Investing in the U.S. stock market is no longer an exclusive domain for institutional investors—it has now become a realistic and attractive option for Indonesian investors who want to diversify their international portfolios.

Based on analysis comparing the stock indices of both countries, the average returns of U.S. stocks have historically tended to be higher with lower risk compared to Indonesian indices, as shown in a study on ResearchGate. With an exchange rate of 1 USD = Rp16,623 as of September 2025, the profit potential from the growth of leading global companies is increasingly appealing.

Article Summary

- 🌐 Global Opportunities & Exchange Rates: Investing in U.S. stocks is crucial for international portfolio diversification since historically they offer higher returns with lower risks than domestic markets, supported by the exchange rate (1 USD ≈ Rp16,623).

- 🔗 Tokenized Stocks (xStocks) & 24/7 Access: Tokenized Stocks are digital representations of U.S. stocks on blockchain/crypto. This innovation enables fractional ownership (small nominal investments) and 24/7 trading, freeing investors from traditional stock exchange hours.

- 📈 Long-Term Discipline (DCA & Value Investing): Main strategies include Dollar Cost Averaging (DCA) to handle volatility, and Value Investing, which focuses on fundamental analysis (P/E, P/B) to identify undervalued stocks.

- 💰 Momentum Income Strategy: Momentum investing (buy the dip) is recommended to accumulate quality stocks during corrections.

- 🚀 Top Picks on Pintu: Pintu platform provides access to xStocks such as Tesla xStock (TSLAX), reflecting EV dominance (+33.63% in 1 Month), and Circle xStock (CRCLX), tied to stablecoin infrastructure (+12.55% in 1 Month as of Oct 3, 2025).

- ✅ Digital Advantage: The combination of classic strategies with Tokenized Stocks offers capital flexibility and the ability to transact digitally in global markets.

Understanding Tokenized Stocks: U.S. Stocks on Blockchain

Tokenized Stocks are digital representations of publicly traded company shares on the blockchain, serving as a bridge between traditional finance and the cryptocurrency ecosystem. This asset tokenization enables fractional ownership and facilitates 24/7 trading, unrestricted by conventional stock market hours.

Each token is designed to track real-world stock price movements, giving token holders economic exposure, although typically without direct shareholder voting rights.

The key advantage of crypto-based stocks is global accessibility and the ability to buy fractions of shares, freeing retail investors from the need to purchase a whole stock, which could cost millions of Rupiah.

Main Strategies for U.S. Stock Investing

1. Dollar Cost Averaging (DCA): Discipline Against Volatility

The Dollar Cost Averaging (DCA) strategy involves investing the same amount of money periodically, regardless of stock price movements, as a primary risk management tool.

This strategy effectively reduces the impact of price volatility on overall purchase costs, allowing investors to accumulate more stock units or tokenized stocks when prices are low, as reviewed by Investopedia.

DCA is highly recommended for beginner investors since it removes the effort and emotional traps of trying to time the market.

2. Value Investing and U.S. Stock Fundamentals

Value investing is a long-term strategy championed by figures such as Benjamin Graham, focusing on buying stocks considered undervalued or traded below intrinsic value.

For U.S. stocks, fundamental analysis requires in-depth evaluation of a company’s financial health, including key ratios such as Price-to-Earnings (P/E) and Price-to-Book (P/B), based on findings published on Scribd. Smart investors look for companies with strong cash flows, controlled debt, and consistent earnings growth prospects.

3. Momentum Investing: Buying Ahead of Catalysts or Buy the Dip

Momentum investing involves buying assets whose prices are rising and selling them when momentum starts to fade. A more conservative variation is “buy the dip.”

Based on investor behavior studies, purchasing during significant price drops that do not change a company’s fundamentals can be an opportunity to accumulate quality assets at lower prices. Analysts at Edward Jones advise investors to prepare a “wish list” of high-quality investments ready to buy in case of unexpected market corrections.

Advantages of Tokenized Stocks: Why Buy Them?

1. 24/7 Trading Advantage

With tokenized stocks, investors gain the benefit of 24/7 trading, which is not possible in traditional stock markets, as explained by Chainlink.

This feature is particularly beneficial for investors in different time zones, such as Indonesia, who can now trade U.S. stocks without adjusting to New York Stock Exchange hours. The continuous trading in the crypto ecosystem enables faster reactions to global news outside regular market sessions.

2. Global Portfolio Diversification

One key finding from ResearchGate is that U.S. stock returns are higher with lower risks compared to the Indonesian market, highlighting the importance of diversification.

Indonesian investors should consider allocating part of their capital into global stocks, whether through conventional shares or tokenized stocks, to optimize their overall risk-to-return ratio. Diversification helps protect portfolios from risks tied to a single country or currency.

Featured Stocks on Pintu: Understanding Tokenized Stocks Fundamentals

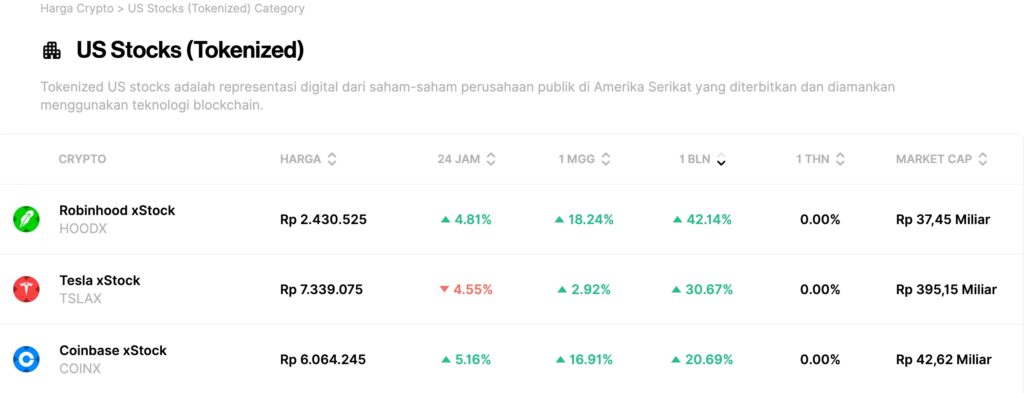

On the Pintu platform, Indonesian investors have access to various tokenized stocks (xStocks) representing leading U.S. companies, paving the way for fractional ownership of global assets.

Two notable xStocks that have gained investor attention are Tesla xStock (TSLAX) and Circle xStock (CRCLX), representing two high-growth sectors: electric vehicles and crypto infrastructure.

1. Tesla xStock (TSLAX)

Tesla xStock (TSLAX) represents shares of Tesla, the global electric vehicle (EV) manufacturer. Fundamentally, Tesla is recognized as a market leader in the EV segment, with competitive advantages in battery technology and autonomous software.

As of Oct 3, 2025, TSLAX is priced at Rp7,339,075, with a market capitalization of Rp395.15 Billion, reflecting significant market interest. The 1-Month chart shows strong volatility, peaking at around Rp8,813,818, but still showing a +33.63% uptrend, indicating long-term growth potential driven by innovation.

2. Circle xStock (CRCLX)

Circle xStock (CRCLX) represents Circle Internet Financial, the company behind the USD Coin (USDC) stablecoin, which plays a critical role in the cryptocurrency and digital finance ecosystem. CRCLX fundamentals are strongly tied to stablecoin adoption and crypto payment infrastructure, making it an investment with strong exposure to the innovative fintech sector.

As of Oct 3, 2025, CRCLX is priced at Rp2,455,930, with a market capitalization of Rp104.89 Billion. The 1-Month chart shows a +12.55% increase, reflecting value appreciation supported by positive developments in the stablecoin and digital payment sectors.

3. Nvidia xStock (NVDAX)

NVDAX is a mid-cap crypto asset sensitive to market sentiment.

As of Oct 3, 2025, NVDAX is priced at Rp3,129,516, down -0.48% in 24 hours, with a daily range of Rp3,117,032 – Rp3,147,531. Market capitalization stands at Rp143.3 Billion, fully diluted value at Rp221.45 Billion, circulating supply of 45,590 NVDAX, and daily trading volume at Rp149.55 Billion.

The stable movement around Rp3.1 million indicates a consolidation phase with active liquidity. NVDAX shows promising growth potential, although risks remain high due to crypto market volatility.

Leveraging Digital Access to Global Stocks

Investing in U.S. stocks offers Indonesian investors important opportunities to achieve diversification and capture stable global economic growth potential. The combination of classic strategies like DCA and Value Investing with modern innovations such as Tokenized Stocks allows retail investors to participate in global markets with more flexible capital and wider trading hours.

In Indonesia, one of the platforms offering access to these innovative products is Pintu xStocks, which provides U.S. tokenized stocks as a bridge for crypto investors to gain exposure to leading global companies. With this ease of digital access, the opportunity to build a global investment portfolio is now more open than ever.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References:

- Bankrate. Tokenized Stock Trading: The Huge Risks In Moving Stocks to Blockchain. Accessed Oct 3, 2025.

- Britannica Money. What Is Dollar Cost Averaging? An Investment Strategy. Accessed Oct 3, 2025.

- Chainlink. Tokenized Stocks & Equities Explained. Accessed Oct 3, 2025.

- Edward Jones. Weekly Stock Market Update. Accessed Oct 3, 2025.

- Gemini Cryptopedia. What Are Tokenized Stocks and How Do They Work?. Accessed Oct 3, 2025.

- Investopedia. Dollar-Cost Averaging (DCA): What It Is, How It Works, and Example. Accessed Oct 3, 2025.

- ResearchGate. Measuring the risk and return of Indonesia’s and United States Stock Index. Accessed Oct 3, 2025.

- Scribd. Value Investment Analysis Based On The U.S. Market – Taking Four Major Industries As Examples. Accessed Oct 3, 2025.