own benefits to users.

Marinade Finance has a unique directed staking feature where each user can choose a validator to delegate SOL staking. Meanwhile, SOL staking in Jito not only gives you staking rewards but also a proportion of MEV rewards earned by Jito validators.

In addition, Jito and Marinade have their own liquid staking tokens (LST), JitoSOL, and mSOL. Users can use Marinade and Jito’s LSTs to earn additional yield. Marinade Finance has a list of DeFi apps that support mSOL while Jito has a guide section on using JitoSOL in its docs. In addition, Jito is in a unique position because it also runs its own validator network with a dedicated validator client application.

With Ethereum’s LSDFi sector booming, it’s not impossible for Solana to experience the same trend. Marinade Finance and Jito are the two leading platforms in liquid staking Solana. Also, these two protocols don’t have a native token yet.

3. Drift Protocol

Drift Protocol is a decentralized trading platform on the Solana network. The Drift trading platform has a TVL of $12 million dollars and 24% TVL growth in the last 30 days. Drift provides spot and perpetual trading options using up to 10x leverage. The protocol also has lending/borrowing and provides a way for users to be liquidity providers. Basically, Drift provides a complete package of DeFi platforms from DEX to trading.

Drift V2 ensures that every incoming order can be executed instantly using the Just-In-Time Auction mechanism. This ensures Drift has a trading speed that is not inferior to centralized crypto exchanges.

One of the innovations of Drift V2 is the insurance fund vault to cover losses experienced by Drift. Users can stake in this insurance fund and get a share of the profits that Drift makes from platform fees. However, there is a risk as their funds may be used to cover Drift’s losses when users experience leveraged losses.

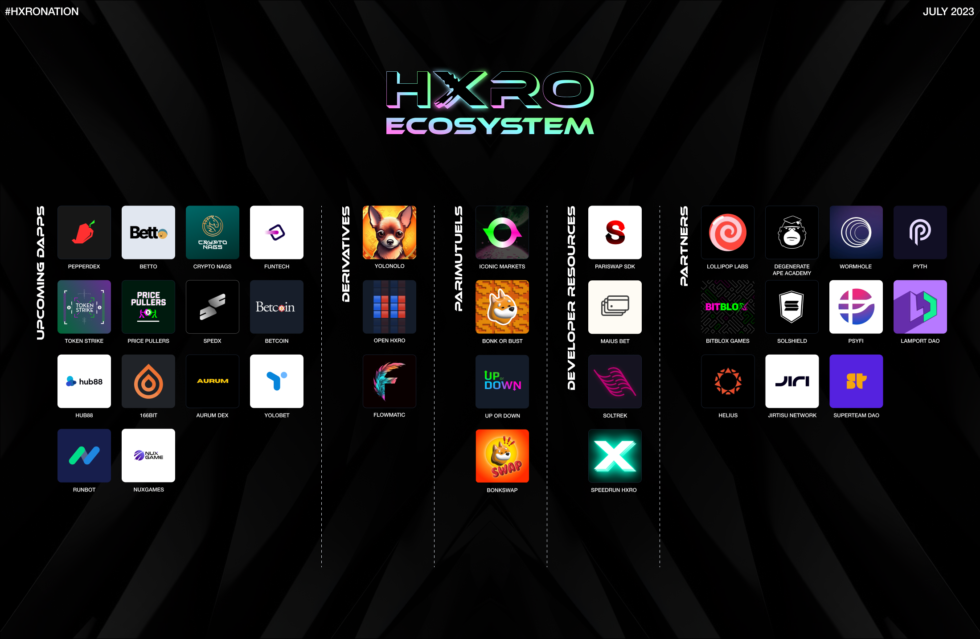

4. Hxro Ecosystem

Hxro is a distributed liquidity layer for derivatives trading and betting applications built on top of the Solana network. Through a set of protocols, Hxro also provides the underlying infrastructure for exchange, risk, margin, and transaction settlement functions needed to build derivatives or gaming applications. There are already 25 applications in the Hxro ecosystem with 11 of them already live.

The Hxro ecosystem is built on three pillars: Hxro Derivatives (Dexterity Protocol and SPANDEX risk engine), Hxro Parimutuel, and liquidity protocol with sAMM. These three pillars provide plenty of tools for developers who want to use the open-source Hxro protocol. Hxro Derivatives can be used for teams that want to create a decentralized derivatives exchange. Meanwhile, development teams looking to create a betting platform can use Hxro’s Parimutuel framework.

In addition, the HXRO token is comprehensively integrated into the Hxro ecosystem through Hxro Finance. The five uses of the HXRO token are governance token, protocol profit share, network incentives, rewards, staking, and protocol transaction fee discount.

With the trend of decentralized betting platforms and derivatives platforms, Hxro has the potential to attract thousands of new users to Solana. Also, transaction fees on Solana are much cheaper than on Ethereum. Crypto developers can also use the software framework provided by Hxro.

Conclusion

In recent months, the crypto community has focused on Ethereum and the increasingly competitive layer 2 sector, while activity on many layer 1 projects has dropped dramatically. However, discussions about Solana have become more frequent.

Network activity data shows that Solana ranks 4th after Bitcoin, Polygon, and Ethereum with 257K daily active addresses. Solana also recorded 18.8 million transactions on July 26, 2023, much higher than its closest competitors, Ethereum and Polygon. Solana has only experienced one network downtime since the beginning of 2023 compared to more than 10 in 2022.

In the DeFi sector, since the beginning of July 2023, talk of Solana has spread further with many new protocols emerging, such as MarginFi, Marinade Finance, Jito, Drift, and Hxro. These five protocols have driven the recovery of TVL numbers in Solana since July 2023.

Although the crypto community tends to consider many layer 1 projects as ghost chains, Solana seems to survive with a large user base. With new and innovative protocols emerging, Solana shows promising potential for future growth and innovation.

How to Buy SOL on the Pintu App

You can start investing in Solana by buying SOL on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for Solana (SOL).

- Click buy and fill in the amount you want.

- Now you are a SOL investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- Ignas, “The Endgame for Solana: An AMA with Michelle, DeFi BD at Solana Foundation”, Substack, accessed on 28 July 2023.

- Francesco, “The Solana Renaissance – Francesco’s Joint”, Substack, accessed on 28 July 2023.

- @DeFiignas, “1/17 What’s the endgame for Solana? And how will Solana recover from a 97% drop in TVL? I interviewed Michelle”, Twitter, accessed on 28 July 2023.

- “An Overview of the Solana DeFi Ecosystem (2023)”, Squads, accessed on 28 July 2023.