In early June 2023, Uniswap, the largest decentralized exchange (DEX), announced plans for a major upgrade to its system with the release of the Uniswap V4 draft code. Uniswap V4 is expected to bring several improvements and enhanced features to be more customizable, efficient, and flexible. This article will further explain what Uniswap V4 is and what features you need to know.

Article Summary

- 🦄 Uniswap V4 is a DEX that runs on the Ethereum blockchain network. It is also a non-custodial automated market maker (AMM) implemented for the Ethereum Virtual Machine (EVM).

- 🪄 In V4, Uniswap will implement Hooks or plugins that allow developers to create custom liquidity pools. In addition, Uniswap will also implement better infrastructure and a significant reduction in gas fees.

- 💵 In addition to feature enhancements, Uniswap V4 will implement two different governance fee mechanisms on swap and withdrawal fees.

- 🪙 Uniswap V4 will re-introduce the Ethereum (ETH) trading pair. Users do not need to wrap or unwrap ETH anymore.

What is Uniswap V4?

Launched in 2018, Uniswap is the largest decentralized exchange (DEX), which has been instrumental in paving the way for the development of automated market makers (AMM) in the crypto industry.

As of June 2023, according to data from DefiLlama, Uniswap has the largest total value locked (TVL) of all DEXs, with a total of 4 billion US dollars. Curve, PancakeSwap, and Balancer follow it.

The widespread adoption of the Uniswap platform has led to an impressive ecosystem, resulting in many projects leveraging its capabilities and attracting a staggering number of users in the millions. The Uniswap development team is trying to improve the system with the Uniswap V4 update to facilitate user needs.

In V4, Uniswap will implement Hooks or plugins that allow developers to create custom liquidity pools. In addition, Uniswap will also implement better infrastructure and a significant reduction in gas fees.

According to Uniswap CEO Hayden Adams, the launch of Uniswap V4 may take the next few months. Uniswap Labs is committed to receiving and responding to feedback from the community and users before launching Uniswap V4.

Updated Features in Uniswap V4

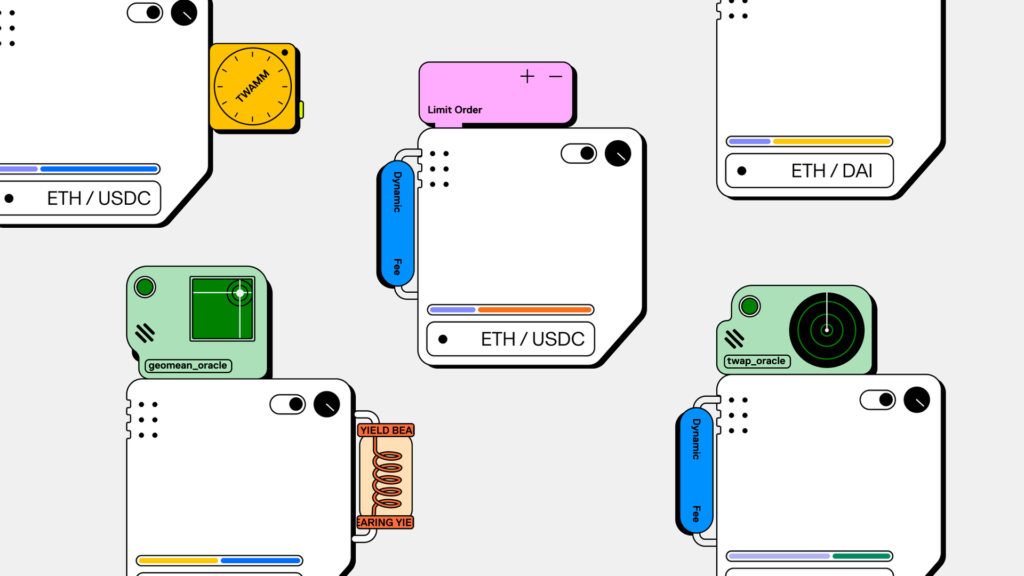

Hooks

A key feature in Uniswap V4 is Hooks. Hooks are customizable smart contracts with specific integration rules to the core platform protocol. With Hooks, anyone can create a custom liquidity pool with particular functionality.

Such functionality enables implementing on-chain limit orders and dynamic fees – features that may be available on more traditional exchange platforms but are more challenging to implement in a blockchain environment.

In the Uniswap blog, Uniswap CEO Hayden Adams wrote that Hooks could serve as a plugin to customize how pools, swaps, fees, and liquidity provider (LP) positions interact. Developers can create customized AMM pools through Hooks that integrate with smart contract v4 on top of the liquidity and security of the Uniswap Protocol.

Hooks allow users to implement features such as dynamic fees, limit orders, time-weighted average market maker (TWAP) orders, and customized on-chain oracles.

Singleton and Flash Accounting

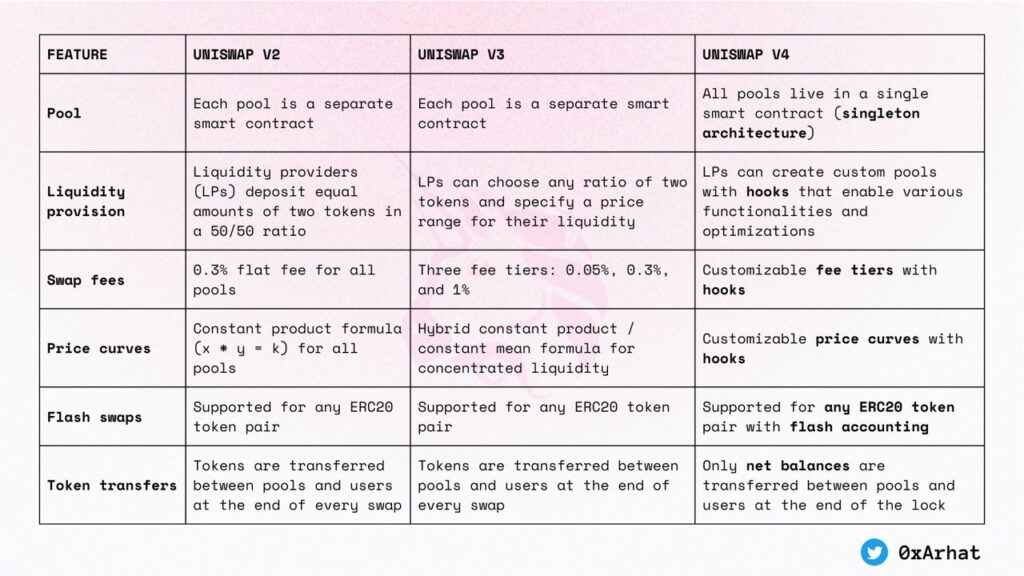

As the name suggests, Singleton is a single contract that contains all the different pools within Uniswap V4. It is unlike Uniswap V3, where Uniswap used a new contract for each pool.

By keeping all its pools in one contract, Uniswap V4 can reduce the gas fee of creating new pools (such as trading new pairs) by 99%.

Uniswap V4 will also implement an internal accounting system known as Flash Accounting. Flash Accounting is a calculation system that simplifies the interaction between V4 pools.

Unlike the Uniswap V3 version, where all assets involved in a trade are transferred in/out of the pool during the swap process. In V4, V4 pools track their balance changes internally and only transfer tokens based on the final outcome of the transaction.

With custom pools and Singleton, developers can utilize Uniswap's security & network without building their own AMM from scratch.

Native ETH

Uniswap V4 re-introduces Ethereum (ETH) trading pairs. In Uniswap V1, the trading pair was between ETH and ERC-20 tokens. However, in Uniswap V2, the development team removed the ETH pair due to implementation complexity and concerns over liquidity fragmentation between the Wrapped ETH (WETH) and ETH pairs.

In Uniswap V4, these issues were mitigated using the Singleton and Flash Accounting features, allowing both WETH and ETH pairs to be used.

In the current Uniswap V2 and V3, most users must wrap their ETH into WETH before trading on the Uniswap Protocol. Then users have to unwrap WETH back into ETH afterward. This process requires an additional gas fee. In V4, users do not need to wrap or unwrap ETH anymore.

Governance Fee Mechanism

Uniswap V4 will implement two governance fee mechanisms: swap and withdrawal fees. In swap fees, it is the same as in V3, where governance can choose to take up to a limited percentage of the swap fee in a particular pool.

In V4, withdrawal fees can be set by Hooks and included in the Hooks contract. Governance also can take up to a certain percentage of the withdrawal fee. Unlike in Uniswap V3, governance does not control the fee tiers.

Donate()

Uniswap v4 has a donate() function, allowing users, integrators and Hooks to directly pay liquidity providers (LPs) in either or both token pools. This feature can be used to tip, system fees, or other incentives to LPs.

Advantages of Uniswap V4

- Pool Customization: The Hooks feature allows developers to add functionality to the liquidity pool and create unique trading features.

- Gas Fee Reduction: Uniswap V4 incorporates features to reduce gas fees, such as singleton model implementation, flash accounting, and native ETH.

- Interoperability: Hooks and ERC-1155 accounting improve integration with other Ethereum protocols and standards, enabling complex interactions between different DeFi protocols.

ERC-1155 accounting on V4 allows users to store tokens in singletons and avoid ERC-20 transfers to and from contracts. It is helpful for users who do frequent swaps or liquidity providers who want to save on gas fees.

- Liquidity Provider (LP): The dynamic fee feature implemented by Hooks can give LPs more control and increase their profit potential.

- Increased New Market Potential: Hooks’ implementation of features such as Time-Weighted Average Market Maker (TWAMM), limit orders, and dynamic fees have the potential to attract traders and increase trading volume.

Conclusion

Uniswap V4 is a non-custodial, non-upgradeable, and permissionless AMM protocol. It builds on the concentrative liquidity model introduced in Uniswap V3 with customizable pools through Hooks.

In addition to Hooks, there are other architectural changes, such as Singleton contracts that store all pool states in a single contract. And also, Flash Accounting efficiently secures pool solvency in each pool.

Overall, Uniswap V4 will bring several improvements and innovations that enhance the functionality, flexibility, and efficiency of Uniswap V4 in facilitating the decentralized trading of crypto assets.

Buy Crypto Assets on Pintu

Interested in investing in crypto assets? Take it easy. You can buy various DeFi crypto assets such as UNI, SUSHI, CAKE, and others safely and easily. Furthermore, Pintu has subjected all its crypto assets to a thorough evaluation process, emphasizing the importance of prudence.

Pintu is also compatible with popular wallets such as Metamask to facilitate transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Uniswap Team, Uniswap V4 Core Whitepaper, Github, accessed 27 Juni 2023.

- Hayden Adams, Our Vision for Uniswap v4, Uniswap Blog, accessed 27 Juni 2023.

- Ben Giove, Unpacking Uniswap V4, Bankless, accessed 27 Juni 2023.

- Sam Kessler, Uniswap Labs Releases Its Plan for Uniswap v4, Invites Community Feedback, Coindesk, accessed 27 Juni 2023.

- Kyrian Alex, Uniswap V4: What you need to know, Medium, accessed 27 Juni 2023.

- Marcus Ledger, Uniswap V4, Twitter, accessed 28 Juni 2023.