Investing in cryptocurrencies can be a high-risk, high-reward venture. The potential for substantial gains is matched by the risk of significant losses. While crypto investments can lead to great wealth, they can also result in massive setbacks. If you find yourself facing losses from crypto investments, don’t lose hope. Here are five crucial steps to help you bounce back and learn from your experiences.

Article Summary

- 🔎 If you have suffered a significant loss in crypto trading, acknowledge the mistake. You also need to take responsibility, evaluate the error, and find solutions to avoid the same thing happening again.

- 🧘♂️ After a significant loss, it’s essential to break from trading activity. Try to calm down and avoid impulse trading.

- 🎯 Test your new trading strategies with small capital to rebuild confidence.

- ⚡ Poor risk management is the main cause of massive losses in crypto trading. Tighten up your risk management to prevent similar losses from happening again.

Losing is Part of Trading

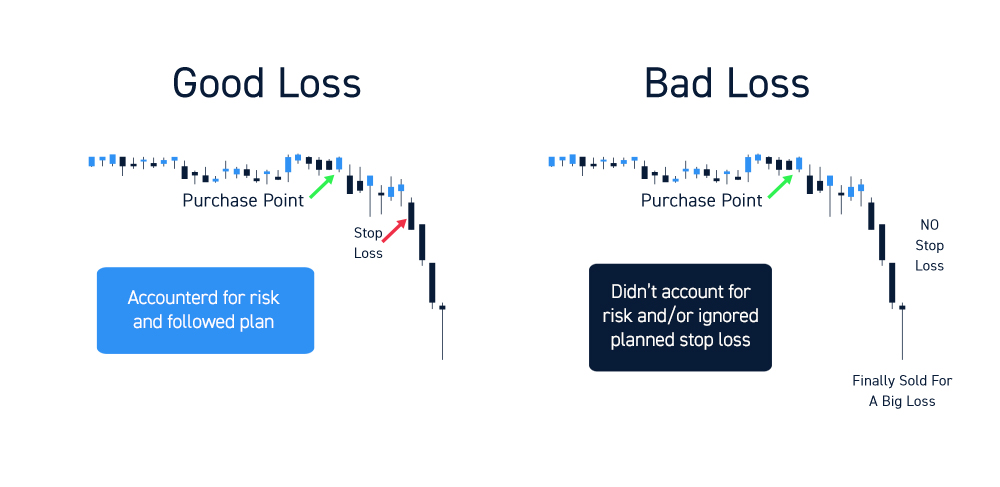

The crypto market is a very volatile place. The market direction can reverse in minutes and expose traders to unexpected losses. When in a losing position, traders always have the option to cut losses. Especially if the price of an asset has crossed the specified stop-loss limit.

But unfortunately, sometimes our brains perceive losses to have a more significant impact than profit, even if they have the same amount. Psychologically, we don’t like to lose something we already have. That’s why traders often don’t want to admit they’re losing money, even though they’re losing their position.

The justification in the trader’s mind is “This price drop won’t last, the price will rise again.” As a result, he keeps loosening the stop-loss limit. When traders are reluctant to cut losses, they open the door to greater losses.

Five Things to Do After a Loss

Here are five things you can do after a loss in crypto trading:

1. Take Responsibility and Evaluate

It may be a small amount of loss, it may be a sizable amount, or it may be a loss to the point of changing lives. However, whatever the reason and whatever the amount, losses are irreversible. Therefore, the trader should admit and take responsibility. After all, he could prevent it by cutting losses. Ignoring the situation shows that he has no control over his trading.

After admitting the mistake, a trader should immediately evaluate the decision that led to the loss. Find out what caused the loss. Is there a solution so that the same thing does not happen again? For example, an automatic cut-loss option is used when the asset price crosses the target price limit. Changing the strategy in determining the right entry point is also possible.

Instead of blaming the situation, use the energy to evaluate and find solutions. Traders can only move on to the next step after realizing their mistakes, taking responsibility, and preparing solutions.

Implementing limit orders is one way to be disciplined in cutting losses. Find out more about limit orders in the following article.

2. Take a Short Break

Large losses will cause traders to experience emotional distress. Self-confidence is also at its lowest. If left unchecked, this can affect performance on the following trades. A trader’s decisions will be haunted by doubt, anxiety, anger, and other negative energies.

<aside> 💡 Avoid trading with hot money or even going into debt to cover losses. This will only put more pressure on the trader and could lead to worse things.

</aside>

Therefore, take a deep breath and stop all your trading activities. Find something else to do, and let time help you recover from those failures. Don’t give up immediately just because you had a bad experience. Remember, past events do not reflect what will happen in the future.

Try not to rush back into the market. Make sure to re-enter the market with a clear mind and no longer filled with negative emotions.

3. Practice and Rebuild Your Confidence

Initially, crypto traders are generally confident in their abilities or luck. Especially if they start trading in a bullish market or have skyrocketing assets. However, these conditions can turn 180 degrees when market realities slap traders.

Therefore, after a failure, evaluate and readjust your trading system. Focus on your new trading strategy and start testing those trading plans. Confidence grows as we see positive results coming from that trading plan.

Use a demo account to test the new system. Since it doesn’t involve real money, traders can focus more without the pressure to make a profit. Keep testing until you find the best formula and gain the confidence to start trading again.

In developing a trading strategy, there are four indicators that should be considered. What are they? Find out here.

4. Start Small

When rebuilding confidence and getting back into trading, use small capital. Small wins can be the most powerful medicine to restore your confidence. Also, losing a small amount of money is much easier to accept and will not cause significant pressure.

Once you’ve won a few trades, try increasing your capital. But remember, don’t rush things. Take things slowly. Some people try to rush back into live trading after a significant loss when they aren’t ready. They end up losing more. Some traders repeat that cycle and never recover.

While trading with a small amount of capital may feel unsatisfying, it’s for the best. Recovering after a big loss is about returning to basics and implementing new trading plans, not making money. Profits will come naturally when the new plans are battle-tested, and your confidence is back.

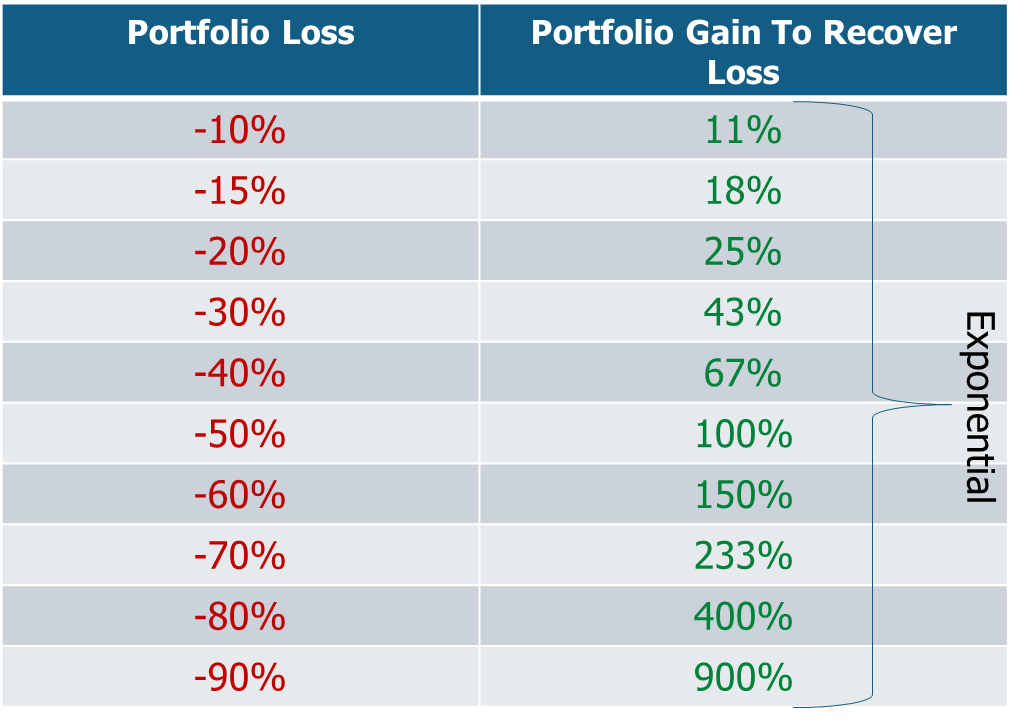

5. Tighten Your Risk Management

Many external factors can indeed cause losses. However, the main cause of large losses is a trader’s poor risk management. Risk management is the only way to prevent significant losses.

There is a famous saying in the financial market regarding risk management: “Manage your risk, or the market will manage it for you.” This saying means that if you cannot manage and adjust your risk level, then the market will manage it for you.

Therefore, substantial losses often signal that there is a flaw in risk management. As such, traders are compelled to reinforce their risk management strategies to avert repeating the same mistakes. Effective risk management may encompass differentiating between trading and investing, deciding on asset allocations, and implementing diversification. It also involves understanding the appropriate timing to ‘attack’ (i.e., aggressively invest) or ‘defend’ (i.e., maintain or reduce investments). Furthermore, it requires setting cut-loss limits and identifying exit points to cap potential losses.

If you want to know more about how to do your risk management on crypto assets, Pintu Academy has prepared the following article.

Conclusion

Losses, whether minor or substantial, can leave a lasting impact on traders and investors alike. Unfortunately, avoiding losses entirely is nearly impossible. Even seasoned investors have faced significant setbacks in their financial journeys. However, it’s crucial to view losses as a part of the learning process and not as a definitive failure.

Never think of a loss as an absolute defeat. Instead, consider it as a temporary setback on your path to achieving financial goals. Embrace losses as opportunities for growth and learning. After experiencing failure, you can put into practice the five steps mentioned earlier. Treat these losses and failures as valuable lessons for self-discovery and personal development. With each setback, you gain valuable insights that can lead to wiser decisions in future investments and trades. Remember, every financial journey will have its ups and downs, and it’s how you learn from the downs that can make all the difference in achieving long-term success.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- Cory Mitchell, Bouncing Back After a Big Trading Loss, The Balance, accessed on 1 August 2023.

- Ken Hawkins, The Art of Cutting Your Losses, Investopedia, accessed on 1 August 2023.

- The Hidden Maze, How to Cope Properly, Twitter, accessed on 1 August 2023.